Canada GIS Allowance: When it comes to financial security in retirement, the Guaranteed Income Supplement (GIS) allowance is a program that low-income Canadian seniors count on every single month. For October 2025, seniors and their families are already asking: When will the payment arrive? What are the eligibility rules? What changes should I expect? This article breaks it all down in plain, easy-to-understand language. We’ll go into payment schedules, eligibility requirements, upcoming rule changes, and step-by-step application guidance. You’ll also get real-life examples, expert advice, and insider tips on how to get the most from this program. Whether you’re a Canadian retiree, a family member supporting aging parents, or even a U.S. reader comparing this to Social Security, this guide will give you the tools to plan confidently.

Canada GIS Allowance

The Canada GIS Allowance for October 2025 will be paid on October 29, 2025, offering crucial support for low-income seniors receiving OAS. This program is income-tested, adjusted quarterly, and supplemented in some provinces with extra payments. With inflation squeezing household budgets, GIS ensures seniors can live with dignity. But with new rule changes coming in October 2025 for sponsored immigrants, staying informed has never been more important. File taxes, sign up for direct deposit, and monitor your eligibility to make the most of GIS.

| Aspect | Details |

|---|---|

| Expected October 2025 Payment Date | October 29, 2025 (direct deposit; cheques may take longer) |

| Program Type | Guaranteed Income Supplement (non-taxable monthly benefit for low-income seniors receiving OAS) |

| Eligibility | Must receive Old Age Security (OAS), meet income limits, be a Canadian citizen/resident |

| Special Allowance | For ages 60–64 if spouse/common-law partner receives GIS, or for survivors |

| Upcoming Change (Oct 1, 2025) | Sponsored immigrants will no longer qualify for GIS/Allowance |

| Income Tested? | Yes, recalculated annually based on tax return |

| Official Source | Government of Canada – GIS Information |

What is the Canada GIS Allowance?

The Guaranteed Income Supplement (GIS) is a non-taxable monthly payment for seniors in Canada who are living on limited income. It’s an add-on to the Old Age Security (OAS) pension, which is available to most seniors once they turn 65 and meet residency requirements.

While OAS gives a flat-rate base amount (adjusted quarterly for inflation), GIS is designed specifically to support seniors who don’t have much in the way of savings, pensions, or investments. It’s part of Canada’s social safety net aimed at reducing senior poverty.

- The Allowance: For people aged 60–64 whose spouse or partner receives GIS. It’s a way to bridge income until both partners reach 65.

- The Allowance for the Survivor: For widows/widowers aged 60–64 with limited income, giving them support until they can apply for OAS and GIS themselves.

Why it matters: Without GIS, many seniors—especially women who spent years as caregivers or immigrants without long work histories—would be forced below the poverty line.

Why GIS Matters in 2025?

In today’s economy, GIS is more than just a nice-to-have; it’s often the difference between living with dignity or facing hardship.

Inflation and Housing Costs

- In 2024, food prices rose by an average of 5.4%, while rents in major Canadian cities jumped over 8% year-on-year.

- A senior living in Toronto or Vancouver often spends 50–60% of their monthly income just on rent.

For a single senior receiving around $1,300–$1,400 per month in combined OAS and GIS, that doesn’t leave much for food, medications, or transportation.

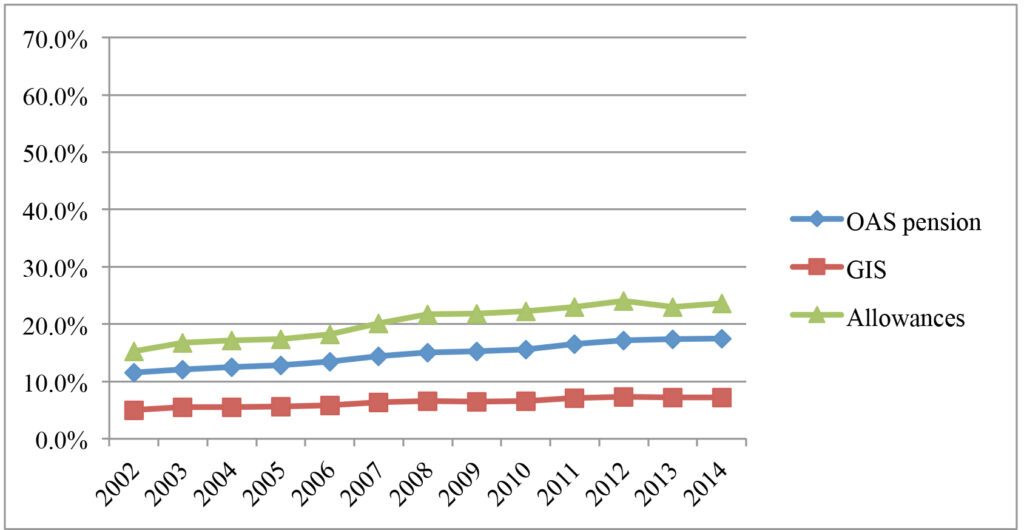

Poverty Reduction

According to Statistics Canada, the introduction of GIS in 1967 helped cut senior poverty rates in half over the following two decades. Today, it continues to support more than 2.1 million seniors across Canada.

Big picture: With an aging population (25% of Canadians will be 65+ by 2030), GIS is only becoming more critical.

October 2025 GIS Payment Date

Mark your calendars: the October 2025 GIS payment date is Wednesday, October 29, 2025.

- Direct deposit recipients: Expect funds on that exact date.

- Cheque recipients: Add several business days for mail delivery.

2025 GIS Payment Dates

- July 29, 2025

- August 27, 2025

- September 25, 2025

- October 29, 2025

- November 26, 2025

- December 22, 2025

Pro tip: Always sign up for direct deposit. It’s free, safe, and ensures you never miss a payment—even during postal strikes or bad weather.

Eligibility Rules for Canada GIS Allowance in 2025

The rules aren’t complicated, but you do need to tick a few boxes.

Basic Requirements

- Must be 65 or older (unless applying for the Allowance).

- Must be receiving Old Age Security (OAS).

- Must reside in Canada and be a citizen or legal resident.

- Must file an annual tax return (this is how the government calculates your GIS).

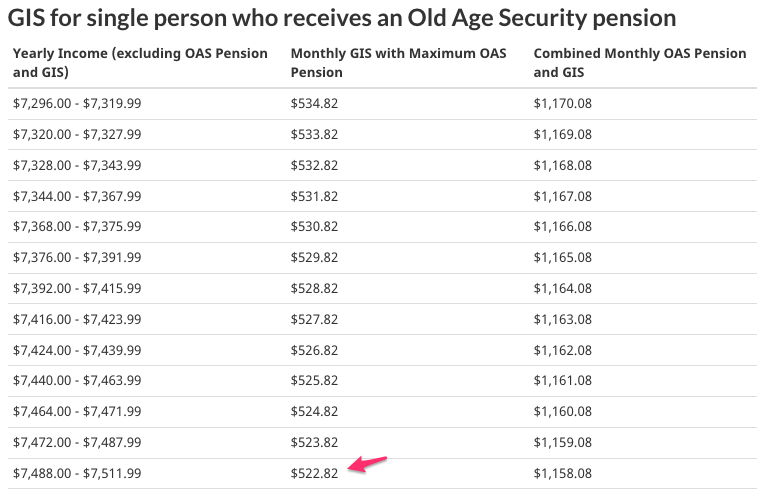

Income Limits

GIS is income-tested. That means your household income (excluding OAS) determines how much you get.

- Single senior: Income must be below about $21,624 CAD.

- Couples: Thresholds vary depending on whether your spouse receives OAS or GIS.

Big Rule Change Starting October 1, 2025

Here’s a significant update: As of October 1, 2025, sponsored immigrants under sponsorship agreements will no longer qualify for GIS, the Allowance, or the Allowance for the Survivor.

This change could impact thousands of families, especially newcomers who depended on GIS as part of their long-term retirement plan. If you or your parents are in this group, it’s vital to start exploring alternative supports—like provincial benefits or family financial planning.

How Much Can You Get in 2025?

As of mid-2025:

- Single seniors: Up to $1,072.93 CAD/month in GIS (in addition to OAS).

- Couples: About $646.43 CAD/month each, depending on household income.

Note: Payments are adjusted quarterly to reflect inflation. That means October 2025 payments could be slightly higher than in July.

Provincial and Territorial Top-Ups

On top of GIS, some provinces and territories offer extra monthly supplements for low-income seniors:

- Ontario: GAINS (Guaranteed Annual Income System) pays up to $83/month.

- British Columbia: Senior’s Supplement adds about $49/month.

- Quebec: Low-income supplements administered through Retraite Québec.

These top-ups can make a meaningful difference—especially when stacked with GIS.

Step-by-Step: How to Apply for Canada GIS Allowance

- Confirm eligibility using the Service Canada tool.

- File your taxes annually—this is how Service Canada verifies income.

- Apply online via My Service Canada Account.

- Apply by mail: Complete and submit form ISP-3025.

- Track your application: Online or by calling Service Canada.

Pro tip: Many seniors are auto-enrolled if they receive OAS, but not always. Double-check to make sure.

How to Check Your GIS Status?

- Log in to My Service Canada Account.

- Select OAS and GIS Information.

- Review your current payment amount and the next payment date.

- Update personal details like address, marital status, or income.

Case Studies

- Single senior (John, 68): With $10,000 in CPP and no private pension, John receives the maximum GIS, giving him about $2,000/month combined with OAS.

- Couple (Rose and Ahmed, both 70): With $28,000 combined income, their GIS is reduced but still provides a helpful top-up.

- Survivor (Maria, 62): As a widow with $14,000 income, she qualifies for the Allowance for the Survivor until she turns 65.

These examples highlight how income levels affect eligibility and payment amounts.

What Happens If…

- You move abroad? GIS stops—you must live in Canada.

- You remarry or partner up? Your income is recalculated as a household.

- Your spouse dies? You may qualify for the Survivor’s Allowance.

- You earn extra money? Your GIS will be reduced in the next recalculation.

Tips for Families Helping Seniors

- Collect all documents early: Tax slips, marriage or death certificates.

- Encourage direct deposit: Faster and safer than cheques.

- Review tax filings: Even “simple” mistakes can affect GIS.

- Stay updated: Income changes, moving provinces, or relationship status shifts can all impact eligibility.

Expert Outlook: The Future of GIS

With an aging population and rising living costs, GIS is under the spotlight. Experts predict:

- More seniors will qualify as personal savings don’t keep up with inflation.

- Pressure to increase GIS payments will grow, especially in expensive cities.

- Policy debates may lead to higher income thresholds or integration with provincial supplements to simplify access.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date