Canada CRA Benefits Payment Dates: When it comes to managing your finances in Canada, knowing Canada CRA benefits payment dates for November 2025 is a game changer. Whether you’re a family with kids, a senior, or a working individual, these payments help to ease the pressure of everyday expenses. The Canada Revenue Agency (CRA) programs provide vital financial support for millions, from child benefits to pensions and tax credits. So, let’s break down the upcoming November 2025 benefits — the dates, eligibility criteria, and how much you can expect to receive — so you can stay ahead of your money game. This comprehensive guide will keep you hooked with clear explanations and practical advice, all served with a friendly, conversational style that’s easy for anyone to understand but packed with juicy details for seasoned pros. No jargon, no fuss — just solid info you can trust.

Table of Contents

Canada CRA Benefits Payment Dates

November 2025 is set to be a pivotal month for Canadian beneficiaries, with multiple CRA payments coming through to provide crucial financial support amid ongoing inflation pressures. Whether you’re raising kids, retiring comfortably, or working part-time, understanding the exact CRA benefits payment dates, eligibility requirements, and how to access these funds will treat you like a financial whiz instead of leaving you in the dark. Stay proactive: file your taxes on time, keep your details fresh on the CRA platform, and sign up for direct deposit for a smooth money flow. And don’t miss the one-time $2400 inflation relief payment, aimed at easing the burden on seniors and low-income Canadians this fall.

| Benefit | Payment Date | Who Is Eligible | Approximate Amount |

|---|---|---|---|

| Canada Child Benefit (CCB) | November 20, 2025 | Parents with children under 18 | Up to $620/month/child |

| GST/HST Credit | November 5, 2025 | Low and moderate-income taxpayers | ~$496 per quarter |

| Canada Workers Benefit (CWB) Advanced | Early November 2025 | Low-income workers | Up to $1,428 annually |

| Old Age Security (OAS) | November 27, 2025 | Seniors aged 65+ | ~$713/month |

| Guaranteed Income Supplement (GIS) | November 27, 2025 | Low-income seniors receiving OAS | Up to $1,065/month |

| Canada Pension Plan (CPP) | November 27, 2025 | Retired/disability workers | ~$1,307 average/month |

| Climate Action Incentive Payment (CAIP) | November 15, 2025 | Residents in eligible provinces | ~$188/quarter/adult |

| CRA One-Time $2400 Inflation Relief Payment | Late October to mid-November 2025 | Seniors (OAS, GIS) and low-income Canadians | Up to $2400 (non-taxable) |

| Official Resource | CRA Official |

Understanding CRA Benefit Payments in November 2025

What Are CRA Benefits and Why Do They Matter?

Simply put, CRA benefits are government payments designed to help Canadians with everyday expenses, from childcare to retirement. In November 2025, the CRA will release multiple payments to support families, seniors, and workers struggling with rising living costs. This is essential for budgeting and financial planning, especially if you rely on these benefits as part of your monthly income.

A Closer Look at Major Canada CRA Benefits Payment

- Canada Child Benefit (CCB): If you’re a parent or guardian, this monthly tax-free payment helps with the costs of raising kids under 18. The amount depends on family income and child age, with up to $620 per month per child under six.

- GST/HST Credit: Paid quarterly, this credit helps offset sales taxes paid by low- and moderate-income Canadians. Expect the next payment on November 5, 2025.

- Canada Workers Benefit (CWB): This refundable tax credit supports low-income workers, especially those in seasonal or part-time jobs. An advanced payment is due in early November.

- Old Age Security (OAS) & Guaranteed Income Supplement (GIS): These are essential lifelines for seniors 65+, with OAS providing a base pension and GIS offering additional help for low-income retirees.

- Canada Pension Plan (CPP): Monthly payments for retired or disabled Canadians who contributed to the plan during their working years.

- Climate Action Incentive Payment (CAIP): A quarterly rebate for residents in provinces that have a carbon tax, helping ease energy costs.

- One-Time $2400 Inflation Relief Payment: A special non-taxable payment targeting seniors and low-income Canadians to help them handle inflation-related expenses this year.

How to Check If You’re Eligible for Canada CRA Benefits Payment?

Eligibility depends on many factors: age, income, family size, residency status, and prior tax filings. Here’s a simple breakdown:

- CCB: You must be a resident with children under 18 and have filed your taxes.

- GST/HST Credit: Filed latest tax returns with income below specified thresholds.

- CWB: Earned income but below certain limits, must file taxes.

- OAS/GIS: Must be 65+ and meet residency and income criteria.

- CPP: Based on years contributed to the plan; eligible at 60+ for partial or 65+ for full pension.

- One-Time $2400 Payment: Seniors or low-income recipients who filed 2024 tax return and receive OAS, GIS, or CPP Disability benefits.

- Disability Benefits: New comprehensive disability benefits support Canadian residents aged 18 to 64 with an approved Disability Tax Credit.

All applicants must file their income tax returns on time to ensure eligibility and timely payments. Even if you had no income, filing is crucial because CRA uses this data to assess your benefit entitlements.

For newcomers to Canada, in your first year of residency for tax purposes, you can begin receiving benefits as long as you’ve submitted required information about your status, income, and family.

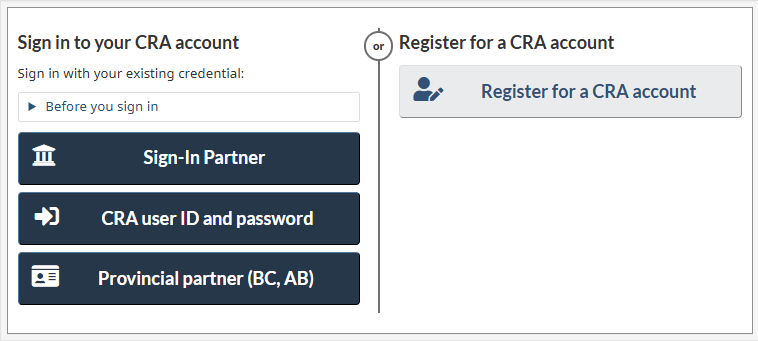

Step-by-Step Guide to Access Canada CRA Benefits Payment

Step 1: File your income taxes on time every year to qualify for most benefits.

Step 2: Register for direct deposit through your CRA My Account for faster payment delivery. Paper checks take longer and can get lost.

Step 3: Keep your information updated — address, banking, marital status — since CRA uses this to calculate and send benefits.

Step 4: Use CRA tools like the MyBenefits app or the CRA website to track payment dates and amounts.

Step 5: If you don’t receive your expected payment, contact CRA or use their online forms to apply or correct your status.

Exploring the $2400 One-Time Inflation Relief Payment

The one-time $2400 inflation relief payment is a form of direct support to help those most affected by inflation — mainly seniors receiving OAS, GIS, CPP Disability, and low-income Canadians who filed their 2024 returns. This payment, distributed between late October and mid-November, is tax-free, ensuring you keep the full benefit amount without added taxes or deductions.

If you didn’t file last year’s return, it’s not too late. Submit your 2024 tax returns soon to qualify for current and future payments. Check your CRA timeline and bank account statements during this period for deposits.

Other Noteworthy CRA Benefits and Rebates in 2025

Besides the key ones mentioned, be aware of:

- Canada Disability Benefit: New monthly support launched in 2025, offering $300 to $1,500/month based on income and disability status; eligibility requires a Disability Tax Credit certificate.

- New Canada Family Benefit: For families with children under 18, providing up to $445/month to help cover rising costs like groceries and schooling.

- Climate Action Incentive: Paid quarterly to residents of provinces with carbon pricing, aimed at offsetting energy costs.

Tracking these additional programs is critical for full financial planning, especially if you fall into multiple eligibility categories.

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

November $2300 One-Time Payment 2025 by CRA: Who Is Eligible and When to Expect Payment

CRA Extra $1900 Cash Boost In November 2025 – Who will get it? Check Eligibility & Payment Date