Canada Next Extra GST Payment: If you’re wondering about the Canada Next Extra GST Payment in 2026, you’re in the right spot. The GST/HST Credit is a critical financial support system designed to ease the tax burden on low- and modest-income Canadians. This article will give you the lowdown on who’s eligible, how much you can expect, when payments happen, and how this benefits you or your family—with the kind of clear, friendly talk that makes it easy for anyone, even a 10-year-old, to get it.

Table of Contents

Canada Next Extra GST Payment

The Canada GST/HST Credit is a handy, automated financial boost designed to lighten the load for Canadian families feeling the pinch of sales taxes on everyday goods. It’s simple: file your taxes, stay eligible, and watch for those quarterly payments that can add up to hundreds of dollars annually. For 2026, expect the same trusted support with payments starting in January and continuing through the year. Use this credit smartly to manage monthly expenses without fuss, and keep your tax files updated so you never miss a dime from the government’s helping hand.

| Category | Details |

|---|---|

| Next Payment Date 2026 | January 5, 2026 |

| Annual Maximum Credit Amounts | $533 for single adults, $698 for couples, $184 per child under 19 |

| Payment Frequency | Quarterly (January, April, July, October) |

| Eligibility Requirements | Canadian resident, file 2024 tax return, age 19+ (or under 19 with specific conditions) |

| Official Info & Application | Automatic eligibility via CRA tax return; no separate application needed |

| Purpose | Helps offset GST/HST paid on daily purchases |

| Official Website | Canada Revenue Agency – GST/HST Credit |

What Is the Canada GST/HST Credit?

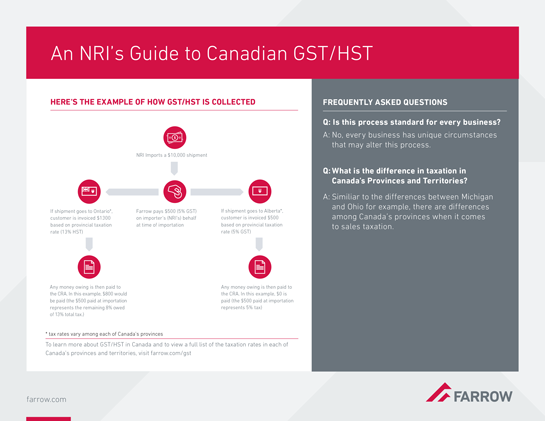

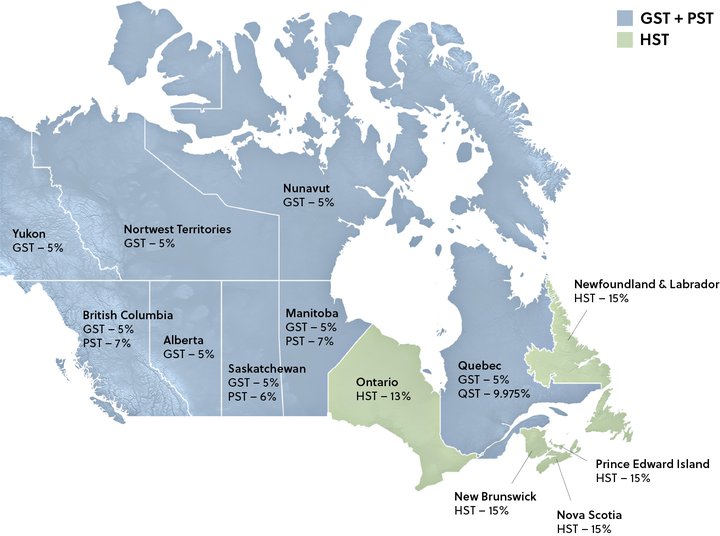

The Goods and Services Tax (GST) is a 5% federal tax added to most goods and services in Canada. Some provinces combine their provincial sales tax with this into the Harmonized Sales Tax (HST), which can be up to 15%. This tax is everywhere, hitting your everyday purchases. But the government knows this can hit the wallet of many families hard, especially those bringing in less cash.

So, here’s where the GST/HST Credit steps in—it refunds part of the GST/HST you pay throughout the year. Think of it like the government saying, “Hey, we got you,” by sending some of that money back in quarterly payments. It’s tax-free and designed to help balance the cost of living.

Quick History and Context

The GST was introduced back in 1991, replacing the older federal sales tax system. It was a big shakeup in how Canadians pay tax on goods and services. The GST/HST Credit program was created as a way to help lower-income Canadians cope with this new system’s costs, making it a social safety net that has helped millions over the past three decades.

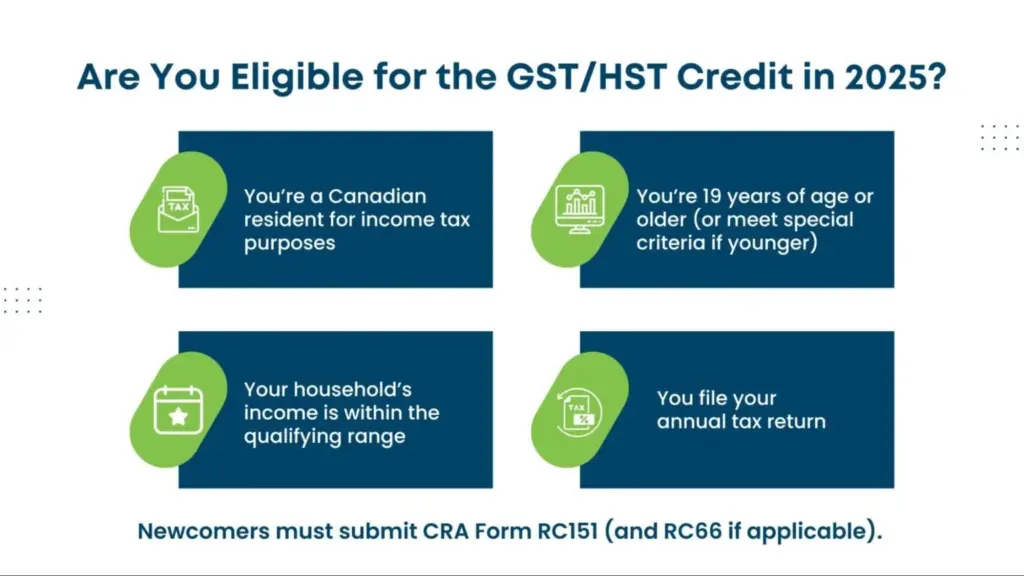

How to Know If You’re Eligible for the Canada Next Extra GST Payment?

No rocket science here. The Canada Revenue Agency (CRA) automatically checks your eligibility when you file your income tax return. Here’s the deal in simple terms:

- You gotta be a resident of Canada for tax purposes.

- Be at least 19 years old OR if you’re under 19, you must live with a spouse, common-law partner, or be a parent living with a child.

- File your income tax return for the previous year on time (for the 2026 GST payment, that means your 2024 taxes).

- Your family income should be below CRA’s thresholds—which change often to keep up with inflation.

No extra forms to fill out, no complicated sign-ups. Just do your taxes, and CRA will handle the rest.

Breakdown of How Much You Can Get?

Here’s the scoop on the extra GST amounts you can expect for the 2025-2026 period. Thanks to inflation adjustments, these amounts went up by 2.7% starting July 2025:

- Single adult: Up to $533 per year.

- Married or common-law couple: Up to $698 combined.

- Each child under 19: Adds $184 annually for the family.

The credit is split into quarterly payments, so you’re likely to see your cash come in four times a year—in January, April, July, and October, starting with the October 2025 payment and continuing through 2026.

Example Scenario:

Let’s say you’re a single parent with two kids. You could get:

- $533 for you

- $184 × 2 for your kids = $368

- Total annual GST credit = $901, broken down to about $225 per quarter.

When Do the Payments Happen? Mark Your Calendar!

CRA sends out these payments four times a year. For 2025 and 2026, the dates are typically:

- January 5

- April 5

- July 5

- October 5

For example, the next GST payment is scheduled for January 5, 2026. If you’re signed up for direct deposit, the cash usually hits your bank account on these dates. Cheques take longer due to mail time.

Who Benefits Most? Demographic Breakdown

- Seniors and retirees: Many living on fixed incomes rely on this credit to cover everyday essentials.

- Single parents: Extra help with childcare and household costs.

- Students working part-time or starting out: The credit provides a financial boost.

- Newcomers and immigrants: After meeting residency requirements and income thresholds, they benefit too.

Basically, if you’re feeling the pinch from sales tax on every buy, this credit has your back.

Common Misconceptions About GST Credit

- Misconception: “I gotta apply separately.”

False. The tax return filing is your application. - Misconception: “It’s taxable income.”

Wrong. It is completely tax-free. - Misconception: “I get it even if I don’t file taxes.”

Nope. Filing is mandatory for eligibility.

Practical Advice: How to Make the Most of Your Canada Next Extra GST Payment

Here are a few tips to help you out:

1. File Your Taxes on Time

Your GST credit depends on your latest tax return. Make sure to send it in before the deadline!

2. Keep Your Address and Direct Deposit Info Updated

If the CRA doesn’t have your current address or banking information, your payment can be delayed.

3. Use the Credit Wisely

This money can help cover groceries, utilities, and everyday expenses. Treat it like a paycheck boost each quarter.

4. Tracking Your Payments

You can check your GST credit balance and payment schedule anytime on the CRA’s official website or by logging into your My Account.

A Simple Guide: Step-by-Step on Canada Next Extra GST Payment

Step 1: Confirm Residency and Tax Filing

CRA verifies your status based on your tax return. File even if your income is low or you don’t owe taxes.

Step 2: Let CRA Calculate

They calculate how much credit you qualify for, based on your income, marital status, and children.

Step 3: Receive Payments Quarterly

Payments get disbursed four times a year—automatic and hassle-free.

Step 4: Repeat Each Year

File yearly taxes to keep receiving the payments.

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

Canada CRA $496 GST/HST Credit for October 2025: Check Payment Dates & Eligibility Criteria

Canada CRA Payment Dates Coming in November 2025, Official Schedule for Various Federal Benefits