Claiming SSS Sickness Allowance: If you’re wondering how to claim SSS Sickness Allowance in 2025, you’re in the right place. Every year, thousands of Filipino employees, freelancers, and overseas workers rely on this benefit when illness or injury forces them to take time off work. With the Social Security System (SSS) updating its contribution rates and salary caps in 2025, understanding how the Sickness Benefit works has never been more important. This article explains everything clearly — from eligibility and filing to computation and payout — in a friendly, conversational tone that’s easy to follow, even if you’re not a finance expert. You’ll also find practical examples, policy updates, and insider tips based on real experiences.

Table of Contents

Claiming SSS Sickness Allowance

The SSS Sickness Allowance in 2025 remains a vital safety net for Filipino workers. With updated contribution rates and simplified online processes, claiming your benefit is now easier and faster than ever. Always keep your contributions active, file promptly, and avoid paperwork errors. Illness shouldn’t lead to financial hardship. The SSS Sickness Benefit ensures that even when you’re down, you’re not left without support. Stay informed, stay compliant, and make the system work for you.

| Item | 2025 Update | Importance |

|---|---|---|

| Daily Sickness Allowance (DSA) | 90% of your Average Daily Salary Credit | Determines benefit per day of approved confinement |

| Maximum Days Covered | 120 days per calendar year; 240 for the same illness | Ensures fairness and prevents abuse |

| Contribution Requirement | At least 3 contributions in the last 12 months before illness semester | Ensures active membership |

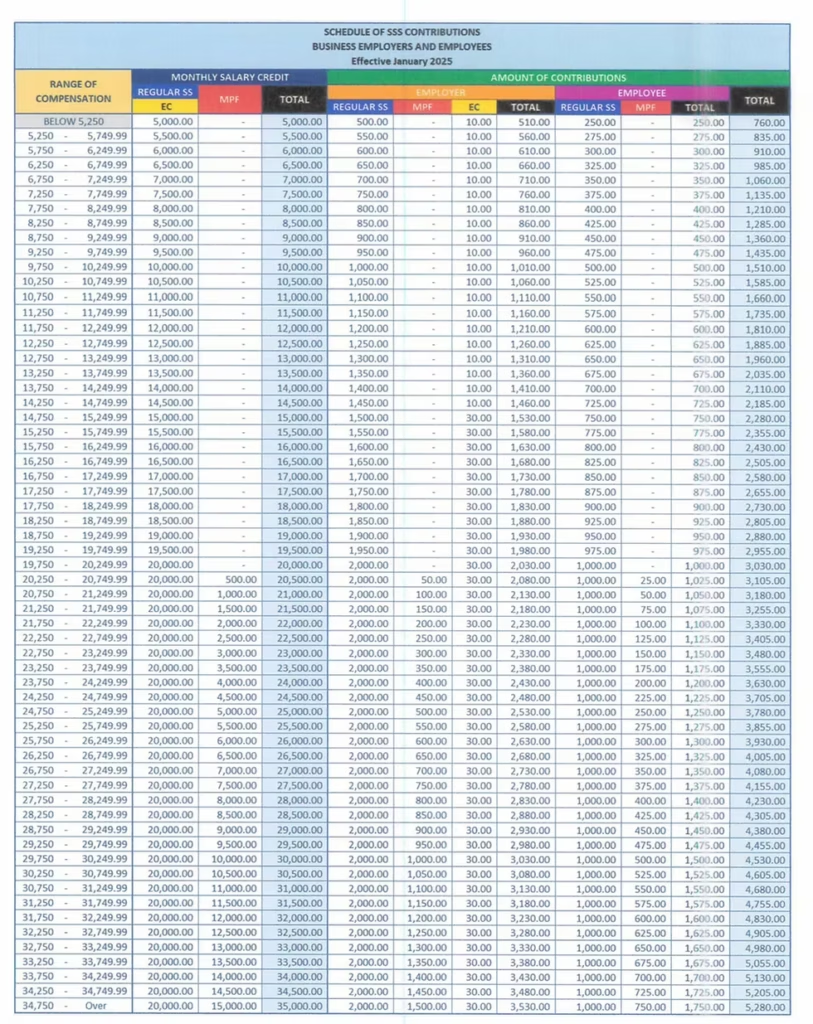

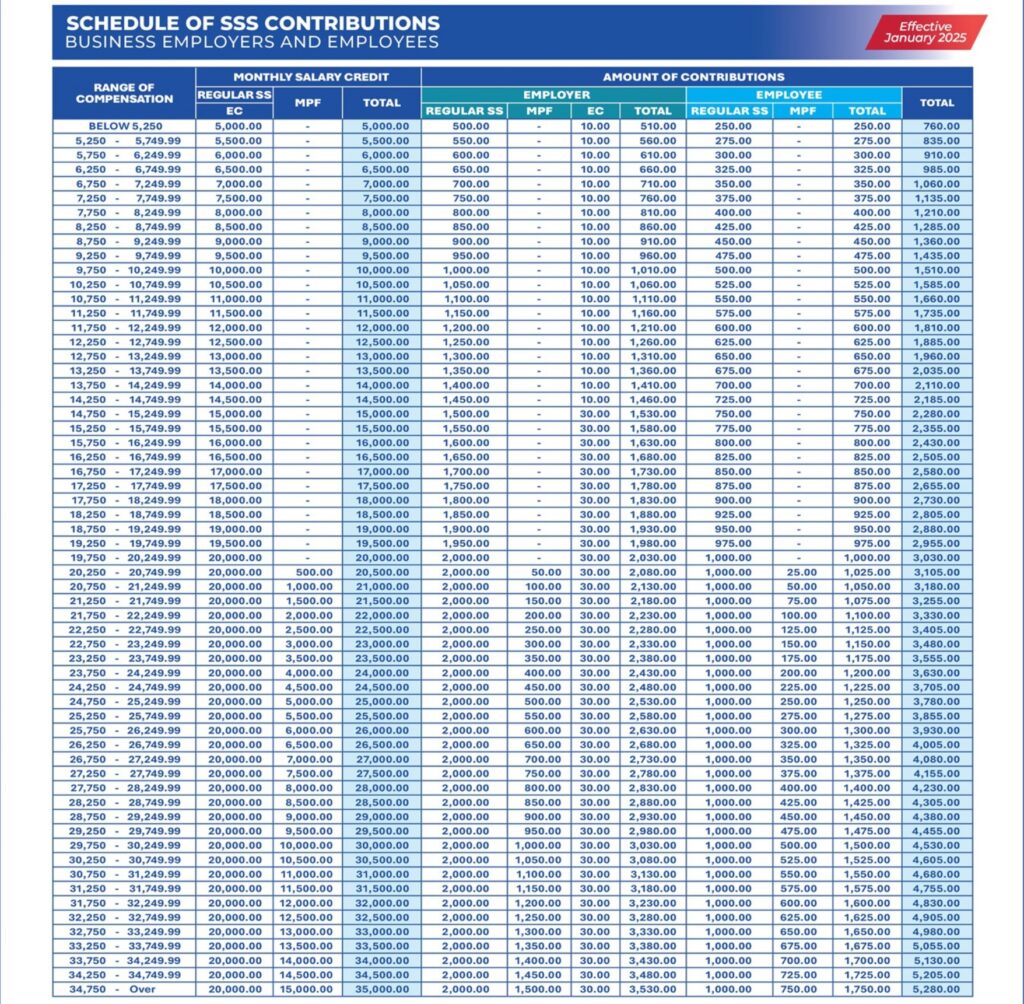

| Monthly Salary Credit Range (2025) | ₱5,000 minimum to ₱35,000 maximum | Raises benefit potential |

| Contribution Rate (2025) | 15% total (employer 10%, employee 5%) | Updates reflect sustainability goals |

| Processing Time | About 5 banking days after approval | Faster digital payouts via PESONet |

| Official Website | SSS.gov.ph |

Why Claiming SSS Sickness Allowance Matters in 2025?

The SSS Sickness Benefit, also known as the SSS Sickness Allowance, is one of the most essential short-term safety nets for Filipino workers. It provides income replacement for days you’re unable to work due to illness, injury, or even quarantine.

In 2025, this program matters more than ever. With rising healthcare costs, economic inflation, and job insecurity, missing work for even a week can strain your budget. The SSS aims to prevent that by offering a daily cash allowance equal to 90% of your Average Daily Salary Credit (ADSC).

Beyond financial help, this benefit gives peace of mind. You can focus on getting better without worrying about bills. For employers and HR professionals, it’s also an essential compliance responsibility under the Social Security Act of 2018 (RA 11199).

What Exactly Is the SSS Sickness Allowance?

The SSS Sickness Allowance is a benefit granted to members who can’t work for at least four consecutive days because of sickness, injury, or confinement (including home isolation). The SSS pays you 90% of your Average Daily Salary Credit (ADSC) for the number of days you are medically certified to be unable to work.

It applies to:

- Employed individuals

- Self-employed members

- Voluntary contributors

- Overseas Filipino Workers (OFWs)

Even if you’re working abroad or as a freelancer, you’re entitled to this benefit as long as your contributions are up to date.

What’s New in 2025?

The SSS implemented several updates effective January 2025:

- New MSC Ceiling: The maximum Monthly Salary Credit increased from ₱30,000 to ₱35,000. This means higher-income earners can receive a bigger benefit.

- Contribution Rate Adjustment: The rate increased from 14% to 15%. Employers shoulder 10%, while employees contribute 5%.

- Improved Online Filing: Members can now file sickness claims entirely online through the My.SSS portal, reducing paperwork and processing delays.

- Shorter Processing: The SSS targets disbursement within five banking days after approval.

- Enhanced Verification: SSS now partners with medical facilities to confirm confinement dates electronically, preventing fraud.

Eligibility Requirements for Claiming SSS Sickness Allowance

Before filing, check if you qualify:

- You must have at least three (3) monthly contributions within the last 12 months before the semester of your sickness.

- You must have been sick or injured for at least four consecutive days.

- For employees, company-paid sick leaves must be used up first before the SSS benefit applies.

- The SSS or your employer must be notified within the deadline:

- For home confinement: 5 calendar days from start of sickness.

- For hospital confinement: within 1 year from discharge.

- You must have not yet reached the 120-day maximum benefit in the same year.

Step-by-Step Guide to Filing SSS Sickness Allowance

Step 1: Notify Your Employer or SSS

- If employed: Inform your employer within five days from the start of your confinement. They will file the notification online.

- If self-employed, voluntary, or OFW: File directly through your My.SSS account or at an SSS branch within the deadline.

Step 2: Prepare Required Documents

- Sickness Benefit Application Form (available on SSS website)

- Medical Certificate (SSS Form MED-01688) signed by a licensed doctor

- Supporting medical records (laboratory results, discharge summary, prescriptions)

- Valid ID (UMID, passport, driver’s license, etc.)

- Disbursement Account Enrollment (DAEM) proof for payout

Step 3: Submit Your Application

Use the My.SSS online portal under E-Services → Submit Sickness Benefit Application (SBA). Upload scanned copies of your documents.

Employers must submit their Sickness Benefit Reimbursement Application (SBRA) for refunds once they advance the employee’s payment.

Step 4: Wait for Evaluation

SSS reviews your application and may contact you or your employer for clarification. Always respond promptly to avoid delays.

Step 5: Receive Payment

Once approved, the benefit will be credited to your bank or e-wallet registered under DAEM. The usual processing time is around 5–7 banking days after approval.

How the Sickness Benefit Is Computed?

The SSS Sickness Benefit follows this formula:

Benefit = (90% × Average Daily Salary Credit) × Approved Days

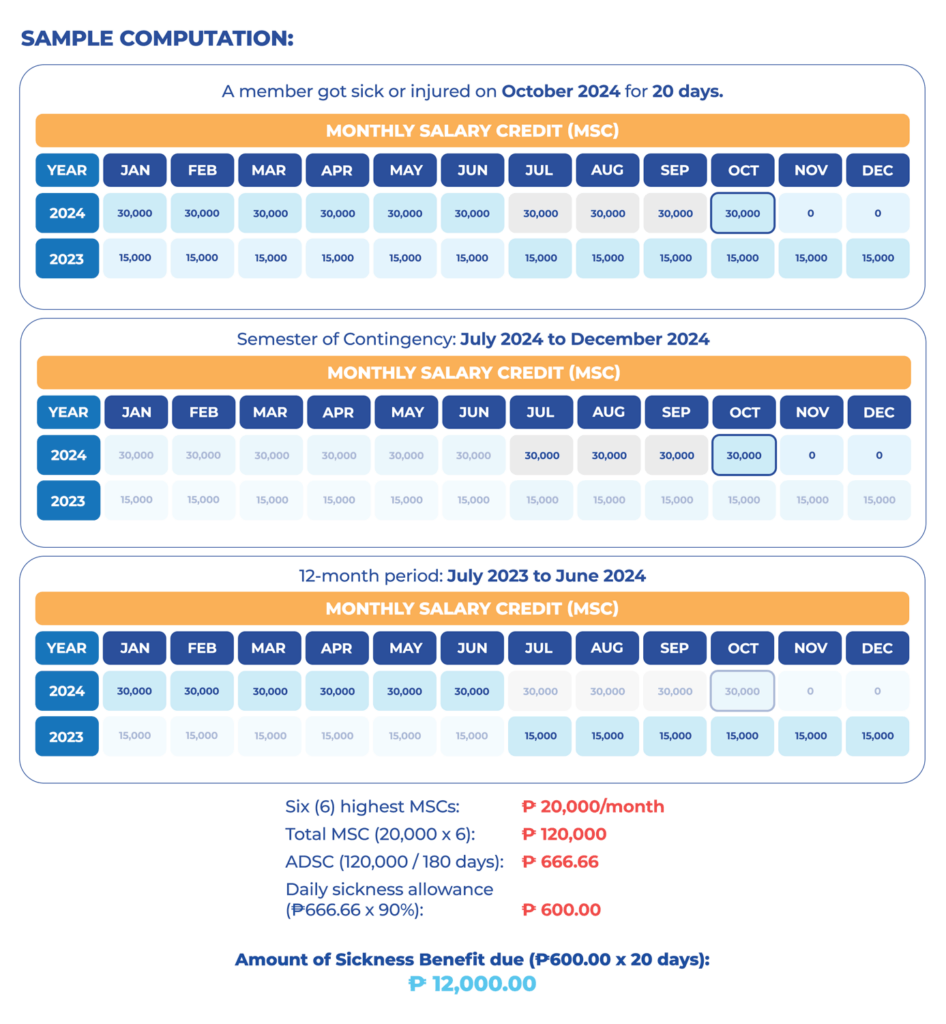

Step 1: Determine Your Semester of Contingency

The semester of contingency refers to the quarter of your sickness and the quarter before it. For example, if you got sick in May 2025, the semester is January–June 2025.

Step 2: Identify the 12-Month Period Before the Semester

Using the same example, your reference period is January to December 2024.

Step 3: Pick Your Six Highest Monthly Salary Credits (MSCs)

From those 12 months, choose your six highest MSCs.

Step 4: Compute Average Daily Salary Credit (ADSC)

Add the six MSCs and divide the total by 180.

ADSC = (Sum of six MSCs) ÷ 180

Step 5: Compute Daily Sickness Allowance (DSA)

Multiply ADSC by 90%.

DSA = 0.90 × ADSC

Finally, multiply your DSA by the approved number of sick days.

Example 1 – Regular Employee

Six MSCs: ₱30,000 × 6 = ₱180,000

ADSC = ₱180,000 ÷ 180 = ₱1,000

DSA = ₱1,000 × 0.9 = ₱900/day

If approved for 10 days, you’ll receive ₱9,000.

Example 2 – Minimum Wage Earner

Six MSCs: ₱6,000 × 6 = ₱36,000

ADSC = ₱200

DSA = ₱180/day

10 days = ₱1,800 benefit.

Example 3 – OFW with Maximum MSC

Six MSCs: ₱35,000 × 6 = ₱210,000

ADSC = ₱1,166.67

DSA = ₱1,050/day

10 days = ₱10,500.

Common Mistakes That Delay or Deny Claims

- Late filing or notification – Filing beyond the 5-day window reduces your payable days.

- Unpaid or missing contributions – You must have three valid payments in the last 12 months.

- Unverified bank account – Always confirm your DAEM enrollment.

- Incomplete medical details – Missing doctor’s license or diagnosis details can delay approval.

- Duplicate filing – Submitting the same claim twice can cause rejection.

Employer’s Role and Responsibility

Employers play a vital role in ensuring smooth processing. They must:

- Advance the sickness benefit to the employee in the next payroll.

- File reimbursement with SSS within five days of receiving notice.

- Maintain accurate digital records of all SSS transactions.

Non-compliance may lead to penalties or administrative sanctions. Employers should also educate staff about My.SSS registration to simplify future claims.

Payout Schedule and Disbursement Process

Once approved, payments are disbursed electronically. The SSS has phased out checks and manual releases.

| Stage | Timeline | Channel |

|---|---|---|

| Claim Filed | Day 0 | My.SSS Portal |

| Review Period | 3–7 working days | SSS Processing Center |

| Approval Notice | Day 7–10 | Email/SMS Notification |

| Fund Credit | Within 5 banking days after approval | PESONet/UMID-ATM/e-wallet |

Real-Life Scenarios

- Example 1: An employee with dengue is confined for seven days. Their HR files the claim and advances payment. After ten days, SSS reimburses the employer.

- Example 2: A freelance designer with no recent contributions is ineligible. The lesson: make voluntary payments to maintain active membership.

- Example 3: An OFW in Singapore gets COVID-19 and files online. Payment arrives in six days via PESONet.

Pro Tips for Faster Approval

- Double-check all uploaded documents for legibility.

- Register your disbursement account in advance.

- Notify your employer immediately after medical consultation.

- Use official SSS online channels only.

- Keep track of your claim through My.SSS > Inquiry > Benefits.

SSS ₱1000 Senior Citizen Pension 2025 – Are You Eligible in the Philippines?

SSS ₱8980 Direct Payment for 60+ Seniors 2025 – Check Eligibility & Payout Dates