CRA $2460 Pension Supplement: The Canada Revenue Agency (CRA) is preparing to disburse a pension supplement of approximately $2,460 in November 2025 to eligible Canadian seniors. This payment is predominantly part of the Guaranteed Income Supplement (GIS), a program designed to provide extra financial support to low-income seniors who receive the Old Age Security (OAS) pension. This article offers a detailed, expert guide on what this pension supplement means, who qualifies, when payments arrive, and practical advice to help seniors and professionals fully benefit from it.

Table of Contents

CRA $2460 Pension Supplement

The CRA’s pension supplement of approximately $2,460 in November 2025 plays a vital role in supporting low-income Canadian seniors, combining GIS, OAS, and CPP programs into a comprehensive income package. Understanding eligibility criteria, timely tax filing, and monitoring payment schedules empower seniors and advisors to secure and maximize these important benefits. Coupled with practical financial strategies, this support smooths the path to a more secure and dignified retirement.

| Topic | Details |

|---|---|

| Program | Guaranteed Income Supplement (GIS) and CRA Pension Supplement |

| Estimated Total Payment | Up to $2,460 for November 2025 |

| Eligibility Requirements | Age 65+, Canadian resident, receiving OAS, income below set thresholds, not under sponsorship |

| Payment Date | November 26–29, 2025 |

| Program Administrator | Canada Revenue Agency (CRA) |

| Official Resource | Canada.ca GIS Information |

What Is the CRA $2460 Pension Supplement for November 2025?

The CRA pension supplement largely revolves around the GIS program, which is a non-taxable monthly top-up to the Old Age Security pension for seniors with limited income. When combined with OAS and Canada Pension Plan (CPP) payments, this supplement can bring total monthly income close to $2,460 in November 2025 for qualified seniors.

This benefit forms a cornerstone of Canada’s commitment to supporting seniors, helping them manage costs such as housing, food, and medical expenses, especially important given global inflationary pressures and rising living costs.

The supplement ensures that vulnerable seniors can maintain a basic standard of living without fear of financial hardship.

Deep Dive into Eligibility Criteria and Income Thresholds

To qualify for the GIS and this pension supplement, seniors must meet several critical conditions:

- Age: Must be 65 years or older as of the date of payment.

- Residency: Must be living in Canada and typically must have resided in Canada for at least 10 years since turning 18.

- OAS Pension: Applicants must be recipients of the Old Age Security pension.

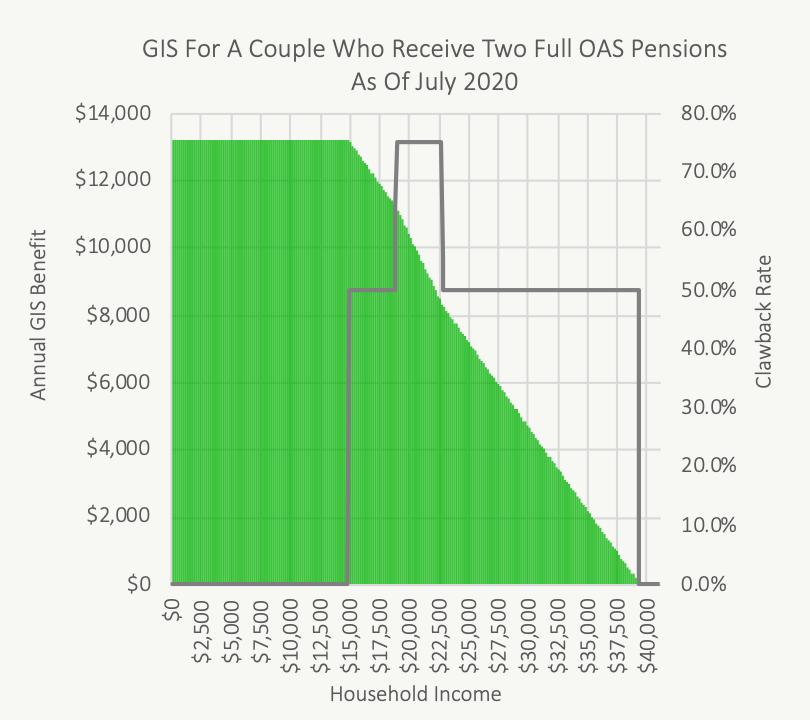

- Income Limits: The GIS is income-tested, meaning your income from the previous calendar year is reviewed to determine eligibility and benefit levels.

- For single seniors, your income (excluding OAS) must be below approximately $22,440 CAD annually.

- For couples, thresholds vary based on your spouse’s OAS or GIS receipt status. For example, combined incomes must generally be below $29,616 if the spouse also receives OAS.

Additional requirements include:

- Not being under a sponsorship agreement. Effective October 1, 2025, sponsored immigrants are excluded from GIS eligibility during the period of sponsorship unless certain exceptions like sponsor’s death apply.

The GIS program ensures that those with the greatest financial need receive the highest possible supplement while gradually reducing the benefit as income increases.

Real-World Context:

Take Susan, a 68-year-old retiree earning $19,000 annually from a part-time job and CPP. Because her income stays under the limit, she qualifies for nearly the full GIS amount, increasing her monthly income significantly and helping fund her medical prescriptions and home heating during harsh winters.

How Much Will You Receive?

The $2,460 approximate pension supplement in November 2025 consists of several parts:

- Old Age Security (OAS): A consistent monthly base pension—around $615 (2025 estimated rate).

- Guaranteed Income Supplement (GIS): Depending on income and marital status, the monthly payments range from $660 to $1,105 roughly.

- Canada Pension Plan (CPP): Regular CPP payments, with additional CPP 2.0 enhancements introduced in 2025 that can increase retirement income by as much as $1,433 monthly for some seniors.

Together, these programs can significantly improve the financial stability of seniors, helping them sustain basic needs and contingencies.

Detailed Payment Schedule for November 2025

CRA issues pension payments regularly and reliably, with November’s supplement payments scheduled between November 26 and November 29, 2025.

- OAS and GIS payments are typically deposited on the same day, providing comprehensive income support simultaneously.

- CPP and the newer enhanced CPP 2.0 payments arrive in the same period, ensuring a consolidated income deposit.

- In select cases, such as if beneficiaries were approved retroactively or if provincial supplements apply, double payments may be processed, boosting seniors’ income further that month.

This consistency supports effective budgeting and financial planning for seniors, who rely on stable cash flow.

Step-by-Step Guide to Application and Maintaining Eligibility?

Step 1: Confirm Eligibility

Verify you meet the age, residency, income, and sponsorship criteria.

Step 2: File Your Tax Returns Annually

CRA uses your previous year’s income tax return to calculate GIS eligibility and benefits. Filing even when you have zero income is crucial to continue receiving benefits uninterrupted.

Step 3: Apply for OAS and GIS

If you are not already receiving benefits, you can apply online via the My Service Canada Account or by completing a paper form.

Step 4: Setup Direct Deposit

Opting for direct deposit ensures faster receipt of payments compared to mailed cheques.

Step 5: Monitor Payments and Communication

Regularly check your CRA or Service Canada online accounts to track payments and respond promptly to any requests or notices.

Step 6: Seek Help if Needed

Contact Service Canada or utilize local community service centers for support with applications or inquiries.

Smart Financial Tips for Seniors Receiving GIS and Pension Supplements

Budget Wisely

Create a detailed, realistic monthly budget prioritizing essential expenses like housing, food, medications, and utilities. The supplement can help fill gaps but should be managed thoughtfully.

Prepare for Inflation

Although government benefits adjust periodically to offset inflation, increasing costs mean seniors need to plan proactively. This might include accessing community assistance programs or consulting a financial advisor for supplemental income strategies.

Beware of Fraud Attempts

Unfortunately, scammers often target seniors regarding pensions. Canadian government agencies do not request sensitive information via unsolicited calls or emails. Always verify communication independently.

Explore Additional Benefits

Many provinces offer supplemental benefits for seniors, such as the Ontario Guaranteed Annual Income System (GAINS) or British Columbia’s Senior’s Supplement, which can add to federal benefits.

Impact of Sponsorship Policy Changes Effective 2025

A significant policy change effective October 1, 2025, limits GIS eligibility for immigrants under sponsorship agreements, extending some sponsorship periods from 10 to 20 years outside Quebec. These seniors will no longer receive GIS while their sponsorship is active unless exceptions apply (e.g., sponsor’s death). This affects numerous seniors and highlights the need for assistance and advocacy for impacted households.

$2600 CRA Payment in November 2025; Who will get it? Check Eligibility

CRA Benefits Payment Dates for November 2025 Released – Check Eligibility & Benefit Amount

65+ Seniors will get $3900 CRA Pension in November 2025, Check Eligibility, Process, Date