The Canada Pension Plan (CPP) will increase in 2025, with some recipients seeing their annual benefits rise by up to $1693, according to updates from the Canada Revenue Agency (CRA) and Employment and Social Development Canada (ESDC). The boost is part of a scheduled enhancement program designed to strengthen retirement income for Canadian workers and respond to persistent inflation pressures.

Table of Contents

CRA $1693 CPP Increase

| Key Fact | Detail / Statistic |

|---|---|

| Annual CPP increase (maximum) | Up to $1693 for eligible recipients |

| Monthly maximum benefit (2025) | $1433.66 |

| Payment dates | Oct. 29, Nov. 26, Dec. 22 (monthly schedule) |

| Automatic eligibility | No reapplication required |

| Official Website | Canada.ca |

Why the CPP Increase Is Happening in 2025

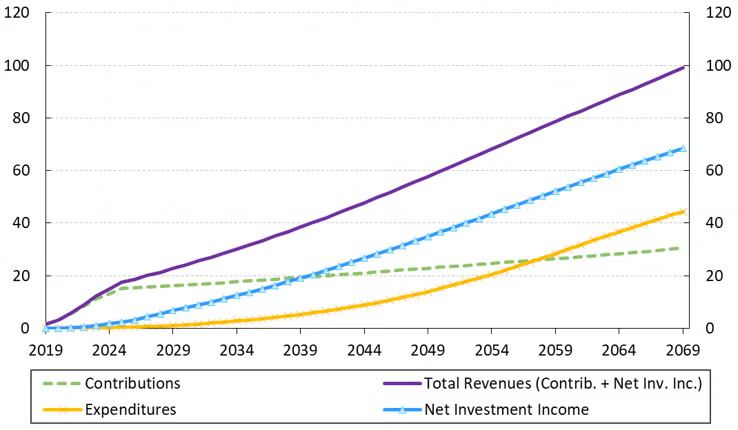

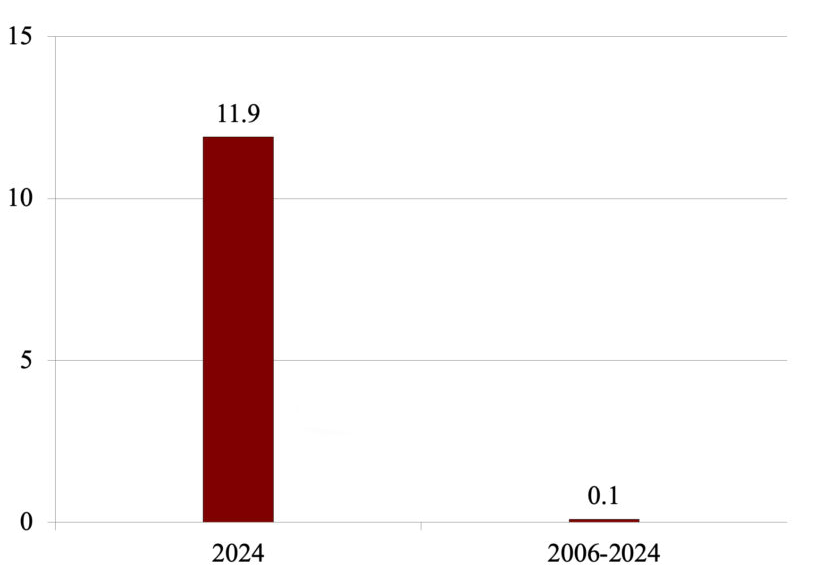

The CPP increase in 2025 stems from two key factors: the CPP enhancement program, which began in 2019, and annual inflation adjustments. The enhancement raises the share of income replaced by CPP from 25% to 33% over time. This means workers who contribute more during their careers will eventually receive higher monthly benefits.

“CPP is built to adapt over time,” said Lisa Grant, spokesperson for Employment and Social Development Canada. “These increases reflect both the contributions Canadians have made and our commitment to maintaining pension value in real terms.”

In addition to enhancement measures, the Consumer Price Index (CPI) is used to index CPP benefits annually to inflation. This ensures payments retain their purchasing power even during periods of higher costs.

How Much Pensioners Will Receive

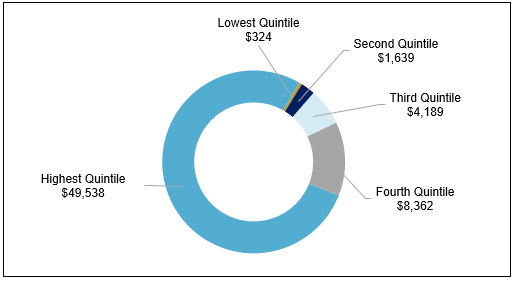

The maximum monthly CPP retirement benefit for new beneficiaries in 2025 is $1433.66, compared with $1,364.60 in 2024. While some headlines refer to a $1693 annual increase, this figure applies to individuals who contributed at the maximum level throughout their careers. Many retirees receive less, depending on their work and contribution history.

Dr. Marcus Leclerc, a senior economist at the University of British Columbia, said the increase is “meaningful, though uneven.”

“Those who contributed the maximum will see the largest gains, but the structure remains proportional,” Leclerc explained. “For most Canadians, the increase will be smaller, yet it still offers some relief amid rising living costs.”

Eligibility Criteria For CRA $1693 CPP Increase

All CPP recipients automatically receive inflation adjustments, regardless of income or contribution history. However, the enhanced benefit applies only to those who contributed under the post-2019 system.

Key eligibility criteria include:

- A valid CPP contribution record during working years.

- Canadian residency or eligibility through an international agreement.

- Already receiving or approved for CPP retirement benefits.

The CRA clarified that no reapplication is required. “Beneficiaries will see adjustments automatically in their monthly deposits,” the agency said in a statement.

CPP Payment Schedule for the Remainder of 2025

Payments are issued on a fixed monthly schedule:

- October 29, 2025

- November 26, 2025

- December 22, 2025

Most Canadians receive their CPP benefits via direct deposit, ensuring same-day availability. Those who still receive paper cheques are advised to allow extra time for delivery.

Cost-of-Living Pressures: A Growing Concern

The increase comes as inflation remains elevated. Statistics Canada reported that inflation averaged 3.2 percent in Q3 2025, driven by rising housing, transportation, and energy costs.

While the CPP increase is designed to protect retirees’ purchasing power, many advocacy groups argue that it is not enough to fully cover real cost increases. Sarah Campbell, director of the National Pensioners Federation, said many seniors are “still struggling with essential costs like rent, groceries, and medication.”

“This increase helps, but it won’t close the gap entirely,” Campbell said. “The affordability crisis for older Canadians is real and growing.”

CPP and the Broader Pension System

The CPP forms one pillar of Canada’s three-part retirement system, which also includes Old Age Security (OAS) and private or workplace savings. OAS payments were increased earlier this year, and the Guaranteed Income Supplement (GIS) continues to target lower-income seniors.

“The design of CPP is to supplement—not replace—other retirement income sources,” said Dr. Anya Sharma, a public finance researcher at Carleton University. “For many Canadians, especially those without employer pensions, these public programs are essential lifelines.”

How CPP Contributions Work

CPP contributions are made by both employees and employers, up to a set annual maximum. In 2025, the Year’s Maximum Pensionable Earnings (YMPE) is set at $70,100, while the additional ceiling (YAMPE) under the enhanced system reaches $79,400.

Employees contribute 5.95% of income up to the YMPE, matched by employers. Those self-employed contribute both portions. These contributions directly influence the future monthly pension amount.

The enhancement introduced a “second earnings ceiling” in 2024, meaning higher earners contribute more — and can ultimately receive higher benefits.

International Context: How Canada Compares

Canada’s CPP is often cited as one of the more stable public pension systems globally. A 2025 report from the Organisation for Economic Co-operation and Development (OECD) ranked Canada’s public pension sustainability above the G7 average.

In the United States, for example, the Social Security system replaces a lower percentage of pre-retirement income on average. European systems, like in France and Germany, typically offer more generous replacement rates but face funding pressures due to aging populations.

“Canada’s model is designed to be sustainable over the long term,” said Leclerc. “The fully funded structure and automatic indexing make it more resilient to demographic shifts.”

Impact on Canadian Households

The increase is expected to inject roughly $3.2 billion in additional CPP benefits into the economy in 2025, according to preliminary estimates from the Parliamentary Budget Officer. Much of that will flow directly into local economies, particularly in communities with higher concentrations of retirees.

Economists say such increases can act as a mild stabilizer during economic slowdowns. “Seniors tend to spend their benefits locally,” said Sharma. “This creates a ripple effect in small businesses and local services.”

Planning for Retirement: What Canadians Should Do Now

Experts recommend Canadians review their CPP contribution statements through My Service Canada Account. This allows individuals to estimate how much their monthly pension will rise under the enhancement program.

Financial advisers also suggest:

- Coordinating CPP with OAS and RRSP withdrawals to optimize after-tax income.

- Considering delaying CPP past age 65 to increase the monthly benefit (by up to 42% at age 70).

- Seeking professional advice for complex situations, such as when combining CPP with private pensions.

“Understanding how CPP fits into your overall retirement strategy is key,” said Sharma. “This increase is helpful, but it’s part of a bigger financial picture.”

Potential Challenges and Criticisms

Some economists caution that CPP alone may not be sufficient for long-term financial security. Critics have also raised concerns about contribution burden on younger workers, especially as Canada’s population ages.

The ratio of working-age Canadians to retirees is expected to fall from 3.2 to 1 in 2025 to 2.5 to 1 by 2035, according to Statistics Canada projections. This could increase fiscal pressure over time, even with the plan’s partially funded structure.

Others warn about unequal benefits between those who spent decades in the workforce and those with lower earnings or time spent out of the labor market, including caregivers and newcomers.

“The CPP enhancement is a powerful tool, but it’s not a silver bullet,” said Leclerc. “We need complementary policies, including affordable housing and health supports for older Canadians.”

Looking Ahead

The federal government anticipates further gradual increases in CPP benefits in the coming years as the enhancement program continues to phase in. The next inflation adjustment is scheduled for January 2026.

“CPP is a cornerstone of Canada’s retirement system,” said Grant. “The 2025 increase is part of a long-term strategy to provide Canadians with more secure and predictable income in retirement.”

Extra Tax Refund In Canada For 2025 – Will you get this refund? Check amount & Date

Canada CRA $1693 CPP Increase in 2025 – Will you get this payment? Check Eligibility & Payment Date

Canada CRA Payment Dates Coming in November 2025, Official Schedule for Various Federal Benefits

FAQ About CRA $1693 CPP Increase

Q1: Do I need to apply to get the CPP increase?

No. If you already receive CPP, the increase is applied automatically.

Q2: Will everyone receive $1693 more?

No. The figure represents the maximum increase. Actual amounts vary based on contribution history.

Q3: How is the increase calculated?

The increase reflects inflation indexing plus enhanced benefits for those who contributed more after 2019.

Q4: Can delaying CPP increase my monthly benefit?

Yes. Delaying CPP past age 65 increases payments by 0.7% per month, up to age 70.