CRA Confirms $742 OAS Boost: If you’ve been keeping tabs on Canadian retirement benefits, you’ve probably seen the eye-catching headline: “CRA confirms $742 OAS boost in 2025.” Sounds like free money, right? But before you start planning that road trip down Route 66, it’s worth slowing down and breaking things down. What exactly is this Old Age Security (OAS) boost? Who qualifies? And most importantly, how much more money will really end up in your pocket? Here’s the truth: Old Age Security isn’t a lottery win or a bonus check. It’s a government pension program that helps Canadian seniors keep up with the rising cost of living. The 2025 OAS boost isn’t a sudden handout but a quarterly inflation adjustment designed to make sure your retirement dollars go just as far tomorrow as they did yesterday. With inflation eating away at savings—whether it’s grocery bills, rent, or medication—this extra cash matters.

CRA Confirms $742 OAS Boost

The CRA OAS boost in 2025 means Canadian seniors will receive about $742 more annually, especially those over 75. While it won’t change your retirement overnight, it’s an important cushion against inflation. By knowing your eligibility, avoiding clawbacks, and using smart financial strategies, you can make the most of this increase and secure a stronger financial future in retirement.

| Point | Details |

|---|---|

| Program | Old Age Security (OAS) – Canada’s largest public pension |

| 2025 Update | CRA confirms quarterly inflation adjustments |

| Boost Amount | Roughly $742 annually for many seniors 75+ |

| Who Qualifies | Canadians 65+ with 10+ years of residence |

| Income Limits | OAS clawback starts at $90,997 (2025 threshold) |

| Full vs. Partial OAS | Full OAS requires 40 years of Canadian residency |

| Official Source | Government of Canada – OAS Payments |

What Is Old Age Security (OAS)?

Old Age Security is Canada’s largest and most universal public pension program. Unlike the Canada Pension Plan (CPP), which depends on how much you contributed while working, OAS is funded from general tax revenues. That means whether you worked in Canada for 40 years or stayed home raising kids, you may still qualify.

Here’s the breakdown:

- Basic requirement: Be at least 65 years old.

- Residency requirement: Lived in Canada for at least 10 years after turning 18.

- Full OAS: Requires 40 years of Canadian residency after age 18.

- Partial OAS: Calculated based on how long you’ve lived in Canada.

OAS was first introduced in 1952, paying just $40 per month. Fast-forward to today, and payments are now in the $700–$800 per month range, depending on your age. That’s a dramatic increase, but when you factor in the cost of living, it shows why OAS adjustments are so important.

The CRA Confirms $742 OAS Boost – What’s Really Happening in 2025?

Headlines about the “$742 boost” can be confusing. Let’s break it down clearly.

- Quarterly Adjustments: OAS rates are reviewed every three months. Payments rise when inflation (measured by the Consumer Price Index, CPI) goes up.

- July–September 2025 rates:

- Ages 65–74 → $734.95/month

- Ages 75+ → $808.45/month

- Annual impact: For many seniors, these increases equal about $742 more per year than in 2024.

Important: It’s not a lump-sum check. Instead, the extra money shows up gradually in your monthly pension payments.

Example:

- If you’re 75+ and getting the maximum OAS, your monthly increase is roughly $60+.

- Over a year, that’s about $742 in additional support—enough to cover two months of utility bills or a few extra grocery trips.

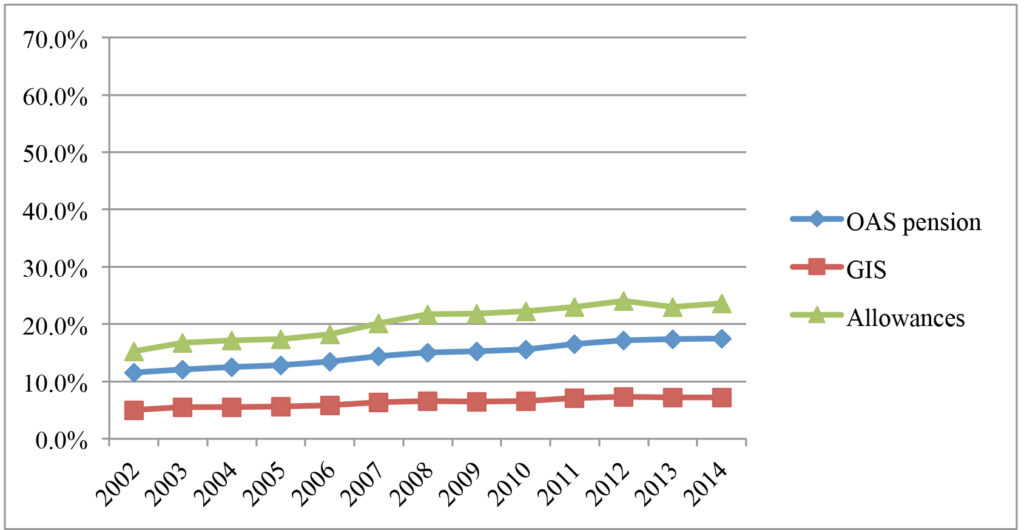

Historical Look: How OAS Has Grown Over Time

Understanding the past helps explain why these increases matter. OAS has always been tied to Canada’s economic conditions:

- 2010: Average OAS was about $516/month.

- 2015: $564/month.

- 2020: $613/month.

- 2022: Big change—Ottawa introduced a permanent 10% increase for seniors 75+, recognizing their higher costs of aging.

- 2025: OAS now $734.95 (ages 65–74) and $808.45 (75+).

In just 15 years, OAS payments have jumped nearly $300/month for many seniors. That’s a lifeline for people who rely heavily on public pensions.

OAS vs. CPP vs. GIS – Understanding the Difference

One of the biggest sources of confusion among seniors is mixing up OAS with CPP and GIS. Let’s make it clear:

- OAS (Old Age Security): Based on age and residency, not work contributions. Almost every Canadian senior qualifies.

- CPP (Canada Pension Plan): Based on how much you contributed during your working years. Higher contributions = bigger pension.

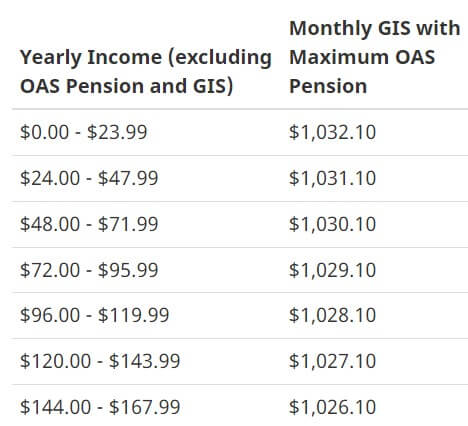

- GIS (Guaranteed Income Supplement): A needs-based top-up for low-income seniors who already get OAS.

So, OAS is like a baseline pension, CPP is tied to your work, and GIS is a safety net for those struggling with very low income.

Who Is Eligible for the CRA Confirms $742 OAS Boost?

OAS is universal, but not everyone gets the same amount. Let’s go deeper into the eligibility factors:

1. Age

- You qualify at 65 years old.

- At 75, you automatically get an extra 10% added on top of your OAS.

2. Residency

- Minimum: 10 years in Canada after turning 18.

- Maximum: 40 years needed for full OAS.

- If you immigrated later in life, you’ll likely get a partial benefit.

3. Income – The Clawback

OAS comes with income limits.

- Clawback starts: $90,997 (2025 threshold).

- Cut-off point: $148,179.

- How it works: OAS is reduced at 15 cents for every dollar you earn over the threshold.

Example:

- Your net world income is $100,000.

- That’s $9,003 over the threshold.

- OAS clawback = $9,003 × 0.15 = $1,350.45.

That means instead of receiving the full $734.95/month, your payments are reduced.

OAS and U.S. Social Security – How Do They Compare?

It’s common for Canadians with family in the U.S. to compare OAS with Social Security.

- Social Security (U.S.): Entirely contribution-based. If you didn’t work, you don’t qualify.

- OAS (Canada): Based on residency, not work. Even someone who didn’t have a career in Canada may still get it.

- GIS vs. SSI (U.S. Supplemental Security Income): Both programs help low-income seniors, but Canada’s GIS tends to be more generous.

This makes Canada’s system more universal, ensuring almost all seniors receive some support.

How to Check If You’ll Get the $742 OAS Boost?

Here’s a simple step-by-step guide:

- Check your age group: Are you 65–74 or 75+?

- Review your residency history: Have you lived in Canada long enough for partial or full OAS?

- Look at your income: Line 23400 on your tax return tells you your net world income.

- Sign in to My Service Canada Account: See your exact OAS payment details.

- Do the math: Compare last year’s OAS payments with this year’s to see your personal increase.

Real-Life Examples

Linda (77, Toronto):

- 2024 OAS: $747/month

- 2025 OAS: $808.45/month

- Annual boost = ~$742

Mike (70, Vancouver, income $120,000):

- His OAS is reduced by clawback.

- Instead of $734.95/month, he receives less.

- His “boost” is smaller because of higher income.

How This Boost Impacts Retirement Planning?

An extra $742 annually might not sound like much, but for seniors on fixed incomes, it’s significant. Here’s how it can fit into your retirement plan:

- Budgeting: That extra $60+ a month can cover groceries, medications, or even part of your property tax bill.

- Tax planning: Since OAS is taxable, use RRSP withdrawals carefully to avoid clawbacks.

- Deferral strategy: If you don’t need OAS at 65, delaying until 70 can boost payments by up to 36%.

Practical Tips to Maximize OAS

- Avoid clawbacks: Keep taxable income below $90,997.

- Income splitting: Share pension income with your spouse to lower taxes.

- Use TFSA savings: Withdraw from TFSAs instead of RRSPs to keep income lower.

- Stay updated: OAS rates change quarterly—always check the official payments page.

Common Myths About OAS

- Myth 1: “Everyone gets $742 extra.” → False. Depends on age, income, and residency.

- Myth 2: “It’s a one-time bonus check.” → Nope. It’s spread over 12 months.

- Myth 3: “OAS payments can go down.” → Wrong. They never decrease, even if inflation falls.