Canada OAS and CPP Changes: Rumors about major Canada OAS and CPP changes in October 2026 have been making the rounds online — from Facebook groups to TikTok explainers and even coffee shop conversations across the country. People are asking: Are retirement rules about to shift again? Will seniors lose benefits or have to wait longer to collect them? Here’s the truth: as of October 2025, there is no official confirmation of any new or proposed changes to the Old Age Security (OAS) or Canada Pension Plan (CPP) taking effect in October 2026. However, these programs are evolving, and understanding the background helps separate fact from fiction. Let’s break it all down — clearly, simply, and with the latest verified information.

Table of Contents

Canada OAS and CPP Changes

At the end of the day, the story of “Canada OAS and CPP changes in October 2026” is a rumor — not a reality. The current laws and eligibility rules remain stable and well-documented. While it’s possible that future governments could revisit pension reforms, any such change would be announced long in advance through official channels. For now, Canadians can rest easy knowing that both OAS and CPP continue to serve as reliable cornerstones of retirement income.

| Topic | Details |

|---|---|

| Rumored Change Date | October 2026 |

| Status | No official announcement or legislative proposal confirmed by the Government of Canada |

| Programs Involved | Old Age Security (OAS), Canada Pension Plan (CPP) |

| Current OAS Eligibility | Age 65+, with at least 10 years of Canadian residency after age 18 |

| CPP Eligibility | Between ages 60–70, with at least one valid contribution |

| Inflation Adjustment | OAS payments adjust quarterly (January, April, July, October) |

| Last Official Policy Change | CPP Enhancement (2019–2025), OAS increase for seniors aged 75+ (2022) |

| Reliable Source | Canada.ca – OAS Eligibility |

| Professional Resource | Service Canada – Pensions and Benefits |

Understanding OAS and CPP — Canada’s Retirement Backbone

For many Canadians, Old Age Security (OAS) and the Canada Pension Plan (CPP) form the foundation of their retirement income. These programs aren’t the same, but they work together to provide financial stability after years of hard work.

OAS is funded through general tax revenues — meaning you don’t have to contribute directly. It’s available to Canadians aged 65 or older who’ve lived in the country for at least 10 years after age 18. It’s designed as a universal benefit, not based on income, though higher earners may see a reduction through what’s known as the OAS clawback.

CPP, on the other hand, is a contributory program. Every time you earn income in Canada, you and your employer contribute a percentage to CPP. When you retire, you receive monthly payments based on how much and how long you contributed. It’s your personal retirement savings account — government-managed, inflation-protected, and backed by the CPP Investment Board.

Where Did the “Canada OAS and CPP Changes” Rumor Come From?

Let’s be real — the internet loves a good scare story, especially about money and government programs. Over the past few months, several blog posts and social videos have claimed that OAS and CPP eligibility ages are set to rise from 65 to 67 by October 2026. Others say the government will “tighten access” to benefits for higher-income retirees.

Here’s the thing: none of these claims are supported by any official documentation, press release, or legislative proposal from the Government of Canada.

The confusion may stem from two real but unrelated developments:

- The 2012 proposal by the Harper government to raise the OAS eligibility age from 65 to 67, which was later reversed by Prime Minister Justin Trudeau in 2016.

- The CPP Enhancement, launched in 2019, which gradually increases contributions and future benefits. Some blogs misinterpret this as an “age change,” but it’s about contribution rates and payout formulas, not eligibility.

In short, the “October 2026” date appears to have originated from misread articles or unofficial financial blogs, not from Service Canada or Parliament.

What’s Actually Changing — and What’s Not

Let’s separate facts from fiction.

What is true and ongoing:

- Quarterly OAS adjustments for inflation (January, April, July, October).

- CPP Enhancement rollout: continues through 2025 to boost future payouts.

- OAS increase for those aged 75+: a permanent 10% boost since July 2022.

- Digital modernization: Service Canada continues expanding online tools for applications and statements.

What’s not confirmed:

- Any increase to OAS or CPP eligibility age.

- Any benefit reductions tied to income thresholds beyond existing clawback rules.

- Any legislated changes taking effect in October 2026.

How OAS and CPP Work Together?

A common question is: Do I get both OAS and CPP?

Yes — most retirees receive both.

For example, a Canadian who worked full-time and paid into CPP for 35+ years might receive about $1,300/month in CPP and another $707/month in OAS as of mid-2025. These amounts vary depending on contributions, age at retirement, and inflation adjustments.

Together, they provide a steady, predictable base income for retirees. However, financial planners recommend supplementing with Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs) to maintain lifestyle comfort, especially in high-cost regions.

Step-by-Step Guide: How to Check Your Canada OAS and CPP Changes Eligibility

Planning ahead is key — here’s how to check your status and maximize your benefits.

Step 1: Confirm your age and residency

You must be at least 65 years old and have lived in Canada for 10 years after age 18 to qualify for OAS.

If you live abroad, you’ll need 20 years of residency.

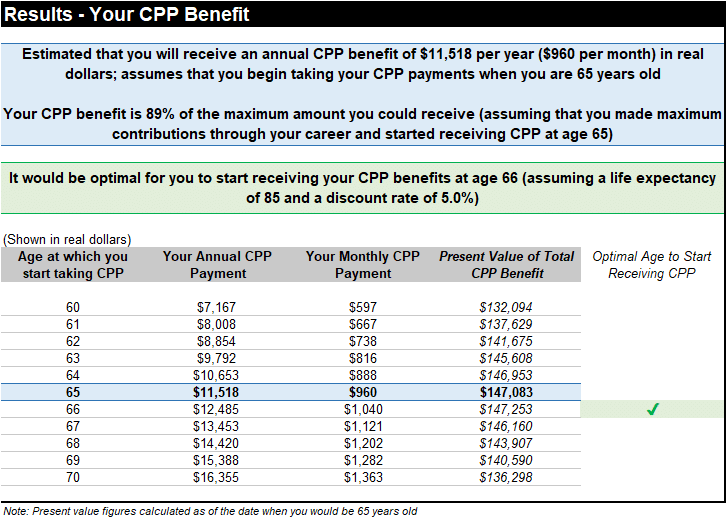

Step 2: Review your CPP contributions

Sign in to My Service Canada Account.

Here, you can view your CPP Statement of Contributions, see how much you’ve paid, and estimate your monthly retirement income.

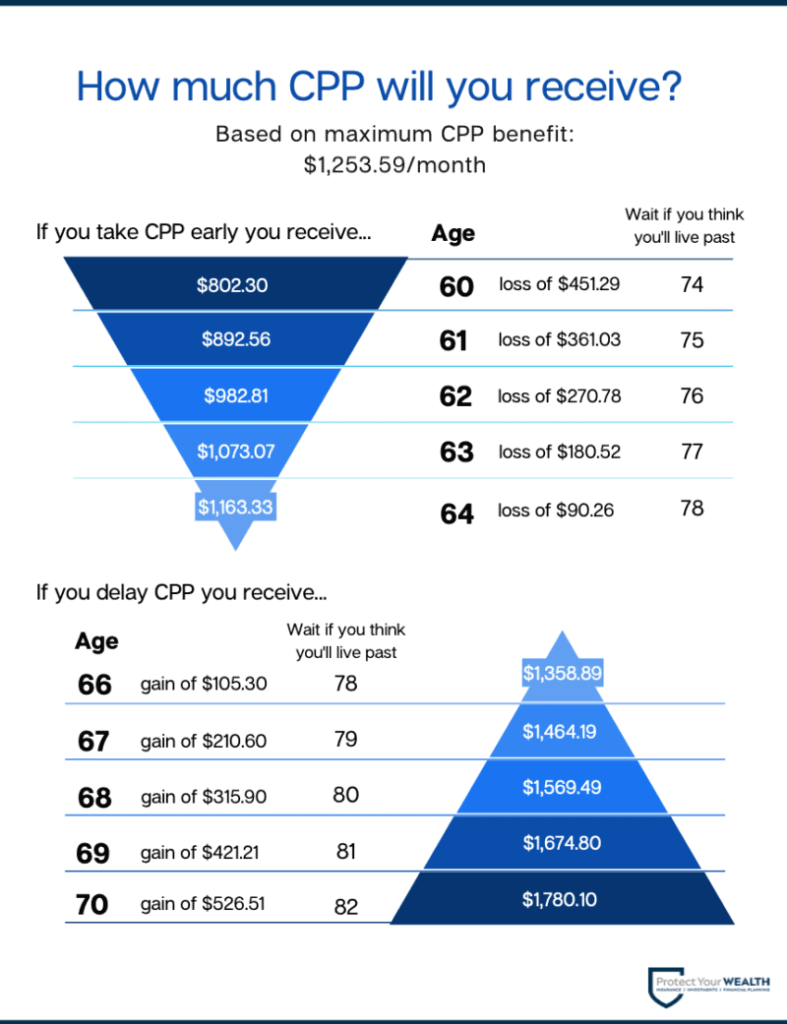

Step 3: Decide when to start your benefits

- OAS can be deferred up to age 70 for a higher monthly payment.

- CPP can start as early as age 60 or as late as 70.

- Early start = smaller monthly checks.

- Delayed start = up to 42% higher payments at age 70.

Step 4: Apply online

Use Service Canada’s online portal. Applications are typically processed in under eight weeks if documentation is complete.

Example: Mary and John’s Retirement Decisions

Mary, 66, delayed her OAS for a year. That decision bumped her monthly pension by 7.2%, a solid return for just waiting. She also postponed CPP until 67 to maximize the benefit, since she had other income sources.

John, 60, chose to start CPP early. He gets smaller checks (roughly 36% less than if he waited until 65), but he enjoys extra income now while running his part-time consulting business.

Both made smart choices — because they planned based on personal needs, not rumors.

Financial Planning Tips for 2025–2026

- Ignore panic posts — check facts on official sites like Canada.ca.

- Understand the OAS clawback: If your net income exceeds $90,997 (2025), your OAS payment will gradually be reduced.

- Plan for taxes: Both OAS and CPP count as taxable income.

- Consider delaying benefits: Waiting a few years can significantly increase lifetime earnings.

- Work with a certified financial planner to balance RRSP withdrawals, CPP timing, and taxes efficiently.

- Stay informed: Subscribe to Service Canada updates for reliable announcements.

Why Canada OAS and CPP Changes Rumors Keep Circulating?

The topic of pensions always sparks strong emotions. After all, retirement security affects every Canadian. When social media posts claim that “benefits are being cut” or “ages are increasing,” they spread quickly — especially when paired with alarming headlines.

But in reality, pension changes take years of public consultation, debate, and formal legislation. Any major shift, like raising the retirement age, would appear first in government budgets or bills, followed by media coverage on outlets like CBC, Global News, and Financial Post.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria

Canada $2988 OAS Per Month for these Seniors: Check Eligibility and Payment Date