As Canadians prepare for the upcoming fall, the Canada Revenue Agency (CRA) has released the crucial payment dates for various benefits scheduled for October 2025. These payments are integral to millions of households, from families with children to seniors relying on pensions. Staying informed about these dates ensures timely access to critical support.

The CRA’s October payment schedule includes important benefits like the Canada Child Benefit (CCB), GST/HST credits, and more, all of which play a pivotal role in helping low- and middle-income Canadians navigate the cost of living.

Table of Contents

CRA Payment Dates for October 2025

| Benefit Program | Payment Date | Who It’s For |

|---|---|---|

| Canada Child Benefit (CCB) | October 20, 2025 | Parents or guardians of children under 18 years of age |

| GST/HST Credit | October 3, 2025 | Low- and moderate-income Canadians |

| Ontario Trillium Benefit (OTB) | October 10, 2025 | Ontario residents eligible for tax credits |

| Canada Workers Benefit (CWB) | October 10, 2025 | Low-income working Canadians |

| Old Age Security (OAS) / CPP | October 29, 2025 | Seniors aged 65+ |

A Look at the October 2025 CRA Payments

Canada Child Benefit (CCB) – October 20, 2025

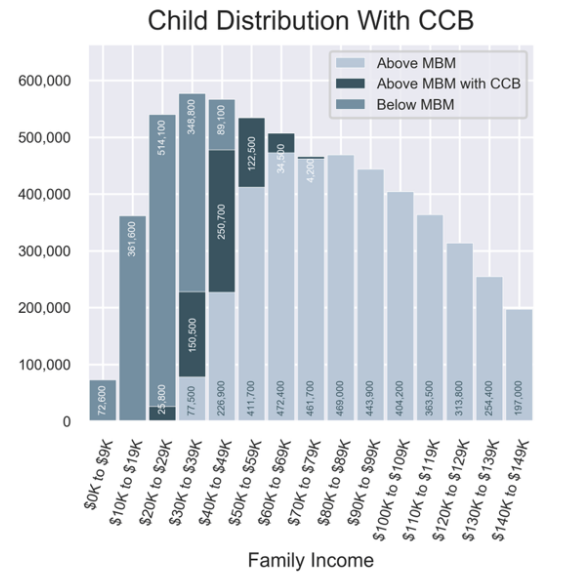

The Canada Child Benefit (CCB) provides financial assistance to parents and guardians of children under 18 years of age. Payments are issued monthly, with October’s distribution set for October 20, 2025. This benefit is especially important for families facing the pressures of raising children, as it can amount to thousands of dollars annually. The CCB is income-tested, meaning that households with higher incomes may receive smaller payments.

According to the CRA, the amount of the CCB is based on a family’s income, the number of children, and their ages. Families must file their taxes annually to determine their eligibility. In 2025, the maximum annual amount for the CCB can be up to $6,765 per child under the age of six and up to $5,708 per child aged six to 17. However, the exact amount is tailored to each household’s income.

Many families rely on the CCB for their children’s day-to-day expenses, from school supplies to extracurricular activities. With inflation affecting everyday costs, the CCB remains an essential part of many households’ financial planning.

Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit – October 3, 2025

A vital support for low- and moderate-income Canadians, the GST/HST credit helps offset the sales tax that these individuals pay on goods and services. October’s payment, which will be issued on October 3, 2025, is part of the CRA’s ongoing commitment to alleviating financial strain. To qualify, Canadians must file their taxes, and payments are adjusted based on income and family size.

This credit is often relied upon by single individuals, couples, and families, and can provide hundreds of dollars per year to eligible recipients. For example, a single individual with no children can receive up to $467 annually, while a couple with children could qualify for significantly higher amounts.

The GST/HST credit is a key part of Canada’s progressive taxation system, designed to support those who are most in need of assistance. As the cost of living continues to rise, the GST/HST credit becomes an even more vital resource for Canadians facing economic pressure.

Ontario Trillium Benefit (OTB) – October 10, 2025

The Ontario Trillium Benefit (OTB) supports Ontario residents by helping with the cost of energy, sales, and property taxes. This payment is issued on October 10, 2025, and benefits eligible residents who pay these taxes. The OTB includes three separate components: the Ontario Energy and Property Tax Credit (OEPTC), the Ontario Sales Tax Credit (OSTC), and the Northern Ontario Energy Credit (NOEC).

The OTB is essential for ensuring that low-income Ontarians can cover these critical expenses, especially as the cost of living continues to rise. This program helps alleviate some of the financial burden on residents who may be struggling with increasing energy costs, rent, and other necessary living expenses. In 2025, eligible Ontario households could receive up to $1,200 per year from the OTB, depending on income and household size.

Canada Workers Benefit (CWB) – October 10, 2025

The Canada Workers Benefit (CWB) is designed to assist low-income working Canadians. This refundable tax credit is issued alongside the GST/HST credit, with payments made on October 10, 2025. It provides extra support to individuals who are working but still earning low wages. The CWB aims to encourage workforce participation by making employment more financially sustainable for Canadians who might otherwise struggle to make ends meet.

For 2025, eligible workers could receive up to $2,400 per year (for single individuals) or $4,800 (for couples) under the CWB. The amount is based on a person’s income, and it is designed to phase out gradually as a person’s income increases.

To qualify for the CWB, individuals must file their taxes, and the amount they receive depends on their income level, marital status, and whether they have children.

Old Age Security (OAS) / Canada Pension Plan (CPP) – October 29, 2025

For seniors aged 65 and older, the Old Age Security (OAS) pension is a critical source of income. Payments are issued quarterly, and the next one is scheduled for October 29, 2025. Similarly, the Canada Pension Plan (CPP) provides benefits to Canadians who have contributed during their working years. Many seniors rely heavily on these payments, which are adjusted based on the individual’s past earnings and contributions to the plan.

The OAS and CPP are designed to provide financial security to Canadians in their later years. As with other CRA benefits, eligibility is determined through tax filings, and timely registration is crucial to ensuring there is no disruption in payments.

In 2025, OAS recipients could receive up to $1,200 per month, while those receiving CPP can expect a monthly benefit that depends on their contributions over the years. The combined OAS and CPP payments are often a significant portion of a senior’s retirement income.

How to Apply for and Verify Eligibility for CRA Benefits

Many Canadians may wonder how to apply for these benefits or verify their eligibility. Fortunately, the process is straightforward:

- File Your Taxes:

To qualify for most CRA benefits, individuals must file their taxes. The CRA uses your tax returns to assess eligibility for programs like the GST/HST credit, CCB, and CWB. Even if you have no income, filing your taxes ensures that you receive the credits you’re entitled to. - Verify Eligibility Online:

Canadians can check their eligibility for various benefits through their CRA My Account. This online portal allows individuals to view their benefit status, update personal information, and apply for direct deposit. - Set Up Direct Deposit:

Direct deposit is the fastest and most secure way to receive payments. To set it up, individuals can log into their CRA My Account or call the CRA for assistance. Direct deposit ensures that funds are deposited directly into your bank account on the scheduled payment dates, reducing the risk of delays or lost cheques. - Address Payment Issues:

If you encounter issues with your payments, such as delays or discrepancies, contact the CRA’s helpline or use the online dispute resolution tools. It’s important to resolve these issues promptly to avoid missing future payments.

Why These Benefits Matter More Than Ever

In the face of ongoing economic challenges, including inflation and housing costs, these CRA benefits are more critical than ever. Canadians have been grappling with rising costs for food, housing, and transportation. The government’s response through these benefit payments helps provide relief to those struggling the most.

According to recent statistics from Statistics Canada, inflation has hit 5.1% in the past year, placing additional strain on Canadian households, particularly those with children and seniors. The benefits provided by the CRA play an essential role in alleviating some of this burden, offering a financial cushion for individuals and families who need it most.

Looking Forward: What’s Next for CRA Payments?

As 2025 progresses, Canadians should remain vigilant for any changes to CRA benefit programs. There is always the potential for new measures or temporary one-time payments in response to economic shifts or unexpected challenges, such as increased housing costs or higher-than-expected inflation rates. In the past, the CRA has adjusted payments or introduced special benefits in response to crises, and 2025 may see similar interventions.

Canada $4100 CRA Direct Payment in October 2025: Check Payment Date & Eligibility Criteria

Canada Work Permit in Oct 2025 – The New Rules to Get a Work Visa Without an Employer’s Involvement

$2,200 One-Time Payment in October 2025? Service Canada Update – Check If You’re Eligible

FAQ

When will the Canada Child Benefit (CCB) be paid in October 2025?

The Canada Child Benefit will be paid on October 20, 2025.

Who qualifies for the GST/HST credit?

The GST/HST credit is for low- and moderate-income Canadians. Eligibility is based on your income, family size, and tax filings.

What is the Canada Workers Benefit (CWB)?

The CWB is a refundable tax credit for low-income working Canadians. The next payment will be issued on October 10, 2025.