CRA Payment Dates: If you’re living in Canada and relying on government benefits, knowing when your payments land is crucial. Whether it’s the Canada Pension Plan (CPP), Old Age Security (OAS), Canada Workers Benefit (CWB), Climate Action Incentive Payment (CAIP), or the GST/HST credit, these payments help millions of Canadians make ends meet. This article breaks down the November 2025 payment dates, expected amounts, eligibility criteria, and practical tips to keep your finances smooth and stress-free. From retirees budgeting for the month to professionals advising clients, this guide is written to be clear enough for anyone, while providing depth for those wanting all the details.

Table of Contents

CRA Payment Dates

In Canada, government benefits such as CPP, OAS, CWB, CAIP, and GST/HST credits form a lifeline to millions. Knowing exact payment dates in November 2025 and understanding the eligibility and amount details will help you make the most of these benefits. Staying organized, filing taxes timely, and using digital tools can ensure your payments arrive smoothly and on time. Whether you’re a proud retiree, a working Canadian pushing through, or an advisor helping clients, this knowledge brings clarity, confidence, and control over your financial life.

| Benefit Program | Payment Date | Average Amount (CAD) | Who It Helps |

|---|---|---|---|

| Canada Pension Plan (CPP) | November 26, 2025 | Max $1,576/month (for age 65+) | Retirees & disabled workers |

| Old Age Security (OAS) | November 26, 2025 | Avg ~$740-$814/month (including bonus) | Seniors 65+ |

| Canada Workers Benefit (CWB) | No payment in November 2025 | Advance payment avg $350 (next Jan 2026) | Low-income workers |

| Climate Action Incentive Payment (CAIP) | No payment in November 2025 | Avg $188 per adult (quarterly) | Residents of eligible provinces |

| GST/HST Credit | No payment in November 2025 | Avg $129.75 per quarter (single) | Low- and modest-income individuals |

What You Need to Know About November 2025 CRA Payment Dates

Each benefit program has its own schedule and payment model. Here’s what you can expect:

Canada Pension Plan (CPP)

- Date: November 26, 2025

- Payment: Maximum monthly payout has increased to $1,576 as of late 2025 for eligible seniors.

- Eligibility: Canadian workers aged 60 or older who contributed to CPP; disability benefits also available.

- Why It Matters: CPP is a key source of retirement income, providing consistent monthly payments to help cover living expenses after work.

Old Age Security (OAS)

- Date: November 26, 2025

- Payment: Typical monthly amounts range from $740 to $814, with the higher amount including a 10% bonus for those 75+.

- Eligibility: Canadian residents aged 65+ with minimum residency criteria.

- Special Note: OAS payments are supplemented by the Guaranteed Income Supplement (GIS) for low-income seniors.

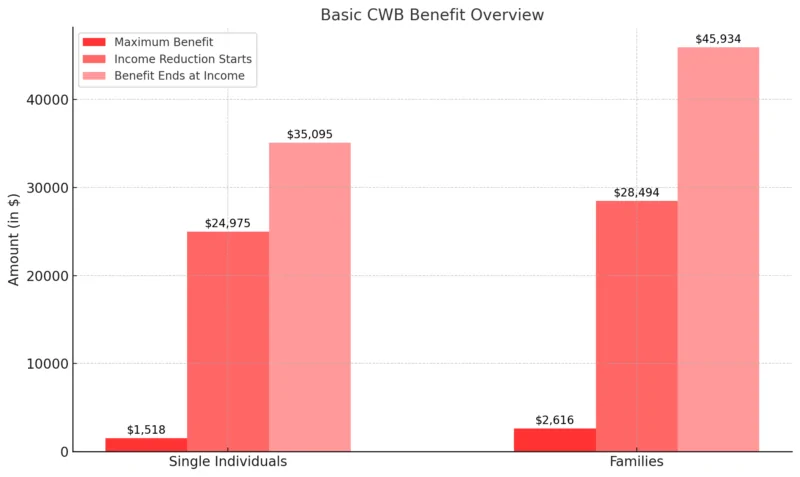

Canada Workers Benefit (CWB)

- Date: No payment in November 2025; next advance payment scheduled for January 2026.

- Payment: CWB is a refundable tax credit designed to support low-income workers. Average advance payments are roughly $350.

- Eligibility: Must be at least 19 years old, a Canadian resident for tax purposes, and have earned income between specific thresholds (e.g., $3,000 to $24,500+ depending on family status).

Climate Action Incentive Payment (CAIP)

- Date: No payment in November 2025; last quarterly payment was in October, next due January 2026.

- Payment: Average payment is about $188 per adult plus extra for children depending on province.

- Eligibility: Available to residents of listed provinces (Ontario, Manitoba, Saskatchewan, Alberta) to help offset carbon tax costs.

GST/HST Credit

- Date: No payment in November 2025. Payments occur quarterly: January, April, July, and October.

- Payment: Single individuals receive roughly $129.75 per quarter, more if you’re married or have children.

- Eligibility: Low- and modest-income individuals and families meeting residency criteria.

Background & Eligibility: Get to Know Your Benefits

Understanding each program helps you plan better:

Canada Pension Plan (CPP)

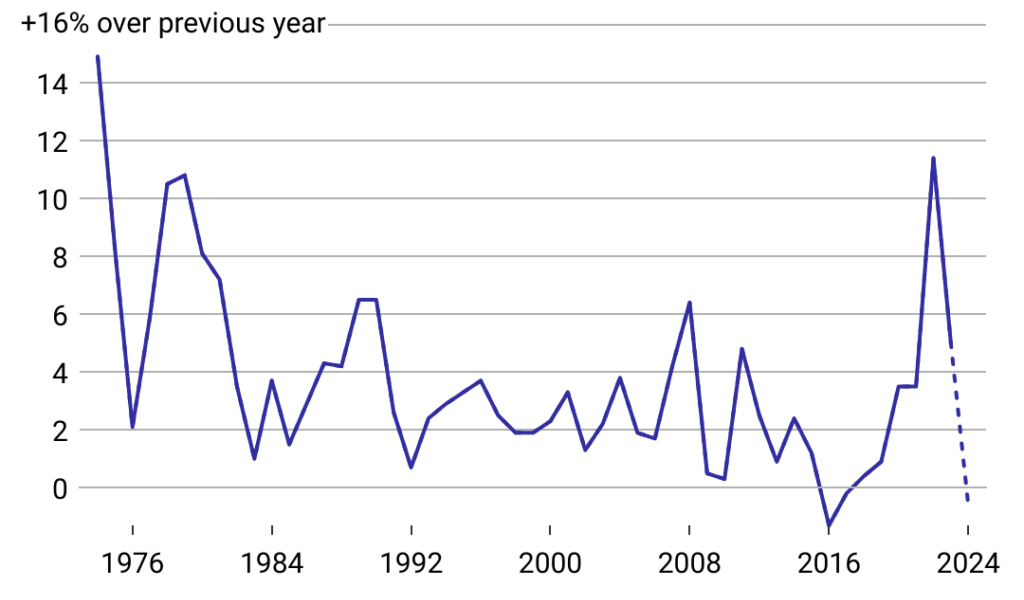

Started in 1966, CPP is funded by worker and employer contributions. Most Canadian workers contribute a percent of their income, which builds their retirement or disability pension. To qualify for payments, you must have contributed to CPP and meet age or disability criteria. Disabled contributors may qualify earlier.

Old Age Security (OAS)

Unlike CPP, OAS is not based on work contributions but on residency in Canada. You must have lived in Canada for at least 10 years after age 18 to get any payment. The OAS includes supplements like GIS for vulnerable seniors with low income.

Canada Workers Benefit (CWB)

The CWB replaced the Working Income Tax Benefit to provide direct financial help to low-income Canadians working full or part-time jobs or as self-employed. To qualify, you must be at least 19 and not full-time students (unless you have a child). Income thresholds apply and benefits phase out as income rises.

Climate Action Incentive Payment (CAIP)

The CAIP helps residents in provinces that have federal carbon pricing to offset increased energy costs. It’s paid quarterly and varies depending on household size and province.

GST/HST Credit

The GST/HST credit reduces the burden of sales taxes on families with modest income. Eligibility depends on income and family status and is determined when you file your tax return.

Practical Advice: Maximising Your Benefits & Avoiding Pitfalls

- Keep Your Info Updated: Always confirm your mailing address, direct deposit info, and personal details on CRA My Account.

- File Taxes on Time: Late or missed tax returns can delay or stop your benefits.

- Sign Up for Direct Deposit: Getting paid electronically is faster and avoids lost or delayed checks.

- Review Income Yearly: Changes in income can affect benefit amounts; stay aware for tax planning.

- Track Payment Dates: Set calendar alerts for payment days, especially for big ones like CPP and OAS.

- Use CRA’s Tools: Benefit calculators, eligibility checkers, and the CRA app are your friends.

- Plan for Off Months: Some benefits pay quarterly. Budget for months with no incoming payments.

Real-Life Scenario: How Knowing Dates Makes a Difference

Joan, a 68-year-old retiree in Winnipeg, relies on CPP and OAS payments to cover her monthly essentials and plan ahead for extra costs like heating bills in winter. Knowing exactly when November’s $1,576 CPP and $814 OAS payments hit her account helps her avoid late fees and budget holiday gifts. Plus, she stays informed about CWB and CAIP, keeping an eye on those payments to help family members who qualify.

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

$628 Canada Grocery Rebate in November 2025: Is it true? How to Check Status

How These Payments Fit Into Your Financial Planning?

Government benefits are essential pillars in many Canadians’ financial health. For retirees, CPP and OAS form the backbone of income, while CWB supports working households stretching every dollar. The carbon rebate eases living expenses related to environmental taxes, and GST/HST credits lighten sales tax burdens.

Strategic financial advisers suggest:

- Using benefits as stable income sources for budgeting.

- Investing a portion for long-term growth.

- Planning ahead for quarters with no payments, like November for some credits.

Important Reminders

- The November 26, 2025 payment date is crucial for CPP and OAS recipients.

- CWB, CAIP, and GST/HST payments follow their own schedules; be sure to check quarterly calendars.

- Always monitor CRA announcements for changes or new one-time payments.

- Take advantage of online tools and customer service for personalized guidance.