Canada Disability Bill 2025: When the Canadian government first announced the Canada Disability Bill 2025, it wasn’t just another policy headline. It was a promise — a long-awaited lifeline for millions of Canadians living with disabilities who’ve been juggling sky-high costs and limited support for decades. Officially known as Bill C-22, this legislation creates the Canada Disability Benefit (CDB) — the first national income supplement designed specifically for working-age Canadians with disabilities. It’s meant to fill the cracks between provincial assistance and the real cost of living. In this article, we’ll walk through every corner of the program: who qualifies, how much money you’ll receive, how to apply, key payment dates, and what pitfalls to avoid. Whether you’re an applicant, a social worker, or a financial advisor, this is your go-to 2025 guide.

Table of Contents

Canada Disability Bill 2025

The Canada Disability Bill 2025 (Bill C-22) is more than a policy — it’s a commitment to fairness. For the first time, Canada has a federal program focused on working-age adults with disabilities. Sure, the benefit is modest at C$ 200 a month, but it’s a crucial first step toward economic inclusion. If you’re eligible, take action now — get your DTC ready, file your taxes, and apply as soon as applications open on June 20, 2025. As one advocate put it, “For years we were told to wait. Now the wait is finally over.”

| Feature | Details |

|---|---|

| Program Name | Canada Disability Benefit (CDB) |

| Legislation | Bill C-22 (Canada Disability Benefit Act) |

| Royal Assent | June 22, 2023 |

| Regulations Effective | May 15, 2025 |

| Applications Open | June 20, 2025 |

| First Payments | July 2025 |

| Maximum Benefit | C$ 2,400 per year (C$ 200 per month) |

| Eligibility | Canadians aged 18–64 with Disability Tax Credit (DTC) approval |

| Residency | Must live in Canada; citizens, PRs, or protected persons eligible |

| Back Payments | Up to 24 months (after June 2025 only) |

| Official Website | Government of Canada – CDB Program |

Canada Disability Bill 2025

Bill C-22 is officially titled An Act to reduce poverty and to support the financial security of persons with disabilities by establishing the Canada Disability Benefit.

It passed Parliament in 2023 after years of advocacy from disability-rights groups. The law set the framework, but the real engine — the regulations — came into force in May 2025, allowing the program to launch.

At its heart, the CDB aims to reduce poverty and boost financial independence among disabled Canadians aged 18 to 64. It acts as a federal top-up layered over provincial programs such as ODSP (Ontario), AISH (Alberta), and SAID (Saskatchewan).

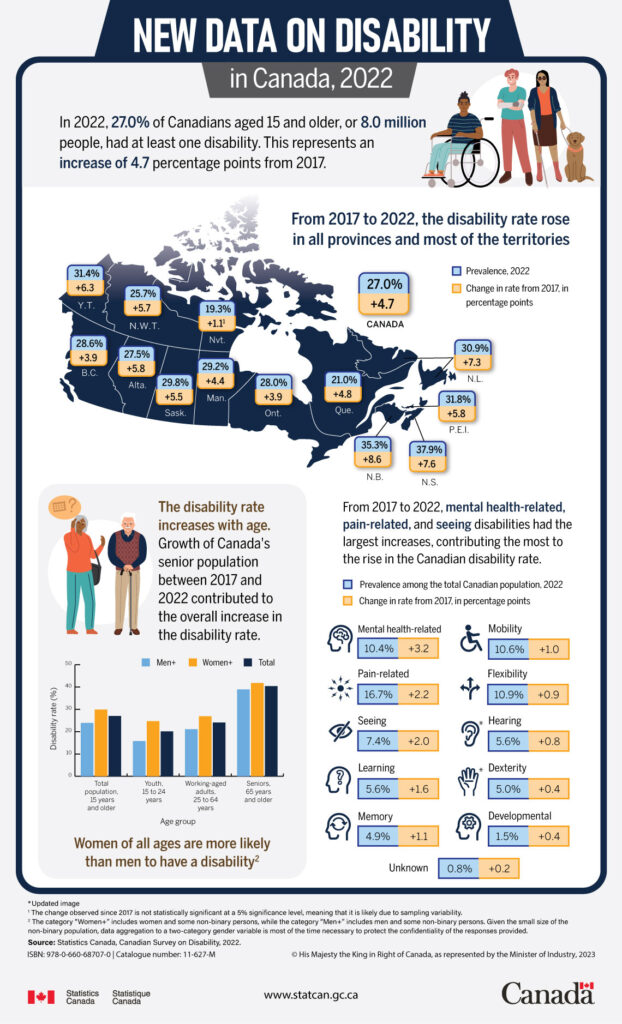

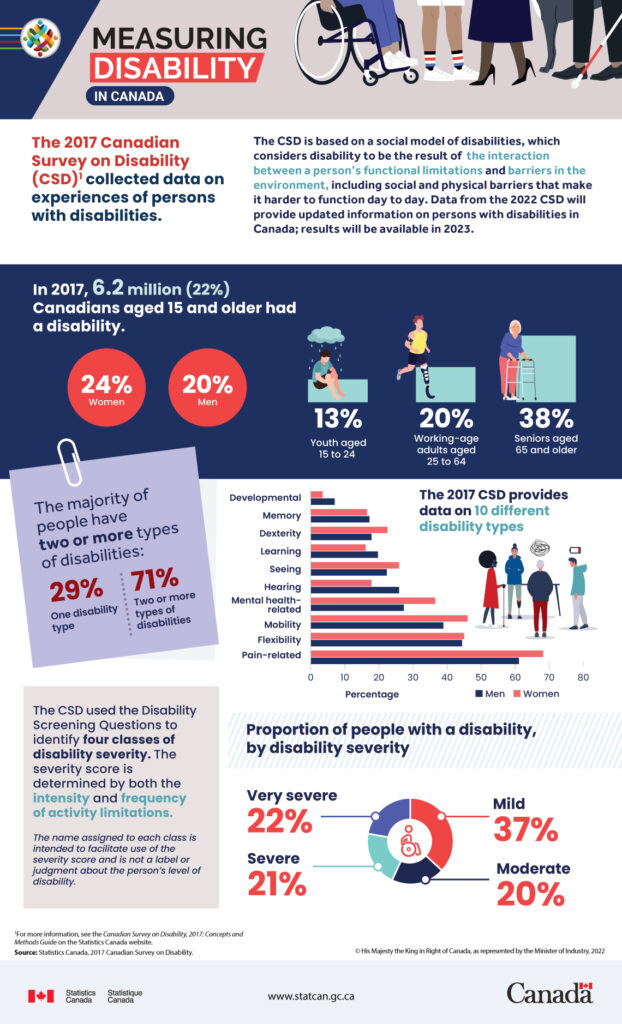

According to Statistics Canada, roughly 6.2 million Canadians — nearly one in four people — live with a disability, and about half of them face persistent poverty. That’s why this bill is often called a “game-changer.”

How Much You Can Receive?

The maximum benefit is C$ 2,400 per year, or C$ 200 per month.

It’s non-taxable, so recipients keep the full amount.

The amount you actually receive depends on your income level and household status. The benefit gradually decreases once you exceed a certain income threshold, much like the federal GST credit.

Example scenarios:

- A single adult with little or no income → C$ 200/month

- A married couple with shared low income → about C$ 150 each

- A working individual earning C$ 25 000/year → partial benefit (C$ 80–100)

The government will use your most recent tax return to calculate your amount. Filing your taxes is mandatory, even if your income is zero.

Who Qualifies For Canada Disability Bill 2025?

Eligibility boils down to six main rules:

- Age: Between 18 and 64 (you remain eligible the month you turn 65).

- Disability Tax Credit (DTC): You must hold an approved DTC certificate.

- Residency: You must be a Canadian resident under the Income Tax Act and have legal status.

- Tax Filing: Both you and your partner (if any) must file annual tax returns.

- Incarceration: Not serving a sentence of two years or more in a federal penitentiary.

- Not Under Suspension: If your benefit was suspended for fraud or non-compliance, you won’t receive payments until reinstated.

Pro Tip: Start your DTC application early — it can take 90 days or more. You can apply through the CRA portal with your doctor’s medical form.

Application Timeline and Due Dates

The application window opens June 20, 2025 through Service Canada.

To get the first wave of payments in July 2025, your application must be submitted and approved by June 30, 2025.

Regular payments arrive on the third Thursday of each month, similar to Canada Child Benefit or Old Age Security.

The first month of eligibility is June 2025, and you can receive up to 24 months of back payments for months after that date.

Timeline Overview

| Event | Date |

|---|---|

| Regulations Enforced | May 15 2025 |

| Application Portal Opens | June 20 2025 |

| Deadline for First Wave Applicants | June 30 2025 |

| First Payments Issued | July 2025 |

| Regular Monthly Payments | Third Thursday of each month |

| Back Pay Available From | June 2025 onward |

How to Apply for Canada Disability Bill 2025: Step by Step

- Confirm your DTC approval via the CRA.

- File your 2024 tax return early.

- Apply online at Service Canada (starting June 20).

- Attach supporting documents (DTC number, ID, income info).

- Track your application status through your Service Canada account.

- Receive approval notice and start payments.

Processing can take 6–8 weeks. Keep your contact and bank information up to date to avoid delays.

Coordination with Provincial Programs

Each province runs its own disability program. While the CDB is federal, there’s a real concern that provinces could reduce local benefits once federal money arrives — known as a “clawback.”

The federal government has publicly stated its intent to avoid clawbacks, negotiating agreements so provincial benefits remain untouched.

Until those agreements are finalized, check with your provincial office (ODSP, AISH, etc.) for specific rules.

Comparison to Other Programs

| Program | Jurisdiction | Average Monthly Payment | Taxable? |

|---|---|---|---|

| Canada Disability Benefit (CDB) | Federal | C$ 200 | No |

| ODSP (Ontario) | Provincial | C$ 1 308 | No |

| AISH (Alberta) | Provincial | C$ 1 787 | No |

| U.S. SSI (Supplemental Security Income) | Federal (U.S.) | US $ 943 (≈ C$ 1 270) | Yes |

The CDB is meant as a top-up, not a replacement. It’s designed to lift recipients closer to Canada’s low-income threshold (about C$ 27 000 for a single adult in 2025).

Real-World Impact and Public Reaction

Advocacy groups like Inclusion Canada and Disability Without Poverty celebrate the program as “historic.” They note that for the first time, disabled adults aged 18–64 will have a national income floor like seniors (OAS/GIS).

However, they also warn that C$ 200 a month is not enough to escape poverty. Many advocates are pushing for an increase to at least C$ 500 per month indexed to inflation.

Financial experts agree it’s a start but say the program’s success depends on how smoothly it’s administered. As disability advocate Rabia Khedr put it:

“The CDB finally acknowledges the systemic barriers we face. But now, we must make sure no province uses it as an excuse to cut supports.”

Benefits for Professionals and Employers

For employers and HR professionals, the CDB means a more stable workforce. With federal top-ups, employees with disabilities can work part-time without losing all benefits.

It also aligns with Canada’s Accessibility Strategy under the Accessible Canada Act. That means businesses may see funding and tax credits expand as Ottawa builds an inclusive economy.

Challenges and Concerns

Every program has growing pains. Here’s what to expect:

- Clawbacks: Still unclear in some provinces.

- Low Payout: C$ 200 a month may not close the poverty gap.

- Delays: DTC and application backlogs could slow payment.

- Accessibility: Advocates want simpler forms for people with visual or cognitive disabilities.

- Awareness: Many eligible people may not know about the benefit until after launch.

Practical Tips for Applicants

- Get your DTC approved first. No DTC = no CDB.

- File your taxes on time every year. It proves eligibility.

- Set up direct deposit with CRA or Service Canada.

- Keep your documents organized — medical certificates, tax forms, CRA letters.

- Use official websites only — avoid third-party sites asking for fees.

- Stay connected with community organizations like Disability Alliance BC for advocacy support.

Canada $15,630 Disability Tax Credit in 2025 – How to get it? Check Claim Process

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Broader Impact on Canadian Society

Beyond financial relief, the Canada Disability Benefit reflects a culture shift. It acknowledges that disability rights are economic rights. Reducing poverty frees people to work, study, and participate in their communities without fear of losing basic supports. Economists at Carleton University estimate that lifting Canadians with disabilities above the poverty line could add over C$ 3 billion annually to the economy through spending and tax revenues. That’s a win for everyone.