CPP $782 + $758 Extra Deposit: If you’re looking for the latest scoop on the Canada Pension Plan (CPP) payment for November 2025, you’re in the right spot. This month, seniors and CPP recipients are buzzing about the $782 regular payment PLUS an extra deposit of $758. You’re probably wondering: who’s eligible, what’s the deal with the extra cash, and how to make sure you don’t miss out? Let’s break it down so it’s crystal clear for everyone—whether you’re just starting to explore CPP or you’ve been receiving payments for years. This guide will give you the facts, practical tips, and step-by-step details to help you fully understand the payment boost in November 2025. No confusing jargon, just clear, straightforward info.

Table of Contents

CPP $782 + $758 Extra Deposit

The CPP $782 regular payment plus the $758 extra deposit for November 2025 marks a big financial boost for many Canadian seniors. If you meet the eligibility rules — aged 60 or above, CPP recipient, and within the income limits — this money will come to you automatically, no headache needed. Filing taxes timely and keeping your banking info updated helps ensure you don’t miss out. This one-time boost shows the government’s commitment to supporting seniors through rising living costs. With careful planning, you can maximize your CPP benefits, making retirement more secure and less stressful. Stay informed, ready, and make November 2025 a month to remember.

| Topic | Details |

|---|---|

| Regular CPP Payment | Approximately $782 expected in November 2025 |

| Extra One-Time Deposit | $758 boost for eligible recipients |

| Eligibility Age | 60 years or older as of November 1, 2025 |

| Income Limit for Extra Deposit | Full extra payment if income under $50,000, reduced for $50,000 – $85,000, none above $85,000 |

| Payment Date | November 26, 2025 (regular & extra deposits) |

| No Application Required | Eligible recipients receive payment automatically |

| Official Info & Updates | Canada Pension Plan Official Site |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan is a government-run social insurance program that provides income support to Canadians when they retire, become disabled, or pass away, leaving survivors. Think of CPP like a paycheck from the government after years of working and paying into the system. It’s designed to help replace part of your income when you’re no longer working full-time.

You and your employer both contribute to CPP through payroll deductions during your working years. If you’re self-employed, you pay both sides yourself — all of which add into your future pension. The amount you receive depends on how much and how long you contributed, your age at retirement, and other factors.

What’s New in November 2025?

In addition to your usual monthly payment (around $782 for many recipients), November 2025 will bring a special one-time boost of $758. This extra payment is designed to ease financial pressures for low- to middle-income seniors and CPP beneficiaries during this period.

Why CPP $782 + $758 Extra Deposit?

The government recognized the rising cost of living and inflation hitting seniors particularly hard. So, this one-time CPP top-up is a targeted financial boost for folks who need it most now. This isn’t just a bonus — it’s a thoughtful, intentional effort to support seniors in Canada with a little extra cushion.

Who Is Eligible for the CPP $782 + $758 Extra Deposit?

Here’s the deal: not everyone gets the extra top-up. The government set eligibility criteria based on age and income to direct help where it’s needed most. You qualify if you meet ALL the following:

- Be a CPP recipient by November 1, 2025 (you must already be on CPP).

- Be age 60 or older as of November 1, 2025.

- File your 2024 income tax return on time (important!).

- Have an annual income under $85,000 — this includes pensions, investments, and other income sources.

- If your yearly income is under $50,000, you get the full $758 extra payment.

- For income between $50,000 and $85,000, you get a partial reduced payment on a sliding scale.

- No extra money if your annual income exceeds $85,000.

If you miss the tax filing or have income over the limit, you won’t qualify for this one-time boost, but you’ll still get your regular CPP payment.

When Will You Get CPP $782 + $758 Extra Deposit?

The regular CPP payment for November 2025 is scheduled for November 26, 2025. The extra $758 will be deposited simultaneously, so it comes as one larger payment in your bank account.

If you get your CPP payments by direct deposit or cheque, be sure your banking info is up to date to avoid delays. If needed, update your information through your My Service Canada Account (MSCA). This special boost does not require any application, meaning if you meet the criteria, the money will come to you automatically.

How Much Can You Expect to Receive in Total?

Let’s do some quick math:

| Payment Type | Amount |

|---|---|

| Regular CPP Payment | $782 |

| Extra One-Time Boost | $758 |

| Total in November | $1,540 |

Remember, $782 may vary depending on your personal CPP contributions and history. The extra $758 is fixed for eligible recipients.

So, seniors falling within income eligibility will see a substantial increase in their November payment — that’s a welcome boost to help cover extra bills, groceries, or whatever you need.

Deep Dive: Eligibility Criteria and Contributions

To qualify for any CPP retirement pension, you must be:

- At least 60 years old.

- Have made at least one valid CPP contribution during your work in Canada or via credits transferred from a spouse or common-law partner after separation or divorce.

These contributions are the foundation of your CPP benefits. If you’ve worked while living in Quebec, note that Quebec has its own pension plan (QPP), but it coordinates with CPP for full benefits.

Contributions and Payment Amounts

For 2025, the maximum pensionable earnings are around $71,300. You pay 5.95% of your income into CPP on earnings between $3,500 and $71,300, and your employer matches that amount (if employed). If you’re self-employed, you pay the full 11.9%.

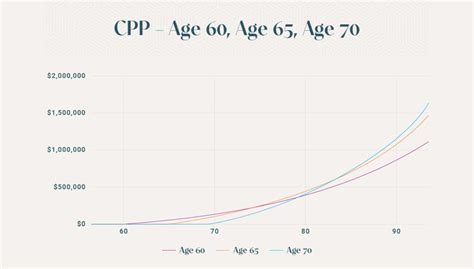

If you consistently contribute the maximum amount for at least 39 years, you’ll receive the maximum CPP payment, which is approximately $1,433 monthly in 2025 for someone retiring at 65. Payments start lower if you retire early (from 60 to 65) and increase if you delay beyond 65 until 70.

Planning Your Retirement and CPP Strategy

- When to Start: You can start CPP as early as 60 but expect a permanent reduced payment (about 36% less if taken at 60). Waiting until 65 gives you your standard amount, and delaying up to age 70 increases your monthly payment by up to 42%.

- Working While Receiving CPP: You can continue working while receiving CPP without losing your pension. You may even qualify for post-retirement benefits if you keep paying into CPP while working after 60.

- Tax and Benefits Impact: CPP benefits are taxable income. The extra $758 boost is also taxable, so it might affect your tax liability or other income-based government benefits.

- Combining CPP with Other Benefits: CPP is designed to work alongside Old Age Security (OAS) and Guaranteed Income Supplement (GIS) to provide a more complete retirement income package.

How to Check and Manage Your CPP Account?

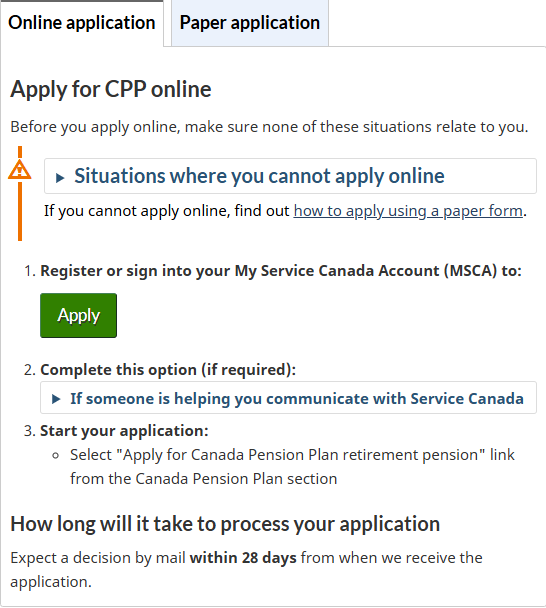

- Use the My Service Canada Account (MSCA) portal online to:

- Review your CPP contributions and history

- Estimate your future CPP payments

- Confirm payment dates and view past payments

- Update personal info, like banking details

- Submit CPP retirement applications (if you haven’t already)

Being proactive on MSCA helps prevent issues and ensures timely payments without delays.

CPP Payment Dates for October & November 2025: Everything Canadian Retirees Should know

CPP & OAS Benefit Payment Coming In October 2025 – Check Revised Amount & Eligibility

Canada $750 + $890 Double CPP Payment Coming In October 2025: Check Eligibility, Payment Date