CRA $2166 Pension Benefit: You’ve probably seen headlines or TikTok videos claiming a CRA $2166 Pension Benefit is coming in October 2025. Sounds like a sweet deal, right? A guaranteed $2,166 landing in every senior’s bank account? Well, hold your horses. While the number is real in some cases, it’s not an official, one-size-fits-all program. Instead, it’s a combination of existing benefits like CPP, OAS, and GIS, which, for some retirees, could add up to around $2,166. Let’s dive deeper — we’ll cut through the noise, break down eligibility, give you the official payment dates, and share real examples, planning tips, and statistics so you’ll know exactly what to expect.

CRA $2166 Pension Benefit

The talk about a CRA $2,166 Pension Benefit in October 2025 is mostly internet myth. The real story is that CPP, OAS, and GIS payments will be deposited on October 29, 2025, and depending on your personal situation, your monthly income could reach or exceed that figure. The lesson? Don’t rely on viral numbers. Use official resources and plan smartly to maximize your retirement income.

| Detail | Information |

|---|---|

| Claim circulating online | CRA $2,166 Pension Benefit |

| Official confirmation | No new program – figure comes from combined benefits |

| Programs involved | CPP, OAS, GIS (and other supplements) |

| Max CPP (2025, age 65) | ~$1,364.60/month |

| Average CPP (2025) | ~$758/month |

| Max OAS (2025, age 65–74) | ~$718.33/month |

| GIS (single seniors, max) | ~$1,065/month |

| Next October payment date | October 29, 2025 |

| Official source | Canada.ca Benefits |

Why the CRA $2166 Pension Benefit Went Viral?

Numbers like this spread fast. It’s easy to see why — $2,166 is a nice round figure, and many people want to believe that Ottawa is stepping in with a generous flat-rate benefit. But in reality, the figure is a mathematical overlap of existing programs.

For example:

- A retiree with maximum CPP ($1,364.60) + maximum OAS ($718.33) already gets over $2,080.

- Add in GIS (~$1,065) for low-income seniors, and the number skyrockets — but not everyone qualifies for GIS.

That’s why this figure is real for some, but not universal.

Understanding Canada’s Pension Programs

Canada’s retirement income system is often described as a three-pillar approach:

- Public pensions (CPP, OAS, GIS).

- Private savings (RRSP, TFSA, employer pensions).

- Personal assets (real estate, investments).

The $2,166 conversation sits squarely in Pillar 1 — the government-provided pensions. Let’s break them down.

1. Canada Pension Plan (CPP)

CPP is the backbone of Canada’s retirement system.

- How it works: You and your employer contribute a percentage of your salary (up to a yearly maximum) during your working years. The more you contribute, the more you’ll receive.

- Eligibility: At least one valid contribution. Even if you worked part-time or had gaps in employment, you might still qualify.

- Amounts:

- Maximum new retirement pension at 65 (2025): ~$1,364.60/month.

- Average new pension: ~$758/month.

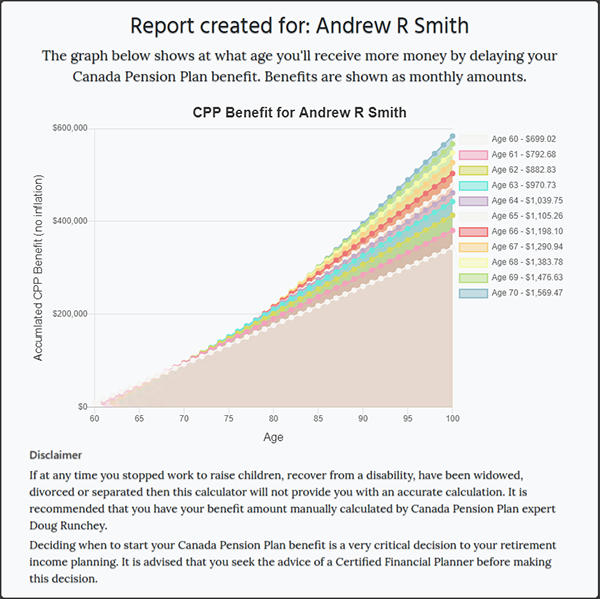

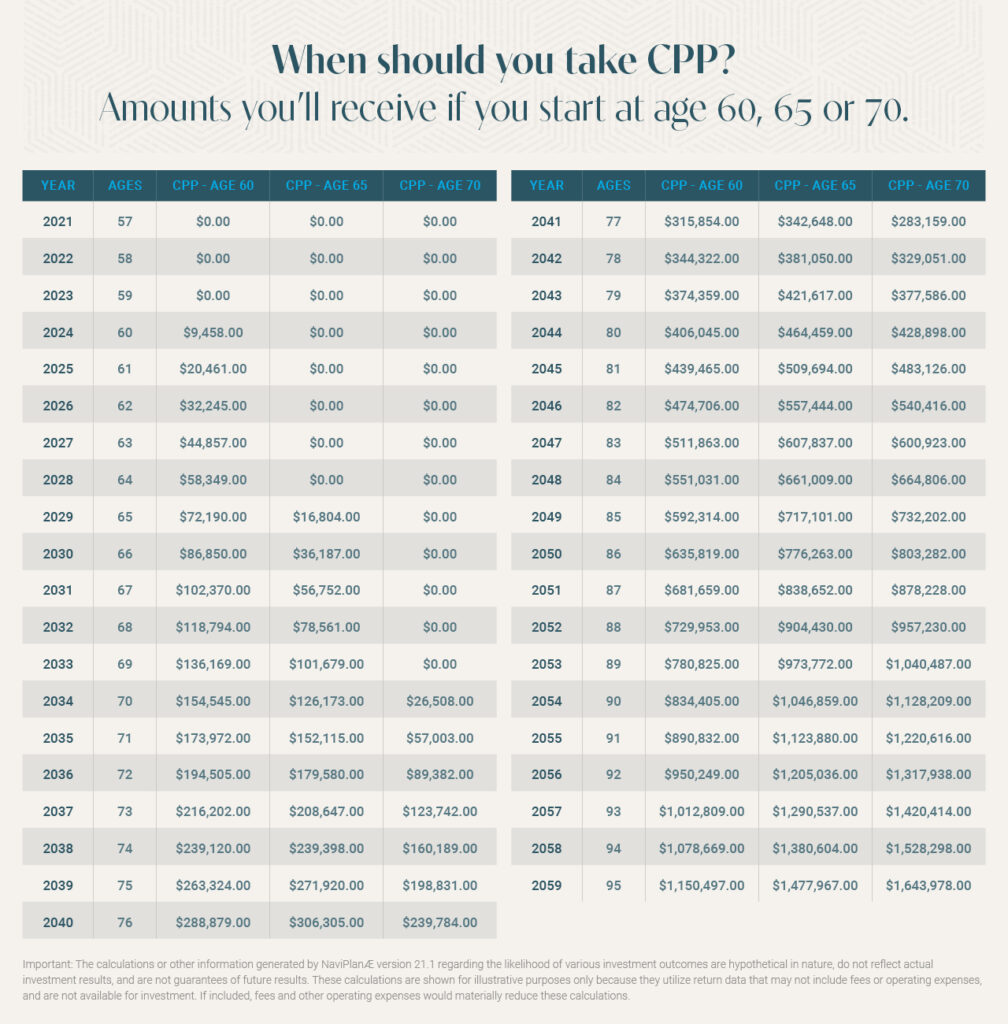

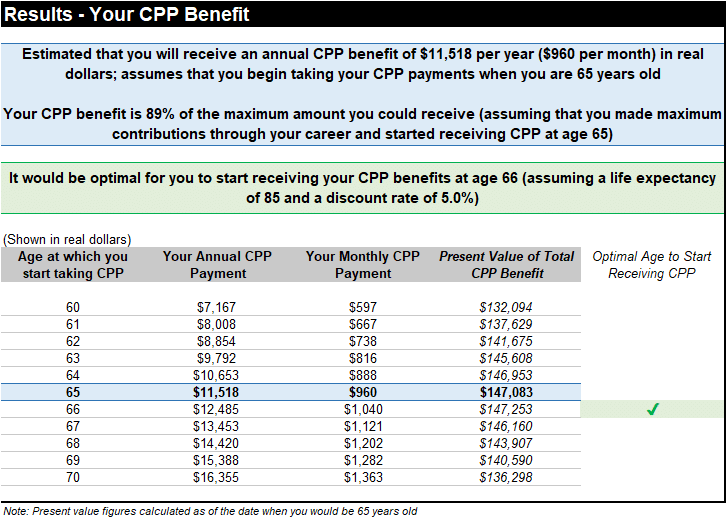

- Flexibility: You can take CPP as early as 60 (with reductions up to 36%) or delay up to 70 (with increases of up to 42%).

Example: Mark, 65, worked full-time in construction and always contributed the max. He’s now receiving around $1,360/month from CPP. On the other hand, his friend Tom, who worked part-time, gets closer to $720/month.

2. Old Age Security (OAS)

OAS is a universal pension, funded by tax revenues, and based on residency.

- Eligibility: Must be 65+ with at least 10 years of Canadian residency after age 18. For full OAS, you need 40 years of residency.

- Amounts (2025): ~$718.33/month for ages 65–74, and more for those 75+.

- Clawback alert: If your annual income is above ~$90,000, your OAS starts getting reduced.

Example: Susan, 68, immigrated to Canada at 40. Since she’s only lived in Canada for 28 years, she qualifies for a partial OAS of around $502/month.

3. Guaranteed Income Supplement (GIS)

GIS is a lifeline for low-income seniors.

- Eligibility: Must already get OAS and have income below a certain threshold.

- Amounts (2025): Up to ~$1,065/month for single seniors, less for couples.

- Tax treatment: GIS is non-taxable, unlike CPP and OAS.

Example: Evelyn, a 75-year-old widow with no private savings, receives OAS ($718) plus GIS ($1,065), giving her around $1,783/month. This is what keeps her afloat financially.

October 29, 2025: The Key Payment Date

Mark your calendar. According to the Government of Canada’s benefits calendar, the October 2025 pension payments will be made on October 29.

This applies to:

- Canada Pension Plan (CPP)

- Old Age Security (OAS)

- Guaranteed Income Supplement (GIS)

For many retirees, this monthly deposit is the cornerstone of their budget — covering housing, groceries, medications, and more.

Historical Context: How Pensions Evolved

- CPP was introduced in 1966 to provide Canadians with a retirement income supplement. Back then, the maximum monthly CPP was just $20.

- OAS has existed since 1952, starting as a $40/month universal payment. It has grown with inflation and residency rules.

- GIS was added in 1967 to help low-income seniors. It remains crucial today, with 40% of OAS recipients also qualifying for GIS.

Understanding this history helps explain why benefits aren’t flat amounts but rather layered, income-tested programs.

Taxation and Retirement Benefits

It’s important to know how pensions are taxed.

- CPP and OAS are taxable and must be reported as income.

- GIS is non-taxable, but income from other sources can reduce or eliminate your GIS eligibility.

- OAS clawback: Known as the “OAS Recovery Tax,” it reduces benefits for high-income seniors (2025 threshold ~ $90,000+).

Pro Tip: If you’re close to the clawback threshold, consider strategies like income splitting with a spouse or drawing down RRSPs earlier.

Statistics You Should Know

- Average combined CPP + OAS: Around $15,200/year (~$1,267/month).

- Median income of Canadian seniors (2023): ~$30,200.

- Seniors in poverty: Around 7% of Canadians over 65 live below the low-income cut-off.

- GIS recipients: Roughly 40% of OAS pensioners.

These numbers show why many seniors don’t hit the viral $2,166 mark, but also why benefits are crucial for financial stability.

Step-by-Step: How to Check CRA $2166 Pension Benefit

Step 1: Open a My Service Canada Account

This online portal gives you access to all pension info.

Step 2: Review your CPP Statement of Contributions

See how much you’ve contributed and what your projected benefits are.

Step 3: Verify OAS eligibility

Check your years of Canadian residency.

Step 4: Apply for GIS if eligible

Don’t leave money on the table — apply if your income qualifies.

Financial Planning Tips

- Delay CPP: Every year you delay past 65 increases your pension by 8.4%.

- Mix savings tools: Use RRSPs for pre-retirement savings, and TFSAs for tax-free withdrawals in retirement.

- Plan for inflation: CPP and OAS are indexed to inflation, but personal costs (rent, food) often outpace official inflation.

- Diversify income: Relying only on pensions may not be enough. Consider part-time work, investments, or downsizing your home.

Canada Wage News: $17.65/Hour Pay Raise; Is Your Province on the List?

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

$742 OAS Boost Confirmed by CRA for October 2025: Check Eligibility & Payment Schedule

Common Mistakes Seniors Make

- Taking CPP too early without considering long-term impact.

- Not applying for GIS, leaving free money unclaimed.

- Ignoring OAS clawbacks, which can reduce benefits unexpectedly.

- Assuming automatic enrollment — not everyone is auto-enrolled in OAS.