CRA Extra $1900 Cash Boost: If you’ve been scrolling through Facebook, Reddit, or TikTok lately, you’ve probably seen the viral posts: “CRA Extra $1,900 Cash Boost Coming in November 2025!” Sounds awesome, right? But before you start planning how to spend that money, let’s talk facts. As someone who’s spent years studying tax policy and government benefit programs, I’ve seen these claims pop up before. Some turn out to be real relief measures, others are pure clickbait—or worse, outright scams. So, let’s unpack this one with real data, official references, and practical advice so you know what’s actually happening with CRA payments in 2025.

Table of Contents

CRA Extra $1900 Cash Boost

Let’s be crystal clear: there is no official CRA Extra $1,900 Cash Boost confirmed for November 2025. The rumor likely stems from confusion around existing benefits and social-media speculation. However, legitimate payments—like the Canada Child Benefit, GST/HST credit, and Canada Workers Benefit—continue to support millions of Canadians. At the end of the day, being informed is better than being misled. Keep your paperwork tight, your accounts secure, and your eyes on the real money Canada already offers.

| Topic | Details |

|---|---|

| Claim | “CRA to issue an extra one-time $1,900 payment in November 2025.” |

| CRA Position | CRA confirms no new one-time benefit announced as of October 2025. |

| Real CRA Payments | Regular benefits (CCB, GST/HST, CWB) continue; November CCB date = Nov 20, 2025. |

| Who Qualifies for Real Benefits | Tax filers with low-to-moderate income, parents, seniors, and eligible workers. |

| Possible Scam Risk | High—fake texts/emails claiming CRA deposits. |

| Pro Tip | Always confirm updates at canada.ca before sharing or clicking any link. |

| Bottom Line | No verified $1,900 payment. Stay informed, file taxes, and claim existing credits. |

| Official Source | canada.ca |

Where Did This CRA Extra $1900 Cash Boost Rumor Start?

Every few months, Canadians see headlines about “extra CRA money.” The reason? Economic stress, political promises, and people wanting hope during tough times.

But here’s the thing: as of now (October 2025), there’s no official CRA press release, Budget update, or Parliamentary bill approving a $1,900 one-time payment. The CRA itself has warned Canadians about false benefit news spreading online.

That means this “extra boost” isn’t confirmed or listed under any recognized government benefit.

Why People Believe It?

Let’s be fair—people aren’t gullible; they’re hopeful.

After years of inflation, housing spikes, and grocery prices hitting record highs, who wouldn’t want a little financial breathing room?

Here’s why this rumor took off:

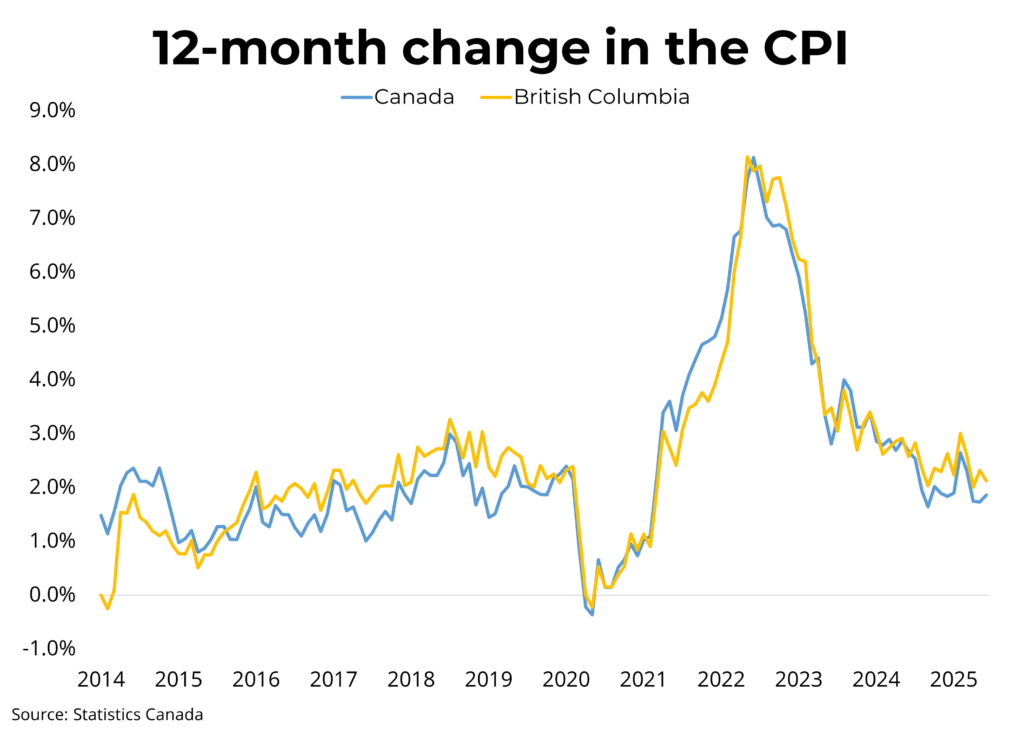

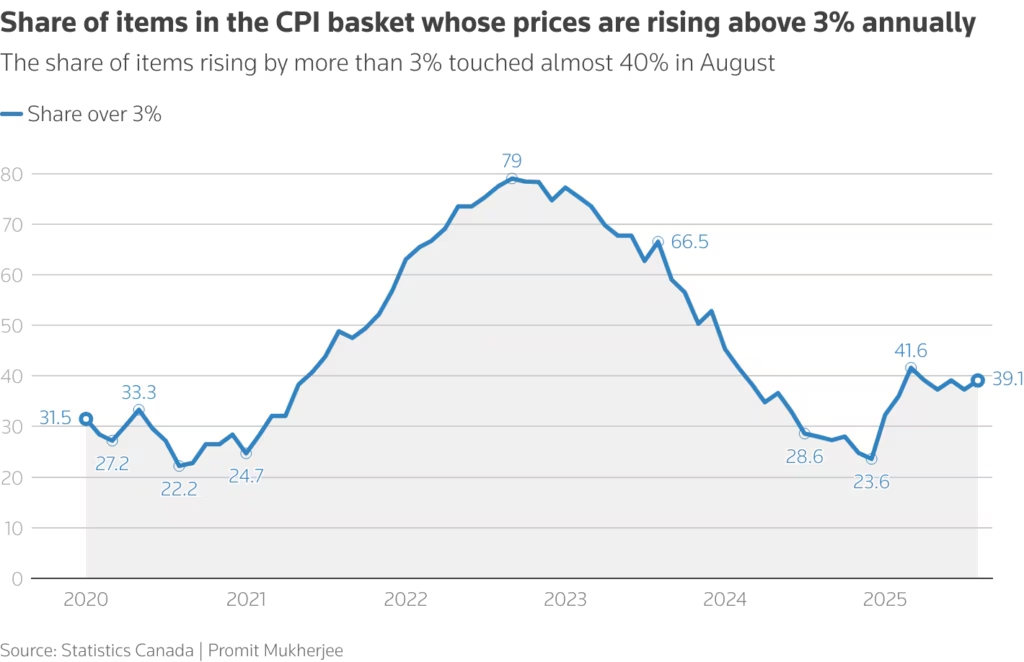

- Inflation remains above 3%, squeezing household budgets.

- Housing costs have jumped nearly 6% year-over-year.

- Groceries are up roughly 5.7% in 2025 according to Statistics Canada.

- Canada has a track record of one-time payments—remember the GST top-up in 2022 and grocery rebate in 2023?

So, when someone hears “CRA $1,900 Boost,” it feels believable because we’ve seen Ottawa deliver similar measures before.

Let’s Talk About Real CRA Programs That Pay You

While the $1,900 rumor is unverified, CRA already sends billions in real, legal benefits. Here’s a breakdown of what’s legit in 2025.

1. Canada Child Benefit (CCB)

A tax-free monthly payment helping parents with kids under 18.

- Next payment date: November 20, 2025

- Annual maximum: up to $7,437 per child (under 6), $6,275 (age 6–17)

- Eligibility: You must file your taxes annually and live with the child.

2. GST/HST Credit

Quarterly payments for low-income individuals and families to offset consumption taxes.

- Average single adult: $496/year

- Family of 4: around $650/year

- Paid automatically after you file taxes.

3. Canada Workers Benefit (CWB)

Supports low-income workers, with automatic quarterly payments since 2023.

- Singles: up to $1,518

- Families: up to $2,616

4. Old Age Security (OAS) & GIS

For seniors aged 65+, these programs continue adjusting to inflation.

- Average OAS benefit: around $713/month

- GIS supplement: up to $1,065/month for low-income single seniors.

Bottom line: You don’t need to wait for rumors—these programs already put real cash in Canadians’ pockets.

Economic Context: Why the Rumor Hit at the Right Time

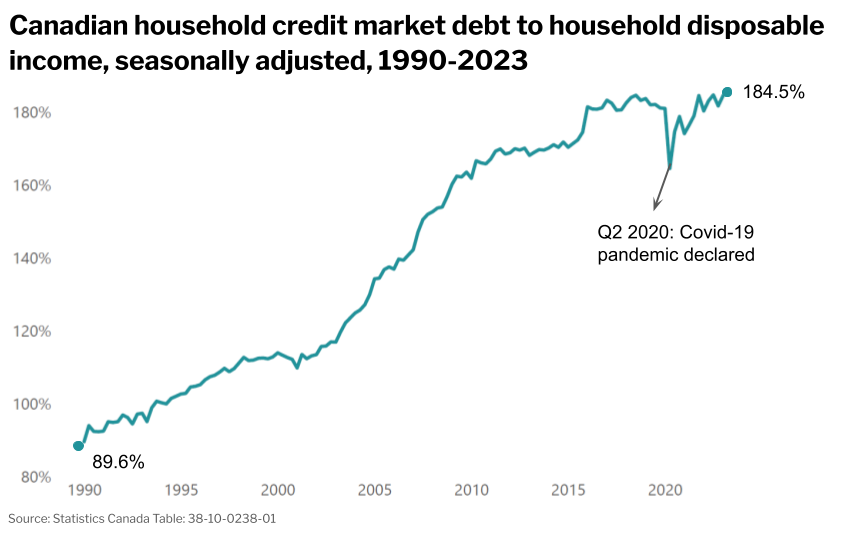

In 2025, affordability dominates public debate. Unemployment has crept to 6.3%, interest rates remain high, and Canadian debt per household has crossed $75,000.

According to a Leger survey (August 2025), 61% of Canadians say they’re “living paycheck to paycheck.” With such numbers, any mention of “extra cash from CRA” spreads faster than wildfire.

However, government aid like the $1,900 boost would typically appear in official budgets, not TikTok videos or WhatsApp messages.

How a Real CRA Extra $1900 Cash Boost Would Work (If Announced)

Let’s imagine Ottawa did approve this kind of program. Based on past reliefs, here’s what it might look like:

| Potential Group | Likely Criteria | Estimated Amount |

|---|---|---|

| Low-income individuals | Net income < $40,000 | $900–$1,000 |

| Families (2 children) | Family income < $80,000 | Around $1,900 total |

| Seniors | OAS + GIS recipients | $500–$1,000 |

| Persons with disabilities | Eligible for DTC + CWB | Up to $1,900 |

The key takeaway? Any official boost like this would be announced months ahead on canada.ca, published in the federal budget, and covered widely by CBC, Global, and CTV—not through random Facebook videos.

How to Spot Fake CRA Posts?

Fraudsters love to prey on financial stress. Here’s your field guide to avoid scams:

- Check the URL: Real CRA sites end with “

.gc.ca” or “.canada.ca.” - Ignore messages asking for money: CRA never requests e-transfers or prepaid cards.

- Watch out for urgency: If it says “act now or lose payment,” it’s fake.

- Grammar red flags: Real government notices don’t have random emojis or typos.

- Cross-verify: Check CRA’s verified social pages or call 1-800-959-8281.

Steps to Protect Yourself (and Still Get Paid Right)

Even if the $1,900 payout isn’t real, there’s still a lot you can do to make sure your benefits are secure.

Step 1 – File Your Taxes on Time

CRA uses your tax info to calculate all benefits.

Missing a return means missing payments—even for CCB or GST credits.

Step 2 – Enroll in Direct Deposit

Direct deposit gets money to you faster and avoids lost cheques.

Step 3 – Keep Your Information Updated

If you moved, changed marital status, or added a new child—update your CRA “My Account.”

Wrong info = delayed or reduced payments.

Step 4 – Check “CRA My Account” Regularly

This is your personal dashboard for benefits, tax returns, and payment notices.

How to Stay Informed About Real Government Benefits

- Bookmark canada.ca/en/revenue-agency.html

- Subscribe to CRA Email Alerts: CRA Notifications

- Follow Reliable News

- Monitor Budget Updates: The next major opportunity for new benefits will likely come in Budget 2026.

Canada $4100 CRA Direct Payment in October 2025: Check Payment Date & Eligibility Criteria

CRA Confirms 2025 OTB Payment Date – Who’s Getting Paid on October 10? Check Payment amount

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria