Canada CRA Parental Benefits Payment: If you’re getting ready to welcome a new baby or have recently adopted a child in Canada, there’s some great news for you. The Canada CRA Parental Benefits Payment in November 2025 promises critical financial support to ease your journey into parenthood or adoption. This comprehensive guide will help you understand everything about these benefits—from eligibility criteria to payment amounts, application procedures, and smart tips to maximize your support. This article is crafted to be friendly and clear enough for a beginner but detailed enough for professionals seeking expert insights. Let’s get it started!

Table of Contents

Canada CRA Parental Benefits Payment

Navigating the Canada CRA Parental Benefits Payment in November 2025 ensures you don’t miss out on financial support critical for welcoming a child into your family. With detailed eligibility rules, generous payment options, accessible application methods, and new enhancements, these benefits stand as a reliable lifeline to help parents focus on what truly matters: their children. Plan ahead, apply early, maintain organized records, and stay informed to maximize this support. Parenthood is already challenging; CRA parental benefits aim to make it a bit easier.

| Aspect | Details |

|---|---|

| Maternity Benefits | Up to 15 weeks; pays 55% of average earnings, max $695/week |

| Parental Benefits | Standard (up to 40 weeks shared, max 35 weeks per parent); Extended (up to 69 weeks shared, max 61 weeks per parent) |

| Payment Dates | November 20, 2025 for monthly child benefits; EI maternity and parental benefits paid weekly post-approval |

| Canada Child Benefit (CCB) | Tax-free monthly payments, up to $7,997 per year per child under 6, and $6,748 for children aged 6-17 |

| Eligibility | Minimum 600 insured hours for EI benefits; residency and caregiving criteria for CCB |

| Application Method | Online via CRA My Account or Automated Benefits Application; paper application via Form RC66 |

| Official Website | Canada Revenue Agency – Parental Benefits & CCB |

What Are Canada CRA Parental Benefits Payment?

The CRA offers Employment Insurance (EI) maternity and parental benefits to support parents who are temporarily out of the workforce due to pregnancy, childbirth, or caring for a newborn or newly adopted child. These benefits include:

- Maternity Benefits: Specifically for birth mothers, up to 15 weeks.

- Parental Benefits: To be shared between parents, allowing each to take time off for child care.

- Canada Child Benefit (CCB): A separate monthly tax-free payment to assist with ongoing child-rearing costs.

These benefits help families manage the financial pressures of those crucial first months and years when maternity and parental care demands are highest.

Who Is Eligible?

Employment Insurance Maternity and Parental Benefits

- Must have worked a minimum of 600 insured hours in the last 52 weeks or since the last claim.

- Maternity benefits apply to biological birth mothers, including surrogate mothers, who are unable to work due to pregnancy and childbirth.

- Parental benefits apply to parents caring for a newborn or recently adopted child, including adoptive parents.

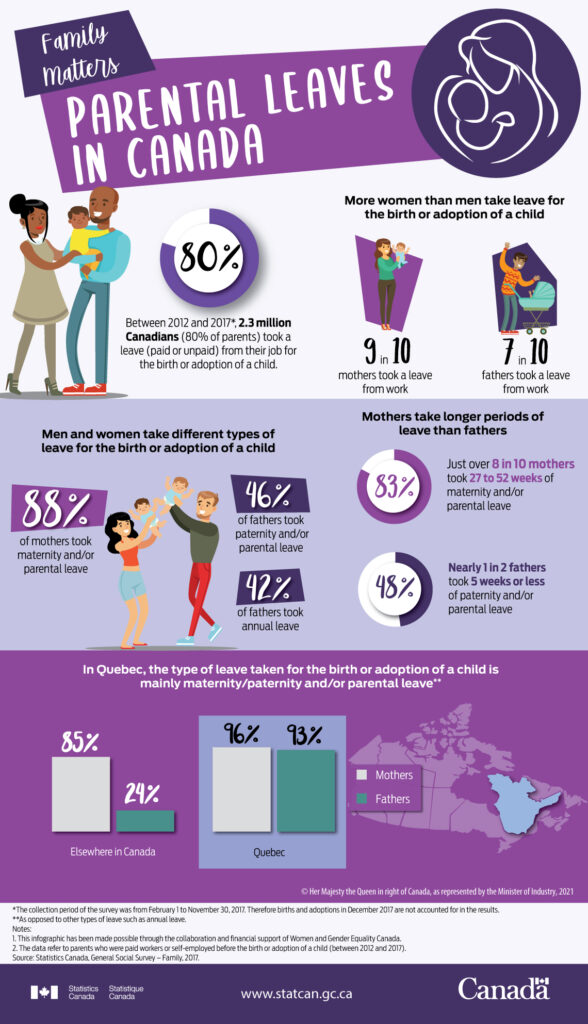

- Quebec residents receive parental benefits through a separate provincial program (Quebec Parental Insurance Plan).

Canada Child Benefit (CCB)

- You must be a Canadian resident for tax purposes and live with the child under age 18.

- You or your spouse/common-law partner must be Canadian citizens, permanent residents, or protected persons.

- You must be primarily responsible for the child’s care and upbringing.

- Tax filing every year is essential to maintain eligibility and accurate benefit calculations.

How Much Can You Get?

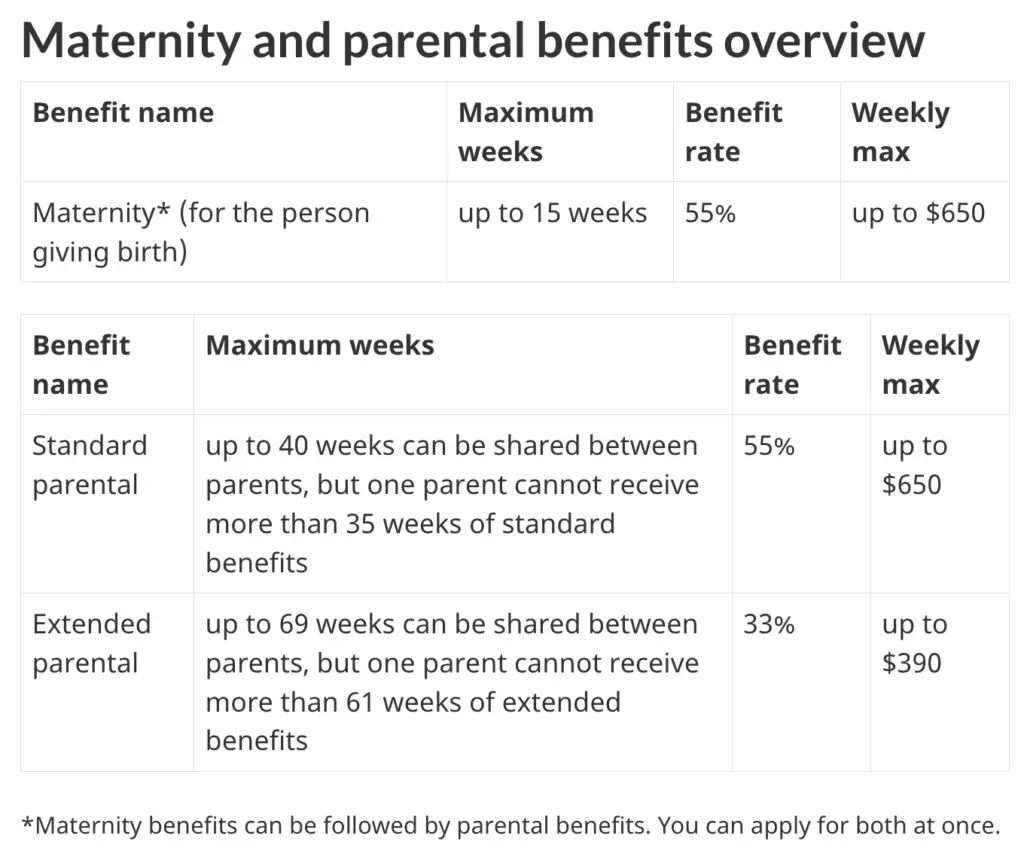

EI Maternity and Parental Benefits

| Benefit Type | Maximum Duration | Weekly Rate as % of Average Earnings | Maximum Weekly Benefit (2025) |

|---|---|---|---|

| Maternity Benefits | Up to 15 weeks | 55% | $695 |

| Standard Parental | Up to 40 weeks shared (max 35 weeks per parent) | 55% | $695 |

| Extended Parental | Up to 69 weeks shared (max 61 weeks per parent) | 33% | $417 |

Example: Sarah takes 15 weeks maternity leave and 30 weeks of standard parental benefits, while her partner claims 10 weeks of parental benefits, sharing the support effectively.

Canada Child Benefit (CCB)

- Families may receive up to $7,997 annually ($666/month) for each child under 6.

- For children aged 6-17, payments are up to $6,748 annually ($562/month).

- Additional Disability Tax Credit payments add up to $3,411 annually for eligible children.

- The November 2025 CCB payment is scheduled for November 20, 2025, with amounts depending on your 2024 tax return income.

When Are Payments Made?

- EI maternity and parental benefits are paid weekly, generally starting after your claim is approved.

- Canada Child Benefit is paid monthly, usually on the 20th of the month. The November 2025 payment will be disbursed on November 20.

- Payments scheduled on holidays or weekends are processed on the prior business day.

How to Apply for Canada CRA Parental Benefits Payment?

Step 1: Get Your Documents Ready

- Proof of your insured hours worked (such as pay stubs or Records of Employment).

- Social Insurance Number (SIN).

- Proof of pregnancy and birth certificates or adoption documents.

- Government-issued photo ID for identification.

Step 2: Decide Between Standard or Extended Parental Benefits

- You cannot switch between these after beginning the benefits, so choose wisely based on your financial needs and how long you intend to stay home with your child.

Step 3: Submit Your Application

- Apply via the CRA online My Account portal for quick processing.

- New mothers can also use the Automated Benefits Application when registering a child’s birth.

- For those preferring mail, submit Form RC66 with required documents to the CRA.

Step 4: Track Your Application and Payments

- Stay aware of the status via your CRA online account.

- Respond to any requests promptly to avoid delays.

For assistance, contact CRA toll-free at 1-800-387-1193.

Tips for Maximizing Your Benefits

- File your taxes promptly: Your CCB payments depend on the previous year’s tax return.

- Choose the right benefit option: If you want more income for a shorter period, opt for standard benefits; if you want more time at home, consider extended benefits.

- Apply early: The sooner you apply, the sooner your payments start.

- Use direct deposit: It’s faster and more secure.

- Keep all records: Keep proof of hours worked and relevant documents organized for smooth claims.

Common Mistakes to Avoid

- Applying late after birth or adoption, which delays payments.

- Failing to update CRA about income or caregiving changes.

- Confusion about who qualifies for maternity (only birth mothers) vs parental benefits (both parents).

- Starting benefits too late or switching benefit plans after payments begin, which isn’t allowed.

- Neglecting to file tax returns yearly, risking CCB termination.

Impact on Taxes and Other Supports

- EI maternity and parental benefits are taxable income and need to be included in your annual tax filing.

- The Canada Child Benefit is tax-free, but payment amounts are adjusted based on your family income calculated from your tax return.

- Receiving EI benefits may affect other provincial social assistance, so consult a tax advisor to understand personal circumstances.

Recent Changes and 2025 Enhancements

- Maximum weekly benefits increased to $695 (from previous years), more closely matching wage inflation.

- Extended parental benefits are now more popular for parents needing longer leave at a lower rate of 33% income replacement.

- New monthly Canada Family Benefit launched, providing an extra $445 monthly payment to families starting this year.

- Automated online applications and direct deposit processing significantly improved speed and reliability.

- Benefits and payment schedules now seamlessly sync with annual tax filings for accuracy.

Extra Support Available for New Parents

- Provincial programs in Quebec, BC, and others may provide additional top-up benefits.

- Parenting organizations and community centers offer advice, financial counseling, and support groups.

- Government-funded childcare subsidies exist to complement CRA benefits.

- Consider seeking a financial planner’s input to budget and optimize your leave and benefits.

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

$7997 Canada Child Benefit 2025 – CRA Confirms New Monthly Payouts for Parents

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates