CRA Benefits Payment Dates: November 2025 is a vital month for many Canadians who depend on the financial support provided by the Canada Revenue Agency (CRA). Keeping track of when your Old Age Security (OAS), Canada Pension Plan (CPP), and Canada Workers Benefit (CWB) payments will arrive can make a huge difference in managing your cash flow effectively. Whether you are a retiree budgeting your monthly expenses, a low-income worker relying on tax credits, or a family planning your monthly budget, this detailed guide will clarify everything you need to know about these benefits. This article is designed to be easy to understand for everyone while offering substantial insights for financial professionals and advisors. It covers the payment schedule, eligibility, practical tips, and common questions—all presented in a friendly, conversational tone with authority and trustworthiness.

Table of Contents

CRA Benefits Payment Dates

November 2025 is an important month for many Canadians relying on CRA benefits to meet their financial needs. The key date to remember is November 26, when Old Age Security and Canada Pension Plan payments arrive—providing crucial income for seniors and retirees nationwide. Families with children will see the Canada Child Benefit on November 20, while low-income workers will look forward to the next Canada Workers Benefit payment in January 2026. Maximizing your benefits means staying informed, filing taxes on time, updating your information, and opting for direct deposit wherever possible. With these strategies, you can navigate November’s payment schedule confidently, ensuring your finances remain steady and on track.

| Benefit Program | November 2025 Payment Date | Who It’s For | Payment Frequency | Additional Info |

|---|---|---|---|---|

| Old Age Security (OAS) | November 26, 2025 | Seniors 65+ | Monthly | Includes Guaranteed Income Supplement (GIS) |

| Canada Pension Plan (CPP) | November 26, 2025 | Retirees, disabled contributors | Monthly | Partial benefits eligible from age 60 |

| Canada Workers Benefit (CWB) | No payment in November | Low-income workers | Quarterly (next in Jan 2026) | Advance payments in Jan/Jul/Oct, no Nov payout |

| Canada Child Benefit (CCB) | November 20, 2025 | Families with children under 18 | Monthly | Supports child-rearing costs |

| GST/HST Credit | No payment in November | Low- and moderate-income families | Quarterly (next in Jan 2026) | Tax credit to offset sales tax |

| Climate Action Incentive Payment (CAIP) | November 15, 2025 | Residents in eligible provinces | Quarterly | Helps offset carbon tax |

What Are CRA Benefits Payment? Breaking It Down

The Canada Revenue Agency manages several important benefit programs designed to offer financial aid to Canadians at various life stages and economic situations. These programs aim to reduce financial stress, support families, seniors, and workers, and help with everyday expenses and long-term security.

- Old Age Security (OAS): This is a government pension paid monthly to most Canadians aged 65 and older. It helps seniors cover daily living expenses such as housing, food, and healthcare costs.

- Guaranteed Income Supplement (GIS): Combined with OAS, the GIS provides additional financial support to low-income seniors, ensuring that they have enough to cover their basic needs.

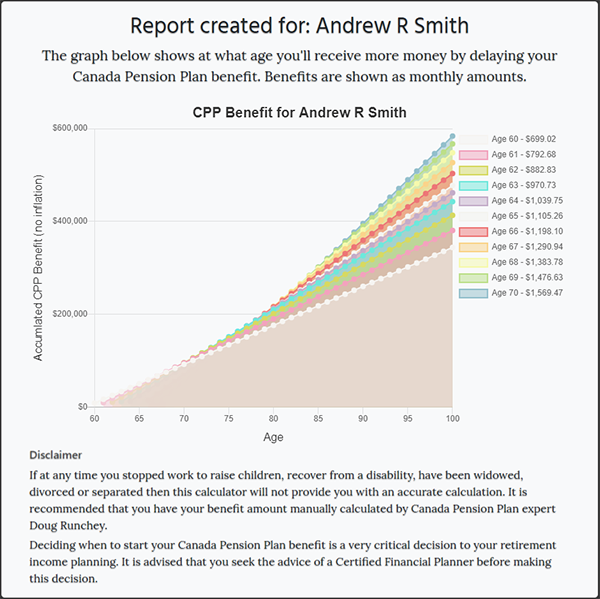

- Canada Pension Plan (CPP): CPP provides retirement, disability, and survivor benefits to Canadians who have contributed through their employment during their working years. Payments start as early as age 60 (with reduced amounts) but increase if deferred to age 70.

- Canada Workers Benefit (CWB): This refundable tax credit helps low-income workers boost their earnings and encourages workforce participation.

- Canada Child Benefit (CCB): This monthly payment assists families with the cost of raising children under 18, helping cover expenses such as childcare, education, and basic living costs.

- GST/HST Credit: A benefit to help offset sales taxes for low- and moderate-income families, paid quarterly.

- Climate Action Incentive Payment (CAIP): A quarterly rebate for residents of certain provinces to compensate for costs related to the federal carbon pricing system.

Together, these benefits represent a comprehensive social safety net that supports millions of Canadians, helping them maintain a decent standard of living.

November 2025 CRA Benefits Payment Dates: What to Expect

Old Age Security and Guaranteed Income Supplement – November 26

For seniors, the most awaited CRA payment in November is the Old Age Security (OAS) pension, along with the Guaranteed Income Supplement (GIS), scheduled for November 26, 2025. This monthly payment offers a vital source of income for seniors, many of whom rely heavily on it to cover essential expenses, particularly with the added financial pressures of winter months.

Key Insight: Direct deposit is the preferred method for receiving OAS/GIS payments because it guarantees quick and secure delivery. Seniors who still receive paper cheques may experience delays due to postal processes or weather interruptions.

Example: Betty, a 75-year-old grandmother living in rural Ontario, budgets her monthly groceries and medication around the OAS deposit date, ensuring bills are covered promptly.

Pro Tip: Setting up direct deposit through CRA My Account can save you time and reduce stress associated with waiting for mailed payments.

Canada Pension Plan Benefits – November 26

The Canada Pension Plan (CPP) payment also comes on November 26. This benefit is an important income source for retirees, disabled contributors, and survivors of deceased contributors. Monthly CPP benefits assist in covering mortgage payments, healthcare costs, and other essentials.

Detailed Note: The CPP is funded by contributions from employees, employers, and self-employed individuals. The maximum monthly CPP retirement benefit in 2025 is approximately $1,350, depending on your contribution history and when you begin receiving payments.

Practical Tip: For those approaching retirement age, delaying CPP benefits up to age 70 results in higher monthly payments—a strategy worth considering for long-term financial planning.

Canada Workers Benefit (CWB) – No Payment in November

Unlike the monthly OAS and CPP, the Canada Workers Benefit (CWB) is paid quarterly. There is no payment scheduled in November 2025; the next payment will arrive in January 2026. This benefit provides a refundable tax credit that helps low-income workers and encourages workforce participation by supplementing earnings.

Additional Info: The amount you receive depends on your income level and family situation. Filing your tax return on time is critical to ensure you receive the CWB payments without interruption.

Canada Child Benefit (CCB) – November 20

Families with children under 18 will receive the Canada Child Benefit (CCB) on November 20, 2025. This monthly payment helps offset the costs of raising children, including expenses related to food, clothing, education, and childcare.

Fact: The CCB is based on family income and size, and extra provincial or territorial top-ups may be available depending on where you live.

Example: The Smith family, with two children under 10, uses the CCB payments to cover part of their childcare costs, helping both parents afford to work full time.

GST/HST Credit – No Payment in November

The GST/HST Credit, designed to offset sales taxes for low- and moderate-income Canadians, is paid quarterly, with no payment in November. The next payment is scheduled for January 2026. This credit can add several hundred dollars annually to eligible families and individuals.

Climate Action Incentive Payment (CAIP) – November 15

On November 15, 2025, residents of provinces where the federal carbon pricing applies (like Ontario, Manitoba, Saskatchewan, and Alberta) can expect the Climate Action Incentive Payment (CAIP). This quarterly rebate helps offset costs related to the carbon tax.

How to Effectively Manage and Maximize Your CRA Benefits Payment?

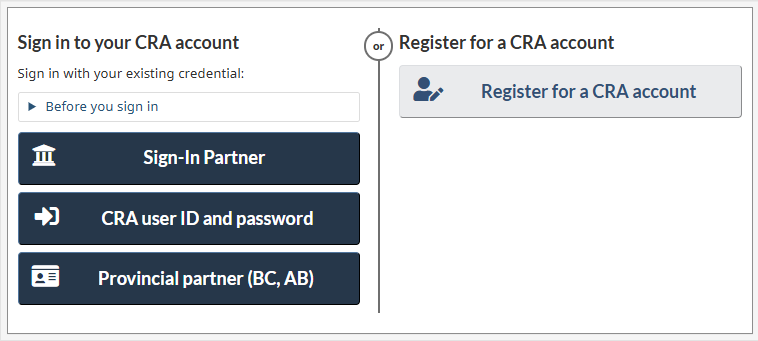

1. Stay Active on CRA My Account

Your CRA My Account is the go-to portal for managing all your benefits. Here, you can monitor payment dates, track amounts, update your personal information, and set up direct deposit. Regularly checking your account helps you avoid surprises and keep control over your finances.

2. Always File Your Income Taxes Promptly

Eligibility and payment amounts often rely on your annual tax returns. Filing late can delay or suspend payments like the CCB, GST/HST credit, and CWB. Develop a habit of filing before the April 30 deadline to keep your benefits intact and ensure proper CRA assessment.

3. Use Direct Deposit for Faster Payments

Avoid postal delays by linking your bank account to CRA My Account and choosing direct deposit. This method guarantees that payments arrive on the exact scheduled days—fast and secure.

4. Keep Your Personal Info Updated

Change of address, banking details, or marital status? Notify CRA immediately through your online account or by phone. Incorrect info can cause payments to be delayed, lost, or sent to the wrong place.

5. Budget Around Payment Schedules

Plan your monthly budget with payment dates in mind, especially for benefits like the CWB that pay quarterly. Understanding when money will hit your account helps avoid shortfalls and ensures bills and essential expenses are paid on time.

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

65+ Seniors will get $3900 CRA Pension in November 2025, Check Eligibility, Process, Date

CPP, OAS, CWB, CAIP, GST & HST By CRA Payment Dates in November 2025 – Know Amount

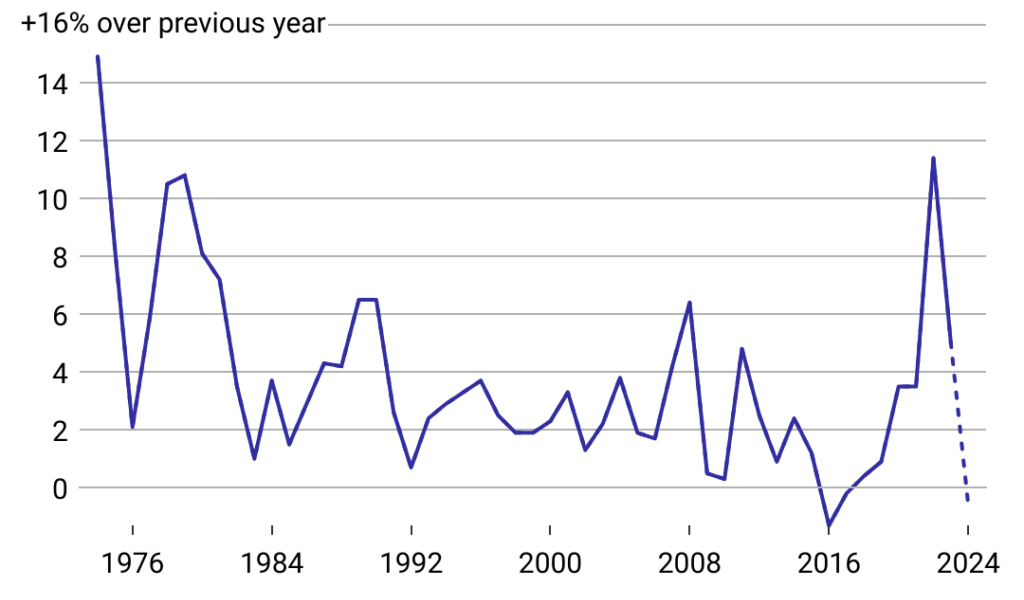

Recent Updates and 2025 Policy Changes to Know

CRA periodically adjusts benefit amounts to account for inflation and economic changes. In 2025, the OAS and CPP maximum payment amounts saw slight increases to keep pace with the rising cost of living. Similarly, the Canada Child Benefit and GST/HST credits were adjusted to provide more support to low- and middle-income families. The CRA has also enhanced its online security systems this year, encouraging digital accounts and direct deposits as safer, more efficient methods to deliver benefits and communicate with recipients.