CPP & OAS Benefit Payment: In October 2025, Canadian seniors and retirees are set to receive their Canada Pension Plan (CPP) and Old Age Security (OAS) benefit payments, scheduled for deposit on October 29. These programs serve as the cornerstone of retirement income for millions across the country, providing vital financial support through the golden years. Whether you’re a newcomer to these benefits, a long-time recipient, or just looking to get a clearer picture of how these payments work and who qualifies, this comprehensive guide breaks everything down — from revised payment amounts and eligibility criteria to practical tips for managing your benefits efficiently.

These October payments reflect inflation-linked adjustments aimed at preserving seniors’ purchasing power despite rising living costs—a smart move amid today’s economic realities. Read on for a complete breakdown of how much you can expect, who qualifies, how to avoid common pitfalls, and strategies for maximizing your benefits. This article is written in a friendly, accessible tone designed to make complex information easily digestible, whether for a curious 10-year-old or a seasoned financial professional.

Table of Contents

CPP & OAS Benefit Payment in October 2025

With October 2025’s CPP and OAS benefit payments set for deposit on October 29, Canadian seniors can look forward to income that reflects thoughtful inflation adjustments designed to keep pace with living costs. These payments provide financial stability for millions, helping cover essentials and supplement other retirement savings. Understanding eligibility, application procedures, taxation, and ways to optimize your benefits ensures you make the most of your retirement income. Stay informed, prepare early, and consult trusted resources to keep your finances on track.

| Feature | CPP (Canada Pension Plan) | OAS (Old Age Security) |

|---|---|---|

| Payment Date | October 29, 2025 | October 29, 2025 |

| Maximum Monthly Payment | $1,433 | Approx. $735.35 for ages 65–74 |

| Inflation Adjustment | 2.6% (2025) | 0.7% (Oct–Dec 2025) |

| Eligibility Age | 60+ | 65+ |

| Residency Requirement | Based on CPP contributions | 10 years residency in Canada after 18 |

| Taxable Income? | Yes | Yes |

| Official Info | Canada Pension Plan | Old Age Security |

What Are CPP & OAS Benefit Payments? The Basics

Let’s start with the basics to lay a strong foundation. The Canada Pension Plan (CPP) was launched in the 1960s as a contributory program requiring workers and employers to pay into a government-managed fund during working years. Upon retirement or disability, contributors receive monthly benefits proportionate to their lifetime contributions and earnings. Simply put, it’s a social insurance plan designed to provide income in later years or in case of disability.

On the flip side, the Old Age Security (OAS) program, which dates back to the late 1950s, provides a universal pension to Canadian seniors aged 65 and older who have lived in Canada for at least a decade after age 18. Unlike CPP, OAS does not require previous employment or contributions—it’s about residency and ensuring seniors aren’t left entirely without financial support after retirement.

These two programs together form a safety net, easing the transition from employment to retirement life.

October 2025 Payment Schedule: When and How

For 2025, the government has set October 29 as the date for CPP and OAS payments. If you have opted for direct deposit, expect to see it hit your bank account early that morning—safe, fast, and reliable. For those receiving paper checks, mail transit times can vary, but payments generally arrive close to this date.

To help you plan your finances, the government publishes an official annual payment schedule accessible via this Benefits Payment Dates Calendar. Bookmarking this is a good idea for managing monthly budgets smoothly.

Detailed Payment Amounts: How Much Will You Receive?

Canada Pension Plan (CPP)

The maximum monthly CPP payment for 2025 is $1,433. This marks a 2.6% increase, reflecting the government’s response to inflation and ensuring seniors’ income keeps pace with rising costs.

Keep in mind, your payment amount depends heavily on:

- How much and how long you (and your employer) contributed.

- Your average earnings over your career, adjusted for inflation.

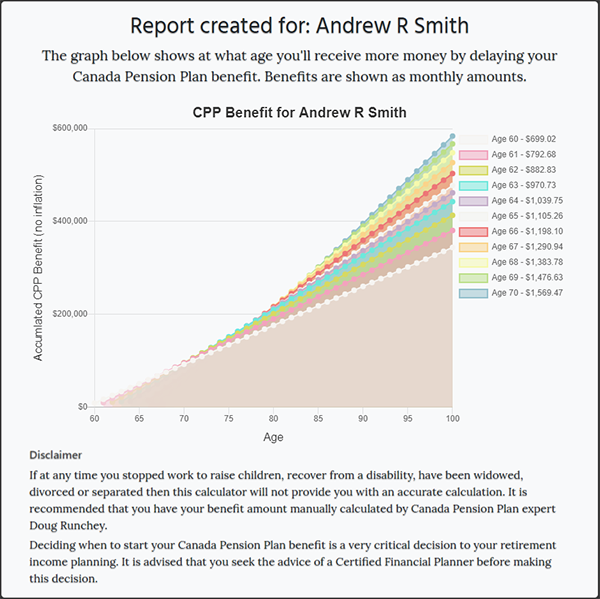

- The age at which you start receiving payments — starting earlier than 65 leads to a permanently reduced monthly pension, while delaying increases your payout.

For example, choosing to take CPP at 60 reduces your monthly benefit by roughly 0.6% for each month before you turn 65, while delaying past 65 increases it by 0.7% per month, up to age 70.

Old Age Security (OAS)

The OAS monthly payment for seniors aged 65 to 74 is approximately $735.35 for the final quarter of 2025, after applying a 0.7% inflation boost. For seniors 75 and older, the amount increases slightly to about $808.44.

OAS benefits are income-tested, so if your taxable income exceeds certain thresholds (about $85,000 CAD annually in 2025), your benefits may be reduced or clawed back entirely. This clawback means higher-income seniors receive less or no OAS.

Guaranteed Income Supplement (GIS)

For seniors with limited income, there’s an additional layer of support called the Guaranteed Income Supplement (GIS). This benefit is non-taxable and provides extra monthly financial aid based on income and marital status. GIS payments can significantly boost retirement income for qualifying low-income seniors, sometimes adding hundreds of dollars per month on top of OAS.

Eligibility Breakdown: Who Qualifies?

CPP Eligibility Criteria

- Must have made contributions to the CPP through employment or self-employment.

- Can start receiving CPP as early as age 60, but the standard age is 65.

- Beneficiaries must apply; it’s not automatic.

- Disability benefits may be available if you qualify under different rules.

CPP benefits reflect your contribution history—there’s no fixed eligibility period beyond contributions.

OAS Eligibility Criteria

- Must be at least 65 years old.

- Must have lived in Canada for a total of 10 years or more after turning 18.

- Must apply to receive OAS benefits; not automatic.

- Payments can be suspended if you live outside Canada for extended periods, unless special provisions apply.

- Clawbacks apply based on income.

Historical Context: Why These Benefits Matter

The CPP emerged out of concerns that many retirees lacked sufficient income, particularly during economic downturns in the early 20th century. It was designed to create a shared responsibility between workers and employers to prepare financially for retirement.

OAS was introduced to help seniors avoid poverty by providing universal access to a basic pension, funded through general tax revenues, separate from employment histories.

With changing demographics — more seniors, longer life expectancy — these plans have evolved, adjusting payment amounts regularly to meet modern cost-of-living demands and ensuring fairness for contributors and beneficiaries alike.

Comparison to US Social Security Benefits

A quick heads-up for native American and US readers: CPP is akin to Social Security retirement benefits in the US — both are contributory social insurance plans. OAS is more similar to Supplemental Security Income (SSI) but universal for Canadian seniors.

The critical difference is OAS’s residency requirement, which allows it to support seniors regardless of employment history, a model that some American systems don’t fully replicate.

Practical Tips to Maximize Your Benefits

- Delay CPP benefits past 65: Waiting until 70 maximizes your monthly CPP payout by up to 42%.

- Apply early: Applications can begin 6 months before your desired start date, preventing payment delays.

- Apply for GIS if eligible: This can add valuable extra monthly income.

- Sign up for direct deposit: Ensures quick and safe payments.

- Track your contributions: Use My Service Canada Account to monitor your CPP contribution record and estimated retirement benefits.

- Plan for taxes: Both CPP and OAS are taxable income. Consult tax planners or use tax software to avoid surprises.

- Keep documentation ready: Social Insurance Number, identification, and proof of residency speed up the application.

Common Mistakes to Avoid

- Failing to apply on time: Delays can result in missed payments and hassles.

- Ignoring income limits on OAS: Not reporting income changes can lead to overpayment recoveries later.

- Not updating your contact or bank details: Payment errors can occur if information is outdated.

- Assuming benefits start automatically: Both CPP and OAS require an application to start payments.

Tax Considerations for CPP & OAS Recipients

Both CPP and OAS payments are considered taxable income in Canada under the Income Tax Act. That means you’ll need to declare these benefits on your tax return and may owe tax depending on your overall income level.

Some provinces offer tax credits for seniors, and certain income-splitting strategies may help reduce taxes owed. Consultation with a tax professional familiar with Canadian senior benefits is highly recommended for tailored advice.

Real Stories from Canadian Seniors

Jean from Toronto shares, “CPP and OAS together cover my basics, and the Guaranteed Income Supplement fills in the gaps. Living on a fixed income means every dollar counts.”

Harold in Vancouver notes, “I screwed up my application paperwork at first and had to start over. Now I tell everyone – get help if you’re unsure.”

Where to Get Help and More Information

- Service Canada: Call 1-800-277-9914 or visit Service Canada for applications and questions.

- Community organizations: Many offer workshops and personal help for seniors applying for benefits.

- Financial advisors: Especially useful for managing benefits in conjunction with other retirement income sources.

Canada $2560 Annual CPP Pension Boost in 2025: Check Enhancement Process & Payment Date

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

CRA’s $2460 Pension Supplement in Oct 2025: Check Payment Dates and Eligibility Criteria!