Direct Deposit of S$1300 Government Benefits: If you’re a Singaporean wondering about the direct deposit of S$1300 government benefits in October 2025, this guide will break it all down for you. From when the payout hits your account to who qualifies and how it fits into the bigger picture of Singapore’s social support system, we’ll cover it all in plain English. Whether you’re just getting started understanding government aid or need solid info for your financial planning, this article’s got your back. Singapore’s government has ramped up its financial help with this S$1300 payout as part of the Assurance Package, designed to soften the blow from rising costs on everyday essentials like food, utilities, and healthcare. Let’s dive into why this matters, who can get it, and how to make sure you’re ready to receive it.

Direct Deposit of S$1300 Government Benefits

The S$1300 government direct deposit in October 2025 is a smart, targeted way for Singapore to tackle rising living costs and support its citizens. From clear eligibility criteria to easy payment processes, this assurance package offers timely relief for many. By understanding how to check your status and make the most of the funds, you can boost your financial wellbeing in a smart, informed way. The payout forms part of a broad, well-structured support network aimed at easing day-to-day financial burdens and strengthening Singapore’s social fabric in tough economic times.

| Key Information | Details |

|---|---|

| Total Maximum Payout | Up to S$1300 |

| Base Payout | S$600 for eligible adults aged 21 and above |

| Additional Senior Support | Extra S$600 for seniors aged 60 and above, totaling S$1200 |

| Eligibility Criteria | Singapore Citizen, Age 21+ (Adults), Age 60+ (Seniors), Income ≤ S$34,000, Own ≤ 1 property with AV ≤ S$21,000 |

| Disbursement Dates | Early October 2025 (1st to 15th October) |

| Payment Method | Direct deposit to Singpass-linked bank accounts |

| Official Eligibility Check | SupportGoWhere Portal Official Website |

Why Is Singapore Giving Out Direct Deposit of S$1300 Government Benefits?

Singapore’s cost of living has been on the rise, squeezing household budgets, especially for seniors and low- to middle-income families. To ease this financial pinch, the government has been issuing relief payments for several years — and the October 2025 payout is the latest and most substantial in recent times.

This payout is part of the Assurance Package 2025, which aims to distribute cash directly to those who need it most. It’s structured to target income groups and property owners judiciously so that support reaches the families who need it without unnecessary leakages.

High inflation rates globally over the past years have pushed prices of food, transportation, and energy higher, impacting day-to-day living. Government interventions like this payout help to ease the pain for the average Singaporean household, making it easier to keep up with costs and maintain a decent quality of life.

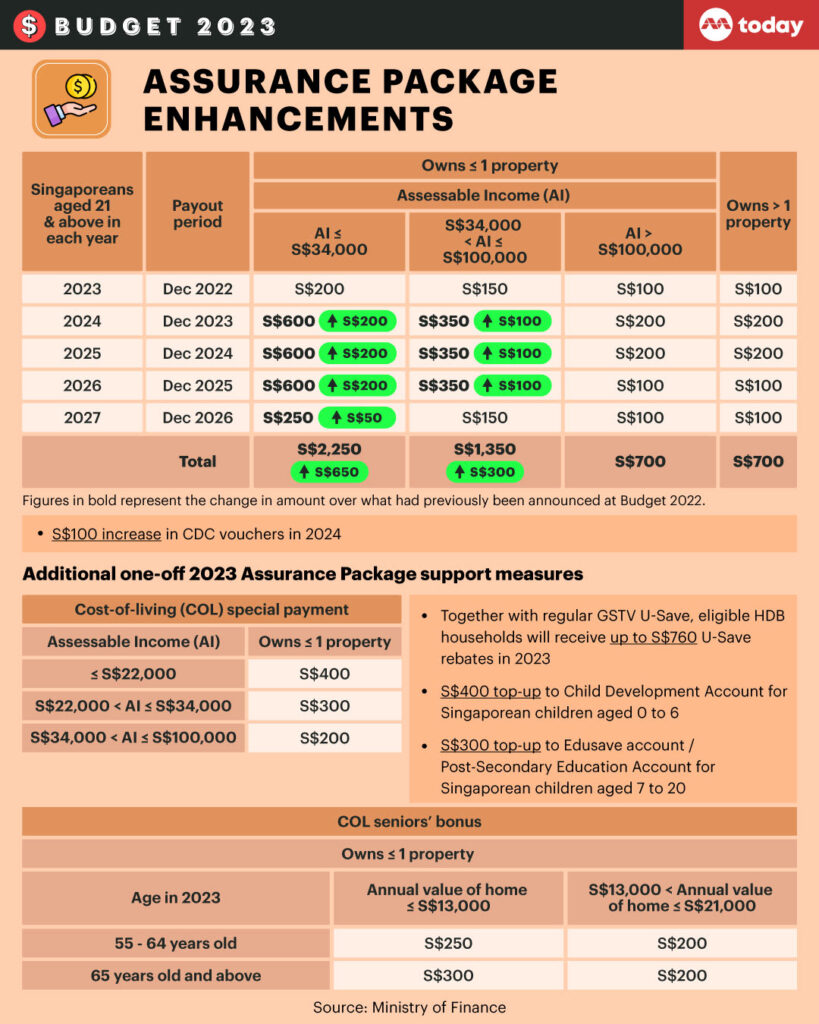

How Does This Year’s Payout Compare?

In 2023 and 2024, similar payouts ranged from a few hundred to around S$900 depending on eligibility. The current S$1300 payout represents an increase, reflecting the government’s response to continued inflation and economic uncertainty.

This steady increase highlights the government’s commitment to keeping pace with Singaporeans’ changing financial needs—a key factor in maintaining social stability and consumer confidence.

To put this into context, this S$1300 amount is not just about meeting basic expenses — it also acts as a buffer against unexpected costs like medical emergencies or sudden price hikes.

Eligibility: Are You In?

Eligibility is based on these main factors:

- Singapore Citizenship: Must be a citizen.

- Age: 21+ for adults, with seniors (60+) getting extra help.

- Income: Household or individual assessable income for Year of Assessment 2024 must be S$34,000 or less.

- Property: Own one property or less, with an Annual Value (AV) no greater than S$21,000.

- Exclusions: Those with multiple properties or high-value properties are excluded to focus resources on those who need it most.

How to Check Your Eligibility for Direct Deposit of S$1300 Government Benefits:

- Go to the SupportGoWhere Portal.

- Log in with your Singpass.

- Use the eligibility checker tool to input your info.

- Review your personalized support package and payment dates.

This eligibility check is a straightforward way for everyone to confirm their payout amount and when to expect it.

Step-by-Step to Update Your Singpass Bank Account Link:

- Sign in to your Singpass account.

- Navigate to “Personal Info” then “My Bank Accounts.”

- Confirm or update your primary bank account details linked to PayNow.

- Save changes to ensure smooth payout processing.

Updating your account details early ensures you won’t face delays or have to resort to alternative payout methods like GovCash, which can be a bit slower.

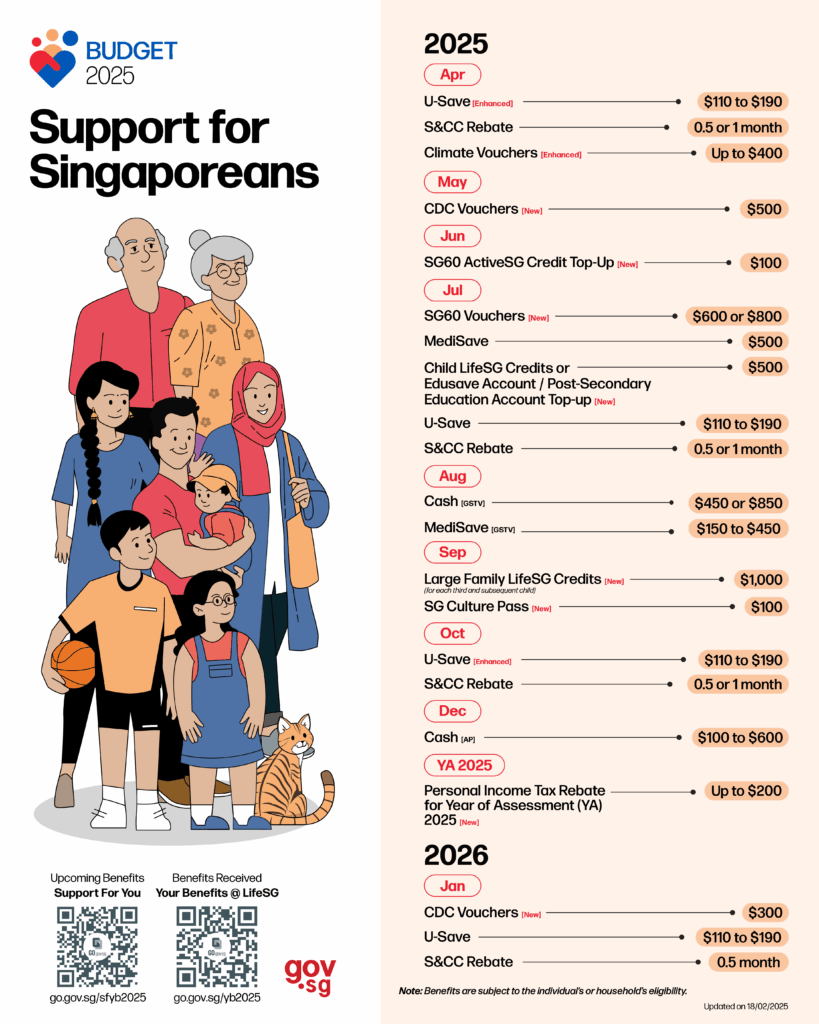

When and How Will You Get the Money?

Payments start flowing early October 2025, usually within the first two weeks. The cash lands directly in your bank account linked to your Singpass ID through PayNow, making it super convenient.

If your details aren’t up-to-date, don’t fret — you can still get paid through alternate channels like GovCash Wallet or collection at community centers.

The government aims to ensure no one is left behind, so even those who might not be digitally connected or who face difficulties with banking have options to claim their benefits.

Real-Life Scenario: Making It Practical

Imagine Sarah, a 62-year-old retiree living in a modest HDB flat. She earns a small pension, and her annual income is within the cutoff. This October, she’ll receive S$1200 (S$600 base + S$600 senior supplement), which she plans to use for her medical bills and groceries, making a big difference in her monthly budget.

On the other hand, Derek, a 40-year-old admin clerk, also qualifies for the S$600 base payout. His plan? To save it as a backup fund to help him ride out unexpected expenses. This shows how the payout can be tailored to personal needs.

By making good use of these payouts, many Singaporeans can build financial resilience in these uncertain times, whether by cushioning their monthly expenses or putting money aside for rainy days.

Tips for Safeguarding Your Direct Deposit of S$1300 Government Benefits

With government benefits come risks of scams. Here’s how to stay safe:

- Never share your Singpass credentials or OTPs with anyone.

- The government will never ask for payment or fees to release benefits.

- Official notifications will only come from government domains like Gov.sg or through the Singpass app.

- Report suspicious calls, messages, or emails claiming to be from the government immediately to the police or the government helpdesk.

Being aware and cautious protects your money and personal information from fraudsters looking to take advantage.

How These Benefits Affect The Economy & Households

Government payouts help stabilize household spending, ensuring families can continue to afford essentials. Economically, pumping cash into the hands of citizens supports consumer spending, which in turn helps businesses and keeps the economy chugging along.

Data from past relief measures show that households receiving direct support reported less financial stress and reduced debt levels post-payout. This helps reduce societal strain and contributes positively to overall economic health.

For many small businesses, this increased consumer spending during payout periods means steady sales and profitability, further reinforcing Singapore’s economic resilience.

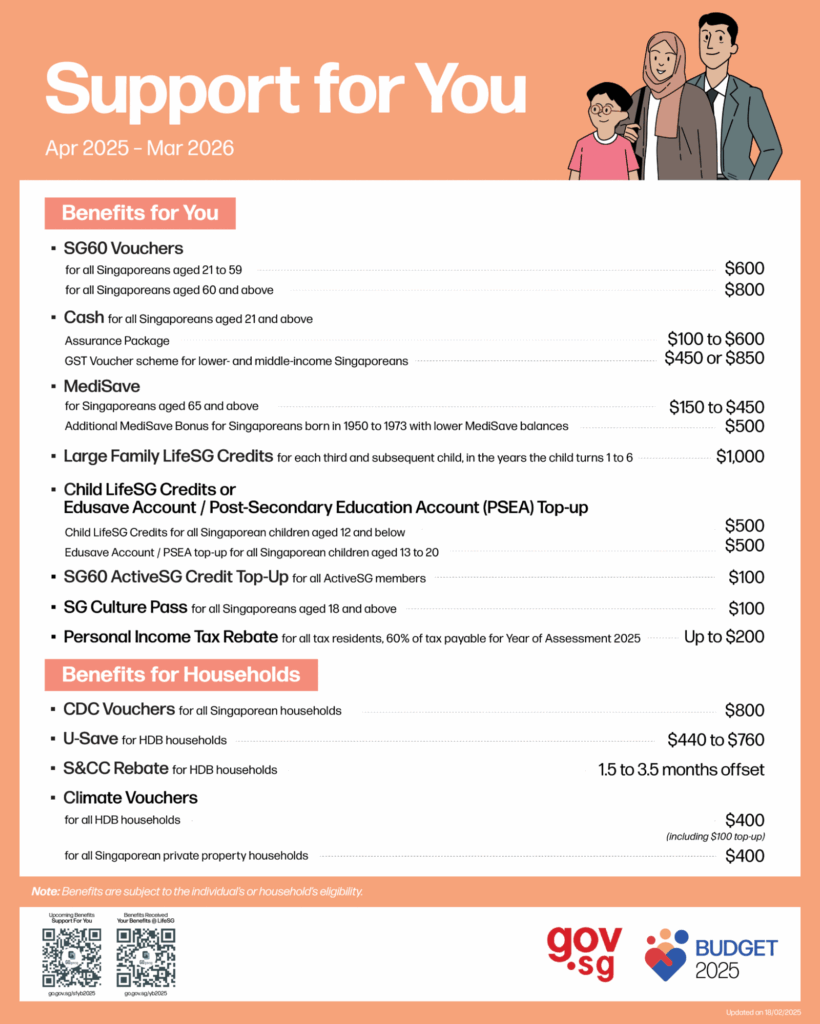

Other Government Support You Should Know About

Besides the S$1300 payout, don’t miss out on:

- GST Vouchers: These reduce the impact of consumption taxes.

- U-Save rebates: Help cut utility bills, especially for HDB residents.

- CDC Vouchers: Distributed to Singaporean households for groceries and hawker food.

- MediSave top-ups: Provide healthcare funding support for seniors.

- Silver Support Scheme: Additional cash support for eligible lower-income seniors.

These various schemes work together to create a layered safety net. Knowing about all the programs available can improve your financial planning and help you maximize benefits.

Singapore $2,250 AP Payout Confirmed – When You’ll Be Paid & How to Qualify

$3,267 Supplement in Singapore in October 2025: Check Eligibility & Deposit Date