Canada $750 + $890 Double CPP Payment: There’s a lot of chatter online about a supposed “Canada $750 + $890 Double CPP Payment Coming in October 2025.” It’s showing up on social media feeds, YouTube videos, and even some blog posts that look convincing. For many retirees and working Canadians, that kind of news sounds like music to the ears — especially with inflation and grocery prices still biting into monthly budgets. But before you plan that extra Costco trip or think about a fall getaway, it’s time to slow down and check the facts.

Is there really a double CPP payment in October 2025? Who’s eligible? And where did this story even come from? Let’s break it all down, step by step.

Table of Contents

Canada $750 + $890 Double CPP Payment

The claim of a “$750 + $890 Double CPP Payment in October 2025” is false. As of now, Canada’s federal payment schedule lists only one regular CPP payment for that month — October 29, 2025. CPP remains one of the most stable, predictable pension systems worldwide. While bonus payments sound tempting, it’s smarter to focus on verified financial planning, tracking contributions, and maximising your retirement strategy through legitimate means.

| Topic | What to Know |

|---|---|

| Rumored Double CPP Payment | $750 + $890 claim not confirmed |

| Official October 2025 Payment Date | October 29, 2025 |

| Maximum Monthly CPP (2025) | $1,433 CAD (age 65 new retirees) |

| Average CPP Benefit (2025) | $848.37 CAD/month |

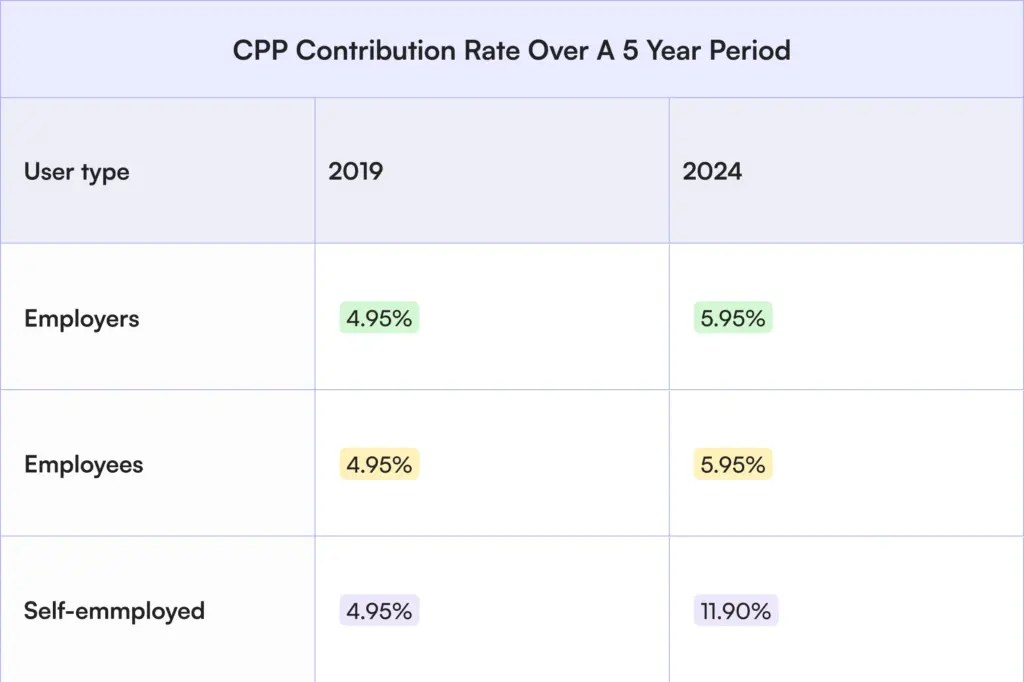

| Contribution Rate (2025) | 5.95% employee/employer, 11.9% self-employed |

| CPP Enhancement | Raises benefits over time since 2019 |

| Source / Reference | Canada.ca |

Understanding the Claim: “Canada $750 + $890 Double CPP Payment”

This rumor claims that seniors and CPP beneficiaries in Canada will receive two separate deposits — one for $750 and another for $890 — in October 2025. Some posts even suggest it’s a “bonus” from the government or a cost-of-living relief payment.

But here’s the truth:

There’s no record, statement, or policy announcement from the Government of Canada, Service Canada, or the Canada Revenue Agency confirming such payments.

According to official sources, the CPP (Canada Pension Plan) continues as a regular monthly benefit, and no additional or “double” payments have been scheduled or legislated for October 2025.

What the Canada Pension Plan (CPP) Actually Is?

To understand why a “double payment” doesn’t fit the CPP model, let’s recap how the plan actually works.

The Canada Pension Plan is a public retirement income system. It’s funded by contributions made by workers and employers throughout their careers. The plan is designed to replace a portion of your income after retirement, disability, or the death of a contributor.

It’s similar in concept to Social Security in the United States — you pay into it while you work, and later, you receive a monthly benefit.

CPP payments are:

- Regular (once per month)

- Based on your lifetime contributions

- Adjusted annually for inflation

- Paid for life once you qualify

That predictability is part of what makes CPP a cornerstone of retirement security in Canada — and why surprise “bonus payments” don’t usually happen.

Why the “Canada $750 + $890 Double CPP Payment” Rumor Is False?

- No official confirmation exists.

Government payment schedules list only one CPP deposit each month, including for October 2025. - CPP is not a relief program.

Unlike one-time COVID or inflation relief checks, CPP is an ongoing pension plan governed by contribution rules and regulations. Any changes require federal legislation. - No budget references.

The federal budgets for 2024 and 2025 include no new provisions for one-time CPP bonuses. - Scam potential.

Some online sources have used this rumor to attract clicks or collect private information from seniors. Always verify through official websites.

How CPP Works: A Simple Breakdown

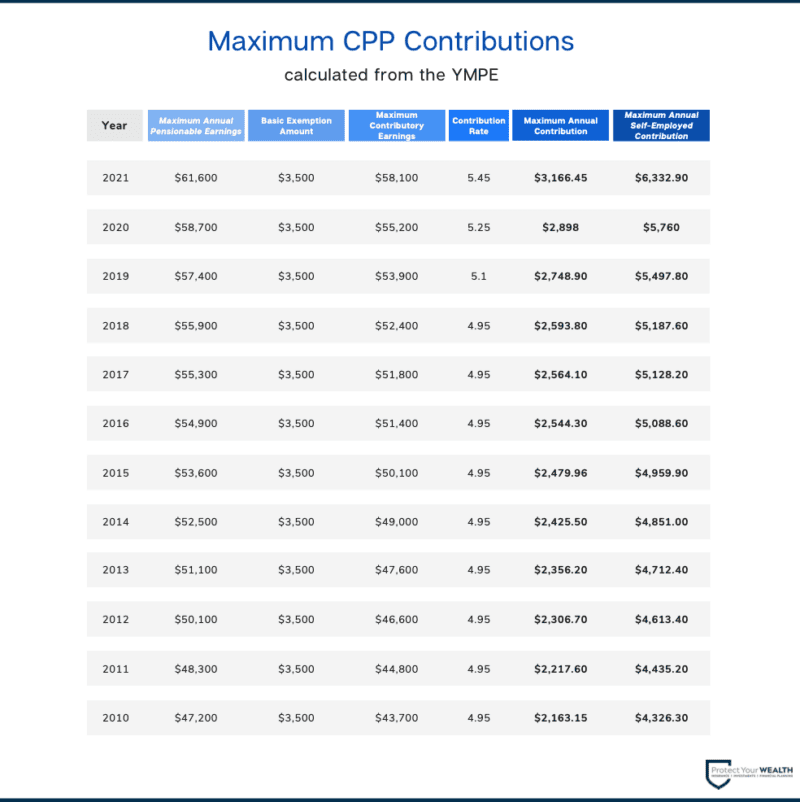

Step 1: You Contribute During Your Working Years

Every employed Canadian (except Quebec, which has QPP) contributes to CPP through automatic payroll deductions.

- Contribution rate (2025): 5.95% from employee, 5.95% from employer

- Maximum pensionable earnings (2025): $71,300

- Exemption amount: $3,500

- Self-employed rate: 11.9% total (both shares)

These contributions fund your future retirement and disability benefits.

Step 2: You Apply for CPP When Ready

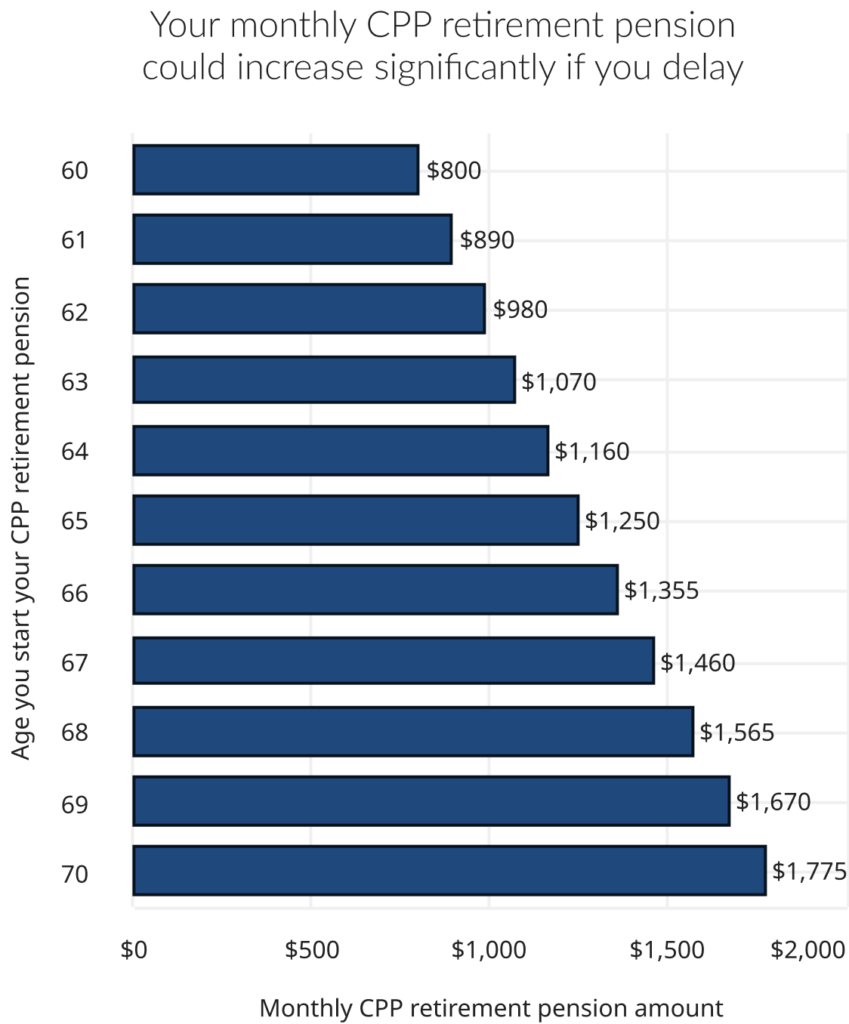

You can start receiving CPP anytime between ages 60 and 70:

- Starting early (at 60) means smaller monthly payments — 0.6% less for each month before age 65.

- Delaying until 70 increases payments by 0.7% per month after age 65.

Step 3: You Receive Monthly Payments for Life

Once approved, CPP is paid monthly for the rest of your life. Payments are automatically adjusted each January to reflect inflation.

For example:

If you start CPP in 2025 at age 65 with full contributions, your monthly amount could reach $1,433 CAD. Most Canadians, however, receive less — around $848 per month.

CPP vs OAS vs GIS: What’s the Difference?

Many Canadians confuse CPP with other federal benefits. Here’s a quick breakdown:

| Benefit | Who Qualifies | What It Provides | Key Difference |

|---|---|---|---|

| CPP (Canada Pension Plan) | Workers who contributed | Earnings-based retirement pension | Based on your work contributions |

| OAS (Old Age Security) | All Canadians 65+ meeting residency | Basic monthly income | Based on years lived in Canada |

| GIS (Guaranteed Income Supplement) | Low-income OAS recipients | Extra support | Needs-based, not contribution-based |

Sometimes, OAS or GIS payments arrive near the same time as CPP deposits, leading some people to think they’ve received “double CPP.” In reality, they’re separate programs.

How Inflation and Cost of Living Affect CPP?

The CPP is indexed to inflation using the Consumer Price Index (CPI). That means if living costs rise, your monthly benefit increases too.

For 2025, experts estimate a 2.7% inflation adjustment, meaning your CPP should rise modestly — not through extra payments, but through a built-in annual cost-of-living increase.

This ensures retirees can maintain purchasing power even as everyday prices change.

Verifying Your CPP Payment Schedule

You can easily confirm your payment details and schedule:

- Visit the official My Service Canada Account (MSCA) at canada.ca/my-account.

- Log in using GCKey or a secure banking login.

- Navigate to “CPP and OAS” → “Payment Information.”

- Check your Statement of Contributions for historical payments and future schedules.

If you notice any discrepancies, contact Service Canada directly by phone or through secure messaging.

Real-Life Example: Understanding Payment Differences

Let’s look at an example for clarity.

Jane, 66, retired in early 2024 after 40 years of full-time work. She receives the maximum CPP of $1,433 monthly.

Her friend Mark, who worked part-time most of his life, receives $780 monthly. Both see the same deposit date (October 29, 2025), but no “double payment.”

If they both receive OAS as well (which arrives a few days apart), their combined deposits could total over $2,000 — which might easily be mistaken for a “double CPP.”

Common Sources of CPP Confusion

- Retroactive Payments:

When your application is approved late, you might receive backdated payments. That’s not a bonus — it’s just what you’re owed. - OAS and CPP Payments Arriving Together:

Two separate programs, often close dates. - Inflation Increase Notices:

Annual increases sometimes spark rumors of “new” money. - Fake “Government Refund” Emails:

These phishing scams mimic Service Canada branding but lead to fraudulent pages.

How to Maximize Your CPP Income?

- Work Longer: Each additional contribution year boosts your average.

- Delay Payments: Waiting until 70 can increase your pension by up to 42%.

- Use the Child-Rearing Provision: Exclude low-income years when caring for young children.

- Keep Contributing Post-65: If working, your Post-Retirement Benefit (PRB) adds to your income.

- Combine With Spouse’s Planning: Coordinate withdrawals for tax optimization.

These strategies are legal, transparent, and far more effective than chasing viral bonus rumors.

Protecting Yourself from CPP Scams

Scammers often target seniors using financial buzzwords like “bonus,” “double,” or “emergency payments.”

Here’s how to protect yourself:

- Never provide your Social Insurance Number (SIN), banking details, or personal info via email or text.

- Ignore messages that promise “extra CPP funds” or “early access.”

- Confirm any payment announcements directly on canada.ca.

- Report suspicious contacts to the Canadian Anti-Fraud Centre.

The government will never ask you to “confirm” your identity through links or urgent messages.

Canada $1400 Extra OAS Payment for Seniors Coming in October 2025: Check Payment Dates & Eligibility

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility