Canada’s $2,000 CRA Direct Deposit: If you’ve been scrolling through TikTok, Facebook, or your family WhatsApp chat lately, you’ve likely come across headlines about a “$2,000 CRA Direct Deposit in October 2025.” Sounds exciting, right? Who wouldn’t want two grand just magically showing up in their bank account? But here’s the catch: it’s not true. While it’s tempting to believe, this claim doesn’t hold up when compared against official announcements from the Canada Revenue Agency (CRA). Still, there are important payments scheduled this October, and understanding them can help you plan your finances better. This article breaks down what’s real, what’s rumor, and how to check if you’re eligible for actual CRA benefits this fall.

Canada’s $2,000 CRA Direct Deposit

The buzz around a $2,000 CRA Direct Deposit in October 2025 is just that — buzz. There’s no government confirmation, and it appears to be a recycled rumor tied to memories of CERB. What is real are scheduled deposits like the GST/HST Credit and the Advance Canada Workers Benefit. For families, seniors, and workers, these programs provide meaningful support. Instead of banking on false promises, check your CRA My Account, stay alert for scams, and plan your finances around verified payments. Reliable budgeting and awareness go much further than viral social media posts.

| Point | Details |

|---|---|

| Rumor | Claims of a $2,000 CRA direct deposit in October 2025 are circulating online. |

| Reality | No official CRA or Government of Canada announcement confirms this payment. |

| What’s Real | Scheduled CRA payments include GST/HST Credit (Oct 3, 2025) and Advance Canada Workers Benefit (Oct 10, 2025). |

| Eligibility | Payments depend on income, family status, and program rules. No universal $2,000 payout exists. |

| How to Check | Visit the official CRA site: canada.ca. |

Why People Believe Canada’s $2,000 CRA Direct Deposit?

The reason this rumor spread so quickly comes down to psychology and history. Back in 2020, during the height of the pandemic, the government rolled out the Canada Emergency Response Benefit (CERB). That program gave eligible Canadians $2,000 per month for up to 28 weeks. For many families, CERB was a financial lifeline.

Even though CERB ended years ago, the $2,000 figure stuck in people’s minds. When posts pop up today claiming a new $2,000 deposit, people instantly connect it to the pandemic-era program. Add in the fact that Americans received multiple stimulus checks, and it’s easy to see how Canadians might believe another payment is on the way.

The problem is that there’s no official announcement to back it up.

What’s Actually Coming in October 2025?

While the $2,000 rumor isn’t true, there are confirmed CRA payments scheduled. Let’s go over them in detail.

GST/HST Credit – October 3, 2025

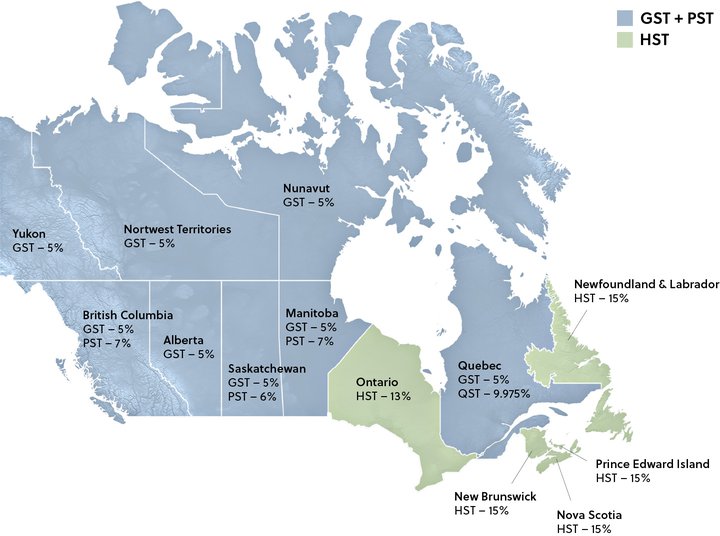

The Goods and Services Tax / Harmonized Sales Tax Credit (GST/HST Credit) is a tax-free quarterly benefit. It’s designed to help low- and modest-income Canadians offset the cost of paying GST or HST on goods and services.

- In 2023–24, the average annual benefit was about $496 for a single adult, and more if you had children.

- According to CRA data, over 11 million Canadians received the GST/HST credit.

- Payments vary depending on your household income and number of dependents.

Advance Canada Workers Benefit – October 10, 2025

The Advance Canada Workers Benefit (ACWB) is a refundable tax credit for low-income workers. Instead of making you wait until tax time, the government pays part of it in advance throughout the year.

- Eligible single workers can get up to $1,518 annually, while families may receive up to $2,616.

- Roughly 3 million Canadians claimed this benefit in 2023.

- Advance payments are spread across three installments, one of which is in October.

Other Ongoing Benefits

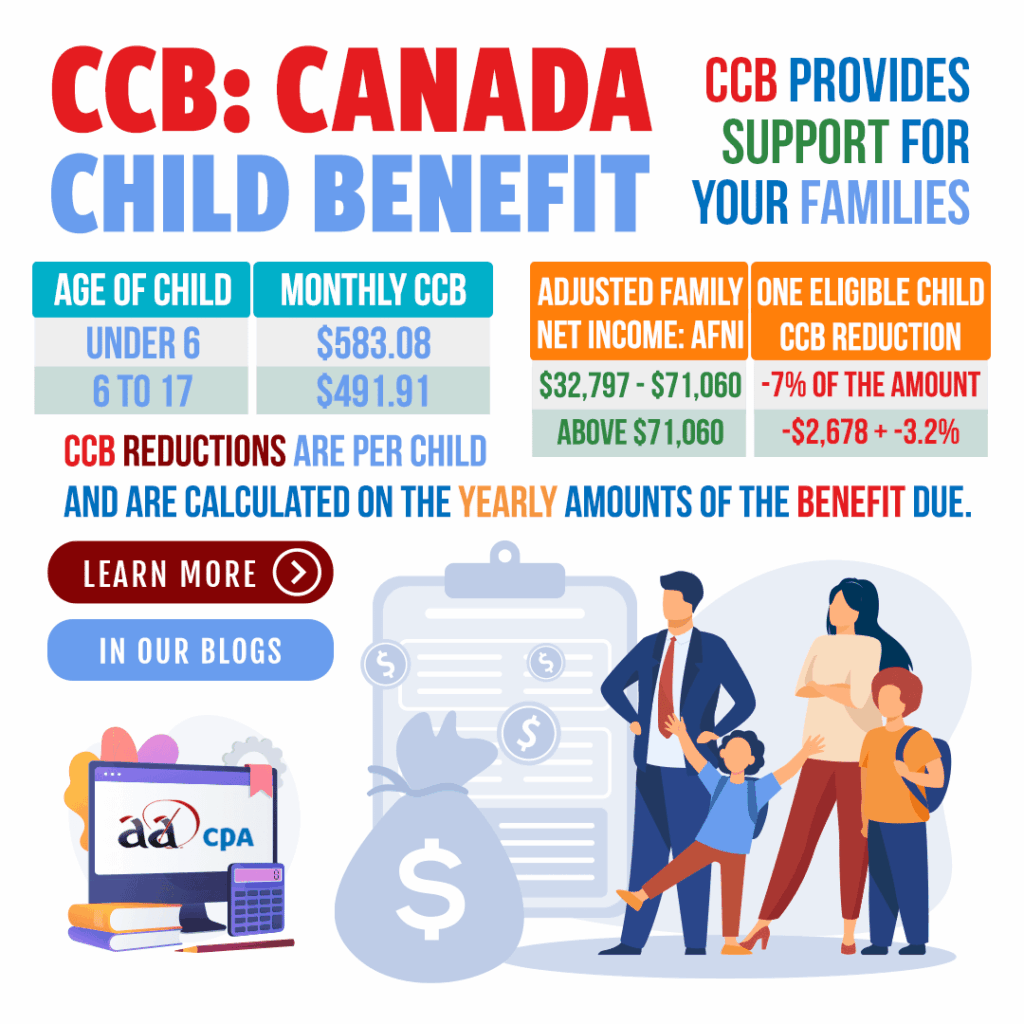

- Canada Child Benefit (CCB): For families with kids under 18.

- Old Age Security (OAS): Monthly payments for seniors over 65.

- Guaranteed Income Supplement (GIS): Extra support for low-income seniors.

So while there’s no flat $2,000 payment, these scheduled benefits are real and substantial.

How CRA Benefits Actually Work?

The CRA doesn’t just hand out money without rules. Each benefit is carefully calculated based on:

- Income level – Lower-income households qualify for higher benefits.

- Family size – Having kids increases your eligibility for the Canada Child Benefit.

- Age and situation – Seniors may qualify for OAS and GIS.

- Tax return – Your benefits are based on your most recent tax filing.

Example:

- A single parent earning $35,000 annually with two children could receive more than $7,000 a year in CRA benefits when combining CCB, GST/HST credit, and ACWB.

- A retired senior living on OAS may qualify for GIS if their income falls below the threshold.

The takeaway: benefits are targeted, not universal.

How to Check If You’re Eligible for Canada’s $2,000 CRA Direct Deposit?

Step 1: Log Into CRA My Account

Use CRA My Account to see all your benefits.

Step 2: Review Benefits & Credits

This section lists upcoming payments with dates and amounts.

Step 3: Keep Taxes Updated

If you don’t file your taxes, you don’t get benefits. Filing ensures CRA has the data to calculate your eligibility.

CRA Scams and How to Avoid Them

Scams linked to CRA benefits are exploding in Canada. The Canadian Anti-Fraud Centre reported Canadians lost $531 million in 2023 to various scams — a record high. Many of those were tied to fake CRA calls, texts, or emails.

Common Scam Tactics

- Fake texts promising “bonus CRA deposits.”

- Phone calls demanding you “pay tax debt immediately.”

- Phishing emails asking for SIN or banking info.

How to Protect Yourself

- CRA will never demand payment by gift cards, Bitcoin, or e-transfer.

- Always verify through My Account.

- If in doubt, call CRA directly at 1-800-959-8281.

- Report fraud attempts to the Canadian Anti-Fraud Centre.

Practical Budgeting Tips for October Payments

Even if you’re not getting $2,000, CRA payments can still help your household budget. Here’s how to make the most of them:

- Cover Essentials First – Food, rent, and utilities should always come before extras.

- Tackle Debt – Use part of the payment to pay down high-interest credit cards.

- Build an Emergency Fund – Even $50–100 per month adds up over time.

- Plan for Seasonal Costs – With winter around the corner, set aside money for heating bills or holiday expenses.

- Think Long-Term – If you can, invest small amounts in RRSPs or TFSAs for future security.

How This Compares to the U.S.?

It’s natural to compare Canada with the U.S., especially since Americans received three rounds of stimulus checks between 2020 and 2021.

- U.S. stimulus checks were broad, flat-rate payments.

- Canada chose targeted, ongoing support programs like CERB, CCB, and GIS.

- While the U.S. approach created short-term relief, Canada’s benefits are designed to provide consistent, needs-based help.

This explains why Canadians don’t see one-time $2,000 checks — but instead, benefit from structured, long-term programs.

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date