CRA $533 One-Time Support: If you’re in Canada and wondering about the CRA $533 One-Time Support payment in October 2025, you’re in the right place. This payment is part of the Canada Revenue Agency’s (CRA) GST/HST credit, a quarterly tax-free benefit designed to help low- and modest-income Canadians by offsetting the cost of sales taxes like GST or HST. Whether you’re a first-timer or a regular recipient, this guide breaks down everything you need to know—from who qualifies, how much you can expect, to the simple steps to ensure you get your money on time. Understanding this support is important because it can make a real difference in managing day-to-day expenses, especially with the rising cost of living. Let’s dive into the details with clear examples and expert advice, keeping things simple yet comprehensive. After all, it’s not only about the money but also about empowering you to navigate government benefits effectively.

CRA $533 One-Time Support

The CRA $533 One-Time Support payment in October 2025 is an essential tool for easing the financial burden of sales taxes on Canadians with low or modest incomes. This guide aimed to break down the eligibility, payment details, and practical steps to ensure you receive this important benefit promptly and efficiently. Stay proactive with filing taxes, updating personal info, and signing up for direct deposit to make the most of what the CRA offers.

| Feature | Details |

|---|---|

| Payment Date | October 3, 2025 (first Friday of October) |

| Payment Frequency | Quarterly (Jan, Apr, Jul, Oct) |

| Maximum Annual Amount | $533 for single adults, $698 for couples, $184 per child under 19 |

| Eligibility | Based on 2024 tax return; must be Canadian resident for tax |

| Purpose | Helps offset GST/HST paid on goods and services |

| Payment Method | Direct deposit (preferred) or cheque |

| No Separate Application | Automatic based on income tax filing |

| Official Website | Canada Revenue Agency – GST/HST credit |

What Is the CRA $533 One-Time Support?

The CRA $533 payment refers to the maximum annual benefit provided to single individuals under the GST/HST credit program for 2025, dispersed quarterly. Depending on family status and income, this amount can be higher for couples or families with children.

GST (Goods and Services Tax) is a federal tax of 5% applied to most products and services in Canada, while HST (Harmonized Sales Tax) combines federal and provincial sales taxes in some provinces, with rates between 13% and 15%. The GST/HST credit works to give back a portion of these taxes to Canadians who might feel the pinch most from paying these sales taxes.

The goal? Making life a bit easier financially by giving low- and modest-income Canadians some tax relief each quarter.

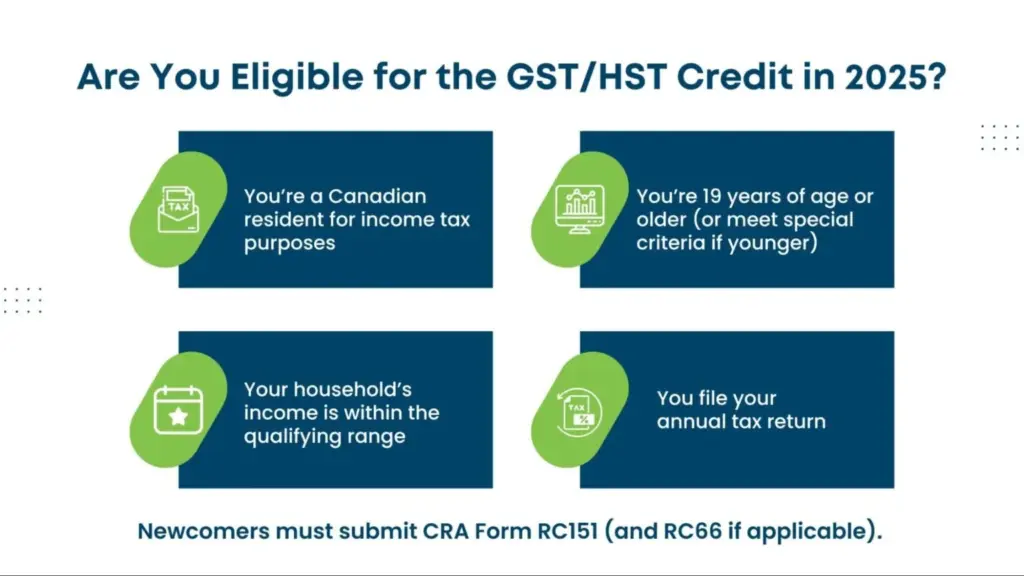

Who Is Eligible for the CRA $533 Payment?

To be eligible, you generally must:

- Be a resident of Canada for tax purposes.

- Be at least 19 years old by December 31, 2024, or have a spouse/common-law partner or be a parent.

- Have filed your 2024 income tax return on time.

- Have an adjusted family net income that falls below specific income thresholds (for singles, the full credit usually phases out above $48,000 annual income).

If you meet these criteria, you won’t need to apply separately—the CRA uses your tax return info to automatically determine eligibility.

How Much Money Can You Expect?

Here’s the breakdown of the maximum amounts for July 2025 to June 2026:

| Household Type | Maximum Annual Credit | Quarterly Payment (Approximate) |

|---|---|---|

| Single Individual | $533 | $133 |

| Couple (Combined) | $698 | $174.50 |

| Per Child Under 19 | $184 | $46 |

Example:

A single parent with two kids could receive about $901 annually or about $225 per quarter, while a retired couple without children might get around $698 annually or $174.50 quarterly.

When and How Will You Receive Your Payment?

The October 2025 payment is scheduled for Friday, October 3, following a consistent quarterly schedule (Jan, Apr, Jul, Oct). The CRA offers two payment methods:

- Direct deposit: Faster, secure, and appears in your bank account on the payment day.

- Cheque: Takes 5-10 business days to arrive by mail, depending on your location.

Signing up for direct deposit through the CRA’s My Account portal is highly recommended to avoid delays.

How This Credit Fits in the Bigger Picture of Canadian Benefits?

The GST/HST credit is just one piece of the puzzle in Canada’s social support system. It complements other benefits like the Canada Child Benefit (CCB), which specifically helps families with children, and income-based supports such as the Canada Workers Benefit (CWB). Together, these programs aim to reduce financial burdens for those who need it most.

As an added bonus, these credits are tax-free, meaning they won’t affect the amount of taxes you owe on your income tax return.

History and Evolution of the GST/HST Credit

The GST/HST credit was introduced in 1991 when the federal GST first came into effect, replacing the previous federal sales tax. Designed to offset the impact of the new tax on low- and modest-income Canadians, the credit has evolved over the years in terms of amounts, eligibility criteria, and payment frequency.

Initially, payments were smaller and less frequent, but as economic conditions and costs of living changed, the government has increased the amounts and made payments quarterly to help families and individuals plan better financially.

Today, the credit is a well-established part of Canada’s tax benefit landscape, serving millions of Canadians each year. According to the CRA, millions of eligible recipients collect the credit annually, helping ease the financial weight of consumption taxes.

Practical Tips: Maximizing Your CRA $533 One-Time Support

Navigating government benefits can be tricky, so here are some tips to make sure you maximize your GST/HST credit experience:

- File taxes on time every year: This is crucial because all credit calculations are based on your tax return.

- Keep your information current: Notify the CRA of any changes to your marital status, dependents, or address.

- Use direct deposit: Avoid long waits for mailed cheques and get your money faster.

- Plan around payment dates: The four quarterly payments come in January, April, July, and October, so plan large bills or expenses accordingly.

- Use credit wisely: Some recipients use these payments to cover everyday essentials like groceries, utilities, or even saving for emergencies.

- Combine with other benefits: If you qualify, stack this with benefits like Canada Child Benefit or provincial programs for more financial support.

Troubleshooting Common Issues

Sometimes payments get delayed or disrupted. Here’s how to handle common problems:

- Delayed payment: Check if your tax return was filed and processed. Filing late can push payments to the next quarter.

- Missing payment: Verify your bank and mailing information in CRA My Account.

- Incorrect amount: Income changes or family composition updates after filing may cause recalculations. Contact the CRA for clarification.

- Scams: Beware of fake calls or emails pretending to be CRA asking for personal info or threatening penalties. The CRA will never request payment by e-transfer or gift cards.

Real-Life Impact: Voices from Recipients

Marilyn, a single mom from Calgary, says, “The quarterly GST/HST payments help me manage my month-to-month bills. Especially during winter heating, it’s a help that can’t be overstated.”

Tom and Sara, retirees from Toronto, use their payments along with their pension to cover extra grocery costs, saying it “makes the difference between scraping and thriving.”

Stories like these show how the credit helps ordinary Canadians manage their finances better in a world where every dollar counts.

Step-by-Step Guide: How to Get Your CRA $533 One-Time Support

- File your 2024 tax return early by the April deadline.

- Ensure your personal info is accurate: address, marital status, dependents.

- Set up direct deposit via CRA My Account.

- Check your eligibility and payment status online.

- Watch for your payment on October 3, 2025.

- If problems arise, contact CRA promptly.

Canada CRA $496 GST/HST Credit for October 2025: Check Payment Dates & Eligibility Criteria

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule