Canada Announced $300 Federal Payment: You’ve probably seen headlines like that blowing up on social media lately. TikTok, Facebook, even WhatsApp chats — everyone’s talking about a mysterious $300 federal payment in October 2025. It sounds exciting, especially with rising costs of groceries, rent, and utilities across Canada. But let’s pause right there — because there’s no official confirmation of any new, one-time $300 federal payment. Not from the Canada Revenue Agency (CRA), not from the Department of Finance, not from any official press release.

Still, that doesn’t mean there isn’t money on the way. In fact, October 2025 will bring a cluster of federal benefit payments, including the GST/HST Credit, Canada Child Benefit, Canada Disability Benefit, and the Advanced Canada Workers Benefit. Some people might receive more than $300 in total — but it’s a mix of ongoing programs, not a one-time bonus. This article breaks down exactly what’s real, what’s rumor, and how you can check if you might qualify for extra money this fall. Written in plain language — but backed by official data — it’s your guide to understanding the truth behind the “$300 payment” story.

Table of Contents

Canada Announced $300 Federal Payment

The “$300 Federal Payment in October 2025” rumor has taken the internet by storm — but after checking official CRA and Canada.ca resources, it’s clear that no such one-time payment exists. Instead, Canadians can look forward to regular scheduled benefits like the GST/HST Credit, Canada Child Benefit, Advanced Canada Workers Benefit, and the brand-new Canada Disability Benefit. Together, these programs continue to provide crucial financial help — sometimes adding up to several hundred dollars a month. The takeaway? Don’t fall for viral posts or unofficial claims.

| Topic | Confirmed Facts (October 2025) | Who’s Eligible / What It Means |

|---|---|---|

| No new $300 payment | No government announcement of a one-time $300 federal payment | Avoid misleading social media posts |

| GST/HST Credit | Next payment on October 3, 2025 | Low- and modest-income Canadians |

| Canada Disability Benefit (CDB) | Monthly benefit starts in mid-2025 | Adults 18–64 with an approved Disability Tax Credit |

| Advanced Canada Workers Benefit (ACWB) | Payment on October 10, 2025 | Low-income working Canadians |

| Canada Child Benefit (CCB) | Payment on October 20, 2025 | Families with children under 18 |

| Official Source | Canada.ca |

Why Everyone’s Talking About the Canada-Announced $300 Federal Payment?

So where did this rumor even come from? There are three main explanations:

- Multiple benefits arrive in October – Many Canadians get their GST/HST credit, workers’ benefit, child benefit, and disability benefit within a three-week window. That can total several hundred dollars — which looks like a single “$300 federal payment” if you’re checking your bank account quickly.

- Social media confusion – Many pages recycle old COVID-era stimulus posts, swapping “2020” for “2025” to drive clicks. It spreads fast when people share screenshots that look official.

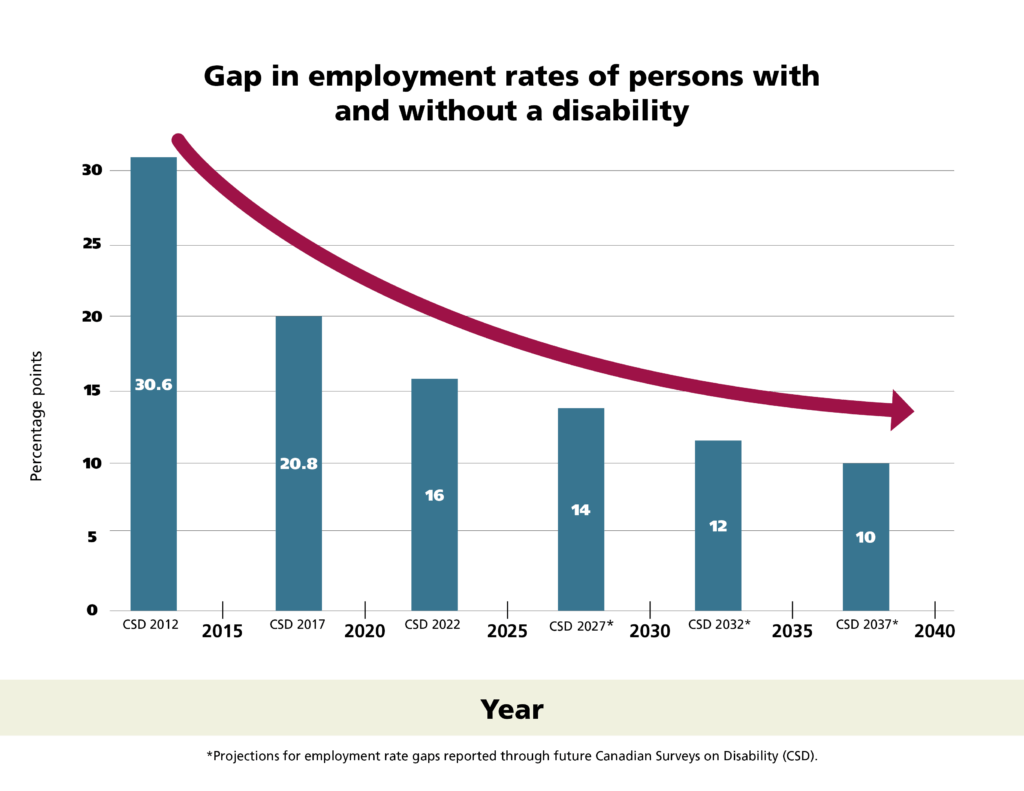

- New benefit programs cause mixed messages – The Canada Disability Benefit (CDB) is brand new, starting in 2025. Early coverage mentioned estimates “up to $300 a month,” which likely helped fuel the rumor.

In short: yes, there’s real money flowing, but no, there’s no flat $300 payment to everyone.

Understanding the Real Benefits Canadians Will Receive

GST / HST Credit

- Next Payment: October 3, 2025

- Who Gets It: Individuals or families with modest incomes who filed a tax return for 2024.

- Average Amount: Around $234 for singles and up to $467 for families per quarter.

- Tax-Free: Yes — this payment is not taxable.

- Purpose: Helps offset the GST or HST Canadians pay on goods and services.

The CRA automatically determines eligibility based on your previous year’s tax return. You don’t have to apply — just make sure you file your taxes on time.

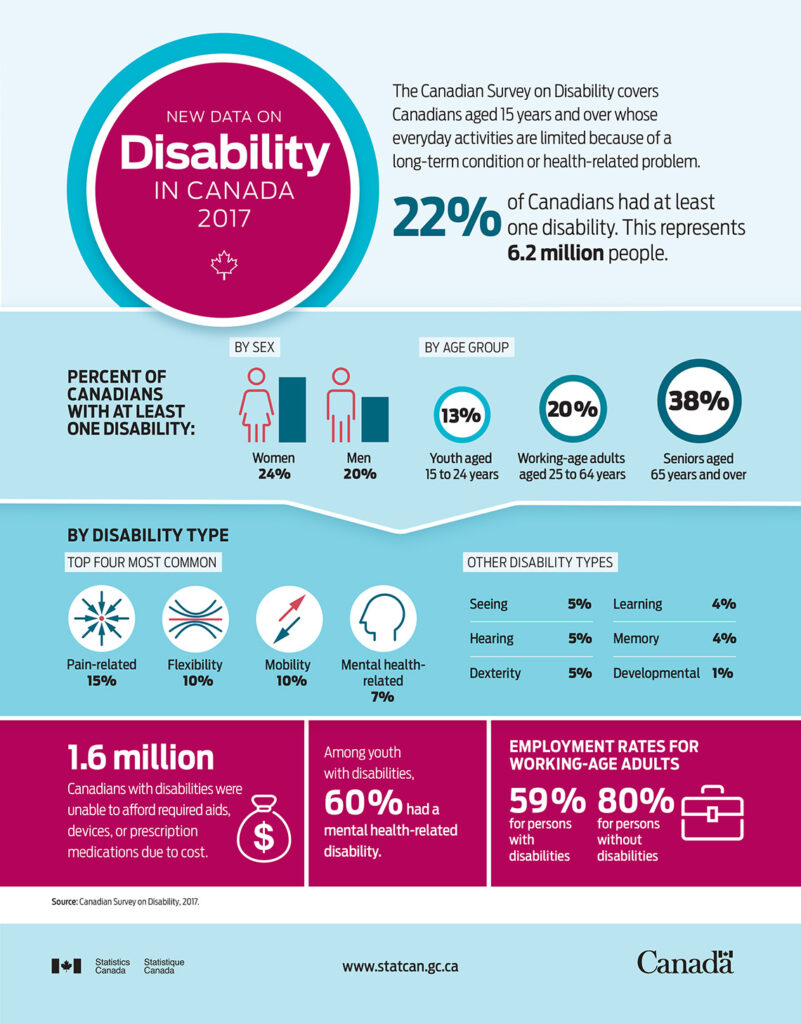

Canada Disability Benefit (CDB)

The CDB is one of the biggest new federal support programs in decades. It’s designed to provide a guaranteed monthly income top-up for working-age adults with disabilities.

- Start Date: Mid-2025 (payments begin in July).

- October Payment: Expected on October 16, 2025.

- Who Qualifies: Canadians aged 18–64 who are approved for the Disability Tax Credit (DTC).

- Estimated Amount: Early reports suggest around $200–$300 per month, depending on income and province.

- Retroactive Pay: If your application is approved late, you could receive back pay to July 2025.

The program is administered federally but may coordinate with provincial disability programs.

Advanced Canada Workers Benefit (ACWB)

This benefit supports low-income working Canadians and ensures that employment always pays more than social assistance.

- Next Payment: October 10, 2025

- Who Gets It: Workers aged 19+ earning below approximately $33,000 (single) or $43,000 (families).

- Average Amount: $350 to $700 quarterly, depending on province and family status.

- How It Works: Automatically calculated when you file your income tax.

Canada Child Benefit (CCB)

The CCB remains one of Canada’s largest family supports.

- Next Payment: October 20, 2025

- Who Gets It: Parents or guardians with children under 18.

- Average Amount: $619 per month for each child under 6, $522 for ages 6–17.

- Tax-Free: Yes.

- Automatic Renewal: Based on your tax return each year.

How to Check If You Qualify for $300 Federal Payment?

- File Your Taxes Every Year

Benefits like the GST/HST credit, ACWB, and CCB depend entirely on your income tax return. If you don’t file, you don’t get paid. - Apply for the Disability Tax Credit (DTC)

If you live with a long-term disability, ask your doctor to help complete the DTC application. Once approved, it unlocks the new CDB payments. - Set Up Direct Deposit

CRA deposits benefits faster and safer directly into your account. You can register through My CRA Account. - Keep Info Updated

Moved? Changed jobs? Got married? These changes affect your benefits. Update CRA records right away. - Use the CRA Benefits Calendar

Bookmark the CRA Benefits Calendar so you never miss a payment date.

Common Scams and How to Stay Safe

Scammers love using fake “benefit announcements.” Here’s how to stay one step ahead:

- The CRA never texts or emails links for payments.

- Official websites always end in “.gc.ca” — never “.com” or “.org”.

- Be skeptical of viral posts claiming new “emergency” or “bonus” cheques.

- Search the claim on Canada.ca or trusted media outlets like CBC, Global News, or CTV.

- If you suspect fraud, report it to the Canadian Anti-Fraud Centre.

Real-Life Scenarios

Let’s take a few examples to see how October payments might actually look.

Scenario 1: Sarah, 29, works full-time making $30,000/year

- GST/HST Credit: $117

- Canada Workers Benefit: $200

Total: $317

Scenario 2: Daniel, 35, single parent of two kids under 6

- GST/HST: $234

- CCB: $1,038

Total: $1,272

Scenario 3: Priya, 42, lives with a disability and earns $22,000/year

- GST/HST: $117

- CDB: $200 + $400 in retroactive pay

Total: $717

Each of these people might look at their October deposits and think, “I got $300!” — but it’s actually a combination of legitimate, scheduled benefits.

October 2025 Benefit Calendar

| Date | Program | Notes |

|---|---|---|

| October 3 | GST/HST Credit | Quarterly payment |

| October 10 | Advanced Canada Workers Benefit | Second installment |

| October 16 | Canada Disability Benefit | Monthly benefit |

| October 20 | Canada Child Benefit | Monthly benefit |

Why Misinformation Spreads So Easily?

Financial misinformation thrives online because it mixes truth with half-truths. A post that says, “Canadians to get $300 in October!” isn’t completely false — some will indeed receive that much — but it’s misleading because it implies a universal payment.

Reasons it spreads fast:

- Clickbait drives ad revenue for fake news sites.

- AI-generated posts recycle old benefit data.

- Facebook groups amplify misleading “shareable” graphics.

- Genuine confusion due to overlapping benefits.

That’s why experts always say: go to the source. The CRA and Canada.ca publish all verified payment schedules in one place.

How to Stay Financially Prepared?

Even without a one-time bonus, there are smart ways to make sure you’re not missing federal support:

- Double-check your eligibility every year for the GST/HST credit and CWB.

- Apply early for the Disability Tax Credit to qualify for the new CDB.

- Enroll in provincial programs — for example, Ontario’s Trillium Benefit or BC’s Climate Action Tax Credit — which often align with federal benefits.

- Track your payments — set up notifications in your bank app to label CRA deposits.

- Read official newsletters from CRA or sign up for email updates at canada.ca.

Financial literacy isn’t about memorizing acronyms — it’s about knowing what’s real and what’s rumor.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount

Canada $4100 CRA Direct Payment in October 2025: Check Payment Date & Eligibility Criteria