Canada’s Minimum Wage Increase: The Canada Minimum Wage October 2025 increase is more than a headline—it’s a financial shift that could impact millions of workers and thousands of small businesses nationwide. Whether you’re earning by the hour, running a local coffee shop, or managing HR for a national brand, this change affects you.

Starting October 1, 2025, several provinces are rolling out new, higher minimum wage rates to keep up with inflation, cost-of-living pressures, and ongoing economic shifts. The goal is simple: make sure Canadians working full-time can afford a basic standard of living in a post-pandemic world of rising costs. Let’s break it all down clearly—what’s changing, why it matters, and how to prepare.

Table of Contents

Canada’s Minimum Wage Increase

The Canada Minimum Wage October 2025 changes reflect a growing national consensus: no full-time worker should live below the poverty line. Provinces from Ontario to Nova Scotia are aligning their pay floors with inflation and affordability realities. For employees, it means a modest but meaningful lift in earnings. For employers, it’s both a challenge and an opportunity—to modernize, automate, and retain good talent through fair pay. The bottom line? Change is constant. Stay informed, stay compliant, and use these increases as a springboard toward a stronger, fairer economy for everyone.

| Province / Jurisdiction | New Rate (Effective Oct 1, 2025) | Previous Rate |

|---|---|---|

| Ontario | CA $17.60/hr | CA $17.20 |

| Manitoba | CA $16.00/hr | CA $15.80 |

| Nova Scotia | CA $16.50/hr | CA $15.70 |

| Prince Edward Island | CA $16.50/hr | CA $16.00 |

| Saskatchewan | CA $15.35/hr | CA $15.00 |

| British Columbia | CA $17.85/hr (June 2025) | CA $17.40 |

| Federal (regulated sectors) | CA $17.75/hr (Apr 2025) | CA $17.30 |

| Official reference | Canada’s Minimum Wage Portal |

Why Did Canada’s Minimum Wage Increase Again?

Over the past few years, Canadians have faced some of the steepest cost increases in recent memory. Rent prices have surged by over 12% since 2023, food inflation remains stubbornly high, and utilities have jumped roughly 7% year-over-year, according to Statistics Canada.

When inflation rises, purchasing power falls—and that’s what these wage hikes are trying to fix. For example, someone earning $15/hour in 2020 now needs roughly $17.50/hour to buy the same basket of goods in 2025. The October 2025 increases are part of a broader national effort to catch up.

The Policy Context

Most provinces have adopted automatic indexing systems, tying minimum wage to the Consumer Price Index (CPI). That means each year, wages rise automatically in line with inflation—removing political delays and ensuring pay keeps pace with prices.

As Lisa McKay, a labour economist at the University of Toronto, explains:

“What’s different now is predictability. Provinces like Ontario and Saskatchewan aren’t waiting for economic emergencies to adjust wages—they’re adjusting gradually, every year.”

The Provincial Picture: Who’s Raising Wages and Why

Ontario

Ontario’s minimum wage increase to $17.60/hr takes effect October 1, 2025, marking its third consecutive annual hike. The province’s formula ties increases to the CPI measured from June-to-June. The government estimates about 1 million workers—roughly one in six employees—will directly benefit.

Manitoba

Manitoba is moving modestly, from $15.80 → $16.00/hr, continuing a post-pandemic series of smaller, steady increases. Manitoba’s retail and food service sectors rely heavily on hourly workers, so even a 20-cent raise can ripple through local economies.

Nova Scotia and Prince Edward Island

Atlantic Canada’s provinces are in catch-up mode. Nova Scotia’s big jump to $16.50/hr makes it one of the fastest risers nationwide. PEI mirrors that path, signaling that the East Coast economy is shifting toward cost-of-living alignment with central Canada.

Saskatchewan

Saskatchewan’s bump to $15.35/hr might seem small, but it follows two larger increases since 2023. The province uses an indexation formula that combines CPI and average wage growth, providing gradual, stable adjustments for small businesses.

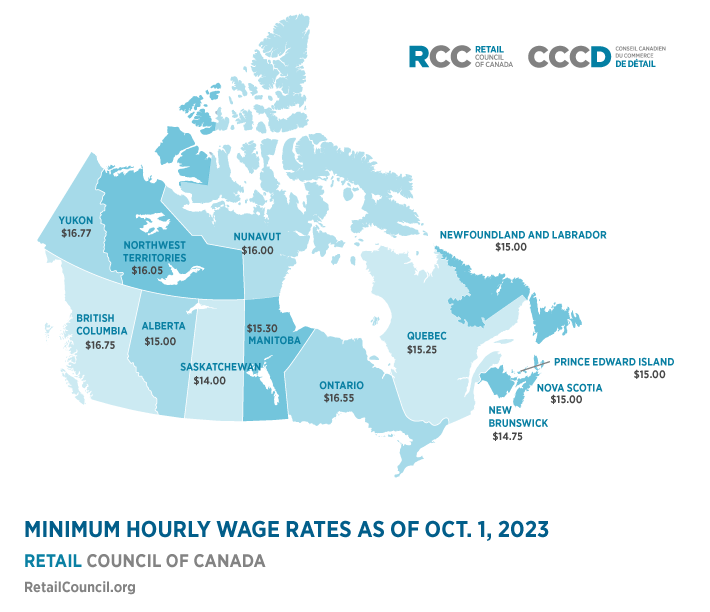

British Columbia and the Territories

BC raised its rate earlier (June 2025) to $17.85/hr, keeping it among the top in Canada. In the North, Nunavut’s $19.75/hr leads the nation, followed by Yukon and the Northwest Territories, where high living costs drive policy.

The Ripple Effect: How Canada’s Minimum Wage Increase Impacts Everyone

It’s easy to assume these changes only affect entry-level workers, but the reality runs deeper.

1. Workers’ Bottom Line

A 40-cent hourly increase equals roughly $832 more per year for a full-timer. That may cover a month of rent, a utility bill, or some extra groceries. It’s modest, but it helps maintain dignity in daily life.

2. Small Business Costs

For employers, payroll costs rise 2–3 % on average. That might not sound huge, but in tight-margin sectors like hospitality or retail, it can be the difference between profit and loss. Still, higher pay can also reduce turnover, saving recruitment costs in the long run.

3. Broader Economic Balance

According to the Bank of Canada, modest wage increases don’t automatically cause inflation. In fact, wage-indexed systems create predictability for both workers and employers—reducing sudden shocks to prices or business operations.

Real-World Scenarios: What It Looks Like in Practice

Case 1: Ontario full-time worker

Old rate $17.20 → new $17.60 = +$0.40/hour.

At 40 hours/week × 50 weeks = +$800 annually before taxes.

Case 2: Manitoba café with 5 staff

Old rate $15.80 → new $16.00 = +$0.20/hour.

5 staff × 30 hours/week × 50 weeks = +$1,500 extra in yearly payroll.

Case 3: Nova Scotia student employee

Old rate $15.70 → new $16.50 = +$0.80/hour.

If working part-time (20 hours/week), that’s roughly +$832 per year—enough to offset tuition or transportation costs.

The Bigger Picture: Cost of Living and Policy Goals

Raising minimum wages isn’t just about immediate relief. It also fits into Canada’s anti-poverty and productivity strategy. When low-income workers earn more, they spend more—mostly in local economies. That increases demand for goods and services, helping small businesses thrive.

At the same time, policymakers hope to reduce reliance on government benefits like rent subsidies or food support by lifting incomes at the base.

However, not everyone agrees. The Canadian Chamber of Commerce warns that small enterprises may respond by cutting hours or delaying hiring. Economists note that the balance between fair pay and affordability remains delicate—especially for rural employers.

What Workers Should Do Before October 1 2025?

- Verify your pay rate after your first October paycheck. If it hasn’t changed, speak to your manager or contact your province’s employment standards office.

- Understand your category: Some roles—students, homeworkers, liquor servers—have special rates. Check your province’s official labour site.

- Plan your budget wisely: Use the raise to build an emergency cushion or pay off debt, not just increase spending.

- Keep records: Always track hours and pay stubs for verification or dispute resolution.

What Employers and HR Teams Should Do?

- Update payroll systems early. Don’t wait until payday to implement the new rates.

- Communicate clearly with staff about their new pay structure and any policy changes.

- Re-budget labour costs. Even small hourly raises accumulate quickly across multiple employees.

- Train managers on compliance—misunderstanding exemptions or categories can lead to penalties.

- Review pay equity: Avoid “wage compression” by adjusting near-minimum roles proportionally.

- Audit contractors: If you use third-party staff, ensure agencies comply with new laws.

Employers found underpaying risk fines, back pay, and even public naming through government transparency reports.

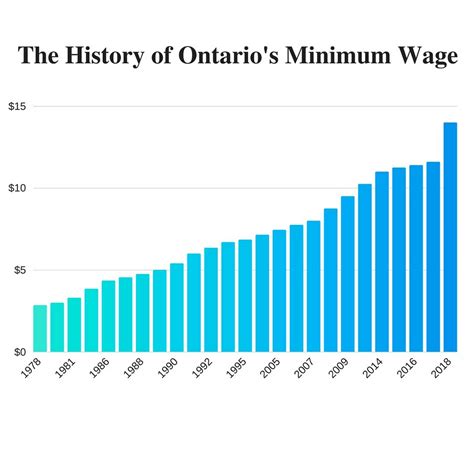

Long-Term Trend: The Future of Canada’s Wage Policy

Many economists believe $20/hour will become the new benchmark within a decade. Provinces are slowly moving toward “living wage” calculations—rates that reflect the actual cost of living rather than the bare legal minimum.

In cities like Vancouver or Toronto, independent research from the Canadian Centre for Policy Alternatives estimates the living wage at $25–$27/hour, far above any legislated minimum. While no province is close to that yet, indexing and steady increases narrow the gap over time.

Expert Commentary

“We used to see minimum wage hikes once every few years. Now they’re baked in annually,” says Dr. Mina Patel, senior policy analyst at ADP Canada. “For workers, that’s stability. For employers, that’s predictability.”

She adds: “The key is planning ahead—if businesses know what’s coming, they can adapt without panic or layoffs.”

That approach aligns with federal policy trends promoting automatic indexing and periodic review, making wage law more data-driven and less political.

Career & Financial Tips for 2025–2026

- Upskill continuously: As entry-level pay rises, mid-level roles must justify higher salaries through added value.

- Use digital tools: Free apps like Mint or YNAB help you manage the extra income efficiently.

- Negotiate smartly: If you’re above minimum wage but close to it, use this change as leverage for a review.

- Employers: Consider incentives—health benefits, flexible hours, or tuition support—to stay competitive beyond base pay.

Canada Wage News: $17.65/Hour Pay Raise; Is Your Province on the List?

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria