Canadian Seniors to Receive $2,400: If you’re a Canadian senior or helping one navigate retirement, you might’ve seen social media posts or online articles screaming: “Canadian Seniors to Receive $2,400 in November 2025!” Sounds like great news, right? But before you get too excited, let’s break down what’s true, what’s not, and what you can actually expect to receive. As someone who’s worked closely with seniors and financial planning, I’ll guide you through everything — in plain English, friendly tone, and reliable sources — so you can make sense of it all.

Table of Contents

Canadian Seniors to Receive $2,400

There’s no confirmed $2,400 one-time payment for Canadian seniors in November 2025. What is confirmed are your regular monthly benefits under OAS, CPP, and GIS — with payment on November 26, 2025. Yes, living costs are rising, but Canada’s social programs continue to adjust quarterly to help seniors maintain stability. The key is staying informed, filing taxes, and verifying news. Financial security in retirement isn’t about chasing rumors — it’s about using the real tools already available to you.

| What | Key Data / Stat |

|---|---|

| OAS Maximum (Oct–Dec 2025, age 65–74) | $740.09/month |

| OAS Maximum (75+) | $814.10/month |

| Next OAS/CPP Payment Date | November 26, 2025 |

| Average CPP Monthly Payment (2025) | $811 |

| CPP Maximum Monthly Payment (2025) | $1,433 |

| Current Inflation Rate (Sept 2025) | 2.8% YoY |

| Official Warning | “No new one-time payment introduced.” |

| Official Website | Canada.ca |

Background: Where Did the Canadian Seniors to Receive $2,400 Story Come From?

Rumors about “big one-time payments” for seniors aren’t new. During the pandemic, the Government of Canada did issue one-time relief payments to support older Canadians:

- In July 2021, seniors aged 75 and older received a $500 one-time payment to help offset the rising cost of living.

- In 2020, OAS and GIS recipients also received emergency COVID-19 relief benefits.

These measures set a precedent — so, when people see claims about another lump-sum “senior bonus,” they often assume it’s real. Unfortunately, as of October 2025, there is no official government announcement confirming a $2,400 one-time payment in November 2025.

How OAS and CPP Actually Work?

Old Age Security (OAS)

The Old Age Security pension is Canada’s backbone retirement income for seniors. It’s funded by general tax revenues — meaning you didn’t directly pay into it like CPP, but you qualify based on age and residency.

Eligibility Requirements:

- Be 65 years or older

- Be a Canadian citizen or legal resident

- Have lived in Canada at least 10 years since age 18

To get the full OAS pension, you must have lived in Canada for 40 years after turning 18. If you’ve lived fewer years, you can receive a partial pension.

Monthly Payment (Oct–Dec 2025):

- Ages 65–74: Up to $740.09

- Ages 75+: Up to $814.10

Payments adjust quarterly to match inflation through the Consumer Price Index (CPI).

Pro Tip: If you defer OAS for up to five years (until age 70), your payments increase by 0.6% for every month you delay, or up to 36% higher overall.

Canada Pension Plan (CPP)

The Canada Pension Plan works differently — it’s based on how much and how long you contributed while working. It’s a contributory, earnings-based program.

Key Facts:

- You can start CPP as early as age 60 (smaller payment) or delay until age 70 (larger payment).

- In 2025, the average monthly CPP retirement payment is around $811, while the maximum for those who contributed the most is $1,433.

- The next CPP payment date is November 26, 2025.

Starting early means smaller monthly checks, but you’ll receive them longer. Delaying boosts your benefit by 8.4% per year up to age 70.

Guaranteed Income Supplement (GIS)

The GIS is an additional monthly payment for low-income seniors who already receive OAS.

Eligibility depends on your total household income.

For example:

- Single seniors earning less than $21,624 may receive the maximum GIS.

- Married couples with combined income under $28,560 may qualify.

GIS amounts are recalculated quarterly, just like OAS, to keep up with inflation.

Why the “Canadian Seniors to Receive $2,400” Story Keeps Circulating?

So why do these rumors persist? A few reasons:

- Misinterpretation of annual totals: Some writers confuse the total yearly OAS ($740 x 12 months ≈ $8,880) and combine it with GIS or CPP, rounding it into a lump-sum figure like $2,400.

- Provincial top-up programs: Provinces such as Alberta, Ontario, and British Columbia offer extra monthly supplements, leading people to believe the federal government is issuing one-time payments.

- Clickbait headlines: Websites and YouTube channels sometimes use misleading titles to attract readers, even when their content is vague.

The Real Impact of Inflation on Seniors

Let’s face it — inflation hits seniors hardest. Fixed incomes mean every grocery trip feels pricier.

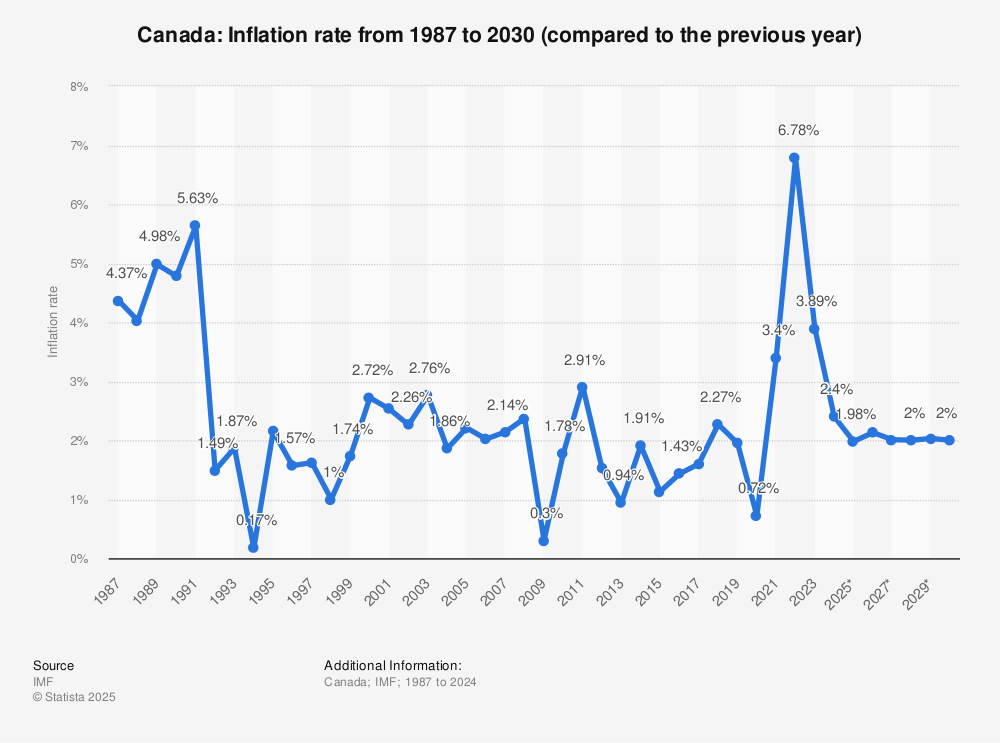

According to Statistics Canada, the CPI inflation rate for September 2025 sits at 2.8%, down from 4.3% in 2023, but essentials like food and housing remain stubbornly high.

This is why OAS and GIS payments are indexed to inflation — ensuring seniors’ purchasing power doesn’t erode over time. If inflation spikes, payments go up the next quarter automatically.

Example:

- OAS increased by 0.7% from July to September 2025.

- GIS saw a similar bump for low-income seniors.

So even if there’s no $2,400 windfall, you’re still protected by automatic adjustments.

Provincial and Territorial Support Programs

Alberta Seniors Benefit

- Eligibility: 65+, lived in Alberta ≥ 3 months, receive OAS, low income.

- Pays an additional monthly supplement based on income and marital status.

Ontario Guaranteed Annual Income System (GAINS)

- Top-up of up to $83 per month for low-income seniors.

- Must receive OAS and GIS to qualify.

British Columbia Seniors Supplement

- Adds $99.30/month for singles, $120.50 for couples.

These may not sound like much individually, but combined with federal benefits, they make a real difference.

Tips for Maximizing Your Benefits

- File your taxes every year. Even if you owe nothing, it ensures your OAS and GIS remain active.

- Apply for every program you qualify for. Check both federal and provincial sites.

- Delay CPP or OAS if possible. Waiting until 70 could raise your retirement income by over 30%.

- Consider pension income splitting. If married, splitting can reduce taxes and increase your net take-home.

- Track your benefits online. Create a My Service Canada Account to monitor deposits.

- Avoid early withdrawals. Dipping into RRSPs too soon can reduce GIS eligibility later.

How to Avoid Scams and False Claims?

Scammers often target seniors with fake offers, pretending to be from Service Canada or the CRA. Here’s how to stay safe:

- The Government never contacts you by text or email asking for personal info.

- Always check official addresses — they end with “.gc.ca”.

- Never pay fees to “apply” for benefits.

- Verify any announcements directly through official government channels or by calling 1-800-O-Canada (1-800-622-6232).

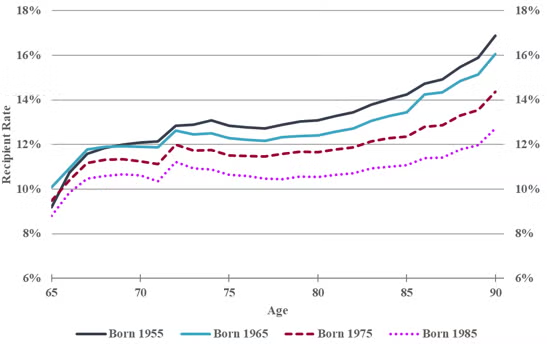

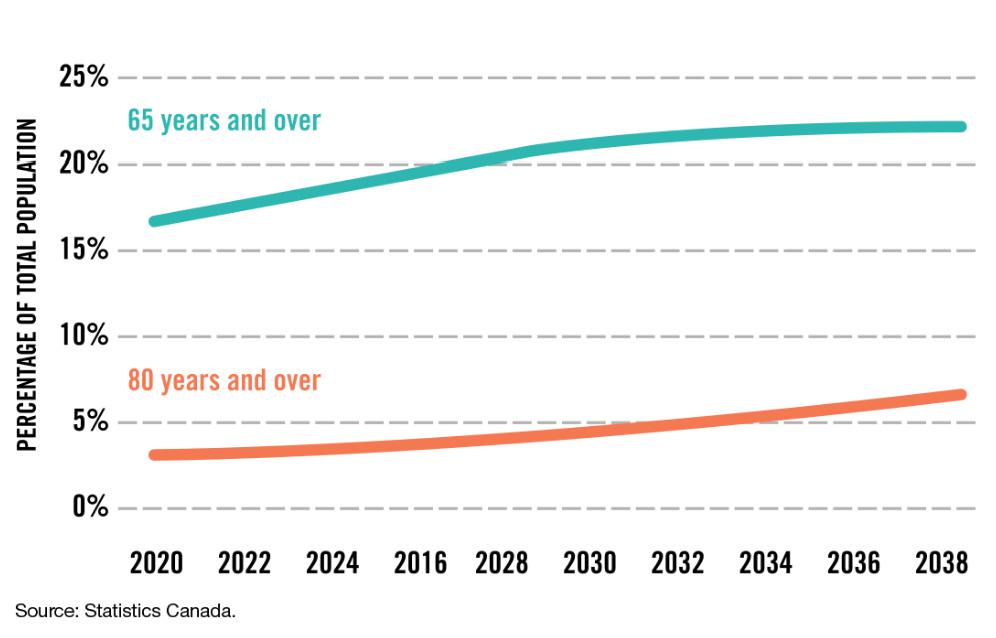

Planning for the Future: Cost-of-Living, Health, and Longevity

Retirement isn’t just about receiving benefits — it’s about planning wisely.

Here are practical long-term strategies:

- Budget for inflation: Assume your expenses will rise about 2–3% per year.

- Consider healthcare coverage: Provincial plans differ, but out-of-pocket drug and dental costs can add up fast.

- Think long-term care: The average cost of assisted living in Canada is $3,000–$6,000 per month, depending on location.

- Build an emergency fund: Aim for at least three months of expenses saved, even in retirement.

Smart planning now ensures you don’t rely solely on OAS and CPP in later years.

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

$628 Canada Grocery Rebate in November 2025: Is it true? How to Check Status

Canada CRA Payment Dates Coming in November 2025, Official Schedule for Various Federal Benefits