DVLA Unveils New Car Tax Policies for UK Drivers: The DVLA Unveils New Car Tax Policies for UK Drivers is the exact topic we’re digging into today. If you’re driving in the UK, buy or sell cars, or just want to keep your finances on the straight and narrow, you’ll want to stick around. I’ve been in this space for a while helping folks avoid surprise costs, and I’m aiming to walk you through the changes in a friendly, easy‑to‑understand way—while still keeping it professional and trustworthy.

Table of Contents

DVLA Unveils New Car Tax Policies for UK Drivers

Alright, folks—here’s the deal: the DVLA’s new car tax policies are real, they matter, and you’re better off being ahead of the game rather than getting caught off‑guard. Whether you’re a daily driver, a business fleet manager, or someone looking to buy a sweet ride, the rules around first registration date, emissions, vehicle list price, and tax rates all matter. Take the time today to check your vehicle’s details, review the likely tax, and factor that into your budget and planning. Stay sharp, stay compliant, and you’ll keep your ride smooth—both on the road and in your books.

| Topic | What changed | What you need to know |

|---|---|---|

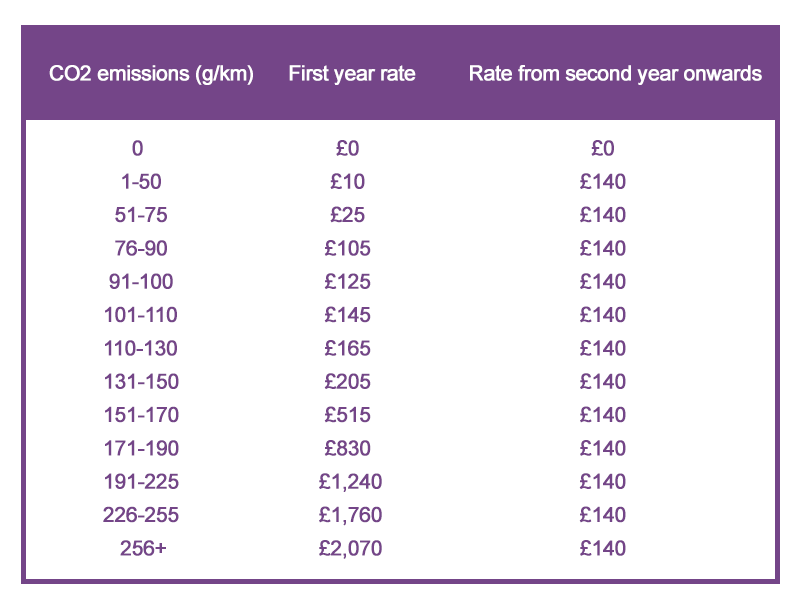

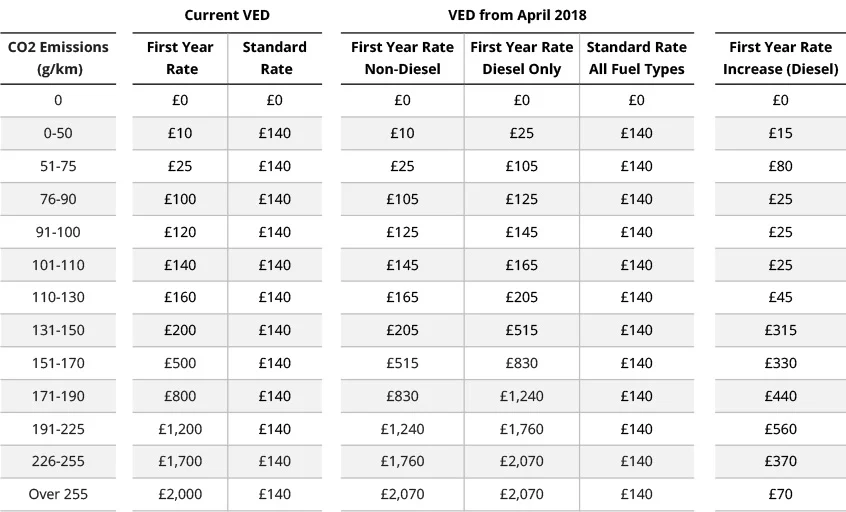

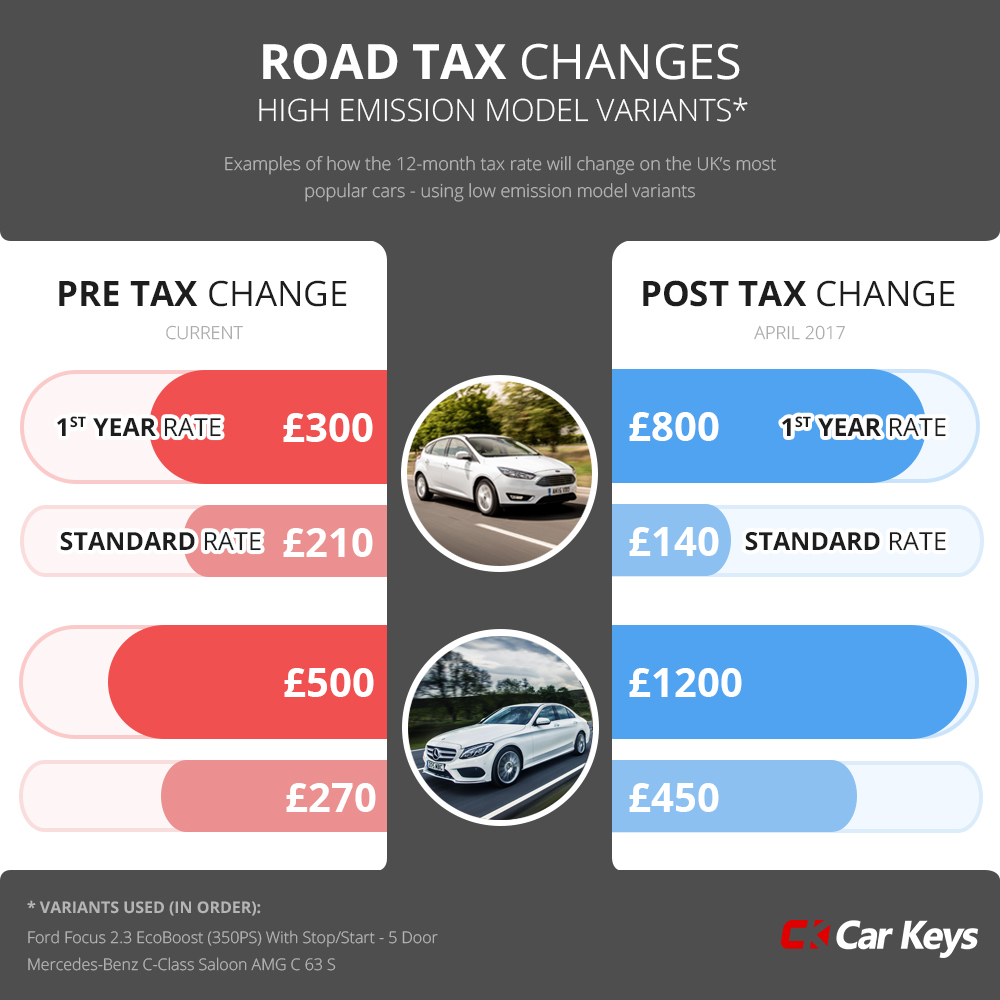

| First‑year rate for new vehicles (from 1 April 2017+) | Cars registered on or after 1 April 2017 pay a “first year” VED based on CO₂ emissions. | If you buy a car now, the emissions band matters for your first‑year tax. |

| Standard annual rate (for later years) | After the first year, most cars go onto a standard rate. | Be aware of what annual tax you’ll be paying going forward. |

| Zero‑/low‑emission vehicles (EVs etc) | From 1 April 2025: zero/low emission cars registered on or after that date now pay the lowest first‑year rate (£10) and then standard rate from second year. | If you drive or buy an EV, the tax is changing—and not all older exemptions hold. |

| Luxury car “supplement” | Cars with a list price over £40,000 attract an extra annual charge (for first 5 years) after initial taxation. | Buying a premium vehicle? Factor in this extra cost. |

| Exemptions changed | Some vehicles that used to be exempt (e.g., certain electric models) now pay tax. | Don’t assume a “green” car means no tax. |

| Buying/renewing tax made easier | Digital services now allow you to tax a vehicle without the old paper reminders etc. (gov.uk) | A smoother process—but you still need to know your obligations. |

What’s happening and why it matters?

Let’s keep it real: the car tax rules in the UK are changing—especially for electric vehicles (EVs), zero‑emission cars, and expensive vehicles. The agency responsible here, the Driver and Vehicle Licensing Agency (DVLA), together with HM Government, has updated the way vehicle tax (we often call it Vehicle Excise Duty or VED) is calculated. These changes affect new and existing car owners alike.

Why should you care? Because new rules mean new costs (or savings), and if you don’t know them, you might get hit with unexpected tax bills—or miss out on savings. Whether you’re a private car owner, a fleet manager, or someone buying a car as a smart move, the rules matter.

What DVLA Unveils New Car Tax Policies for UK Drivers? Step‑by‑step guide

Let’s break these down in a way that’s clear enough for a ten‑year‑old to grasp, yet detailed enough for professionals to act on.

Step 1: Identify when your car was first registered

- If your car was first registered before 1 April 2017, it follows the “old” tax bands (based on fuel type, emissions, etc).

- If first registered on or after 1 April 2017, then the new regime applies: first year tax based on CO₂ emissions, then standard rate after.

- If you have a zero/low‑emission vehicle registered on or after 1 April 2025, special lowest rate applies.

Step 2: Check your vehicle’s emissions / fuel type / list price

- Find out your CO₂ emissions (g/km) if petrol/diesel/alternative fuel. This determines your first‑year rate.

- If you have a zero‑emission or ultra‑low emission vehicle, check how the new tax rules apply.

- If the list price of the car at “new” was over £40,000, you may owe the “luxury car supplement” for 5 years.

Step 3: Determine your tax payment schedule and rate

- First year: For cars registered 1 April 2017+, the tax you pay in year one depends on emissions. Example: 0 g/km (electric) may be £10 (for vehicles registered 1 April 2025+).

- From second year onwards: A flat “standard rate” for most cars registered after 1 April 2017. Example figure: £195 for many zero/low emission cars.

- Extra charge if list price over £40k: The first 5 years after year one you’ll pay the standard rate plus the extra supplement.

Step 4: Be aware of exemptions – and changes to them

- Some vehicles remain exempt: for example, historic vehicles (pre‑1 January 1985) may qualify.

- Electric cars used to be mostly exempt, but under the updated rules from 1 April 2025, many must pay the standard rate.

- If you stop using a vehicle (e.g., store it off‑road), you might apply for SORN (Statutory Off Road Notification) and get a refund if tax already paid.

Step 5: Practical actions for you (whether you’re a driver, fleet owner, or buyer)

- Drivers/individuals: When you buy a new vehicle or are renewing tax, keep these steps in mind: check registration date, check emissions, check list price if premium.

- Professional/fleet managers: Large purchases, EV roll‑outs, and premium vehicles all need tax planning. Build the tax cost into total cost of ownership.

- Buyers: Don’t assume an EV = zero tax forever. Check the date of registration and the rules for your category.

- All: Set up a Direct Debit if you prefer monthly or semi‑annual payments. Be aware monthly payments may include extra surcharge.

Step 6: Double‑check for updates continuously

Tax rules change. The government websites list the updated rate tables, for example the “V149” rates from April 2025. Make it a habit to check official guidance before making vehicle purchase or budgeting tax.

Why this matters – the professional lens

From an industry/professional standpoint, the significance of these changes is broad.

- Financial planning & budgeting: Companies buying or leasing vehicles need to factor in tax as part of Total Cost of Ownership (TCO). A “cheap tax year one” might lead into larger payments later.

- Vehicle strategy: Shifting to EVs is popular—and good for sustainability—but tax assumptions must be verified. If you assume zero tax and that changes, you’ll end up with a cost gap.

- Compliance risk: If you don’t tax a vehicle correctly, you can be fined, clamped, or otherwise penalised. The official site warns of legal obligations.

- Resale/value implications: The taxation regime impacts how vehicles are valued and maintained. Premium vehicles (over £40k list price) carry extra tax for 5 years, so buyers and sellers need to take that into account.

- Environmental & policy impact: The tax changes also reflect the UK’s push toward lower emissions—so vehicles with clean credentials benefit, but the benefits vary by registration date and other factors.

The Impact of These Changes on Different Types of Vehicles

Electric Vehicles (EVs) and Hybrid Cars

The shift towards zero-emission vehicles is a direct response to the UK government’s commitment to cutting down carbon emissions. From 1 April 2025, EVs will still benefit from a lower first-year rate (£10), but this will be followed by the standard tax rate of £195 annually.

For hybrid cars, the exemption that used to apply for certain models is being phased out. Many hybrid cars will now pay the same rate as regular petrol or diesel cars from the second year onward.

This is a stark contrast to the complete exemption from road tax that electric cars once enjoyed, as part of the government’s green initiative to promote EV adoption. While this change may be disappointing to some EV owners, it reflects a more balanced approach, as more EVs hit the market.

Petrol and Diesel Cars

Petrol and diesel cars still remain the backbone of the UK’s fleet, but they now face stricter taxes. Under the new rules, CO₂ emissions will continue to determine how much you pay for the first-year tax, and the introduction of the luxury car supplement means that vehicles with a list price above £40,000 will incur additional costs.

If you’re driving a high-emission petrol or diesel car, it’s more important than ever to keep an eye on these changes, as the rates are set to rise for higher-emission vehicles. Taxing these vehicles based on CO₂ emissions helps to curb air pollution, a major concern in urban areas.

Changes in Enforcement and Penalties

The DVLA has also ramped up its enforcement measures to ensure compliance with the new rules. It is becoming increasingly common for vehicles that are not correctly taxed to be penalized. With better use of digital systems, the DVLA will be able to track untaxed vehicles more efficiently than ever before. This will likely lead to higher penalties for non-compliance.

This means you need to stay on top of your vehicle’s tax status to avoid fines, clamping, or even being taken to court. The DVLA is also more active in using automatic number plate recognition (ANPR) cameras to identify untaxed cars on the road.

Common Pitfalls & How to Avoid Them

- Assuming EV = zero tax: Not true anymore! From April 2025, some electric vehicles will pay the standard rate, so don’t assume you’re off the hook.

- Ignoring the list price “luxury supplement”: If your car’s list price was over £40,000, you’ll pay an extra charge for five years. This affects premium cars and high-performance vehicles.

- Not checking your emissions category: Even if your car is “green,” you need to check if it’s affected by the new VED system.

- Falling behind on digital services: Tax is now easier to handle digitally, but you still need to keep track of updates to ensure your payments are accurate.

UK Seniors Face Major Driving Rule Change in October 2025; How It Could Affect Your License?

New UK Driving Rule Change for Seniors Begins from 1 October 2025 – Check Revised Rules

Urgent Warning for Millions of UK Households Prepare Now for Major Energy Crisis