Canada’s federal government has not announced any special $1,693 Canada Pension Plan (CPP) payment or one-time “CPP increase” for 2025, and no such amount appears on official schedules or program updates from the Government of Canada or the Canada Revenue Agency (CRA). CPP retirement benefits did rise in January 2025 due to routine indexation and the ongoing CPP enhancement, but verified maximum monthly figures are different from the viral $1,693 claim and depend on each person’s contributory history, not a flat across-the-board raise or bonus.

Several blogs and social posts have circulated headlines about a $1,600–$1,700 “CPP bonus” or “CPP increase,” often suggesting a one-time transfer or a universal boost in a specific month of 2025. These posts do not cite primary government notices and frequently conflate standard indexation with ad hoc payments that are not supported by CRA or Service Canada publications.

Table of Contents

Canada CRA $1693 CPP Increase in 2025

| Key fact | Detail/Statistic |

|---|---|

| No official $1,693 CPP payment | No CRA/Service Canada notice lists a $1,693 transfer |

| 2025 CPP indexing applied in January | Benefits adjust annually; no mid‑year universal “bonus” |

| Contributions updated for 2025 | YMPE $71,300; YAMPE ~14% above YMPE; 5.95% rate |

| Payment dates are routine | 2025 CPP dates published on Canada benefits calendar |

For 2025, the Canada Pension Plan reflects its standard annual indexation and the final scheduled changes to contribution ceilings under the enhancement, but there is no government‑announced $1,693 payment on any month of the calendar; recipients should consult official portals to confirm individual amounts and deposit dates.

What the Government Says

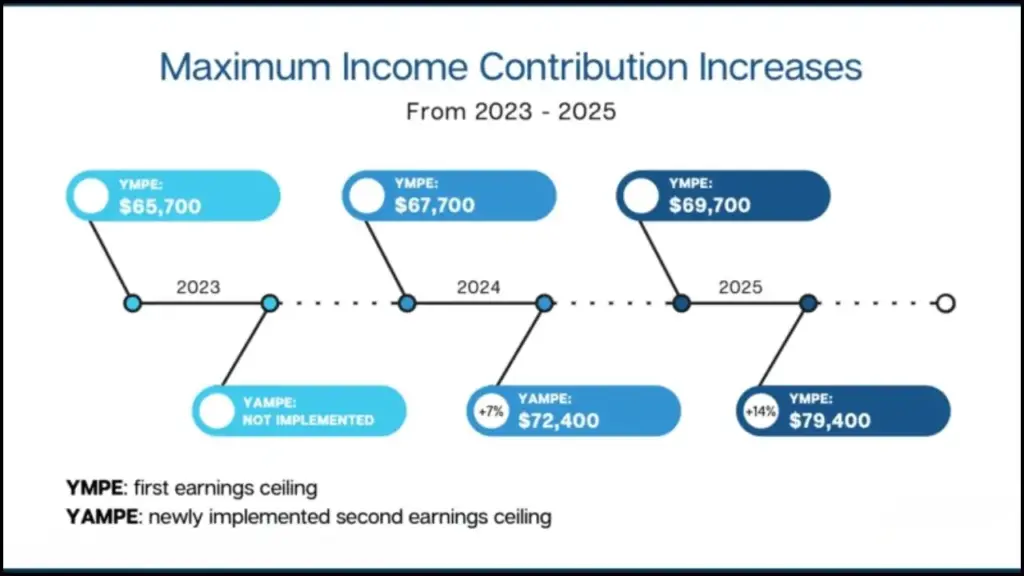

Official Canada pages detail the 2025 framework: routine cost-of-living adjustments (COLA) applied in January and the final phase of the CPP enhancement, including higher earnings ceilings used to calculate contributions and, over time, higher benefits for contributors who pay at the enhanced levels across their careers. The CRA’s October 31, 2024 bulletin set the 2025 Year’s Maximum Pensionable Earnings (YMPE) at $71,300 and confirmed the second ceiling the Year’s Additional Maximum Pensionable Earnings (YAMPE)—remains approximately 14% above YMPE from 2025 onward; contribution rates remain 5.95% for employees and employers, and 11.90% for self‑employed, with updated maximums tied to those ceilings. None of these official materials include a $1,693 payment.

What Changes Actually Occurred in 2025

- CPP amounts are updated once a year in January to align benefits with inflation, protecting purchasing power for retirees and beneficiaries; this is not a discretionary “bonus” payment and is separate from tax measures or provincial programs. In 2025, the enhancement schedule that started in 2019 continues to raise the share of covered earnings and adds the second earnings ceiling (YAMPE), which affects contributions now and benefits over time for those contributing at higher income levels.

- Financially, the CRA confirmed for 2025: YMPE rises to $71,300; the basic exemption stays at $3,500; employee and employer rates remain 5.95% with a higher maximum contribution ($4,034.10 each); the self‑employed maximum is $8,068.20 at 11.90%. These technical adjustments are central to the CPP enhancement’s design and do not create a one‑time $1,693 deposit for current retirees.

Will you Get a $1,693 CPP Payment?

There is no verified federal program promising a $1,693 CPP deposit in 2025, and none of the official payment calendars list such an amount on any 2025 date. Monthly CPP amounts vary by individual contribution history, the age at which benefits start, and coordination with survivor or disability benefits, so many recipients see different payments, but these differences are not an ad hoc “increase” to a flat $1,693. If a personal deposit appears close to that figure, it reflects the person’s entitlement computation and indexation, not a universal program.

Eligibility Criteria for Canada CRA $1693 CPP Increase in 2025

Eligibility for the CPP retirement pension depends on having made valid contributions during one’s working years in Canada; the benefit becomes payable as early as age 60, with actuarial reductions, or as late as age 70, with actuarial increases. The 2025 enhancement elements influence future benefit levels for contributors paying at higher earnings levels, especially younger workers who will contribute over many years under the enhanced regime. Current retirees’ monthly amounts reflect past contributions and annual indexation rules, not a separate 2025 “bonus”.

How Much can you Actually Receive in 2025

Government tables list maximum amounts for new CPP benefits starting in 2025, but very few retirees receive the maximum because it requires consistent contributions at or near the ceiling over most of one’s career. Indexation applied in January aims to keep benefits aligned with consumer prices, while the enhancement increases the replacement rate and covered earnings over time, gradually lifting possible maximums for future retirees who fully participate in the enhanced contribution schedule. None of these authoritative references specify or imply a uniform $1,693 amount.

CRA $1693 CPP Increase Payment Dates in 2025

CPP is deposited on a monthly schedule published by the Government of Canada; dates for 2025 are listed on the official benefits calendar rather than in ad hoc social posts or third‑party blogs. Beneficiaries should use the government calendar to confirm monthly deposits and should avoid relying on unofficial date lists that sometimes circulate alongside false “increase” claims. Payment timing can vary slightly by bank processing, but the federal schedule is the authoritative reference.

How to Verify your Amount

The most reliable way to confirm an individual CPP amount is to log into a My Service Canada Account (MSCA) and review the benefits section, which reflects current entitlements and indexation applied in January 2025. The federal CPP program pages provide definitions and methodology used to calculate benefits, including how contributory periods, dropout provisions, and start age adjustments affect payments. Contribution rules and ceilings published by CRA are critical for understanding why amounts may differ across recipients and years.

Why Misinformation Spreads About CPP “Increases”

Rumors often blend legitimate technical updates—such as COLA or higher contribution ceilings—with speculative figures or misread charts, creating viral posts about “extra” cheques that never materialize on official calendars. Several recent claims have asserted flat boosts or bonuses in 2025 without citations to CRA or Service Canada, which maintain centralized pages for payment dates, contribution parameters, and benefit rules. Readers should be cautious with unsourced amounts and verify against federal web pages before resharing financial claims.

The Big Picture: CPP Enhancement and Sustainability

The CPP enhancement is a long‑term reform intended to replace a larger share of average earnings and cover a broader band of earnings through the introduction of the second ceiling (YAMPE), financed by higher contributions that began phasing in 2019. The CRA states that from 2025 onward, YAMPE is set at about 14% above YMPE, which matters for contributors with earnings between the two ceilings and shapes future benefit entitlements for those who contribute at higher levels. These changes do not produce one‑time fixed payments like $1,693 in 2025, but they do affect the trajectory of benefits for younger cohorts over decades.

FAQs on Canada CRA $1693 CPP Increase in 2025

Is there a $1,693 CPP payment in 2025?

No. There is no official notice of a $1,693 CPP payment on federal schedules or program updates for 2025; routine indexation and enhancement rules apply instead.

Did CPP increase in 2025?

What are the official 2025 payment dates?

How do YMPE and YAMPE affect me?

They determine the earnings bands on which CPP contributions are calculated, which, over time, influence future benefits for contributors; for 2025, YMPE is $71,300 and YAMPE is approximately 14% above YMPE.

Where should I verify my own payment?

Use My Service Canada Account and the federal CPP program pages for personal amounts; for contribution rules and ceilings, see CRA updates.