CRA’s $2460 Pension Supplement: There’s been a lot of chatter lately about a “CRA $2,460 Pension Supplement in October 2025.” If you’ve seen posts or headlines claiming seniors are getting a new top-up this fall, you’re not alone — Canadians coast-to-coast are asking “Is this for real?” Let’s break it down like a pro but in plain talk. Whether you’re retired, getting ready to retire, or just helping out Mom and Dad, this article gives you the facts, numbers, and expert insight — no fluff, no fear-mongering.

CRA’s $2460 Pension Supplement

The “CRA $2,460 Pension Supplement” may not be official (yet), but the conversation around it spotlights the real challenges seniors face in 2025. Canada’s aging population is growing fast, and many depend on these payments for stability. If such a top-up arrives, it will likely drop with regular OAS or CPP deposits — probably on October 29, 2025. Stay smart, stay safe, and never click those “confirm your bonus check” links you see online — because if the government owes you money, you won’t need to chase it; they’ll find you.

| Item | Details / Data |

|---|---|

| Claimed Amount | $2,460 Pension Supplement (not officially confirmed by CRA or Service Canada) |

| Possible Payment Date (if real) | October 29, 2025 (aligned with scheduled OAS/CPP payments) |

| Core Benefits Involved | Old Age Security (OAS), Canada Pension Plan (CPP), Guaranteed Income Supplement (GIS) |

| Inflation Adjustment (Oct–Dec 2025) | + 0.7 % OAS indexation |

| GIS Income Limit (2025) | Single: ≤ $22,440 / year • Couple limits vary up to ~$53,808 |

| CPP Max Monthly 2025 | $1,433.00 • Average $848.37 |

| Where to Check | My Service Canada Account |

What Exactly Is This CRA’s $2460 Pension Supplement?

Here’s the truth: no official CRA bulletin or Canada.ca press release confirms a one-time “$2,460 supplement” for October 2025.

However, it’s easy to see where the number comes from. Many Canadians currently receive a combination of CPP, OAS, and GIS benefits that, together, can total around $2,400 – $2,500 monthly. Some online outlets have confused that monthly combined amount with a “special payment.”

Other times, people refer to quarterly inflation adjustments (every Jan, Apr, Jul, Oct) as a “bonus,” even though they’re just standard cost-of-living updates.

So while the figure is circulating online, it’s not a confirmed government program — at least not yet.

Why the Buzz?

Canadians are feeling the pinch. According to Statistics Canada, inflation remained above 3 % in 2025, especially for groceries and housing. Seniors on fixed incomes have been hit hard; almost one in four Canadians aged 65+ say they’ve reduced spending on essentials.

That’s why even whispers of a “$2,460 top-up” get attention. After all, during the pandemic, the federal government issued one-time payments to seniors ($300 – $500 in 2020). So people wonder: “Could Ottawa be doing it again?”

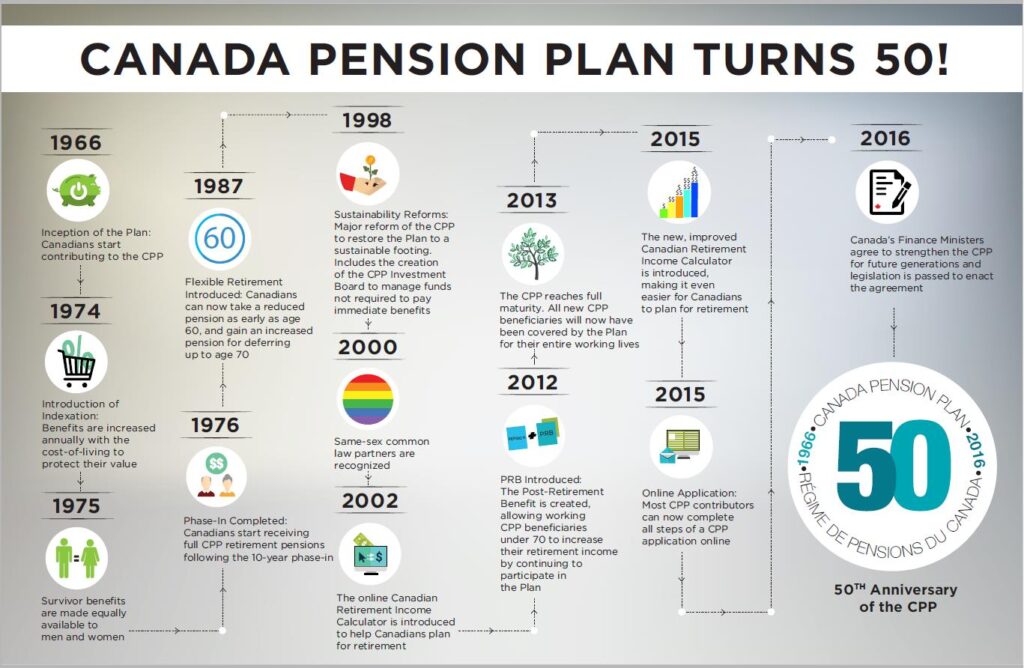

Understanding CRA’s $2460 Pension Supplement Framework

To make sense of any potential supplement, you’ve gotta know the main pillars of the system.

1. Old Age Security (OAS)

- Monthly benefit for Canadians 65+.

- Indexed quarterly to inflation.

- Automatically increases if the Consumer Price Index rises.

- You can check the current OAS rate here.

2. Canada Pension Plan (CPP)

- Based on your employment earnings and contributions.

- 2025 max monthly payment: $1,433.00.

- Average retiree receives around $848.37/month.

3. Guaranteed Income Supplement (GIS)

- Non-taxable benefit for low-income OAS recipients.

- Eligibility depends on income and marital status.

- Automatically reviewed each July if you’ve filed taxes.

Where Does the CRA’s $2460 Pension Supplement Fit In?

That number could represent:

- Three months of combined benefits. If someone gets ~ $820/month (GIS + OAS), that’s ~ $2,460 per quarter.

- Projected cost-of-living boosts. Quarterly indexing adds up over a year, and people mistake that for a single lump sum.

- Media shorthand. Some sites use the term “pension supplement” to refer to any increase for seniors — even routine ones.

So it’s possible the figure is a mythical mash-up of existing benefits rather than a new program.

Step-by-Step: How to Check Your Eligibility and Payments

Even if this specific supplement doesn’t materialize, here’s how to ensure you’re getting every dollar you’re entitled to:

Step 1: Log in to My Service Canada Account

- Go to MSCA.

- Check your OAS/CPP/GIS status, payment dates, and recent adjustments.

Step 2: File Your Taxes on Time

- Even if you have no income, file your return. The GIS and Allowance are auto-renewed based on tax data.

Step 3: Stay Updated on Official Announcements

- Visit Canada.ca/news or check press releases from Employment and Social Development Canada (ESDC).

- Never trust viral posts until they’re confirmed there.

Step 4: Mark Your Calendar for Payment Dates

2025 OAS & CPP deposit dates include: Jan 29, Feb 26, Mar 26, Apr 28, May 28, Jun 25, Jul 29, Aug 27, Sep 26, Oct 29, Nov 26, Dec 22.

Step 5: Report Missing Payments Quickly

- Call Service Canada at 1-800-277-9914 if your deposit is late or missing.

Cost of Living & Why Top-Ups Matter

As of mid-2025, StatsCan reported that senior households spend on average $1,070/month on groceries and $1,390/month on housing. With fixed pensions, every increase matters.

Many advocates — including CARP (Canadian Association of Retired Persons) — have called for one-time relief payments for low-income seniors to offset inflation. If the federal budget includes that relief, a $2,460 boost could be plausible.

Watch Out for Scams and Misinformation

Unfortunately, when rumors of government money spread, scammers show up.

Here’s how to stay safe:

- The CRA will never text or email you about a benefit payment link.

- Always check sender addresses — legit emails end with “@canada.ca”.

- If you’re unsure, call 1-800-O-Canada (1-800-622-6232).

- Report suspicious calls to the Canadian Anti-Fraud Centre.

Practical Tips for Maximizing Your Pension Income

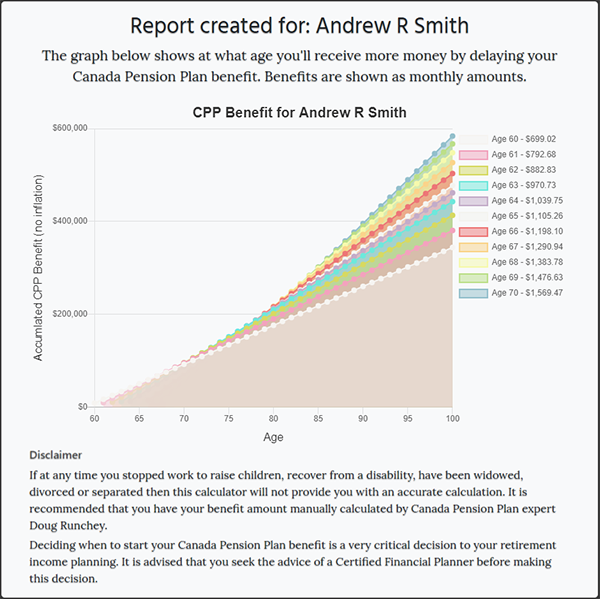

- Delay CPP if possible. Every month you delay after age 65 adds ~0.7 % to your benefit.

- Apply for the Allowance or Allowance for the Survivor if you’re under 65 and low-income.

- Claim provincial supports (like Ontario GAINS, Alberta Seniors Benefit).

- Set up direct deposit — faster, safer, less paper.

- Budget for quarterly indexing — each increase may seem small but adds up over a year.

Example Case Study

George (71, Vancouver) receives OAS ($713) + GIS ($600) + CPP ($900). Total ~ $2,213 monthly. He sees Facebook posts about the $2,460 supplement and expects a bonus deposit in October.

He logs into MSCA and finds no update — so he checks Canada.ca and learns it’s just a rumor. Good move: he avoids sharing bank info to scammers pretending to “confirm eligibility.”

This shows how staying informed keeps your wallet safe.

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Expert Perspective

Financial planner Laura Henderson (FPSC) explains:

“Every few months these viral ‘bonus checks’ pop up. Most aren’t true, but they reveal a real issue — seniors need help keeping up with rising costs. So instead of chasing rumors, people should maximize real programs like GIS, the Canada Workers Benefit (for part-time retirees), and provincial credits.”

That’s smart advice — keep your focus on the known benefits and stay alert for new policy announcements from Ottawa.