For many older Australians, the Age Pension is more than just a payment—it’s the backbone of financial stability in retirement. As costs rise, maintaining the real value of that support is critical. In 2025, the government’s biannual indexation has brought about meaningful changes to pension rates, deeming rules, and eligibility thresholds. In this article, we explore the Centrelink Age Pension increase in October 2025, detail the new rates and tests, and explain who stands to benefit or lose from the adjustments.

Table of Contents

Centrelink Age Pension Increase October 2025

Though commonly referred to as the “October 2025 increase,” the revised Age Pension rates come into effect from 20 September 2025. The adjustment is automatic — eligible pensioners do not need to reapply. The increase is part of the government’s semiannual process, which takes into account consumer inflation, average wage growth, and a living-cost index for pensioners.

From 20 September 2025:

- Singles receive an extra A$ 29.70 per fortnight on top of their existing rates.

- Couples collectively gain A$ 44.80 per fortnight (i.e. A$ 22.40 each).

- These increases apply not only to the base pension but also to supplementary and energy components of payments.

These adjustments are intended to keep pensioners’ purchasing power intact amid inflation and rising everyday costs.

Overview Table: Key 20 September 2025 Pension Rates & Thresholds

| Category / Component | New Fortnightly Maximum | Increase from prior | Notes & conditions |

|---|---|---|---|

| Single (full) including supplements | A$ 1,178.70 | + A$ 29.70 | Base rate + pension supplement + energy supplement |

| Couple (each) including supplements | A$ 888.50 | + A$ 22.40 | Combined = A$ 1,777.00 |

| Deeming rates (for financial assets) | Lower: 0.75% / Upper: 2.75% | +0.50 pp each | Applies to income test of financial assets |

| Assets test – full pension cut-offs (homeowner) | Single: A$ 321,500 | Increased | Threshold for full pension |

| Assets test – part pension cut-offs (homeowner) | Single: A$ 714,500 | Increased | Beyond this, pension is reduced to zero |

| Part pension cut-off (non-homeowner) | Single: A$ 972,500 | Increased | For those without home ownership |

| Income test – full pension limit | Single: A$ 218 / fortnight | Raised | Above this, pension begins to reduce |

| Income test – upper limit for part pension | Single: A$ 2,575.40 / fortnight | Set | Beyond it, no pension entitlement |

Notes: The table combines base, supplement, and energy components for full pension. All thresholds and tests reflect changes effective 20 September 2025 and apply for the period through 19 March 2026.

The “October 2025” Age Pension increase, officially effective from 20 September, is part of Australia’s ongoing effort to keep the support system fair and responsive. In this round, singles gain A$ 29.70 fortnightly, couples A$ 44.80 combined, and key thresholds, deeming rules, and supplements are updated. However, the real impact will differ among pensioners depending on assets, income, and individual circumstances.

If you receive or plan to apply for the Age Pension, it’s essential to:

- Review your assets and income in light of new thresholds

- Ensure Centrelink has up-to-date data

- Use online tools to estimate your new entitlements

Why the Changes Are Called “October” When They Start in September

Many refer to the increase as being in October simply because the updated fortnightly payment period overlaps into October. But officially, the new rates take effect on 20 September 2025. The naming is colloquial, not technical. The government indexes pension payments and thresholds twice a year—20 March and 20 September—based on inflation, average wages, and a pensioner-cost index. These automatic adjustments aim to preserve the purchasing power of pensioners over time.

What Changes Beyond Just the Pension Amount

Deeming Rate Adjustments

One of the most consequential changes in this round is to the deeming rates used in the income test for financial assets. The deeming rates are assumed rates of return applied to a person’s financial assets, regardless of their actual earnings.

From 20 September 2025:

- The lower deeming rate (applied to the first portion of financial assets) rises from 0.25% to 0.75%.

- The upper deeming rate (for amounts above the threshold) increases from 2.25% to 2.75%.

These higher deeming rates mean pensioners with larger financial holdings may be assessed as having more “income” under the income test—even if their actual returns are lower—which can reduce their pension entitlement.

Asset and Income Test Threshold Updates

Indexation also lifts the bar for how much you can own or earn before your pension is reduced or cancelled.

Assets Test

From 20 September 2025:

- Full pension cut-off (homeowner): A$ 321,500 for singles (assets above this reduce the pension).

- Part pension cut-off (homeowner): Up to A$ 714,500 for singles (beyond that, pension detaches).

- For non-homeowners, the thresholds are higher (e.g. up to A$ 972,500 for single part pension).

- For couples, combined thresholds apply (for both full and part pension) using joint assets.

Thus, many pensioners whose assets were just over previous limits may now regain some or full pension eligibility.

Income Test

Effective thresholds:

- Full pension income limit (single): A$ 218 per fortnight

- Upper limit for part pension (single): A$ 2,575.40 per fortnight

- For couples, combined figures apply (e.g. A$ 380 per fortnight for full pension).

- Additionally, the Work Bonus still allows up to A$ 300 per fortnight of employment earnings (per person) to be excluded from the income test, helping those who continue working part time.

Importantly, when both the assets test and the income test apply, the government pays the pension under the test that yields the lower payment.

Supplement & Energy Components

The base pension is only one element. Pensioners also receive:

- Pension Supplement — an additional fortnightly amount to support living costs

- Energy Supplement — to offset household energy costs

When the base rate is indexed upwards, these supplements also adjust. In this 20 September 2025 change:

- The Pension Supplement maximum for singles is A$ 84.90 (increase ~A$ 1.30)

- The Energy Supplement is A$ 14.10 (remains steady)

- For couples, corresponding amounts also rise (e.g. supplement A$ 64.00 each).

These components are integral to the full pension totals listed in the overview.

Transitional Pension Adjustments

Some pensioners remain on transitional pension rates—a safeguard for those affected by older income test rules. Those rates too are increased, with new cut-offs and supplements applied for the transitional group. For example:

- Single transitional rate rises to A$ 959.70 per fortnight

- Couples (each) get increased rates in their transitional scheme

But once assets or income exceed transitional cut-offs, those pensioners shift to the standard part or full pension tests.

Who Qualifies under the New 2025 Rules

To receive the Age Pension under the new rules, a person must satisfy a set of criteria:

- Age requirement: You must have reached the qualifying age (currently 67 for those born after a certain cut-off).

- Residency conditions: You must meet residence tests (e.g. a minimum period living in Australia).

- Assets test: Your total assessable assets must be under a threshold (or part pension threshold).

- Income test: Your income (including deemed income from financial assets) must be within allowable limits.

- Other rules: Special conditions apply for those overseas, separated couples, or advance payments.

Because of the revised deeming rates and lifted thresholds, some people who lost part or full pension eligibility may regain it; others may see reductions because their (deemed) income now exceeds limits.

Special Cases & Scenarios

- One partner eligible: If only one partner in a couple qualifies, tests are applied to combined assets and income, and that person is paid half the combined couple rate.

- Living outside Australia: Long-term overseas pensioners get paid every 4 weeks (instead of fortnightly). Deeming and threshold rules may differ.

- Advance payments: After three months on pension, you may request one to three advance payments. The amounts are proportionate and recoverable over time.

- Rent Assistance: If you pay rent or residential costs, additional Rent Assistance may be granted (subject to eligibility). Rent Assistance thresholds are also indexed.

- Asset hardship provisions: In special financial distress, pensioners may access exemptions or alternative assessments.

What Pensioners Should Expect

Automatic Application

There’s no need for pensioners to reapply. Centrelink automatically adjusts payments from 20 September 2025 to reflect the new rates.

Varied Net Impact

While the headline increase is positive, the net gain varies. Pensioners with significant financial assets may receive less of a boost (or even see reductions) if their deemed income increases under the new deeming rates.

Changes in Eligibility

Some individuals may shift between full, part, or no pension status. Those near threshold limits should recheck their status under the new regime.

Importance of Updated Records

Pensioners must ensure Centrelink has current data on their:

- Assets (financial and non-financial)

- Income sources

- Marital status and living arrangements

- Work income (especially for those partially employed)

Errors or outdated records could lead to overpayments or underpayments.

Use Online Tools

Centrelink’s online portal and mobile app let you view your upcoming payment. You can also use online calculators provided by retirement or government websites to estimate your entitlements under the new rules.

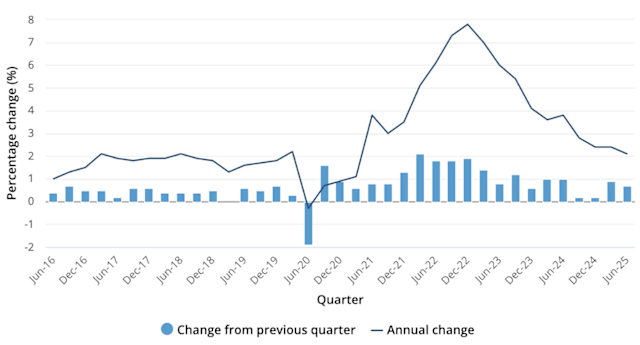

Historical Context: Why Indexation Matters

Australia indexes pensions biannually to prevent social security from losing value in real terms. The government considers Consumer Price Index (CPI), Average Weekly Earnings (AWE), and a special Pensioner and Beneficiary Living Cost Index. Whichever of these indicators rises the most usually guides the increase.

Over time, regular indexation has helped pensioners maintain purchasing power against inflation. But changes to rules like deeming, thresholds, and means tests continually reshape how much pensioners take home.

Australia $1116 Age Pension Coming in October 2025: Check Eligibility & Payout Dates

Australia $500 Cost Of Living Payment in October 2025 – Check Eligibility criteria & Pay Dates

FAQ About Centrelink Age Pension Increase

Q: Do I need to apply for the new increase?

A: No. The increase is automatic for all eligible pensioners from 20 September 2025.

Q: What if my payment doesn’t reflect the new rate?

A: Check your MyGov / Centrelink account and contact them to ensure your details (income, assets, address) are up to date.

Q: Will working affect my pension?

A: You can work and still receive Age Pension. Up to A$ 300 per fortnight (per person) is excluded from the income test. Above that, pension reduction may apply.

Q: How do deeming rates affect me?

A: Deeming rates assume your financial assets generate income at specified rates (0.75% and 2.75%). Even if actual returns are lower, these rates dictate what income is deemed for the income test.

Q: What happens if my assets exceed the part-pension limit?

A: If your assets go beyond the part-pension threshold, you lose eligibility for Age Pension under the assets test.

Q: I live overseas—does this affect my pension?

A: Yes. Long-term overseas residents are paid every four weeks instead of fortnightly. Also, thresholds and deeming rules may differ for overseas pensioners.