Canada CPP OAS Benefit Payment Date: Planning for retirement? You’re definitely not alone. Millions of Canadians rely on the Canada Pension Plan (CPP) and Old Age Security (OAS) as foundational sources of income in their golden years. If you’re wondering when the CPP and OAS payment dates are for November 2025, how much you can expect, and whether you qualify, this guide breaks it all down for you—clear, friendly, and straightforward, just like chatting with a neighbor over coffee. Whether you’re a newbie to retirement planning or a seasoned pro, this comprehensive rundown will give you practical advice, key dates, and insider tips to maximize your benefits.

Table of Contents

Canada CPP OAS Benefit Payment Date

The Canada Pension Plan (CPP) and Old Age Security (OAS) remain vital pillars of retirement income, with steady monthly payments expected on November 26, 2025. Seniors can look forward to maximum monthly payments of around $1,433 for CPP and $727.67 for OAS, plus a special $2,500 windfall payment to ease financial pressures. Being informed about eligibility, payment schedules, tax considerations, and upcoming government changes helps Canadians maximize their benefits and confidently plan for a secure retirement.

| Topic | Details |

|---|---|

| CPP & OAS Payment Date | November 26, 2025 |

| Max CPP Monthly Benefit | Approximately $1,433 (for age 65 claimants in 2025) |

| Max OAS Monthly Benefit | Up to $727.67 for ages 65-74, higher for 75+ |

| CPP Claim Age Range | Between 60 and 70 years old |

| OAS Eligibility Age | 65, with deferral option up to 70 for higher benefits |

| Additional Payment | $2,500 windfall payment expected in late Nov 2025 for qualifying seniors |

What Are CPP and OAS?

Before diving into payment dates and amounts, it’s important to understand what exactly the CPP and OAS are. The Canada Pension Plan (CPP) is a contributory social insurance program designed to provide Canadians with a basic monthly retirement income based on how much they contributed during their working years. It’s funded mostly by deductions from employees and employers, or by self-employed individuals paying both shares. The earlier you start collecting, the lower your monthly payments, and vice versa.

On the other hand, the Old Age Security (OAS) is a government-funded pension program paid monthly to seniors who meet residency requirements—regardless of their work history or contributions. OAS is considered a universal benefit, designed as a baseline income for seniors based on their legal status and residency in Canada.

These two programs operate as complementary components of the Canadian retirement income system, ensuring broad social security coverage for seniors across the country.

Canada CPP OAS Benefit Payment Date — Save the Date!

For November 2025, the CPP and OAS monthly benefits will be deposited on November 26th, which is the last Wednesday of the month, following Canada’s consistent benefits payment schedule. This reliable schedule means you can plan your budget and bills ahead knowing exactly when the money will arrive.

In addition to monthly benefits, there is a special $2,500 one-time windfall payment scheduled for late November 2025. This payment is aimed at easing financial pressures due to inflation and rising costs that many seniors are facing post-pandemic. Keeping an eye on official announcements is critical, so you don’t miss this important support.

Breakdown of Benefits: How Much Can You Expect?

CPP Payments

To understand how much you might get from CPP, it helps to know:

- The maximum monthly CPP payment for 2025 is approximately $1,433 for those who contributed the maximum amount throughout their working life and claim at 65.

- Payments are adjusted annually to keep pace with inflation, through a cost-of-living adjustment (COLA).

- You can start receiving CPP as early as age 60, but your monthly payments will be reduced by 0.6% for each month before age 65 (up to a 36% reduction if taken at 60).

- Delaying CPP past 65 increases your pension by 0.7% for each month delayed up until age 70, raising the maximum possible by up to 42%.

- The actual amount depends heavily on your total contributions during your working years.

OAS Payments

With OAS, here’s what you need to know:

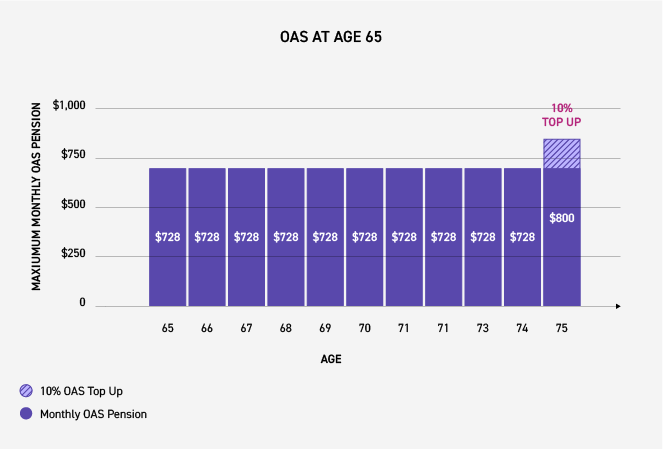

- The base OAS monthly payment for 65-74 years old in 2025 is around $727.67.

- Seniors aged 75 and older receive approximately 5% more than those aged 65 to 74, to offer better cost-of-living support.

- You can choose to defer OAS payments up to age 70, increasing monthly payments by roughly 0.6% per month (a total of 36% extra at 70).

- OAS benefits are subject to income testing, known as the “clawback.” For 2025, clawback applies if your income exceeds $90,997 and phases out completely by approximately $148,605.

- The amount seniors receive can be partial or full, depending on how many years they have lived in Canada after turning 18.

Are You Eligible to Claim Canada CPP OAS Benefit?

CPP Eligibility

- Eligibility for CPP retirement benefits requires making contributions to the CPP during your working life, either through employment or self-employment in Canada.

- You must be between 60 and 70 years old to apply.

- Your pension amount depends on how much and for how long you have paid into CPP. You need to have made sufficient contributions to qualify.

- CPP also offers disability and survivor benefits under certain circumstances.

OAS Eligibility

- You must be 65 or older.

- You must be a Canadian citizen or legal resident at the time your pension application is approved.

- Residency requirements differ depending on where you live:

- If living in Canada, you need to have resided in Canada for at least 10 years after turning 18.

- If you live outside Canada, the residency requirement is 20 years after age 18, and you must have been a Canadian resident or citizen before leaving.

- OAS eligibility is based on legal status and residence history rather than work history.

- Partial OAS is available if you have lived in Canada for less than 40 years since age 18, with the amount proportional to years resided.

How To Apply for Canada CPP OAS Benefit Payment: Step-by-Step

Planning your application is key to receiving benefits without hassle:

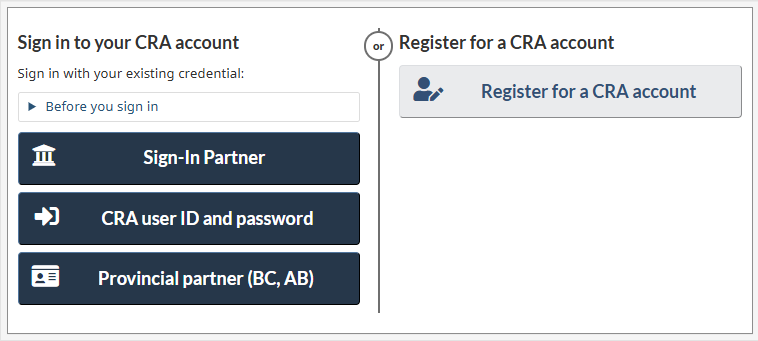

- Check Your Contribution and Residency Status:

Use the My Service Canada Account online portal to review your CPP contribution history and OAS eligibility details, ensuring all your records are accurate. - Gather Required Documents:

Prepare your Social Insurance Number (SIN), valid government-issued ID, proof of residency documents, and any records of work or contributions outside Canada if applicable. - Decide When to Start Benefits:

Consider your health, income needs, and tax situation before deciding to claim CPP or OAS early, on time at 65, or later up to 70 to maximize payments. - Submit Your Application:

Apply online via Service Canada, or by mail if online is not an option. Apply at least six months before you want payments to begin. - Monitor Additional Payments:

Stay alert to announcements about the $2,500 windfall payment and ensure you meet any criteria to qualify.

Planning for the Future: Smart Money Moves with CPP and OAS

Receiving CPP and OAS is an important financial milestone, but to ensure security in retirement consider these tips:

- Delay Benefits When Possible:

Healthy retirees with other income sources might benefit from delaying CPP and OAS to increase monthly payments significantly. - Tax Planning is Essential:

Both CPP and OAS are taxable income. Taxes aren’t automatically deducted from benefits unless you request withholding through Service Canada. Plan your income and withholdings to avoid large tax bills at year-end. - Integrate with Other Retirement Income:

Factor in personal savings such as RRSPs, employer pensions, and other investment income to create a diversified and sustainable retirement income strategy. - Budget for Inflation:

Although both CPP and OAS amounts include annual inflation adjustments, continued rises in living costs mean careful budgeting remains necessary.

Tax Implications: What Seniors Need to Know

Taxes can affect how much of your CPP and OAS you keep:

- Both CPP and OAS payments are considered taxable income in Canada, reported annually on your tax return.

- Payments come without automatic tax deductions unless you opt for withholding via Request for Voluntary Federal Income Tax Deductions.

- If taxes aren’t withheld, you may need to manage quarterly instalments or a larger tax bill when filing.

- For Canadians living abroad, a non-resident withholding tax of 25% may apply, though tax treaties with other countries can reduce this rate.

- Income from CPP and OAS counts toward eligibility for other federal and provincial tax credits and benefits, so comprehensive tax planning is beneficial.

Changes Coming in November 2025: What Seniors Should Expect

The Canadian government continues to adapt its retirement system to balance sustainability and fairness:

- The CPP retirement age is set to gradually increase from 65 to 67 by 2030, promoting longer workforce participation and eventual higher benefits.

- The OAS payment for seniors aged 75 and older will increase by up to 5%, giving extra financial relief amid rising costs.

- Income thresholds for OAS clawback will increase modestly, allowing more Canadians to qualify for full or partial OAS benefits.

- The introduction of the $2,500 windfall payment in November 2025 aims to assist seniors facing inflationary pressures.

These updates mainly affect new retirees from November 2025 onward and signal evolving retirement norms in Canada.

Interaction with Other Benefits

Many seniors qualify for additional income supports that complement CPP and OAS:

- Guaranteed Income Supplement (GIS): Provides income-tested top-ups for low-income seniors receiving OAS.

- Allowance and Allowance for the Survivor: Assistance programs for low-income temporary residents aged 60-64 or survivors.

- Provincial Supplements: Some provinces add further benefits based on residency and income criteria.

Awareness of these programs helps optimize total retirement income and avoid missing benefits that enhance financial security.

Impact of COVID-19 on Senior Benefits

The COVID-19 pandemic introduced significant economic challenges, leading to temporary adaptations in senior benefits:

- Service Canada extended application deadlines and offered emergency top-ups to safeguard seniors from financial hardship.

- The $2,500 windfall payment set for November 2025 is part of ongoing government efforts to support seniors coping with inflation and pandemic-related expenses.

- Keep informed through official channels for any forthcoming benefit adjustments or emergency supports.

Canada Grocery Rebate Amount for November 2025 – Check Eligibility & Payment Dates

Canada $300 Federal Payment in November 2025 – Who will get it? Check Eligibility

$360 Canada OTB In November 2025 – These people are eligible, Check Eligibility & Payment