Canada $713.34 OAS Pension: If you’re living in Canada or planning retirement here, you may have heard about the Old Age Security (OAS) pension and its estimated payment of $713.34 for November 2025. Whether you’re wondering who qualifies, how much you can expect to get, or when the government deposits payments, this comprehensive guide breaks down everything in a friendly, clear way. Even if you’re not a numbers person, you’ll get the scoop on eligibility, payment details, and tips to make the most of this essential financial boost for seniors. No jargon here—just solid info plus expert guidance you can trust.

Table of Contents

Canada $713.34 OAS Pension

The Old Age Security (OAS) pension remains a cornerstone of retirement income for Canadians 65 and older. With about $713.34 average monthly payments for November 2025, this benefit is a crucial safety net adjusted regularly for inflation. Eligibility hinges on residency and citizenship, but various tools like benefit deferrals, social security agreements, and complemented benefits like GIS can considerably boost your retirement income. Stay on top of your payments, understand your income impact on the clawback. The financial peace of mind it offers is worth the effort.

| Highlight | Details |

|---|---|

| November 2025 OAS Payment Date | November 20 or 26, 2025 (depending on bank/payment type) |

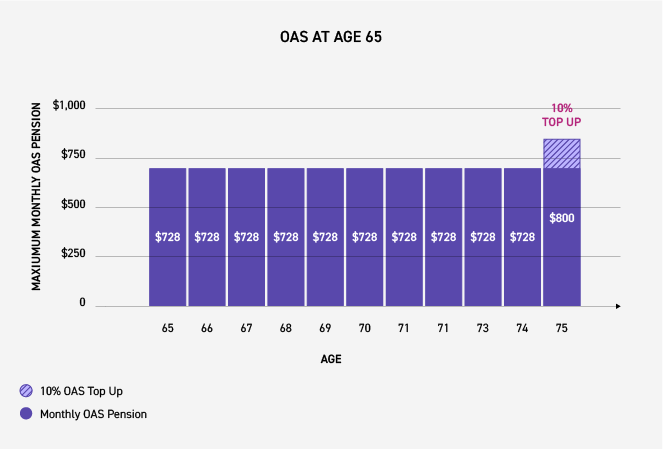

| Typical Monthly Payment Amount | $740.09 (ages 65–74), $814.10 (ages 75+) |

| Eligibility Age | 65 years or older |

| Residency Requirement | 10 years living in Canada after 18 for partial; 40 years for full pension |

| Income Threshold for Clawback | Approx. $90,000 or more in net income means partial repayment |

| Application Process | Usually automatic if tax info is updated; manual application possible |

| Official Source | Canada.ca |

What Is the Old Age Security (OAS) Pension?

The OAS pension is a government benefit paid monthly to Canadian seniors aged 65 and older. It helps with living expenses once earnings from work start winding down. Unlike the Canada Pension Plan (CPP), which is based on your employment contributions, OAS is funded by tax revenues and based primarily on age and residency.

How Much Can You Expect?

- In 2025, the average OAS payment will be roughly $713.34 per month.

- More specifically, people aged 65 to 74 will get about $740.09, while those 75 and older will receive around $814.10 monthly.

- These payments adjust quarterly based on inflation to keep pace with rising living costs.

Who is Eligible for Canada $713.34 OAS Pension?

To receive the OAS pension, you need to meet a few basic criteria:

- You must be 65 years of age or older.

- Be a Canadian citizen or legal resident when your pension application is approved.

- Residency requirements:

- Have lived in Canada for at least 10 years after age 18 to receive a partial pension.

- For the full pension, you need to have resided in Canada for at least 40 years after age 18.

- If you live abroad, you can still receive payments if you have 20 years of residency after 18 and were a citizen or legal resident before leaving.

- Your income will be reviewed; earning above certain limits could lead to a repayment or clawback.

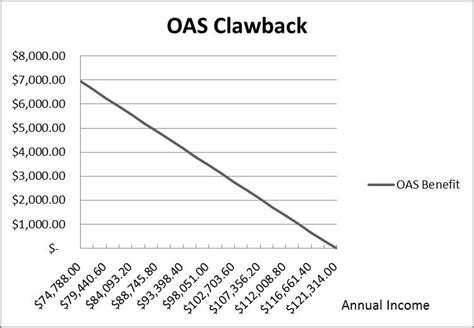

Income and the OAS Clawback Explained

One important point: if your net income exceeds roughly $90,000 per year, you may have to pay back part or all of your OAS pension. This is called the OAS clawback or recovery tax.

Here’s how it works:

- For every dollar above the threshold, you repay 15 cents.

- If your income gets too high (about $134,000 or more), your OAS pension could be fully clawed back.

So, if you have other big income streams like investment earnings or a high CPP pension, plan accordingly to minimize surprises.

How and When is OAS Paid?

OAS payments come monthly, usually around the 20th to 27th of each month. Your November 2025 payment should arrive between November 20 and 26.

They’re paid through direct deposit to your bank. If you haven’t set this up yet, it’s wise to do so to avoid delays.

If you don’t apply by yourself, the government often automatically signs you up based on tax records and age information. But if you’re not receiving payments and are eligible, apply promptly via Service Canada’s online portal: Old Age Security Application.

Social Security Agreements and OAS for Expats

If you spent part of your working life outside Canada, particularly in countries that have a social security agreement with Canada (like the U.S., UK, Australia, etc.), you may still qualify for OAS. These agreements let you combine your years of contributions or residency in both countries to meet eligibility requirements.

That’s super important if you’ve worked in multiple countries but call Canada home now.

How to Maximize Your OAS Benefits: Pro Tips

- Keep Your Info Updated: Make sure Service Canada has your current address and bank details.

- Consider Deferral: You can delay OAS pension start up to age 70 and get 0.6% more monthly for every month you defer. That adds up to roughly 36% more per year! Smart for healthy seniors who want bigger checks.

- Factor in the Clawback: If you have high income, consult a financial advisor to plan withdrawals or income timing.

- Combine with GIS: The Guaranteed Income Supplement (GIS) helps low-income seniors and can be claimed alongside OAS.

- Utilize Tax Credits: Seniors may be eligible for extra tax credits and benefits, lowering overall tax burdens.

OAS vs Other Benefits: What’s the Difference?

| Benefit | Description | Eligibility | Payment Frequency |

|---|---|---|---|

| Old Age Security (OAS) | Monthly pension based on age and residency | 65+, residency in Canada | Monthly |

| Canada Pension Plan (CPP) | Earnings-based pension from employment | Based on valid CPP contributions | Monthly |

| Guaranteed Income Supplement (GIS) | Additional income support for low-income seniors | Low income, receiving OAS | Monthly |

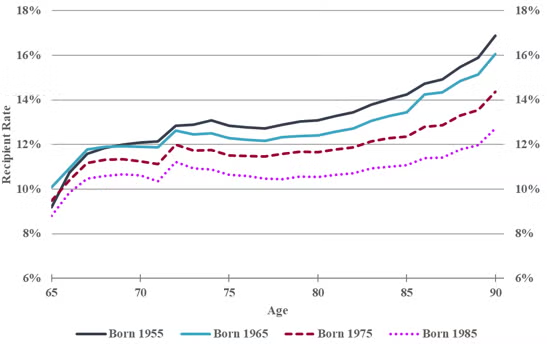

Historical Evolution of OAS

Understanding the OAS pension today means looking back at its roots. The Old Age Security program began in 1927 as a modest initiative providing a $20 monthly pension to British subjects aged 70 and older who met residency and income criteria. It was means-tested with strict income limits and excluded certain populations.

The program was a modest start to nationwide benefits for poor elderly Canadians, but it laid the foundation for the comprehensive system we see now. In 1960, OAS paid a flat $55 monthly benefit at age 70, funded by general revenues. The eligibility age gradually dropped from 70 to 65 between 1966 and 1970, expanding access. Over time, the program moved away from strict means testing and grew to cover nearly all Canadian seniors meeting residency requirements.

The Canada Pension Plan (CPP) launched in 1966 complemented OAS by providing earnings-related benefits based on employment contributions, adding greater income replacement security. Today, OAS remains a non-contributory program acting as a safety net to ensure all seniors have a basic income floor, while private savings and other pensions provide additional retirement income.

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria