Canada Cost of Living Increase: The term “Canada cost of living increase in November 2025” refers to the latest inflation adjustment that affects federal pensions and benefits such as Old Age Security (OAS). Each quarter, the Canadian government reviews payment amounts to help retirees keep up with the rising cost of living. This article breaks everything down — what the increase means, how much more you’ll receive, when payments hit, and what professionals, retirees, and everyday Canadians should know. You’ll also get extra tips on taxes, budgeting, and planning ahead for future cost-of-living changes.

Table of Contents

Canada Cost of Living Increase

In short, the Canada Cost of Living Increase in November 2025 means a 0.7% boost in Old Age Security (OAS) payments for eligible seniors. This automatic increase reflects the inflation trend measured by the Consumer Price Index, and payments will land on November 26, 2025. While modest, the change ensures seniors’ incomes continue to rise in step with inflation. For financial advisors, it’s a reminder to adjust income forecasts, review clawbacks, and keep clients informed about how small quarterly bumps build up over time.

| Item | Detail |

|---|---|

| Increase rate (Oct–Dec 2025) | 0.7% increase in OAS payments |

| Annualized change (Oct 2024–Oct 2025) | About 1.7% increase overall |

| Maximum OAS (ages 65–74) | Approx CAD $740.09/month |

| Maximum OAS (ages 75+) | Approx CAD $814.10/month |

| Payment date (November 2025) | November 26, 2025 |

| Application required? | None — adjustment happens automatically |

| Inflation measure used | Consumer Price Index (CPI) |

| Official reference | Government of Canada – OAS Payment Amounts |

The Context: Why a Canada Cost of Living Increase Happens

Let’s start with the basics. When prices for things like food, housing, and gas rise, that’s inflation. To make sure seniors aren’t losing buying power, the Government of Canada adjusts OAS payments every three months using the Consumer Price Index (CPI).

This adjustment — called the Cost of Living Increase (COLA) — keeps payments in line with inflation trends. You’ll see these changes reflected in your OAS and, in some cases, in related programs such as the Guaranteed Income Supplement (GIS).

So when people talk about a “cost of living increase in November 2025,” they’re referring to the new adjustment that applies to the October–December 2025 quarter. The updated amount shows up in your November 26, 2025 payment.

Why the Canada Cost of Living Increase Matters?

While 0.7% might not sound like much, it’s a lifeline for millions of Canadians on fixed incomes. Even a few extra dollars per month can help offset grocery or utility costs that have climbed faster than wages.

For example, a retiree receiving CAD $740 a month will now get around CAD $745 starting November 2025. It’s not a fortune, but it’s automatic and reflects the government’s attempt to shield seniors from inflation.

For financial advisors or professionals helping retirees, these changes matter for forecasting and tax planning. It’s important to:

- Update income models to reflect the higher payment amounts.

- Review OAS clawback thresholds — high-income earners could see part of their benefit reduced.

- Advise clients early so they understand that increases are modest but consistent.

- Encourage better budgeting — inflation doesn’t stop at 0.7%, so it’s wise to plan beyond the government’s adjustments.

How the Adjustment Works?

Here’s the step-by-step on how the system determines your new payment:

- StatCan updates CPI data monthly.

The government reviews inflation levels from Statistics Canada. - Every quarter (Jan, Apr, Jul, Oct), the government calculates how much prices changed compared to the previous three months.

- The OAS and GIS payments are indexed based on that number.

- If inflation falls, payments won’t decrease — they’ll stay at the last indexed level until inflation rises again.

So, for October–December 2025, the CPI showed a 0.7% increase over the previous period, triggering this latest OAS adjustment.

That means retirees don’t need to fill out any paperwork or apply — the system automatically adjusts the amount in your November payment.

Who Qualifies for Canada Cost of Living Increase?

You can get OAS if you meet these requirements:

- You’re 65 years or older

- You’re a Canadian citizen or legal resident at the time of approval

- You’ve lived in Canada for at least 10 years since age 18 (for payments within Canada)

- You’ve lived in Canada for 40 years after turning 18 for the full pension

If you don’t meet all those conditions, you may still qualify for a partial pension.

For low-income seniors, the Guaranteed Income Supplement (GIS) provides extra financial help. The GIS amount also adjusts quarterly with inflation.

The November 2025 Payment Date

For 2025, OAS payments follow a regular monthly schedule. The November 2025 payment date is Wednesday, November 26.

If you use direct deposit, the funds will appear in your bank account on that date. Cheque recipients should expect a few extra business days for mail delivery.

OAS Payment Amounts by Age Group

Your payment depends on age and residency history:

- Ages 65–74: Maximum CAD $740.09/month

- Ages 75+: Maximum CAD $814.10/month (includes the permanent 10% age 75 bonus)

These are maximums — most people receive less based on how many years they’ve lived in Canada or if their income triggers a clawback.

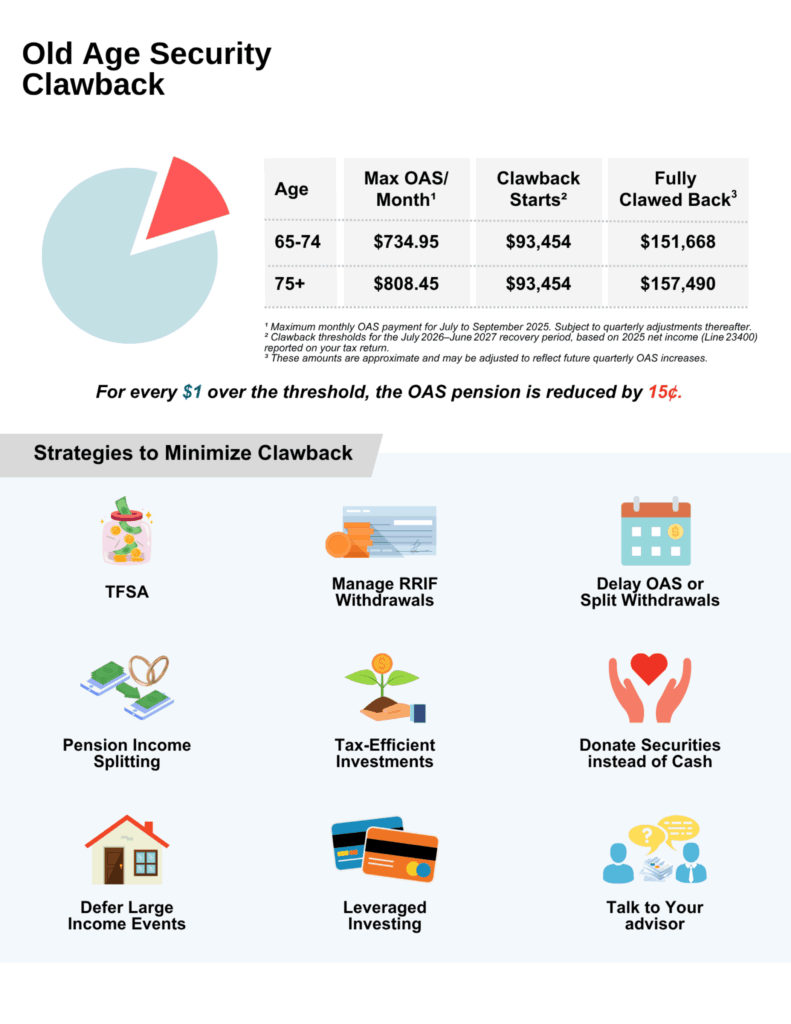

Understanding the “Clawback” (OAS Recovery Tax)

Here’s where many Canadians get tripped up. The OAS clawback applies when your net income exceeds a certain threshold.

For the 2025 tax year, that threshold is roughly CAD $90,997. For every dollar above that, your OAS payment is reduced by 15 cents.

Once income reaches about CAD $148,000, the OAS benefit may be fully clawed back.

So if you’re a high-income retiree, the 0.7% increase might not reach your pocket — the tax recovery could offset it.

How to Plan for This Canada Cost of Living Increase?

Whether you’re a retiree, a family member, or a financial advisor, here’s a game plan:

- Check your eligibility – confirm you’re enrolled in OAS or GIS.

- Review your income – stay below clawback thresholds when possible.

- Monitor the payment schedule – November 26 2025 is key.

- Adjust your budget – inflation isn’t going away, so account for higher prices.

- Explore delaying OAS – deferring payments until age 70 increases your pension by about 36%.

- Consider taxes – OAS is taxable, but GIS isn’t.

- Track future quarters – the next review will happen in January 2026.

What Else to Know?

Beyond the headline increase, here are a few extra facts that could help you or your clients:

- Automatic 10% boost at age 75: Anyone who turns 75 automatically receives an extra 10% on top of their regular OAS rate, introduced in 2022.

- Payments are taxable: Your OAS counts as taxable income, so you’ll need to report it on your annual tax return.

- Non-residents can still qualify: Canadians living abroad may still get OAS depending on how long they’ve lived in Canada.

- CPP vs OAS: The Canada Pension Plan (CPP) works separately from OAS but often pays around the same date each month.

- Inflation protection: If CPI drops, OAS doesn’t fall. The government freezes the payment until inflation rises again.

Canada Carbon Tax Rebate Coming in 2026? Check Eligibility, Payment Amount & Date

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria

Pension Boost Canada in November 2025: Check Expected CPP and OAS Pension Increase in 2025

Real-World Examples

Example 1: Mary, 68 years old

Mary lives in Alberta and has lived in Canada for 40 years. Her monthly OAS payment before October 2025 was CAD $734.95. With the 0.7% increase, her new payment rises to CAD $740.09. That’s an extra CAD $5.14 per month — roughly CAD $61 more per year.

Example 2: Joe, 76 years old

Joe is 75+ and automatically receives the 10% age bonus. His payment before the increase was CAD $808.45/month. With the 0.7% bump, he’ll now receive about CAD $814.10/month. Because he also works part-time, he must monitor income to avoid the clawback.

Example 3: Financial Advisor Scenario

You’re advising a 65-year-old client deciding when to start OAS. You show them two scenarios:

- Start now at CAD $740/month, indexed quarterly.

- Delay until 70 for 36% higher payment (~CAD $1,006/month).

You explain that deferring helps reduce clawback risk while benefiting from multiple inflation adjustments.

Common Myths

- Myth 1: You must apply each time for an increase.

Truth: It’s automatic once you’re enrolled in OAS. - Myth 2: The increase is one-time.

Truth: It happens quarterly — expect more small bumps each year. - Myth 3: Everyone gets the same amount.

Truth: The amount depends on your age, years in Canada, and income. - Myth 4: The government can reduce OAS if inflation drops.

Truth: Payments never decrease; they stay flat until inflation rises again.

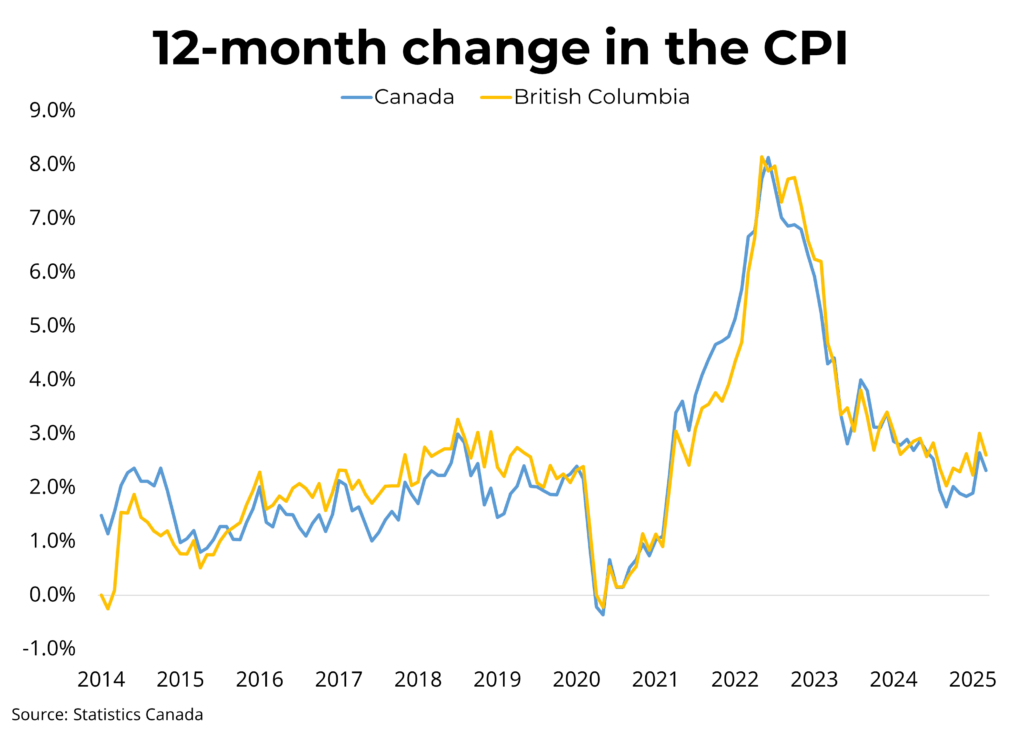

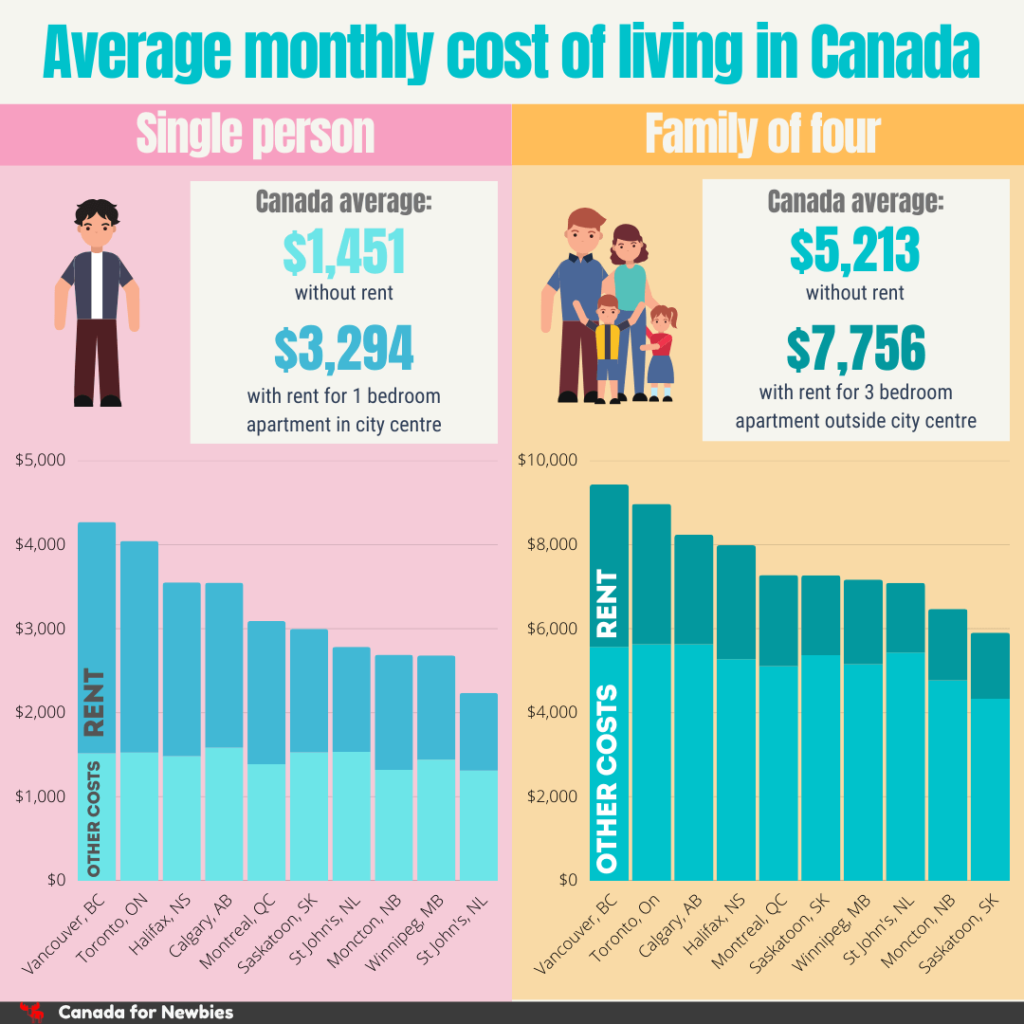

Economic Context: Inflation and Outlook

According to Statistics Canada, inflation has moderated from the peaks of 2022 and 2023 but remains sticky in core categories like food and housing. For retirees, this means their budget pressures haven’t vanished. A 0.7% COLA helps, but inflation has averaged around 3% annually in recent years — so the increase does not fully offset rising living costs. Economists expect gradual CPI growth of 2–2.5% through 2026, suggesting future OAS adjustments will continue but stay modest. For financial professionals, the key is to balance these trends in long-term retirement forecasts.

Practical Takeaways

- No need to apply — it’s automatic.

- Expect a 0.7% increase in your November 26 payment.

- Recalculate budgets and tax plans to include the higher amount.

- Keep an eye on the clawback if you earn over CAD $90,000.

- Plan ahead — inflation adjustments happen quarterly, not yearly.