Canada OAS Payment Increased to $1,615: If you’ve heard the buzz about the Canada Old Age Security (OAS) payment increasing to $1,615 in October 2025, you’re not alone. The claim has spread widely on Facebook, TikTok, and even in local news outlets. Seniors are asking: “Is this for real?” Others are skeptical: “That’s way too high, right?”

The truth is simple: the OAS program itself does not pay $1,615 per month. The official amounts are much lower, but when combined with other programs like CPP (Canada Pension Plan) and GIS (Guaranteed Income Supplement), some retirees may see totals around $1,600. This article breaks it all down with official numbers, historical context, payment dates, practical examples, and strategies to help you or your loved ones plan ahead.

Canada OAS Payment Increased to $1,615

The headline “Canada OAS Payment Increased to $1,615 in October 2025” is misleading if taken literally. The real OAS maximums are $740.09 (ages 65–74) and $814.10 (ages 75+), with the October payment landing on October 29, 2025. The $1,615 figure only makes sense when OAS is combined with CPP and GIS. For families and professionals, the key takeaway is understanding how all these programs work together — and always relying on official sources like Canada.ca for planning.

| Topic | Details |

|---|---|

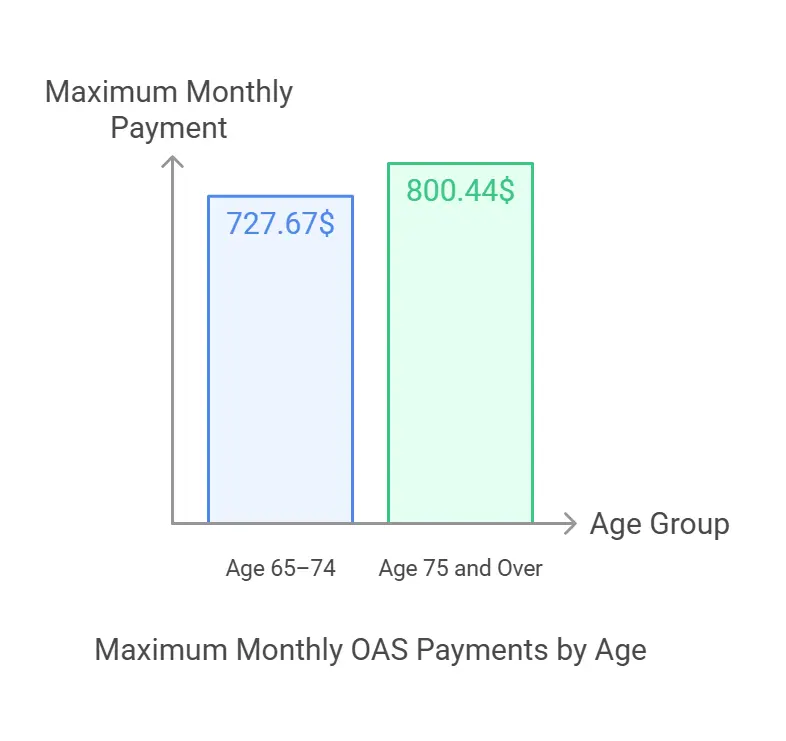

| Official OAS Payment (Oct–Dec 2025) | $740.09 (ages 65–74), $814.10 (ages 75+) |

| Rumored OAS Payment ($1,615) | Misleading — possible OAS + CPP + GIS combined |

| Eligibility | Canadian residents aged 65+, with 10+ years of residence (40 years for full pension) |

| Payment Date (October 2025) | October 29, 2025 |

| Adjustments | Payments rise quarterly with inflation (CPI) |

| Historical Note | Introduced in 1952; expanded and modernized over decades |

| Official Source | Canada.ca OAS Benefits Page |

A Quick Refresher: What Is Old Age Security (OAS)?

Old Age Security is one of the cornerstones of Canada’s retirement system. Introduced in 1952, OAS was created to provide a basic income floor for seniors, ensuring no older adult would live without support.

Key milestones include:

- 1965: Creation of the Canada Pension Plan (CPP), working alongside OAS.

- 1970s: Introduction of the GIS (Guaranteed Income Supplement) for low-income seniors.

- 2012: Government attempted to raise OAS eligibility to age 67, but the decision was reversed.

- 2022: Seniors aged 75+ received a permanent 10% OAS increase.

OAS today is funded from general tax revenues, not individual contributions. That means your work history doesn’t determine OAS eligibility — your years of residence in Canada after age 18 do.

The October 2025 Numbers

According to the Government of Canada, OAS payments for October–December 2025 are:

- Ages 65–74: $740.09 per month

- Ages 75+: $814.10 per month

These numbers are indexed to inflation and change every quarter (January, April, July, October). If consumer prices rise, OAS rises too.

The Canada OAS Payment Increased to $1,615 Rumor Explained

Why are so many headlines saying $1,615? It comes from confusion between programs:

- OAS + GIS: Low-income seniors may receive GIS on top of OAS. GIS can add hundreds more per month, pushing totals into the $1,600+ range.

- OAS + CPP: Most retirees also receive CPP, based on their work history. Combined with OAS, the average can land close to $1,600.

- OAS + Other Allowances: Couples where one spouse is under 65 may also qualify for Allowances.

So yes, $1,615 is possible — but it’s not OAS alone.

Official OAS Payment Dates for 2025

OAS payments arrive on a set schedule. For October 2025, the payment date is:

- October 29, 2025

Other late-2025 dates include:

- November 26, 2025

- December 22, 2025

December is always earlier due to the holidays.

Who Qualifies for OAS?

Not everyone in Canada automatically gets the maximum. Eligibility depends on:

- Age: You must be at least 65.

- Residency: At least 10 years in Canada after age 18 for a partial pension. 40 years for the full pension.

- Income: High-income seniors face clawbacks. In 2025, the threshold starts around $90,997. At $148,065+, OAS is fully clawed back.

If you’ve lived or worked abroad, you may still qualify under international social security agreements.

Applying for Canada OAS Payment Increased to $1,615: Step-by-Step

Most Canadians are auto-enrolled, but not all. If you’re not, here’s how:

- Check your My Service Canada Account (MSCA).

- Apply six months before age 65.

- Submit proof of age and residency.

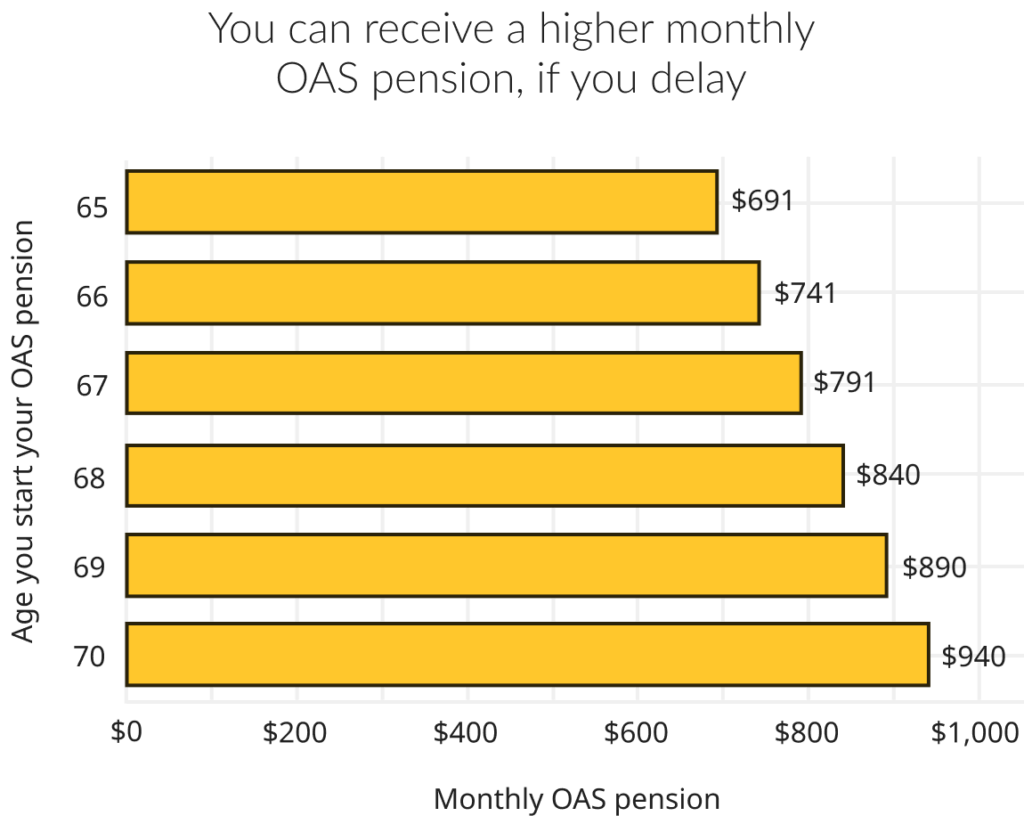

- Choose to defer if you want. Deferring up to age 70 increases your payments by 0.6% per month (7.2% per year).

Pro tip: If you’re still working at 65 and have a good income, deferring can boost your OAS and reduce clawbacks.

Understanding GIS and the Allowance

The Guaranteed Income Supplement (GIS) is designed for low-income seniors. It’s not taxable, unlike OAS, and can add significant monthly income.

- Single seniors: Can receive up to ~$1,065 monthly in GIS (2025 estimate).

- Couples: GIS varies depending on both partners’ income.

The Allowance is available to low-income seniors aged 60–64 whose spouse/partner receives OAS and GIS.

Together, OAS + GIS + Allowances can make the total benefits package much more generous than OAS alone.

The Impact of Inflation

Canada ties OAS adjustments to the Consumer Price Index (CPI). This protects seniors against inflation, ensuring that when the price of groceries or rent goes up, benefits rise too.

For example:

- If CPI jumps 2% in July 2025, OAS rates increase in October 2025.

- This mechanism guarantees purchasing power is somewhat preserved.

By contrast, in the U.S., Social Security benefits adjust annually through a COLA (Cost of Living Adjustment), not quarterly.

OAS vs. U.S. Social Security

| Feature | Canada OAS | U.S. Social Security |

|---|---|---|

| Eligibility | Residency-based | Contribution-based |

| Funding | General tax revenue | Payroll taxes |

| Adjustment | Quarterly (CPI) | Annual COLA |

| Maximum Monthly (2025) | $814.10 (75+) | ~$4,873 (for high earners at age 70) |

Americans retiring in Canada? Thanks to international agreements, you may qualify for both OAS and U.S. Social Security.

Real-Life Example: Martha’s Story

Martha, 72, has lived in Canada all her life. She collects:

- OAS: $740.09

- CPP: $760

- GIS: $115

Total monthly = $1,615.09

That’s how the viral number plays out in real life — but notice how it’s stacked benefits, not OAS alone.

Myths and Misconceptions

- Myth: Everyone will get $1,615 in 2025.

Truth: No. That’s a mix of programs. - Myth: OAS never changes.

Truth: Adjusted every quarter for inflation. - Myth: You can’t get OAS abroad.

Truth: If you’ve lived in Canada for at least 20 years after 18, you can collect outside Canada.

Financial Planning Tips for Professionals & Families

- Stack benefits smartly: Combine OAS, CPP, GIS, and personal savings for stability.

- Avoid clawbacks: If you have high retirement income, spread withdrawals across accounts to stay below thresholds.

- Defer strategically: Waiting until 70 can give you up to 36% more OAS.

- Use RRSPs and TFSAs wisely: These tools can balance taxable vs. non-taxable income.

- Consult a financial planner: Especially useful for cross-border retirees.

The Future of OAS

Canada’s aging population poses challenges. By 2030, one in four Canadians will be over 65. That puts strain on public programs like OAS. Governments face tough questions:

- Will OAS eligibility age rise in the future?

- Can the system remain sustainable as life expectancy grows?

- How will immigration and workforce size affect funding?

While OAS remains secure today, seniors and professionals should plan with flexibility, knowing changes could come down the road.

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility