CPP Payment Dates: If you’re counting on the Canada Pension Plan (CPP) payments to keep your finances steady in the coming months, it’s crucial to stay on top of the exact payment dates for October and November 2025. The CPP is a lifeline for millions of Canadian retirees, providing predictable monthly income. Knowing when your money will hit your bank account or arrive by check can help you plan expenses like rent, groceries, and medical costs. This guide breaks down all you need to know about the CPP payment schedule for October and November 2025 with clear, practical insights. Whether you’re new to CPP or a seasoned retiree, this article will spell out the essentials—from payment dates to how CPP fits into your overall retirement income plan. Plus, it’s all explained in a friendly, easy-to-understand way, with some informed advice to help you make the most of your benefits.

Table of Contents

CPP Payment Dates

Managing the Canada Pension Plan payments with knowledge and planning makes your retirement safer and smoother. The key payment dates for October and November 2025—October 29 and November 26—should be bookmarked now. By understanding eligibility, application steps, benefit calculation, and how CPP fits into your retirement income, you gain control over your financial well-being. Taking proactive steps like setting up direct deposit, applying early, and considering delayed retirement benefits can maximize your income. The CPP remains a solid foundation for Canadian retirees, providing much-needed stability in the golden years.

| Topic | Details |

|---|---|

| October 2025 CPP Payment Date | October 29, 2025 |

| November 2025 CPP Payment Date | November 26, 2025 |

| Maximum Monthly CPP Payment | CAD 1,433 for age 65 retirees |

| Average Monthly CPP Payment | CAD 848.37 |

| Payment Method | Direct deposit preferred; cheque option available |

| OAS Payments Alignment | OAS payments also scheduled same dates for convenience |

| Eligibility Requirements | At least 60 years old, made valid CPP contributions |

| Importance | Key to stable retirement income covering living costs |

| Source | Canada.ca CPP Benefits |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan (CPP) is a government-run program that provides retirement, disability, and survivor benefits to Canadian workers and retirees. Think of it as a steady paycheck funded by your contributions while you worked, your employer’s contributions, and the government’s investment of those funds. It helps replace a portion of your income once you retire or if you can’t work due to disability.

Almost every Canadian worker over age 18 who earns above CAD 3,500 a year contributes a small percentage of their income to CPP. When it’s your time to retire—usually starting at age 60 or older—you begin collecting those benefits monthly, giving you financial independence without relying completely on savings or family support.

Eligibility Requirements: Who Can Receive CPP?

To qualify for the CPP retirement pension, you must meet two main conditions:

- Be at least 60 years old

- Have made at least one valid contribution to the CPP during your working years in Canada

Valid contributions could also come from credits received through a divorced or separated spouse or common-law partner. If you worked in Quebec, you might fall under the Québec Pension Plan (QPP), which operates differently but is coordinated with CPP for people who have worked both in Quebec and other provinces.

You don’t have to stop working to receive your CPP benefits. In fact, if you’re under 70 and still working, you can continue to make contributions and qualify for the CPP Post-Retirement Benefit, which bumps up your monthly income.

If you die before claiming CPP, your estate or family may be eligible for survivor benefits depending on your situation.

A Brief History of CPP

The CPP was created in 1966 in response to growing awareness that many Canadians lacked adequate retirement income. The program has grown and adapted to economic and social changes, including increasing contribution rates and raising maximum benefit levels to ensure retirement funds keep pace with inflation and living costs. It remains a core part of Canada’s retirement income security today.

Why Knowing Your CPP Payment Dates Matters?

If you’re on a fixed retirement income, knowing exactly when payments arrive is essential. It helps you avoid overdraft fees, time bills properly, and manage your day-to-day expenses without sudden surprises. For example, you might need to pay rent, utilities, or medications shortly after the payment hits your bank account. Planning ahead makes life less stressful.

For October 2025, the CPP payment date lands on October 29, and for November 2025, it will be on November 26. These dates are typically a few days before the end of each month, allowing recipients to prepare financially for upcoming expenses.

How Much Can You Expect to Receive?

In 2025, the maximum CPP monthly retirement payment if you claim at age 65 is about CAD 1,433. This amount represents the highest payout available to those who have made maximum contributions to the CPP over at least 39 years.

However, the average CPP payment is substantially lower—around CAD 848.37—since most individuals work varying lengths of time and contribute different amounts.

Additionally, many seniors qualify for Old Age Security (OAS) payments, which complement CPP by providing additional income. In 2025, the maximum OAS payment is approximately CAD 740.09 a month for those aged 65 to 74, rising to about CAD 814.10 for seniors 75 and over.

How CPP Fits Into Your Retirement Income?

Think of your retirement income like a puzzle. CPP is a key piece but isn’t the entire picture. Other common income sources include:

- Personal savings and investments

- Employer pensions

- Old Age Security (OAS)

- Guaranteed Income Supplement (GIS) for low-income seniors

Together, these income streams help cover important expenses such as housing, healthcare, food, transportation, and personal needs during retirement.

Keep in mind that if you continue working and contributing to CPP after starting your benefits (and you’re under 70), you may earn extra post-retirement benefits that increase your monthly income.

CPP vs U.S. Social Security: A Quick Comparison

Many Americans wonder how Canada’s CPP stacks up against the U.S. Social Security system:

| Feature | Canada Pension Plan (CPP) | U.S. Social Security |

|---|---|---|

| Eligibility | Based on working and contributing in Canada | Based on working and contributing in the U.S. |

| Retirement Age | 65 standard, early at 60 (reduced), late up to 70 (increased) | Full benefits at 67, early at 62 (reduced) |

| Max Monthly Payment | CAD 1,433 (2025) | About USD 1,600 (2025 average) |

| Other Benefits | Disability, survivor, post-retirement benefits | Disability, survivor benefits |

| Contribution Rates | 5.95% on earnings up to a limit | 12.4% on earnings up to a cap (split between employee and employer) |

While both systems aim to provide baseline retirement security, the CPP tends to require higher contribution rates, reflecting Canada’s enhanced emphasis on financially supporting seniors.

Practical Advice for CPP Recipients

1. Set Up Direct Deposit

Opt for direct deposit to get your CPP payments faster and safer than mailed checks, which can be delayed or lost.

2. Keep Your Info Up to Date

Update your personal and banking details immediately with Service Canada via your My Service Canada Account to avoid missed or delayed payments.

3. Budget Around Payment Dates

With October 29 and November 26 as official payment dates, plan your monthly bills and essentials accordingly.

4. Understand Tax Implications

CPP payments are taxable income, unlike OAS payments, which may have different tax treatments. Plan with a tax advisor to optimize your tax situation.

5. Apply Early

You should apply for CPP benefits about three to six months before you want payments to start, ensuring timely receipt.

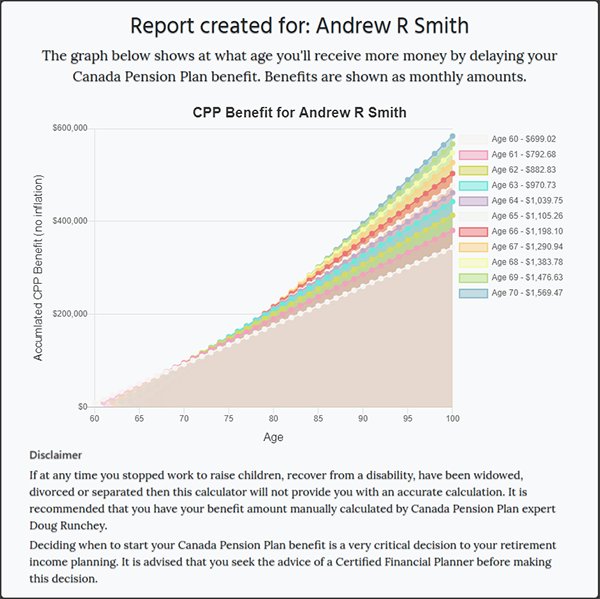

6. Consider Delaying Retirement Benefits

If you can afford to wait until age 70, your CPP payment increases by 42% compared to starting at 65, raising your monthly income substantially.

7. Work After Retirement

If you continue working before age 70, you keep contributing to CPP and receive post-retirement benefits, adding more income on top of your regular pension.

How to Apply for CPP?

Applying for CPP is straightforward, especially online:

- Create or log in to your My Service Canada Account.

- Navigate to the CPP retirement pension section.

- Complete the application with accurate personal and employment history.

- Upload required IDs, such as your Social Insurance Number.

- Submit your application and wait for approval, which typically takes 7-14 business days online.

Paper applications can take longer, up to 120 days.

CPP & OAS Benefit Payment Coming In October 2025 – Check Revised Amount & Eligibility

Canada $2560 Annual CPP Pension Boost in 2025: Check Enhancement Process & Payment Date

Canada $1700 CPP Releasing in October 2025 for these Seniors: Check Eligibility & Payment Schedule