Canada Carbon Tax Rebate: If you’ve been hearing rumors that the Canada Carbon Tax Rebate might be coming back in 2026, you’re not alone. From coffee shop chatter in Calgary to Reddit threads and financial blogs, folks all over are wondering if the once-popular Canada Carbon Rebate (CCR) will make a return next year. So let’s clear the air — no fluff, no fancy jargon. This article breaks down what’s real, what’s not, and how this rebate actually works. Whether you’re a busy parent, a student just filing your first tax return, or a finance pro looking for the facts, this guide is your one-stop shop.

Table of Contents

Canada Carbon Tax Rebate

The Canada Carbon Tax Rebate 2026 may not be coming back — at least not yet. But the end of this rebate doesn’t mean the end of climate affordability efforts. The government is likely exploring new ways to help Canadians transition to cleaner energy without breaking the bank. If you’ve been counting on these payments, don’t stress.

| Topic | Details |

|---|---|

| Program Name | Canada Carbon Rebate (CCR), formerly Climate Action Incentive Payment (CAIP) |

| Last Payment Date | April 22, 2025 |

| Status for 2026 | No federal rebate scheduled (Program paused after April 2025) |

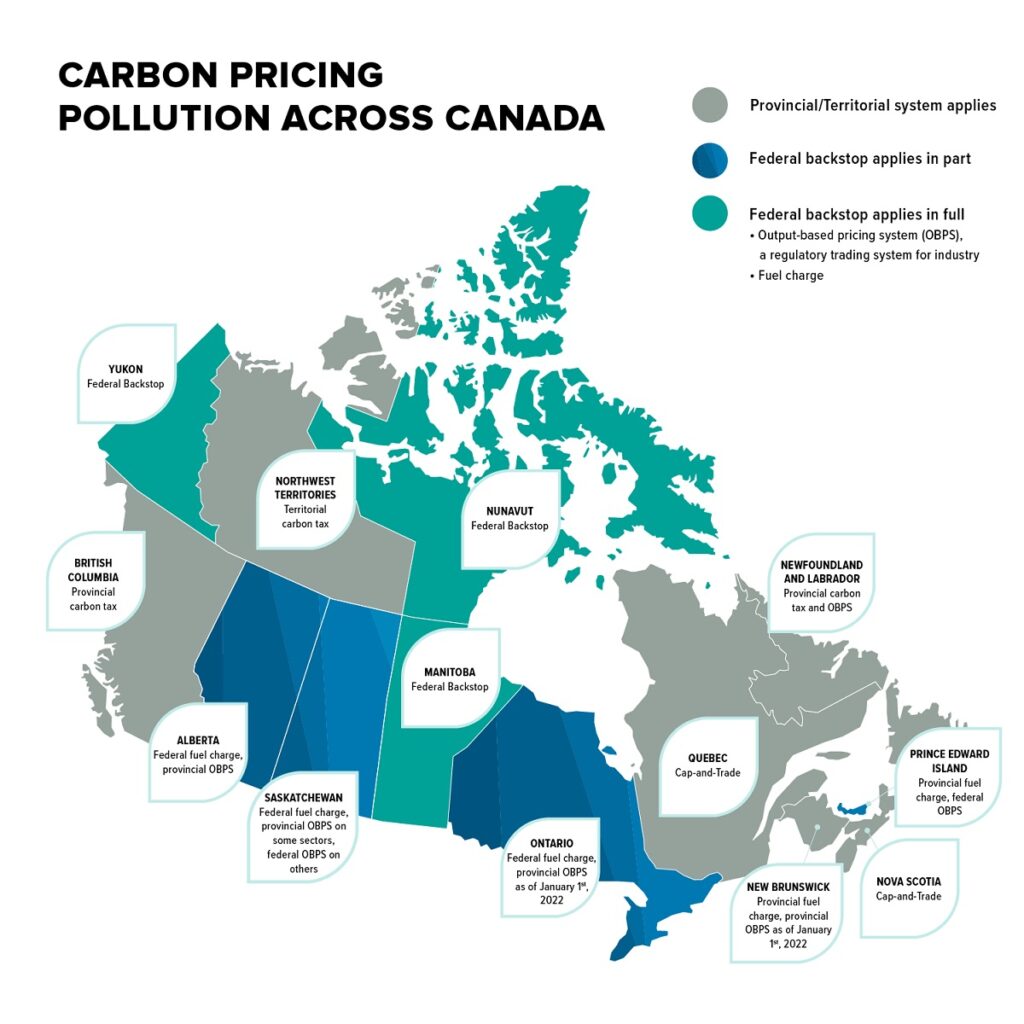

| Eligibility | Canadian residents in provinces under the federal carbon-pricing system |

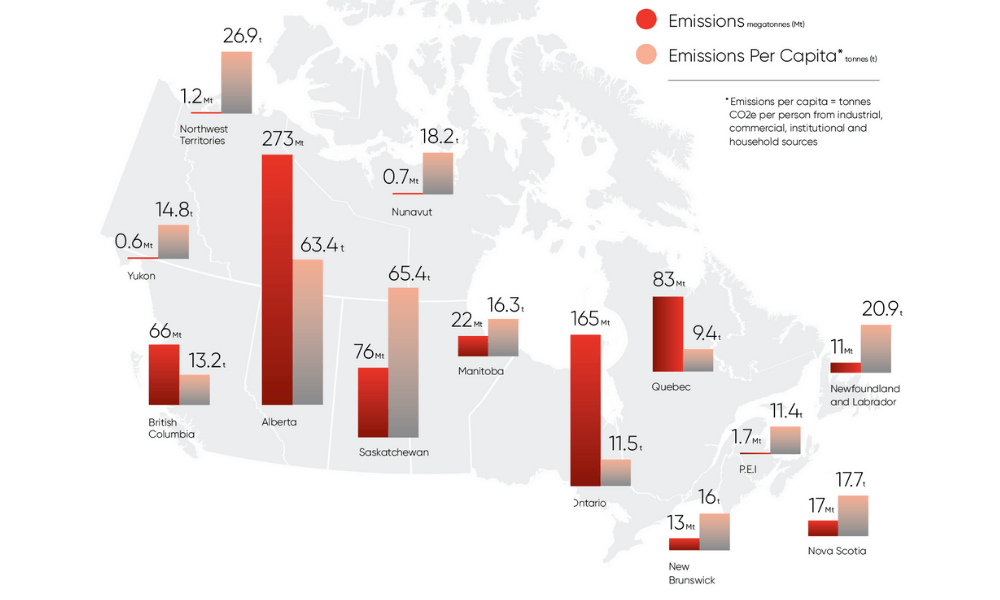

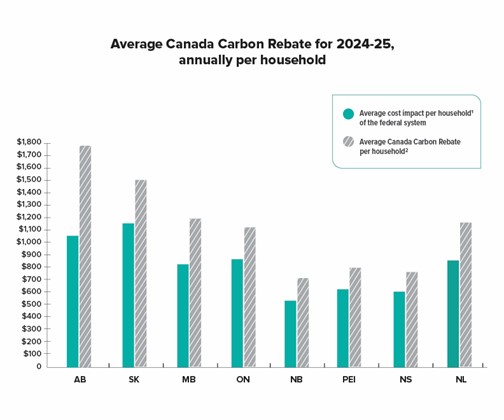

| Average Annual Payment (2024) | $250–$1,120 depending on household size and province |

| Rural Supplement | 20% bonus for residents outside Census Metropolitan Areas |

| Official Website | Canada.ca – Canada Carbon Rebate |

What Is the Canada Carbon Tax Rebate?

The Canada Carbon Rebate (CCR) is a government payment designed to offset the cost of the federal carbon tax. Essentially, when fuel and heating prices go up because of carbon pricing, the government sends a rebate to households to help balance the cost.

Think of it as a “cash-back” for doing your part to live in a cleaner, greener country. The idea was simple: charge polluters, help regular Canadians, and use that money to encourage greener habits.

Introduced in 2019 as the Climate Action Incentive Payment, it later evolved into the CCR in 2024 to make it easier for people to understand what it was actually for.

Why Was the Rebate Paused in 2025?

The federal government announced that the consumer fuel charge — the main source of CCR funding — would end in March 2025. With that, the CRA confirmed the final CCR payment was issued in April 2025.

That means, as of now, there are no new quarterly payments planned for 2026.

However, some provinces may continue similar programs or introduce new ones independently. So, while the federal rebate is on pause, local rebates might still pop up. Keep your eyes on your provincial government’s announcements.

A Quick Look Back: Why the Carbon Rebate Mattered

The carbon rebate wasn’t just about money — it was about accountability.

When the federal carbon tax was introduced, it was meant to make people and businesses think twice about burning fossil fuels. But since that raised everyday costs (like gas and heating), the rebate was a way to say: “Hey, we know prices are up, but here’s some relief.”

According to Statistics Canada, over 80% of households in provinces using the federal carbon-pricing system got back more money in rebates than they paid in additional fuel costs.

That’s a win-win in most folks’ books.

Payment Dates & Amounts (2024–2025 Reference)

Here’s a snapshot of what the payments looked like before the pause:

- Quarterly schedule: January, April, July, and October.

- 2025’s final payment: Issued on April 22, 2025.

Example: Alberta 2024 Base Year

- Individual: $228

- Spouse: $114

- Child (under 19): $57

- Family of Four: $456 + rural bonus (20%) = ~$547

Step-by-Step: How to Check Your Eligibility for Canada Carbon Tax Rebate

Even if no new payments are scheduled, you might still want to check your eligibility status or confirm your previous payments. Here’s how:

- Log into your CRA My Account

- Go to Benefits and Credits.

- Click Canada Carbon Rebate.

- Review your payment history and eligibility notes.

- If anything looks off, call the CRA Benefit Enquiries line at 1-800-387-1193.

Pro Tip: Even if the program doesn’t restart, filing your taxes on time keeps you eligible for any new benefit programs the government rolls out.

The Economics: What Experts Say

According to environmental economist Dr. Brett Dolter from the University of Regina, the rebate was “critical to public acceptance of carbon pricing.” Removing it without a clear replacement could create “confusion and financial stress for middle-income households.”

Financial planners echo that concern. Without the rebate, the average family in Saskatchewan could lose about $1,000 in annual offset support.

The federal government has hinted at introducing new climate affordability programs in the future, but no official replacements have been confirmed yet.

How It Compares to U.S. Programs

Many American readers might be thinking, “Wait, don’t we have something like that?”

Not exactly — but similar ideas exist. The Inflation Reduction Act (IRA) in the U.S. provides tax credits and rebates for clean energy investments, such as buying electric vehicles, installing solar panels, or improving home efficiency.

While Canada’s CCR was direct cash in your account, the U.S. approach uses tax credits — meaning you benefit when you file taxes or make green purchases.

So, while the north gets a “refund check,” the south gets a “discount at checkout.” Different systems, same goal: reduce emissions without crushing consumers.

Future Outlook: Could the CCR Return in 2026 or Later?

As of fall 2025, there’s no confirmed plan to restart the Canada Carbon Rebate in 2026. However, policy experts suggest that if fuel prices spike or climate goals lag, the government could relaunch a similar incentive under a new name.

Tips for Canadians: How to Stay Prepared

Even if the rebate is paused, here’s what smart households are doing:

- Keep receipts for home energy upgrades — these could qualify for future green tax credits.

- Track your CRA benefits — updates usually appear in your My Account dashboard before public announcements.

- Explore provincial energy programs — Ontario, Alberta, and Nova Scotia have their own eco-grant systems.

- Stay informed through official newsletters — sign up for CRA email alerts.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

65+ Seniors will get $3900 CRA Pension in November 2025, Check Eligibility, Process, Date