Check Out If You’re Getting Silver Support in 2025: If you’re a senior citizen living in Singapore, or you’re watching out for your aging family members, you need to know about the Silver Support Scheme in 2025. This government program is designed specifically to provide regular cash supplements to seniors who earned lower wages in their working years and now have limited retirement savings. Its goal? To help cover daily expenses — groceries, healthcare, transport — so seniors can live their golden years with dignity and less financial worry. This article breaks down everything about the scheme: eligibility, payments, history, how to check if you qualify, and tips on maximizing its benefits — all explained clearly and conversationally.

Table of Contents

Check Out If You’re Getting Silver Support in 2025

In 2025, the Silver Support Scheme stands as a vital pillar of support for Singapore’s low-income seniors. Offering up to S$1,080 quarterly, it helps seniors live with dignity and less financial stress, all through a streamlined, automatic enrollment process. Staying informed, keeping your details up to date, and combining this aid with other resources can help you and your loved ones enjoy a secure and comfortable retirement.

| Feature | Details |

|---|---|

| Eligibility | Singapore citizens aged 65+, with lower lifetime CPF contributions, living in 1- to 5-room HDB flats |

| Maximum Payment | Up to S$1,080 quarterly (about S$360/month) |

| Payment Frequency | Quarterly: March, June, September, December |

| Assessment | Automatic based on government records; no application needed |

| Payment Method | Direct deposit to bank accounts or GovCash for unbanked seniors |

| Official Info Link | CPF Silver Support Scheme |

What Is the Silver Support Scheme?

The Silver Support Scheme is a quarterly cash assistance program introduced by the Singapore government in 2016. It was created to bridge the gap for seniors whose retirement savings fall short, by providing them with supplemental income. The scheme targets those who have had lower lifetime earnings and thus have limited financial resources in retirement, ensuring they can meet essential expenses and maintain their quality of life.

Unlike many benefit programs that require lengthy applications, this scheme automatically assesses eligibility each year using government data, which means seniors don’t have to apply—making it hassle-free. The cash payments start the quarter seniors turn 65 and continue as long as they remain eligible.

Why Does It Matter?

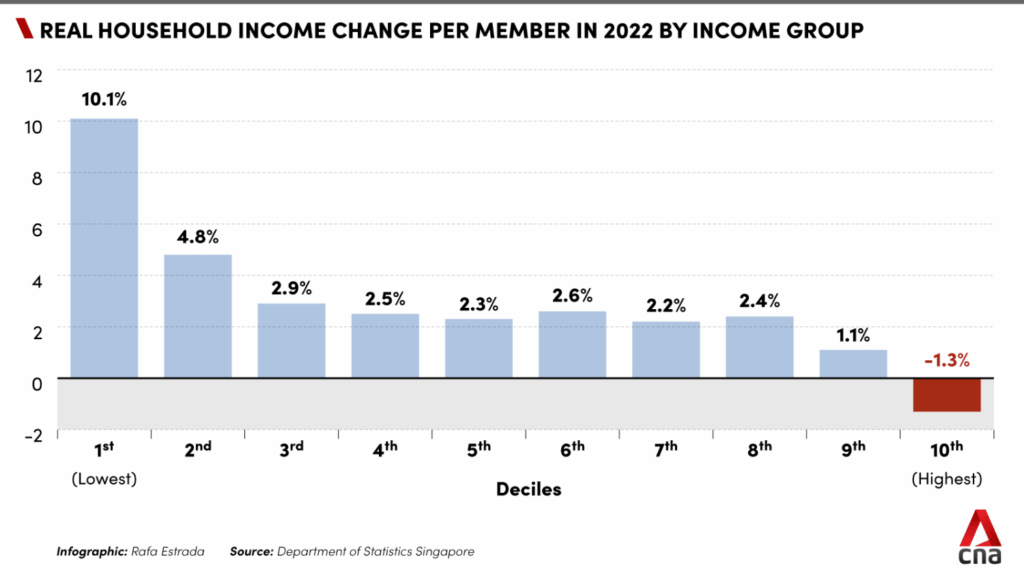

Many seniors didn’t have the luxury of consistent high-paying jobs or robust retirement plans. The rising cost of living, healthcare needs, and day-to-day expenses can quickly add up and become overwhelming. Silver Support is a direct response to these challenges, helping vulnerable seniors avoid financial hardship and live more comfortably.

By bolstering household incomes for seniors in financially constrained situations, the scheme fosters economic security, dignity, and independence—all crucial for a well-lived retirement.

Who Qualifies for Silver Support in 2025?

This scheme focuses on those who truly need support, defined by factors from age to income and housing status.

Detailed Eligibility Criteria:

- Age and Citizenship: You must be a Singapore citizen aged 65 or older during the assessment year.

- Lifetime CPF Contributions: Your total CPF contributions up to age 55 should be S$140,000 or less. This is a key gauge of your lifetime earnings and savings.

- Self-Employed Income: If you were self-employed, or a platform worker, between ages 45 to 54, your average annual net trade income should not exceed S$27,600.

- Housing: Residents must live in a 1- to 5-room HDB flat. Ownership of private property or more than one property disqualifies you, except in some special cases.

- Household Income: Your monthly per capita household income cannot exceed approximately S$2,300.

- Property Ownership: Neither you nor your spouse should own multiple properties or reside in a 5-room or bigger HDB flat, ensuring the scheme targets seniors with fewer assets.

Why These Criteria?

Singapore’s policymakers designed these criteria to make sure Silver Support goes to seniors who had limited earning capabilities and fewer savings or assets during their working years. This helps avoid overlap with other retirement support schemes which target different income groups.

It also aims to prevent double-dipping where wealthier seniors receive this support, keeping resources available to those who need them most.

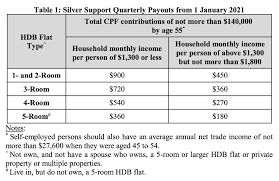

Payment Amounts and Frequency in 2025

In 2025, the government increased the Silver Support payouts to better match inflation and rising living expenses. Payments are sent out every quarter (March, June, September, December).

| Housing Type | Quarterly Payout (S$) | Approximate Monthly Equivalent (S$) |

|---|---|---|

| 1-2 Room HDB | Up to 1,080 | ~360 |

| 3 Room | Up to 864 | ~288 |

| 4 Room | Up to 648 | ~216 |

| 5 Room | Up to 215 | ~72 |

For those under the ComCare Long-Term Assistance Scheme, the payout is guaranteed at S$430 per quarter irrespective of housing or income.

How Are These Amounts Calculated?

The size of your HDB flat and your per capita household income are the main factors determining how much you get. Seniors in smaller flats with lower household incomes receive larger payouts because they typically face higher relative financial pressure.

These regular payments offer cash flow that can be used flexibly, whether that’s paying utility bills, covering medical expenses, or simply buying groceries.

A Brief History and Evolution of Silver Support

Initially announced in 2014 and launched in early 2016, the Silver Support Scheme has grown considerably:

- 2016: Started with quarterly payouts ranging from S$300 to S$750. Eligibility was limited to those with lifetime CPF contributions capped at S$70,000 and household income cutoffs around S$1,100.

- 2021 Enhancements: In response to feedback and changing demographics, policymakers doubled the CPF contribution cap to S$140,000, raised income ceilings, and increased payout amounts.

- 2025 Updates: Payout ceilings rose to a maximum of S$1,080 quarterly; household income ceilings increased to S$2,300, widening eligibility. The government also streamlined the notification and payment system to improve accessibility.

Reflecting A Growing Commitment

The scheme exemplifies Singapore’s adaptive social policy—a recognition that seniors’ financial needs evolve and require continuous attention as living costs rise and the population ages.

How to Check Your Eligibility and Receive Silver Support in 2025?

Seniors don’t need to apply. The government checks eligibility yearly using CPF data, housing records, and income information. Qualified seniors are sent a notification every December for payments in the following year.

To stay in the loop:

- Log in to the CPF Board website with your Singpass account.

- Check your Silver Support eligibility under the designated tab.

- Verify your linked bank account or GovCash details to ensure smooth payments.

- Contact CPF or local Social Service Offices if you think you missed your payout or need help.

This system offers a fully automated, secure way to keep seniors informed and receive payments without manual intervention.

Real-Life Perspective: Auntie Lim’s Story

Auntie Lim is 68, living in a 2-room HDB flat after years working as a cleaner. With limited CPF savings, she worries about rising grocery and medicine costs. The S$1,080 she receives quarterly via Silver Support is a big help, allowing her to budget monthly essentials without stress. She shares, “It’s not just the money, it’s the peace of mind knowing the government has my back.”

Stories like hers illustrate how Silver Support impacts lives beyond the balance sheet—bringing dignity, security, and emotional relief to seniors.

How Silver Support Fits Into Singapore’s Larger Eldercare Strategy?

Singapore’s social programs for seniors work as a coordinated safety net:

- CPF LIFE: Provides guaranteed lifelong payouts based on retirement savings.

- MediSave and CHAS: Cover healthcare expenses and subsidies.

- ComCare: Offers additional social assistance for low-income households.

- GST Vouchers (GSTV): Offset consumption tax burdens.

Silver Support enhances these by focusing on those with lower lifetime earnings and savings, ensuring retirees do not fall through gaps between schemes.

Supplementing retirement income with such programs is key in a society emphasizing active, inclusive aging.

What If You Think You Were Missed?

Mistakes occasionally happen. If you believe you qualify but didn’t receive notifications or payouts:

- Contact the CPF Board service hotline or visit the local Social Service Office.

- Prepare documents proving income, CPF history, and housing.

- Apply for an appeal or reassessment to review your case.

- Remember, staying proactive can mean the difference between receiving support or missing out.

Smart Tips for Seniors Using Silver Support

- Prioritize Basic Needs: Use your Silver Support supplement mainly for essentials—food, healthcare, utilities.

- Combine With Other Help: Layer Silver Support benefits with MediSave subsidies, ComCare assistance, and GST vouchers.

- Stay Updated: Keep CPF and household information current to avoid missed payments.

- Embrace Community Resources: Seek support from local senior activity centers, welfare groups, and voluntary organizations.

- Educate Family Members: Help younger relatives understand the scheme to assist with managing finances wisely.

$1,080 Old Age Payment in November 2025: How Singapore’s Social Security Scheme Operates!

2025 Retirement Age Updates in Singapore: New Conditions and Details Revealed!