CRA Approved $1100 OAS Benefit: If you’ve been on Facebook, YouTube, or TikTok lately, you’ve probably seen posts claiming, “CRA approves a $1,100 OAS payment for all Canadian seniors this October!” Sounds exciting — but hold your horses. Before you start planning what to do with that extra money, let’s break it down. Is the $1,100 Old Age Security (OAS) benefit real, or just another online rumor that’s gotten out of hand? This article walks you through what’s true, what’s not, and how Canada’s OAS system really works. We’ll also cover how to check your eligibility, avoid scams, and make sure you’re getting every legitimate benefit available to you.

Table of Contents

CRA Approved $1100 OAS Benefit

Despite viral claims, the CRA has not approved a $1,100 OAS benefit for all seniors in October 2025. The real OAS payment remains between $740 and $814 per month, with additional GIS benefits available to low-income seniors. The next official payment date is October 29, 2025. Always verify information, keep your taxes up to date, and manage benefits securely. Don’t let misleading headlines confuse or scare you — when it comes to your retirement income, facts matter more than Facebook.

| Topic | What’s True / What to Know |

|---|---|

| $1,100 OAS Bonus Claim | No official confirmation that CRA or the Government of Canada approved a one-time $1,100 benefit for all seniors in 2025 |

| OAS Payment Date (October 2025) | Scheduled for October 29, 2025 |

| OAS Maximum Monthly Amount (Oct–Dec 2025) | Ages 65–74: $740.09; Age 75+: $814.10 |

| GIS (Guaranteed Income Supplement) | For low-income OAS recipients; maximum for singles is $1,105.43/month |

| OAS Clawback (Recovery Tax) | Begins at around $93,454 net annual income (2025) |

| Apply or Verify Benefits | Use My Service Canada Account (MSCA) |

| Official Source | Canada.ca |

Understanding the Old Age Security (OAS) Program

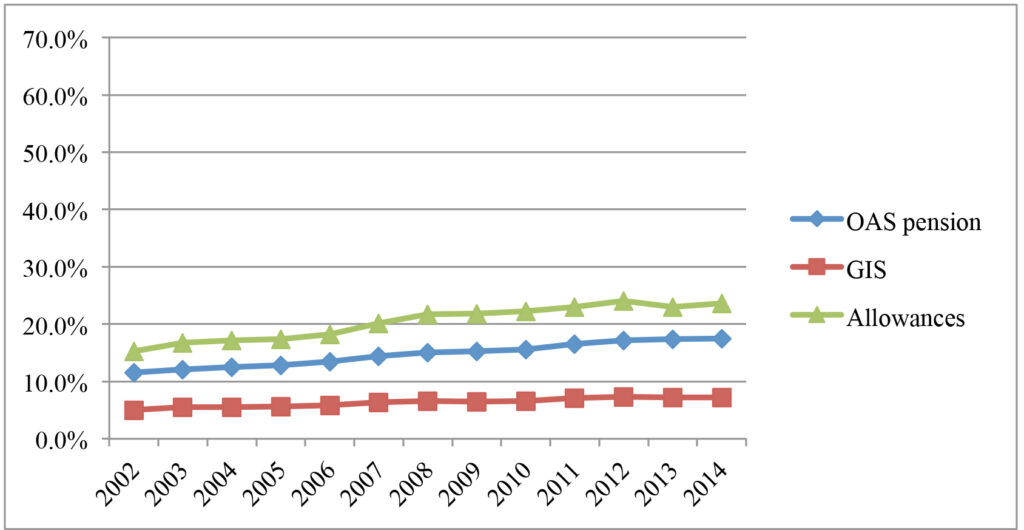

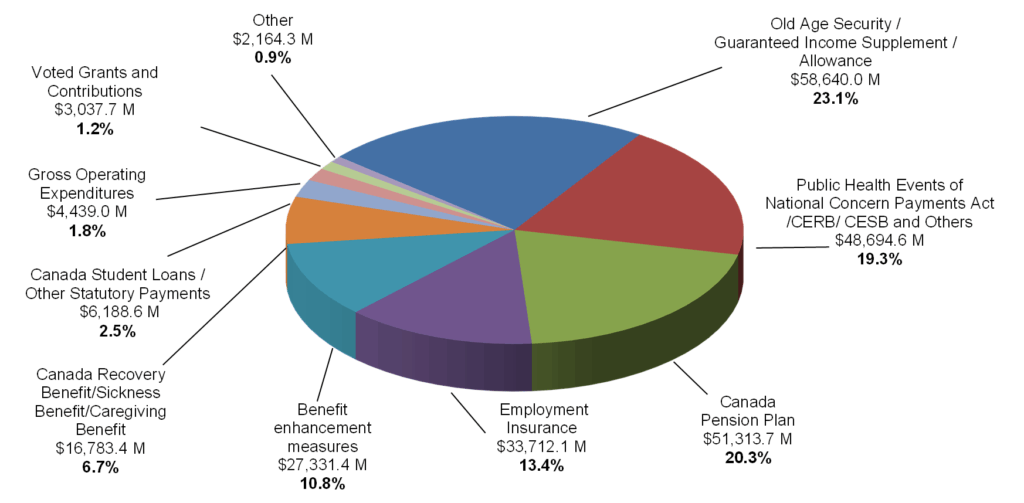

The Old Age Security (OAS) pension is one of Canada’s most important federal programs. It’s been around since 1952, designed to ensure that older Canadians have a stable income during retirement — even if they didn’t contribute to a private or workplace pension.

Unlike the Canada Pension Plan (CPP), OAS isn’t based on how much you worked or earned. It’s funded by tax revenues, so almost everyone who has lived in Canada long enough can qualify.

To be eligible, you must:

- Be 65 years or older

- Be a Canadian citizen or legal resident

- Have lived in Canada for at least 10 years after turning 18

If you’ve lived in Canada for 40 years or more, you likely qualify for the full OAS pension. But if you’ve lived here for fewer years, you may still get a partial benefit, calculated based on your years of residency.

Why the CRA Approved $1100 OAS Benefit Claim Isn’t True?

Let’s get to the heart of the issue. Despite what viral videos and blog headlines suggest, there’s no official announcement that the Government of Canada or the Canada Revenue Agency (CRA) has approved a new $1,100 universal OAS payment in October 2025.

Here’s what’s really happening:

- The maximum OAS monthly payment for ages 65–74 in late 2025 is $740.09.

- The 75+ group receives up to $814.10/month (a 10% increase added in 2022).

- The Guaranteed Income Supplement (GIS), which can reach about $1,105/month, is not for everyone — it’s reserved for low-income seniors who already receive OAS.

So when people talk about a “$1,100 OAS payment,” they’re often confusing OAS with GIS. The GIS can bring a person’s total monthly benefit above $1,800, but that applies only to specific low-income recipients — not all seniors.

If this were a government-approved universal payment, there would be an official press release, budget line item, or CRA notice. There isn’t one.

How OAS Payments Are Calculated?

OAS payments are indexed to inflation and adjusted every quarter — in January, April, July, and October. The adjustments are tied to the Consumer Price Index (CPI), which measures changes in living costs like food, shelter, and utilities.

If the CPI goes up, so does your OAS. But if prices go down (which rarely happens), your payment stays the same — it never decreases.

For October–December 2025, the government estimates:

- $740.09/month for ages 65–74

- $814.10/month for ages 75+

These figures come straight from the federal OAS payment schedule and reflect the most recent inflation-based adjustments.

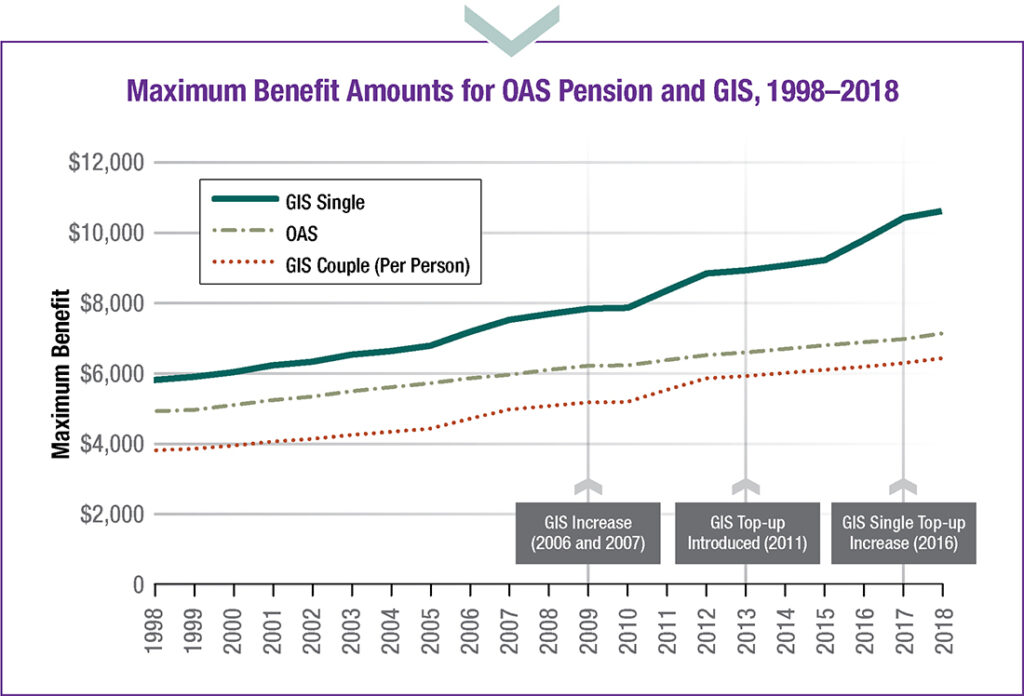

The Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement (GIS) is an additional monthly payment for low-income seniors who already get OAS. It’s non-taxable, meaning you won’t owe tax on it, and it’s designed to help cover essential living costs.

To qualify for GIS:

- You must be receiving OAS

- You must have a low annual income

- You must live in Canada

As of late 2025, the maximum GIS for a single senior is $1,105.43/month if their income is below about $22,272/year.

Couples can also receive GIS, but the combined income threshold is higher, and the payments are split based on household income.

You don’t need to reapply every year — as long as you file your taxes, GIS renews automatically.

Understanding the OAS Clawback (Recovery Tax)

If you have a high income, you might have to repay some or all of your OAS. This is called the OAS Recovery Tax, or clawback.

For the 2025 tax year, the clawback starts if your net world income is above $93,454. Once your income passes that level, you’ll repay 15 cents of every dollar over the threshold.

Example:

- If your net income is $100,000

- Your income above the threshold = $100,000 − $93,454 = $6,546

- Clawback = $6,546 × 0.15 = $982

That means you’d repay about $982 of your OAS in taxes. If your income is very high (over $150,000+), you could lose the entire OAS payment for that year.

Comparing OAS, GIS, and CPP

It’s easy to mix these up, so here’s a quick breakdown:

| Program | Purpose | Taxable? | Based On | Typical Range |

|---|---|---|---|---|

| OAS (Old Age Security) | Base pension for most Canadians 65+ | Yes | Residency | $740–$814/month |

| GIS (Guaranteed Income Supplement) | Extra payment for low-income OAS recipients | No | Income | Up to $1,105/month |

| CPP (Canada Pension Plan) | Earnings-based pension | Yes | Lifetime contributions | Average $772/month (2024) |

Together, these programs help seniors maintain a reasonable standard of living in retirement.

Example Scenarios

Example 1: Mary, 68, Alberta

Mary worked part-time most of her life and earns about $18,000/year in retirement. She qualifies for full OAS and full GIS.

Her monthly payments might look like this:

- OAS = $740

- GIS = $1,105

Total ≈ $1,845/month

Example 2: Bob, 72, British Columbia

Bob earns $95,000/year from investments and pensions. His income is above the clawback threshold, so his OAS is partially reduced.

He receives a smaller OAS amount and no GIS.

These examples show why blanket claims like “everyone gets $1,100” are misleading — benefits depend entirely on income and eligibility.

How to Check Your Eligibility and Apply for CRA Approved $1100 OAS Benefit?

- Confirm Your Eligibility

You must be 65 or older, a Canadian citizen or permanent resident, and have lived in Canada for at least 10 years after age 18. - Apply Online via My Service Canada Account (MSCA)

Most people are automatically enrolled, but some need to apply. Use your MSCA login to apply or confirm your enrollment. - Keep Your Taxes Updated

OAS and GIS eligibility are based on your tax returns. Even if you earn little or nothing, always file your taxes. - Set Up Direct Deposit

You can have payments sent directly to your bank account for safety and convenience. - Check Payment Dates

For October 2025, payments are scheduled for October 29, 2025.

Inflation and Future Adjustments

Inflation directly affects how much seniors receive. Over the past few years, Canada’s inflation rate has fluctuated between 2.8% and 6%, leading to OAS adjustments of around 3% per year.

In 2022, the government introduced a 10% permanent increase for seniors aged 75 and older — the first since 1973 — recognizing that older retirees often face higher costs, particularly in healthcare and housing.

As inflation persists, OAS and GIS amounts are expected to continue rising modestly each quarter to maintain purchasing power.

Budgeting Tips for Seniors on OAS or GIS

- Track your fixed expenses — rent, food, transportation, and medical costs should take priority.

- Automate bill payments right after OAS deposits to stay organized.

- Use senior discounts on groceries, prescriptions, and transit passes.

- Apply for provincial top-ups, like Ontario’s GAINS or B.C.’s Shelter Aid for Elderly Renters (SAFER).

- Avoid unnecessary debt — interest can quickly erode limited retirement income.

For tailored advice, speak with a certified financial planner who understands senior benefits.

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility

How to Avoid Scams and Misinformation?

Sadly, fraudsters often target seniors with fake “OAS top-up” messages.

Here’s what to remember:

- CRA or Service Canada will never call, text, or email you to demand payment or gift cards.

- Don’t click links in suspicious emails.

- Visit only the official government website.

- Report suspicious messages to the Canadian Anti-Fraud Centre at antifraudcentre-centreantifraude.ca.

When in doubt, call Service Canada directly to verify any information.