Canada October $3555 Widow Pension Support: If you’ve stumbled on stories about the Canada October $3,555 Widow Pension Support, you’re probably asking: is this real, or just another online rumor? Let’s cut straight to it: there is no official Canadian government program that pays widows or widowers exactly $3,555 per month. What does exist are real, established supports like the Canada Pension Plan (CPP) Survivor’s Pension, Old Age Security (OAS), and the Guaranteed Income Supplement (GIS).

The confusion comes from mixing these legitimate benefits, sometimes stacking them together, and throwing around a rounded-up figure. In reality, what widows receive depends on age, income, and how much their spouse contributed to CPP. This article digs deep: the facts, eligibility rules, benefit calculations, comparisons to U.S. survivor pensions, common mistakes, and a step-by-step guide to applying. By the end, you’ll know exactly what to expect — no fluff, no clickbait.

Canada October $3555 Widow Pension Support

The much-hyped Canada October $3,555 Widow Pension Support isn’t a new government program. Instead, widows and widowers in Canada have access to long-standing supports like the CPP Survivor’s Pension, OAS, GIS, and provincial supplements. While the maximum is far less than $3,555, these benefits provide important financial stability. The smartest move? Apply early, combine programs strategically, plan for taxes, and explore every available provincial and federal option. That way, you’ll get the most out of the system.

| Topic | Details |

|---|---|

| Program Name | Canada Pension Plan (CPP) Survivor’s Pension |

| Rumored Benefit | $3,555/month (not official) |

| Actual Average | $387.98/month (2024 CPP survivor’s pension average) |

| Maximum Survivor’s Benefit | $818.76/month (if 65+) |

| Other Benefits | OAS, GIS, Allowance for Survivor, CPP Death Benefit |

| Eligibility | Legal spouse or common-law partner of deceased CPP contributor |

| Application Deadline | Apply ASAP – retroactive payments capped at 12 months |

| Taxable? | Yes (CPP survivor’s pension and OAS are taxable; GIS is non-taxable) |

| Application Form | ISP1300 – Survivor’s Pension |

| Official Website | Government of Canada – CPP Survivor Pension |

What Is the “Canada October $3555 Widow Pension Support”?

The so-called “$3,555 widow pension” has become a hot topic across social media, news blogs, and community groups. But here’s the deal:

- No official Canadian government program pays widows $3,555/month.

- That number is likely created by adding together CPP survivor’s benefits, OAS, GIS, and provincial top-ups, then rounding up.

- Many online articles are written by non-government sources, sometimes based on speculation rather than facts.

To put it plainly: you might receive survivor benefits, but you won’t see a flat $3,555 check. Instead, payments are calculated based on your late spouse’s contributions and your own age and income.

A Historical Look at Survivor Benefits in Canada

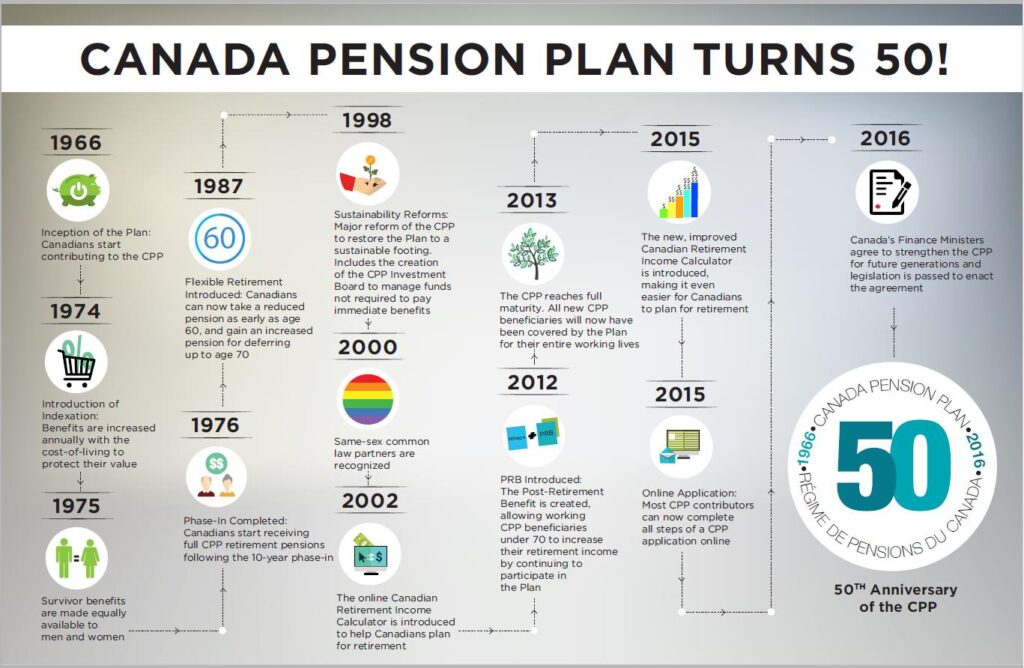

The Canada Pension Plan (CPP) launched in 1966. From the beginning, it included survivor benefits — recognizing that widows, especially women at that time, were at high risk of poverty after losing a spouse.

Key milestones include:

- 1970s: Flat-rate benefits introduced for younger widows.

- 1990s: Expansion to include common-law partners, reflecting social changes.

- 2000s: Adjustments to align with inflation, though critics argue increases have lagged behind living costs.

Today, the survivor pension remains a vital safety net, but many seniors’ organizations say it needs reform to reflect rising housing, food, and healthcare costs.

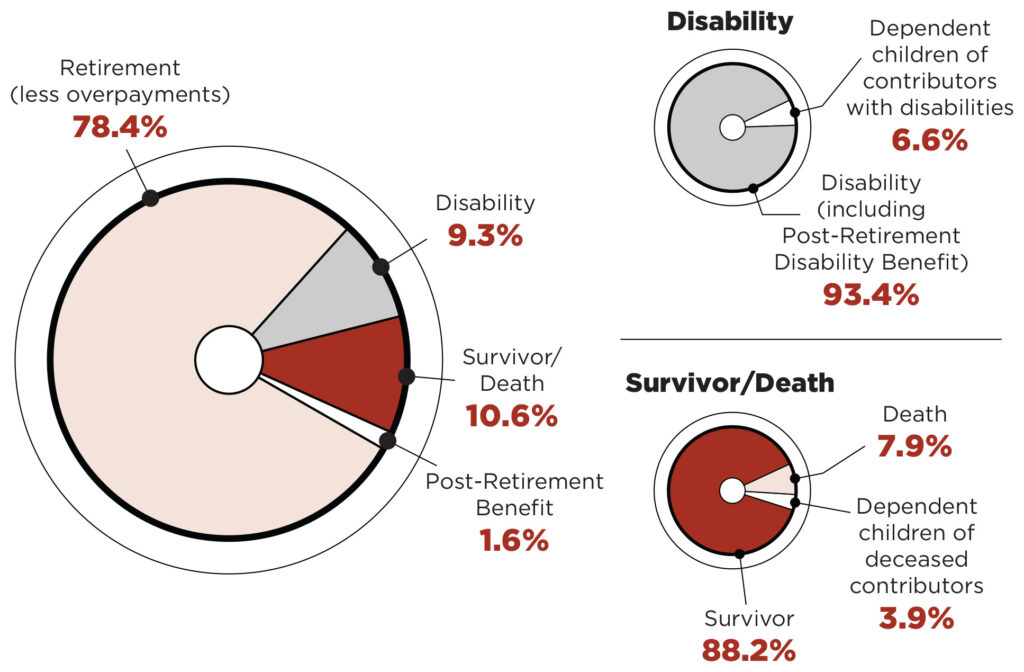

How Survivor Benefits Work in Canada?

The CPP Survivor’s Pension is the cornerstone of widow and widower support. Here’s how it works in detail:

1. If You’re Under Age 65

- Flat-rate benefit: $213.99/month (2024).

- Plus 37.5% of your spouse’s retirement pension.

- Example: If your spouse’s CPP was $1,200/month → you’d get $213.99 + $450 = $663.99/month.

2. If You’re 65 or Older

- You receive 60% of your spouse’s retirement pension, up to the maximum.

- Example: If your spouse received $1,400/month → you’d get $840/month.

3. Maximum Limits

- $818.76/month (65+)

- $707.95/month (under 65)

- Average actual benefit: $387.98/month in 2024.

4. Combining With Your Own Pension

If you’re already drawing CPP retirement or disability, the two benefits are combined — but subject to a maximum. This prevents people from “double dipping.”

Other Widow/Widower Supports in Canada

Beyond the CPP Survivor’s Pension, widows can access other important programs:

CPP Death Benefit

- A one-time, taxable lump sum of up to $2,500.

- Paid to the estate, or to the spouse/next of kin if no estate exists.

Old Age Security (OAS)

- Monthly payment starting at age 65.

- Maximum $713.34/month in 2024.

- Based on residency in Canada (minimum 10 years).

Guaranteed Income Supplement (GIS)

- For low-income seniors receiving OAS.

- Maximum of $1,065.47/month for singles.

- Non-taxable, but income-tested — if you earn too much, it gets reduced.

Allowance for the Survivor

- Transitional benefit for widows aged 60–64 with low income.

- Ends at 65 when OAS begins.

Provincial Supplements

- BC Seniors Supplement: Monthly top-up for OAS/GIS recipients.

- Ontario GAINS: Adds up to $83/month for low-income seniors.

- Quebec residents receive survivor benefits through the Quebec Pension Plan (QPP), similar to CPP.

Real-Life Examples

Case Study 1 – Mary, Age 63

Mary’s husband contributed to CPP for 30 years. He was receiving $1,200/month.

- CPP Survivor Pension = $213.99 + $450 = $663.99.

- Plus GIS (low-income) = $800.

- Total = $1,463.99/month.

Case Study 2 – David, Age 70

David’s wife received $1,500/month from CPP. He also gets OAS.

- Survivor’s Pension = $900.

- His own OAS = $713.

- GIS (reduced, due to income) = $400.

- Total = $2,013/month.

Both examples show why $3,555 is unlikely, though stacking programs can provide stability.

Step-by-Step: How to Apply for the Canada October $3555 Widow Pension Support

Step 1: Collect Required Documents

- Death certificate

- SINs (yours and spouse’s)

- Marriage certificate or proof of common-law status

- Bank account info for direct deposit

Step 2: Complete Application

- Use the ISP1300 form.

- Available online or in paper form.

Step 3: Submit Application

- Online via My Service Canada Account.

- Or by mail to the nearest Service Canada office.

Step 4: Processing

- Usually 6–12 weeks.

- Retroactive payments capped at 12 months.

Tax Implications

- CPP Survivor Pension → taxable income.

- OAS → taxable, subject to clawback if income exceeds ~$90,000/year.

- GIS → not taxable, but income-tested.

For professionals, this means survivor benefits can bump widows into higher tax brackets. For lower-income widows, GIS offers relief but can shrink quickly if additional income comes in.

Comparison: Canada vs. U.S. Survivor Benefits

In the United States, Social Security survivor benefits often equal 100% of the deceased spouse’s benefit if the widow waits until full retirement age.

In Canada, the survivor pension caps at 60%. This is a significant difference, and it means Canadian widows often need to rely more on personal savings or provincial supports.

Common Mistakes to Avoid

- Waiting to apply: Retroactive payments are limited. Delay = lost money.

- Assuming automatic enrollment: Survivor benefits don’t start automatically. You must apply.

- Ignoring provincial benefits: Many seniors overlook extra supplements.

- Not planning for taxes: Some widows are shocked when survivor benefits push them into higher tax brackets.

- Overlooking Allowance for the Survivor: Widows under 65 often don’t realize they can apply.

Canada Wage News: $17.65/Hour Pay Raise; Is Your Province on the List?

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here

Future Outlook for Survivor Benefits

There’s growing advocacy for change. Seniors’ groups have suggested:

- Raising the survivor percentage from 60% to 75%.

- Increasing GIS for widows below the poverty line.

- Improving benefit indexation to keep pace with inflation.

While no official reforms have been passed yet, the issue is gaining traction in federal budget debates.