CRA Benefits Payment: When it comes to managing your finances in Canada, knowing exactly when the Canada Revenue Agency (CRA) benefits payments arrive can have a huge impact on your budget and peace of mind. November 2025 is stacked with many critical payments for families, seniors, low-income workers, and others. Whether you’re awaiting your Canada Child Benefit (CCB), counting on Old Age Security (OAS), or watching for a special one-time federal payment, understanding the complete payment schedule helps you plan smartly and avoid any surprises. This article breaks down the CRA benefits payment dates for November 2025 in a clear, friendly way designed for everyone—whether you’re 10 or a seasoned pro in finance. You’ll get detailed insights, practical tips, and official info to make sure you get the most out of these key CRA benefits.

Table of Contents

CRA Benefits Payment

The CRA benefits payment schedule for November 2025 is full of vital payments aiding millions across Canada. Understanding the timeline, eligibility, and how to avoid issues can make a major difference in managing finances and reducing stress. Timely tax filing, keeping your CRA account updated, and choosing direct deposit ensure smooth payments. With CRA’s ongoing service improvements, accessing these benefits is becoming faster and easier — making November a pivotal month for many Canadian households.

| Benefit Program | Payment Date(s) | Frequency | Eligible Recipients |

|---|---|---|---|

| Canada Child Benefit (CCB) | November 20, 2025 | Monthly | Families with children under 18 |

| Old Age Security (OAS) | November 27, 2025 | Monthly | Seniors aged 65 and older |

| Canada Pension Plan (CPP) | November 27, 2025 | Monthly | Retired individuals, disabled persons |

| GST/HST Credit | November 5, 2025 | Quarterly | Low and middle-income Canadians |

| Climate Action Incentive (CAI) | November 15, 2025 | Quarterly | Residents in certain provinces |

| Canada Workers Benefit (CWB) | Next payment in January 2026 | Quarterly | Low-income workers |

| Canada $300 Federal Payment | November 20–30, 2025 (One-time) | One-time | Eligible low and middle-income Canadians |

Why CRA Benefits Payment Is a Game Changer?

Living costs keep jumping, and millions of Canadians count on the government’s CRA payments to help balance their budgets, cover essentials, and prepare for the future. These benefits are critical support systems tailored to different life stages and needs.

- The Canada Child Benefit (CCB) supports families raising kids by covering daily costs from food to school supplies.

- Old Age Security (OAS) and the Canada Pension Plan (CPP) provide a steady income for seniors and those unable to work due to disability.

- The GST/HST Credit returns part of the sales tax paid, easing expenses for low- and middle-income Canadians.

- The Climate Action Incentive (CAI) offsets extra costs for residents subject to carbon pricing in certain provinces.

- Finally, the Canada $300 Federal Payment is a fresh burst of relief for those facing inflation and rising prices, automatically disbursed this November.

The financial lifeline from these benefits helps Canadians maintain stability, meet daily needs, and reduce financial stress.

November 2025 CRA Benefits Payment Schedule Explained

November 5, 2025 – GST/HST Credit

This is a quarterly tax-free payment designed to help low- and middle-income Canadians by offsetting the GST or HST they pay on purchases. Qualifying individuals don’t need to apply separately if their taxes are filed on time—CRA reviews tax data annually for eligibility.

November 15, 2025 – Climate Action Incentive

Residents of provinces such as Alberta, Ontario, Manitoba, and Saskatchewan will receive this quarterly payment to help with costs related to carbon taxes on fuel, heating, and electricity. This incentive helps cushion the financial impact of Canada’s environmental policies.

November 20, 2025 – Canada Child Benefit (CCB) and $300 Federal Payment

Families with kids under 18 will receive their monthly CCB income support, which is vital for day-to-day expenses. In addition, the one-time $300 Federal Payment begins distribution, targeted to eligible Canadians based on filing their 2024 tax returns and income thresholds. The CRA automatically deposits this tax-free payment by direct deposit or mailed cheque by the end of the month.

November 27, 2025 – Old Age Security (OAS) and Canada Pension Plan (CPP)

Seniors and retired workers will get their reliable monthly income from these programs. This money is essential for housing, healthcare, prescription costs, and general living expenses.

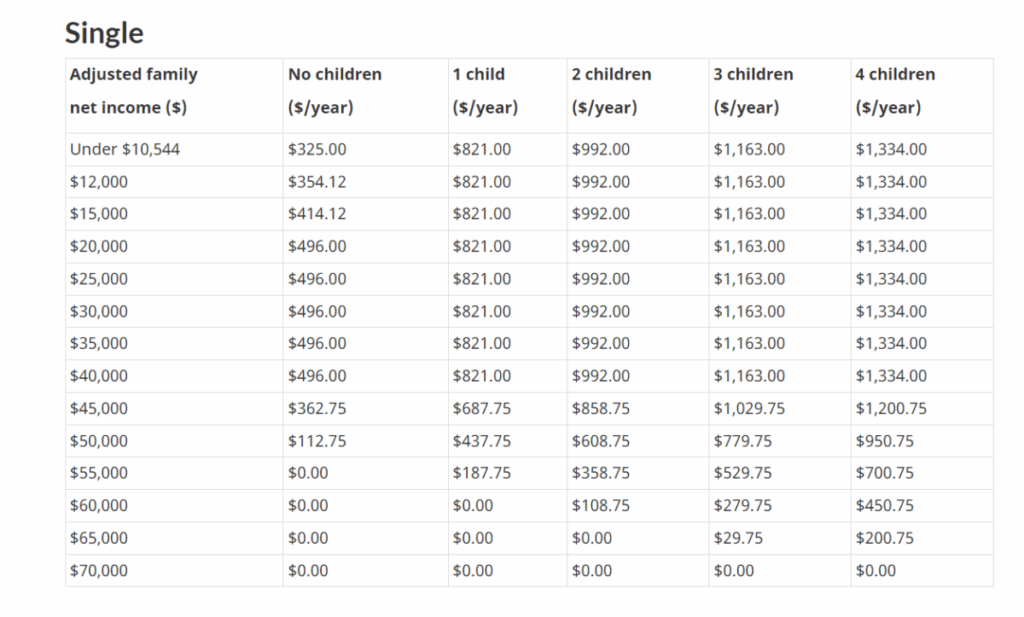

Who Qualifies for CRA Benefits Payment in 2025?

Eligibility requirements vary by benefit but generally include:

- Filing a valid federal income tax return for 2024 to enable CRA to determine benefit eligibility and amounts.

- Being a resident of Canada for tax purposes for the relevant year.

- Income thresholds designed to target low and moderate-income Canadians are applied (family size and province impact benefit levels).

- For the Canada Child Benefit, you must be responsible for a child under 18 living with you.

- The Canada Workers Benefit requires active employment and income below provincial-specific limits.

- Special categories like Indigenous peoples, newcomers, and protected persons have tailored criteria ensuring broad eligibility.

- The $300 Federal Payment targets Canadians with low to moderate incomes who’ve filed taxes for 2024.

These rules aim to offer fair financial help to those who need it most.

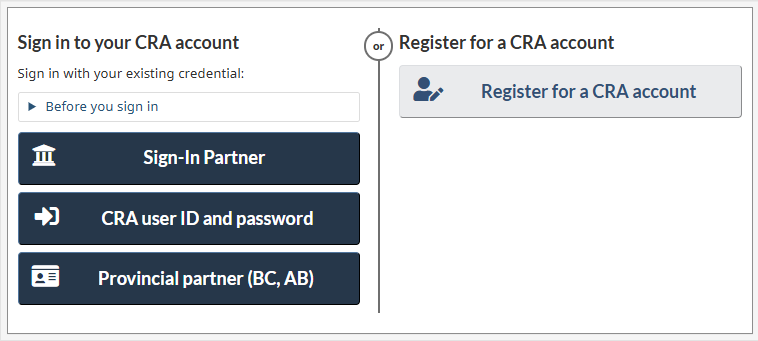

How to Get the Most from Your CRA Benefits Payment?

- File your taxes on time and accurately. The CRA relies on your tax filing to assess your benefits for each year.

- Keep your CRA My Account up-to-date with your current mailing address, banking info, and personal details to avoid payment delays.

- Opt for direct deposit. Payments arrive faster securely than by mailed cheques.

- Use CRA’s online tools. Monitor your payment status with the CRA My Account portal or mobile app for realtime updates.

- Avoid scams. The CRA never asks for personal information via unsolicited emails or phone calls. Always verify through official online portals.

Common Mistakes to Avoid

- Forgetting to update your bank or address info.

- Filing tax returns late or not at all, forcing benefit interruptions.

- Ignoring CRA notices on eligibility or payment issues.

- Assuming benefits continue automatically without filing annual returns.

Avoiding these simple mistakes ensures smooth, uninterrupted payments.

What to Do if Your Benefits Are Denied or Delayed?

If you encounter issues:

- Check your CRA My Account for any alerts or messages.

- Verify your last tax return was processed correctly.

- Contact CRA for explanations or to request a formal appeal.

- Reach out to community organizations or financial advisors if assistance is needed.

CRA provides appeal processes to ensure you receive what you qualify for.

Positive Changes: CRA’s 2025 Service Improvements

The CRA’s 2025 100-day Service Improvement Plan targets faster processing, fewer hold times, and better online experiences. More secure portals and streamlined payment operations mean Canadians should expect quicker response times and smoother interactions when dealing with benefit issues. These enhancements reflect CRA’s effort to make benefits more accessible and easier to manage.

CRA Benefits Payment Dates in November 2025 – OAS, CPP & CWB Benefits Date

65+ Seniors will get $3900 CRA Pension in November 2025, Check Eligibility, Process, Date

CPP, OAS, CWB, CAIP, GST & HST By CRA Payment Dates in November 2025 – Know Amount

Financial Planning Tips for CRA Benefit Recipients

- Plan monthly expenses around fixed CRA payment dates.

- Prioritize essentials like rent, utilities, and groceries using your benefits.

- Enable banking alerts for deposits so you know when funds arrive.

- If finances are complex, seek professional advice on budgeting and tax filing.