CRA Announces Payment Dates: If you’ve been wondering when your Canada Revenue Agency (CRA) benefits will hit your bank account this fall, you’re not alone. Millions of Canadians depend on monthly or quarterly payments — from the Canada Child Benefit (CCB) to the GST/HST credit — to keep their budgets on track. Well, good news: the CRA has officially announced the payment dates for October 2025, and we’re here to break them down. Whether you’re a parent, retiree, or worker trying to stretch every dollar, this guide covers everything you need to know — payment dates, estimated amounts, eligibility details, and practical financial advice. Let’s dive in.

Table of Contents

CRA Announces Payment Dates

The CRA payment dates for October 2025 are now set and clear. Canadians can expect:

- GST/HST Credit – October 3

- Ontario Trillium Benefit & ACWB – October 10

- Canada Child Benefit – October 20

- OAS / CPP – October 29

The exact CRA payment amount depends on income, province, and family composition. To stay on track:

- File your taxes early

- Use direct deposit

- Keep your CRA profile updated

- Budget around your benefit dates

For millions of Canadians, CRA payments aren’t just numbers — they’re lifelines. Knowing when they arrive, how they work, and how to manage them wisely is the key to financial stability in 2025.

| Benefit / Program | Payment Date (October 2025) | Average / Typical Amounts |

|---|---|---|

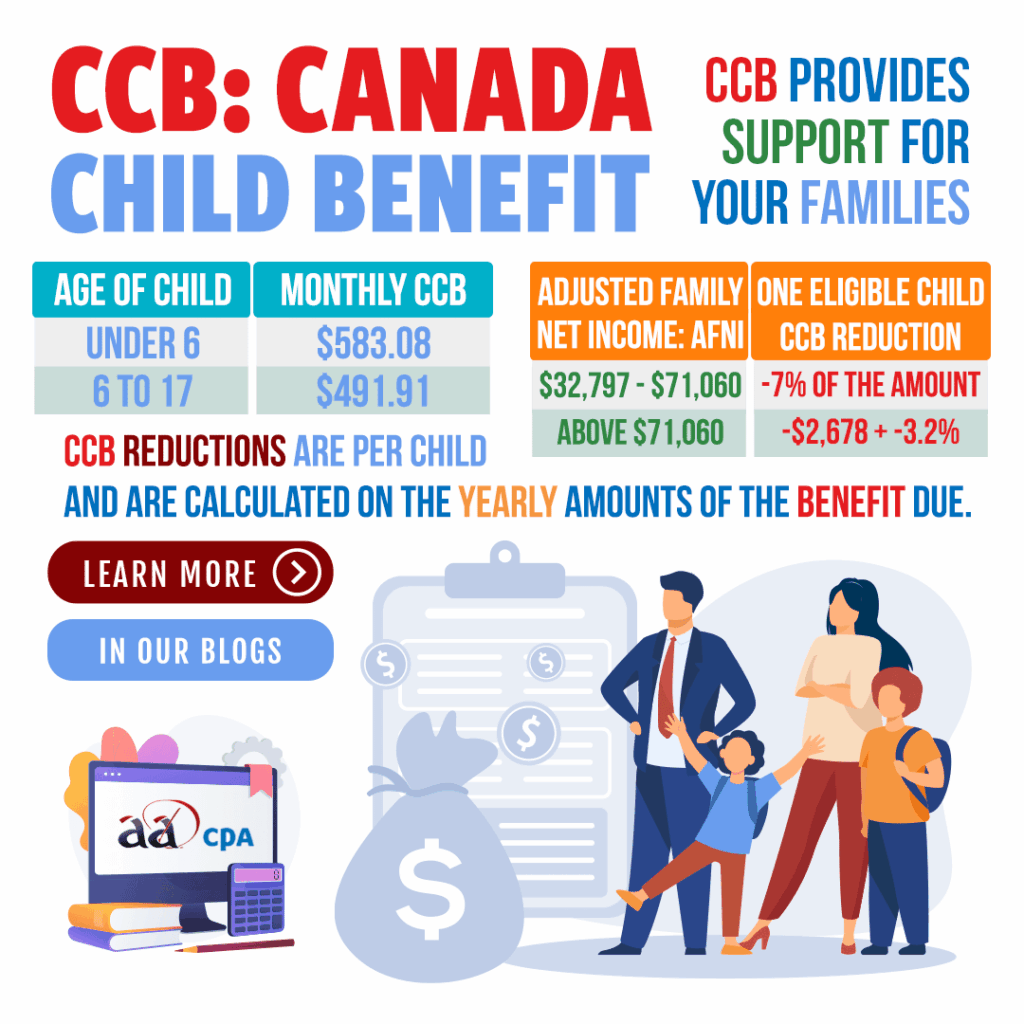

| Canada Child Benefit (CCB) | October 20, 2025 | Up to $7,787 per child under 6 and $6,570 per child aged 6–17 per year |

| GST / HST Credit | October 3, 2025 | Up to $533 (single), $698 (couple), plus $184 per child (based on income) |

| Ontario Trillium Benefit (OTB) | October 10, 2025 | Based on energy, sales, and property tax claims |

| Advanced Canada Workers Benefit (ACWB) | October 10, 2025 | Up to $1,518 for singles / $2,616 for families (advance payment) |

| Old Age Security (OAS) / CPP | October 29, 2025 | OAS: up to $713.34/month, CPP average $758.32/month |

Why CRA Announces Payment Dates Matter?

Timing matters — especially when life’s bills don’t wait. Many Canadians build their monthly budgets around CRA benefit payments, and a delay or missed date can ripple through rent, grocery, and childcare costs.

Here’s why staying on top of CRA’s schedule matters:

- It helps you avoid late bill payments by syncing due dates with deposits.

- It ensures financial predictability — no nasty surprises mid-month.

- It protects against fraud or scams, since you’ll know exactly when and how much to expect.

- It helps professionals, retirees, and families track cash flow and plan ahead.

Simply put, these aren’t just government deposits — they’re essential income supplements that make real life work for millions of people.

What’s New for 2025?

The 2025 benefit year includes several important updates:

- Canada Carbon Rebate (CCR) officially ended in April 2025, replaced by a new climate affordability initiative.

- OAS and CPP received modest increases (around 3.2%) tied to inflation adjustments.

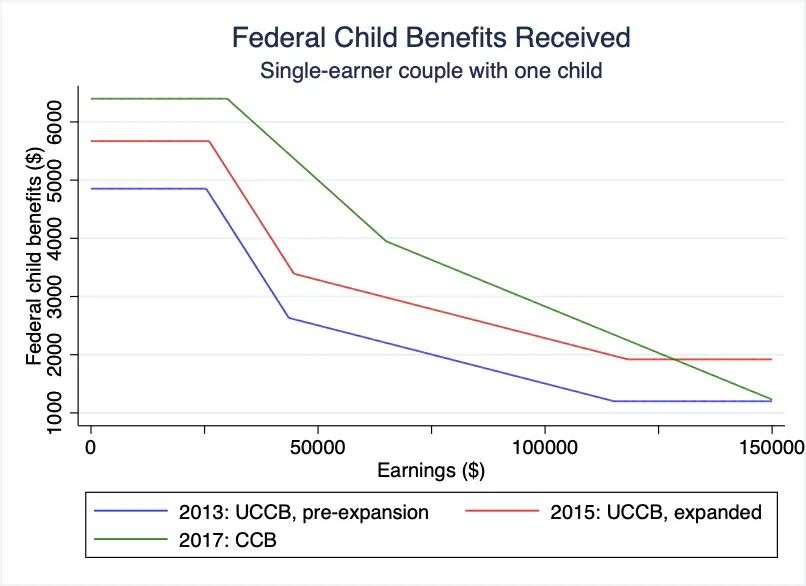

- The Canada Child Benefit (CCB) increased again in July 2025 to keep pace with the cost of living.

- Automatic Advanced CWB Payments continue — helping lower-income workers without requiring separate applications.

- CRA’s direct deposit participation crossed 95%, meaning faster payments and fewer mail delays.

The government continues to digitize benefit delivery, making it easier to track and receive funds in real-time through the CRA My Account system.

Step-by-Step Guide: Managing CRA Announces Payment Dates in October 2025

1. File Your 2024 Tax Return Early

Most CRA benefit calculations — including CCB, GST/HST credit, and ACWB — are based on your 2024 tax return.

If you miss the April 30, 2025 filing deadline, your benefits could pause or be recalculated later, delaying payments. Filing early ensures the CRA has accurate data to base your benefits on. Even if you have no income, you should file — it’s the only way to qualify.

2. Set Up or Update Direct Deposit

Avoid the old-fashioned paper cheque delays by setting up direct deposit. You can do this easily through:

- CRA My Account (under “Profile” > “Direct Deposit”)

- Your online banking portal (most major banks let you register CRA payments directly)

Once set up, your payments go straight to your account — secure, fast, and trackable.

3. Know Your Payment Dates and Mark Your Calendar

Here’s how October 2025 plays out:

- October 3 → GST/HST Credit

- October 10 → Ontario Trillium Benefit and ACWB

- October 20 → Canada Child Benefit

- October 29 → OAS / CPP for seniors

If a date falls on a weekend or holiday, CRA typically pays one business day earlier.

4. Track Payments in CRA My Account

Don’t waste time waiting on hold. Instead, log in to CRA My Account and check your Benefits & Credits section.

There you can view:

- Upcoming payment dates

- Payment history

- Any adjustments, holds, or reassessments

If a payment doesn’t show up after 10 business days, contact CRA directly.

5. Handle Delays the Smart Way

If your payment doesn’t show up on time, don’t panic. Follow these quick checks:

- Confirm your direct deposit details.

- Verify that your tax return was assessed.

- Look for a notice of reassessment — CRA may have adjusted your benefits.

- Review any outstanding debts or overpayments, which can trigger offsets.

- If all else fails, call CRA Individual Inquiries at 1-800-959-8281.

CRA won’t text or email you payment requests — so ignore suspicious links.

Inflation and the Cost of Living in 2025

The Bank of Canada projects inflation to hover near 2.9% in late 2025. While that’s moderate compared to 2022–2023 spikes, everyday costs like food, energy, and rent remain high.

That’s why CRA’s indexed benefits are crucial. For example:

- CCB increased mid-2025 to account for price growth.

- OAS and CPP adjustments ensure retirees maintain buying power.

- CWB and GST credits target low-income households most affected by rising costs.

Still, the math is simple: inflation eats away at every dollar. So, make these benefit payments work for you, not vanish into daily spending.

Budgeting Advice: Stretching Your CRA Payments Further

Even though CRA benefits aren’t massive, they’re powerful when managed wisely. Here’s how to get the most out of them:

- Automate your bills. Schedule essential payments (rent, hydro, insurance) to align with CRA deposit dates.

- Separate needs from wants. Use CCB or GST funds for necessities, not impulse buys.

- Create a buffer fund. Set aside 10% of each benefit for emergencies.

- Invest long-term. Open a TFSA or RESP — both come with government incentives.

- Track expenses. Free tools like Mint or YNAB sync with Canadian banks and keep your spending visible.

A few smart moves can make your October 2025 benefits last beyond the month.

Common CRA Myths (and the Truth)

Myth 1: CRA payments are taxable.

Not true — most benefits, like CCB, GST/HST, and OTB, are tax-free. Only pensions (CPP, OAS) count as taxable income.

Myth 2: Everyone gets the same amount.

Nope. Amounts depend on income, marital status, dependents, and province.

Myth 3: CRA payments come automatically forever.

They continue only if you keep filing taxes annually and meet eligibility requirements.

Myth 4: CRA will call or text if a payment is late.

Never. CRA doesn’t contact by text for payments. Any such message is a phishing scam.

Example Scenarios

Example 1: Mark, age 68, retired

- CPP (Oct 29): $750

- OAS (Oct 29): $710

Total: $1,460 — taxable but steady monthly support.

Example 2: Jasmine, single mom, 2 kids under 10

- GST/HST (Oct 3): $250

- OTB (Oct 10): $90

- CCB (Oct 20): $1,150

Total: around $1,490 tax-free for October.

Example 3: Alex, low-income worker, no kids

- ACWB (Oct 10): $350 (advance installment)

- GST/HST (Oct 3): $200

Combined boost: $550 to cover essentials.

These examples show how CRA payments support different stages of life — from working individuals to retirees.

Policy Insight: CRA’s Digital Modernization

CRA has been modernizing rapidly since 2023. By 2025, nearly every benefit program is digitally integrated, making My Account a one-stop hub for:

- Benefit eligibility checks

- Address or banking updates

- Automated recalculations for changing income

- Secure message tracking

This digital-first system reduces fraud, increases transparency, and speeds up payment processing times.

However, it also means Canadians must keep their online profiles up to date — especially after major life changes like marriage, divorce, or new dependents.

How to Contact CRA?

If you need help or suspect an issue with your payment:

CRA Individual Inquiries: 1-800-959-8281 (Mon–Fri, 8 a.m.–8 p.m. local time)

CRA Website: https://www.canada.ca/en/revenue-agency.html

Secure Messages: Use your CRA My Account message center.

Avoid using social media for CRA inquiries — they don’t handle personal files outside official portals.

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date