Centrelink Lump Sum One Off Payment: Australia’s rising cost of living has pushed the government to step up with financial relief for those who need it most. The Centrelink Lump Sum One Off Payment 2025 is designed to ease the burden on millions of Australians by providing one-off cash boosts. Whether you’re a pensioner, carer, or jobseeker, understanding how this payment works, who qualifies, and how to manage it can make a big difference. This guide breaks it down into simple, practical steps, making it easy to follow whether you’re a beginner or looking for detailed expert insights.

Table of Contents

Centrelink Lump Sum One Off Payment

The Centrelink Lump Sum One Off Payment 2025 is a crucial lifeline helping millions of Australians manage rising costs and financial stress. With both $750 and $4,100 payment options available, the initiative supports a broad spectrum of the population who rely on welfare payments. By keeping your information updated and understanding the timing and implications of these payments, you can make the most of this support.

| Payment Type | Eligible Group | Expected Payment Period | Amount |

|---|---|---|---|

| Age Pension | Seniors | Jan – Mar 2025 | $750 |

| Disability Support Pension | Disabled Australians | Feb – Apr 2025 | $750 |

| Carer Payment | Registered Carers | Feb – Mar 2025 | $750 |

| JobSeeker Payment | Unemployed Australians | Mar – Apr 2025 | $750 |

| Parenting Payment | Low-income Parents | Apr 2025 | $750 |

| All Centrelink Recipients | Qualified Beneficiaries | Jan – May 2025 | $4,100 |

What Is the Centrelink Lump Sum One Off Payment?

The Centrelink Lump Sum Payment program in 2025 consists of two major payments designed to provide quick relief against inflation and rising essential costs:

- $750 One-Off Payment: Targeted mainly at people on welfare benefits such as Age Pension, Disability Support Pension, Carer Payment, JobSeeker, and Parenting Payment. This is to support day-to-day living expenses like groceries, bills, and rent.

- $4,100 One-Off Payment: Available for recipients with greater financial need, including certain pensioners and carers. This lump sum aims to cover bigger expenses like medical bills, rent arrears, or utility payments.

The payments require no action from recipients — they will be credited automatically to the bank accounts linked to Centrelink via MyGov. This automatic process reduces delays and bureaucracy, putting money swiftly into the hands of beneficiaries.

This payment scheme is part of the government’s larger plan to tackle financial pressures many households face due to global economic conditions and inflationary trends within Australia.

Why Did Centrelink Roll Out These Lump Sum Payments?

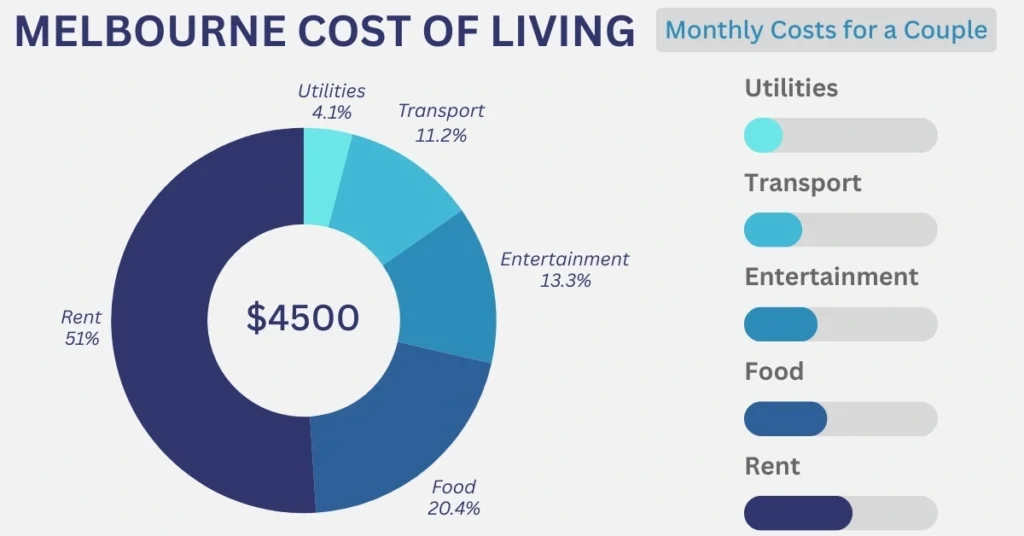

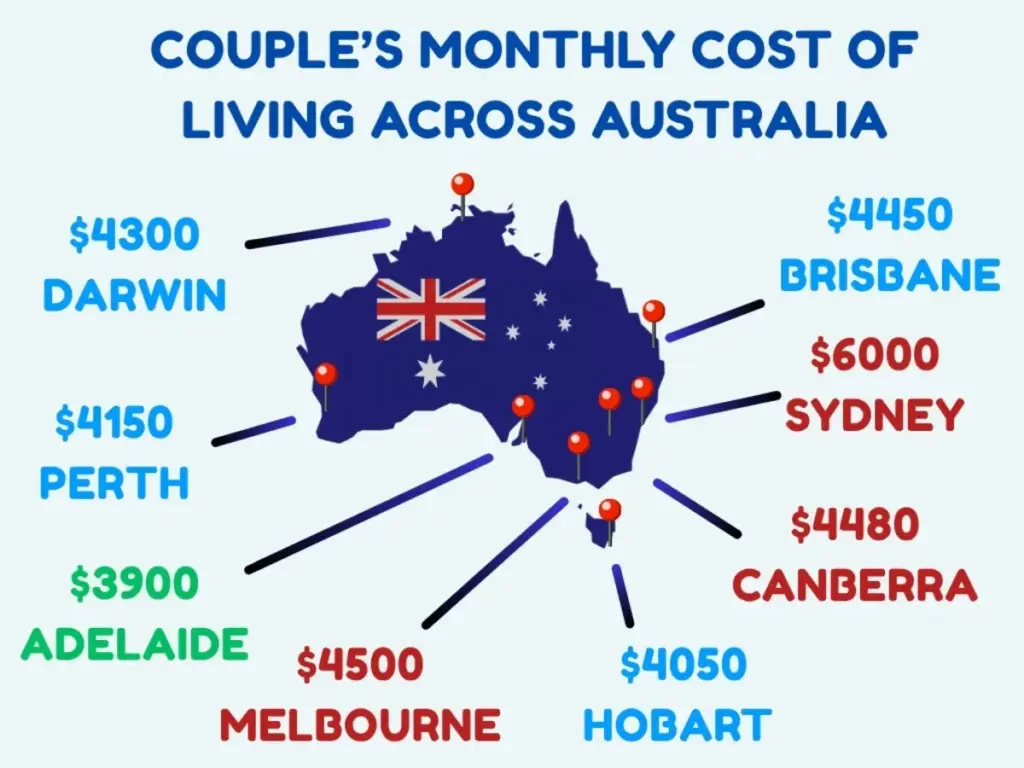

The government launched these payments as a direct response to the cost-of-living crisis. Rising food prices, energy bills, rents, and healthcare expenses are squeezing the budgets of many Australians. The lump sum payments aim to:

- Provide immediate relief for everyday expenses, helping recipients avoid financial stress and hardship.

- Mitigate the impact of inflation for those who depend on welfare payments.

- Help families and individuals pay off debts or unexpected costs that accumulate during tough economic periods.

- Deliver cash quickly through an automated system to those most affected without waiting for lengthy claims processes.

This timely intervention provides a financial safety net, helping stabilize the finances of millions during economically volatile times.

Official Eligibility Criteria: Who Qualifies?

Eligibility is streamlined and based mostly on existing Centrelink receipt status:

- You must be an Australian citizen or permanent resident registered with Centrelink.

- You must receive one or more qualifying payments such as the Age Pension, Disability Support Pension, Carer Payment, JobSeeker Allowance, Parenting Payment, or Youth Allowance as of a specified cut-off date.

- Your income and assets must fall within Centrelink’s thresholds to ensure the payments target those genuinely in need.

- It is essential that your bank and contact details are accurate and up-to-date in your MyGov account linked to Centrelink.

- No new application is required, but continuous eligibility verification happens via Centrelink’s administrative systems based on existing records.

Centrelink will automatically identify eligible recipients and credit the payments accordingly. If you think you are eligible but haven’t received payments by the deadlines, contacting Centrelink quickly is advisable.

Payment Timeline: When Will You Get Paid?

The payments are disbursed in phases throughout the first half of 2025:

- January to March 2025: Rolling out primarily to Age Pensioners and senior citizens as part of the $750 and $4,100 payments.

- February to April 2025: Disability Support Pension and Carer Payment recipients receive their payments.

- March to April 2025: JobSeekers and other income support recipients get their boosts.

- April to May 2025: Families receiving Parenting Payments and youth benefits receive lump sums.

Payments directly appear in linked bank accounts, usually with transaction descriptions referencing Centrelink to help you identify them. Ensure your MyGov notifications are enabled to stay updated on payment status and dates.

What Does the Centrelink Lump Sum One Off Payment Mean?

This larger amount targets households under extreme financial pressure beyond the typical costs. It specifically supports pensioners, carers, and low-income families whose expenses such as rent arrears, medical bills, or urgent household repairs have created significant financial strain.

It’s a meaningful one-off cash boost intended as a financial reset—not permanent income support.

Understanding Tax and Income Implications

- These lump sums are exempt from income and assets tests for Centrelink, meaning they usually don’t reduce your ongoing payments.

- These payments aren’t taxable and will not be included as income on your tax return.

- However, lump sums related to compensations, insurance, or worker’s settlements might affect eligibility and payments differently and should be reported.

How Will This Affect Your Other Benefits?

The lump sums typically have no negative effect on existing Centrelink benefits when administered properly. But if you receive other lump sums from compensations or legal settlements, this can impact your payments. Common considerations:

- Centrelink may apply a “preclusion period” during which no other benefits are paid, depending on other lump sums you receive.

- It’s essential to report all lump sums to Centrelink to avoid overpayment debts or payment suspensions.

- Centrepay payment arrangements remain unaffected by these lump sums and can help manage bills.

How to Prepare and Maximize Your Centrelink Lump Sum One Off Payment?

Step 1: Check your MyGov account to ensure all payment and personal information is current.

Step 2: Update your bank and contact details to prevent delays.

Step 3: Review your payment schedule on MyGov and mark dates.

Step 4: Budget your lump sum wisely—prioritize housing, food, and essential medical costs.

Step 5: Consider setting aside funds for upcoming expenses or emergencies.

Step 6: If unsure, reach out to Centrelink Financial Information Services Officers for free, confidential advice.

Historical Context: Centrelink Lump Sum Payments Over Time

Australia has a tradition of providing lump sum payments during crises—like natural disasters, economic downturns, or pandemics—to support vulnerable groups. This 2025 scheme follows similar past initiatives, such as cost-of-living boosts and economic support payments during COVID-19. Historically, these payments help maintain household stability until normal payment schedules and income levels normalize.

Practical Advice for Using Your Payment Wisely

- Prioritize essential bills first: Rent, utilities, groceries, and health care.

- Don’t overspend on luxury or non-essential items immediately.

- Use budgeting tools or money management apps to stretch your payment.

- Consider contacting a financial counselor if you’re unsure how best to allocate funds.

- Keep documentation of your spending in case you need to present evidence for continued eligibility.

Australia Pension Plan Payment November 2025: Check Payment Dates & Claim Process