CRA Sending Double Payments: If you’ve been hearing buzz about the Canada Revenue Agency (CRA) sending what sounds like double payments this November 2025—including up to $1,700 in Old Age Security (OAS) plus an extra $650 in additional benefits—you’re not alone. This article breaks down exactly what’s happening, who qualifies, and how you can make sure you don’t miss out, all explained in a clear and friendly way with expert insights and practical advice.

Table of Contents

CRA Sending Double Payments

November 2025 brings a coordinated wave of CRA benefit payments—up to $1,700 in Old Age Security plus roughly $650 in supplemental rebates and federal inflation relief, along with payments for families and working Canadians. Far from being a double payment error, this robust financial support package is designed to help millions navigate inflation and winter expenses with greater ease. By staying informed, filing taxes on time, maintaining updated information, and using direct deposit, Canadians can smoothly access these benefits.

| Benefit | Estimated Amount | Eligibility | Payment Date |

|---|---|---|---|

| Old Age Security (OAS) | Up to $1,700 (monthly + supplements) | Canadians aged 65+ with residency and income criteria | November 27, 2025 |

| $300 Federal Inflation Payment | $300 | Low- and middle-income Canadians filing 2024 taxes | November 20-30, 2025 |

| Grocery/Energy Rebates & Top-ups | Up to $650 | Varies by province and income | November 2025 (varies) |

| Canada Child Benefit (CCB) | Up to $620 per child | Parents with children under 18 | November 20, 2025 |

| Canada Pension Plan (CPP) | ~$1,300 average | Retired and disabled workers | November 27, 2025 |

What’s the Deal With These November Payments?

Every November, the CRA issues multiple payments aimed at easing financial burdens for Canadians facing rising living costs, especially with inflation and cold weather expenses. This year, payments totalling roughly $2,300 or more for some individuals are getting attention. But this isn’t an accidental double payout—rather a coordinated release of several benefit programs:

- Old Age Security (OAS) is the cornerstone pension for Canadian seniors aged 65 and over, averaging around $713 monthly but can increase with supplements like the Guaranteed Income Supplement (GIS). These supplements provide additional monthly payments based on income levels, helping the most vulnerable seniors stay financially afloat. For those with very low income, GIS can add several hundred dollars to their monthly income, sometimes exceeding $1,000.

- The $300 Federal Inflation Payment launched in 2025 aims to ease the impact of inflation on low- and middle-income Canadians. This one-time payment is automatically deposited to eligible recipients based on their 2024 tax returns. It’s designed to help cover everyday price increases, like gas or groceries, that have squeezed household budgets this year.

- Additional grocery and energy rebates vary by province but are intended to provide relief on rising food and heating costs. Provinces like Ontario and British Columbia have implemented these to help residents during the winter months. These payments may require separate registration in some provinces, so it’s important to check your local government website. The amounts can reach up to about $650, offering significant supplemental support.

- The Canada Child Benefit (CCB) is a vital tax-free payment made monthly to parents and caregivers. It is calculated based on family income and the number of children under 18. Payments can be as high as $620 per child under six. The CCB helps cover costs like school supplies, childcare, and extracurricular activities.

- The Canada Pension Plan (CPP) offers income to retired or disabled workers who have contributed to the plan during their working years. The average monthly payment is around $1,300. This pension forms a key component of retirement income for many Canadians, complementing OAS and private savings.

Together, these payments create a financial boost that while not a literal double payment, may appear as such since many arrive within the same period, offering welcome financial relief just before the holiday season.

Eligibility: Who Gets What?

Old Age Security (OAS)

- Eligibility requires being at least 65 years old and having lived in Canada for a minimum of 10 years after age 18.

- Income thresholds affect the amount paid. Seniors with annual income above set limits face a “clawback” that reduces the OAS pension.

- The Guaranteed Income Supplement (GIS) offers additional monthly payments to seniors with low income, sometimes exceeding $1,000 monthly depending on circumstances.

- OAS payments are taxable and must be declared on annual tax returns.

Federal Inflation Payment ($300)

- This payment targets low- and middle-income taxpayers based on tax returns for the year 2024.

- The CRA automatically determines eligibility; no application is needed.

- Recipients should ensure their tax filings are accurate and timely to avoid delays.

Grocery and Energy Rebates

- Eligibility and application processes vary widely across provinces.

- Some provinces require registration or application, while others issue payments automatically.

- These rebates help manage expenses tied to essentials such as food and heating fuel during colder months.

Canada Child Benefit (CCB)

- Available to parents and guardians with children under 18 years.

- Payment varies by family income and number of children.

- It is non-taxable and designed to assist with costs related to childrearing.

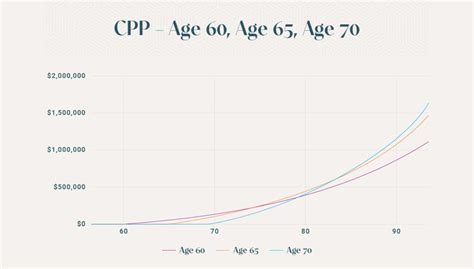

Canada Pension Plan (CPP)

- Paid to people who have contributed to CPP during their working life.

- Includes retired Canadians as well as those who qualify for disability benefits.

- The average monthly benefit reflects years of contribution and age at retirement.

November 2025 CRA Payment Schedule — Dates to Know

November’s CRA payment schedule is carefully staggered to manage cash flow and avoid overwhelming processing systems:

- November 5: GST/HST Credit payments helping low- and middle-income individuals offset sales tax.

- November 15: Climate Action Incentive Payment for eligible provinces offsetting carbon costs.

- November 20: Canada Child Benefit payments reach parents.

- November 20 – 30: Federal $300 inflation payment deposits.

- November 25: Advanced Canada Workers Benefit payment for eligible low-income workers.

- November 27: Major pension payments including Old Age Security, Guaranteed Income Supplement, and Canada Pension Plan.

Setting up direct deposit through CRA is essential to ensure timely receipt without postal delays. Paper cheque users are encouraged to switch to electronic payments to avoid delays, especially in winter weather.

Busting the Myth: It’s Not a Mistake or Scam

The idea of receiving two or more large government payments in a short span can raise suspicions about errors or scams. It’s important to understand:

- These multiple payments are planned and legitimate benefits released by the government.

- Each payment corresponds to a different program or relief effort.

- CRA communicates clearly via My Account and official channels—no unexpected payment requests or demands.

- Be vigilant against phishing and scam calls impersonating CRA, especially during peak payment periods.

- The CRA will never ask for sensitive information through unsolicited emails or calls.

How to Maximize Your CRA Sending Double Payments and Stay Safe?

To get the most from your eligible benefits while keeping your information secure:

- File your 2024 income taxes on time and accurately to confirm eligibility.

- Register for direct deposit to speed up payment receipt and avoid mailing problems.

- Keep your CRA My Account personal details, such as address and banking info, current.

- Check your province’s website for any required rebate applications and deadlines.

- Consult with tax professionals or financial advisors if you’re unsure about eligibility or need help filing.

- Beware of CRA impersonation scams. Verify any suspicious contact through official CRA lines.

Historical Context and Why These Payments Matter

Old Age Security has been a pillar of retirement income in Canada since its inception in the 1950s, providing a reliable financial foundation for seniors. The Guaranteed Income Supplement was added to help those most in need, making it one of the most important anti-poverty measures for seniors.

In recent years, inflation and economic pressures have led the government to introduce additional relief payments and rebates to help Canadians cope with rising costs of living. The November 2025 schedule reflects a continued commitment to safeguard vulnerable citizens’ financial stability while supporting working families amidst uncertain economic conditions.

Glossary of Key Terms

| Term | Meaning |

|---|---|

| OAS (Old Age Security) | Monthly pension paid to Canadian seniors aged 65+ with residency requirements |

| GIS (Guaranteed Income Supplement) | Additional income supplement for low-income OAS recipients |

| Clawback | Income-based reduction or repayment of government benefits due to high earnings |

| CRA My Account | Online portal where Canadians manage benefits, tax info, and payment status |

| Direct Deposit | Secure electronic payment directly into a bank account without postal delays |

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

CRA Benefits Payment November month Dates 2025: Check Provincial, Territorial Benefit Schedule

CRA Extra $1900 Cash Boost In November 2025 – Who will get it? Check Eligibility & Payment Date