Canada $3500 Old Age Security Payment: Hey there, Canada! If you’ve been hearing buzz about a $3,500 Old Age Security (OAS) payment hitting bank accounts in November 2025 and wondering whether it’s true, you’re in the right place. Whether you’re already enjoying your retirement or planning ahead, understanding OAS is crucial to keep your money matters steady. This detailed guide breaks down everything — eligibility, payment structure, adjustments, and even a bit of fascinating OAS history.

Table of Contents

Canada $3500 Old Age Security Payment

The Canada Old Age Security (OAS) program is a foundational pillar of financial security for millions of seniors. While rumors about a $3,500 one-time payment in November 2025 are unfounded, regular OAS payments — combined with GIS and related benefits — continue to support older Canadians through rising living costs. Staying updated, managing your tax situation, and exploring options like deferring payments or combining GIS can help you maximize what you receive.

| Highlight | Details |

|---|---|

| OAS Payment Date (November 2025) | Around November 26, 2025 (subject to banking schedules) |

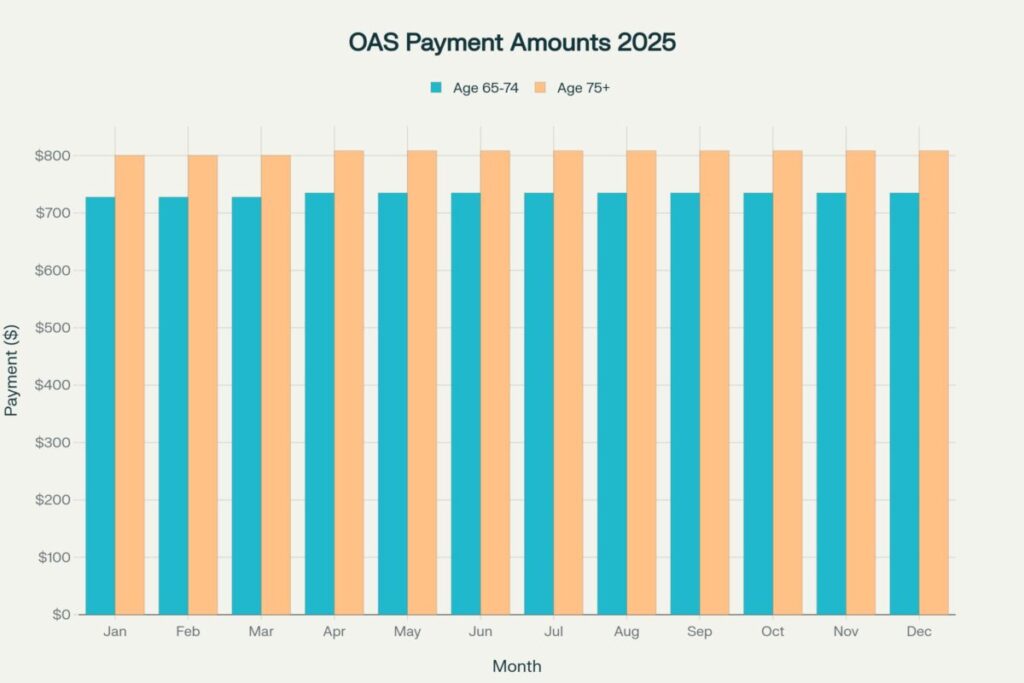

| Monthly Payment Amount (Oct–Dec 2025) | $740.09 (65–74 years), $814.10 (75+) |

| Past One-Time Relief Payments | $2,350 issued earlier in 2025; no new $3,500 payment confirmed |

| Funding Source | General tax revenue (not employee contributions) |

| Eligibility | 65+, Canadian citizen or legal resident, 10–20 years residency rule applies |

| Additional Benefits | GIS, Allowance, and Allowance for the Survivor programs |

| Official Site | Canada.ca – Old Age Security |

What Is Old Age Security (OAS)?

Old Age Security (OAS) is Canada’s cornerstone public pension program. It was launched in 1952 and has become one of the country’s most important social safety nets. Unlike the Canada Pension Plan (CPP), which you pay into through your working life, OAS doesn’t depend on your employment history or contributions. It’s funded through general government revenues, which means every Canadian taxpayer helps sustain it.

OAS is meant to ensure that seniors over 65 have a basic, reliable income source, especially after retirement. Over time, it’s been expanded through additional programs like the Guaranteed Income Supplement (GIS) for low-income seniors and Allowances for spouses and survivors aged 60–64.

In short, OAS is the backbone of Canada’s senior income support system — and it’s indexed to inflation, so payments rise as the cost of living does.

A Bit of OAS History: From 1927 to Today

The OAS traces its roots to the Old Age Pensions Act of 1927, introduced by the Mackenzie King government after years of advocacy from social reformers like James S. Woodsworth and Abraham Heaps. Back then, seniors had to pass a humiliating means test and could only receive small, province-based pensions.

The Old Age Security Act of 1951 replaced this patchwork with a federal system that removed most of those degrading tests. The first universal OAS payments were issued in 1952, at just $40 per month.

Since then, the program has evolved significantly:

- 1967: The GIS (Guaranteed Income Supplement) was added.

- 1975: OAS became fully indexed to inflation.

- 2022: Seniors aged 75+ started receiving a 10% permanent payment boost.

- 2025: The program now helps about 7 million Canadians and costs more than $50 billion annually in benefits.

Today, it remains central to Canada’s retirement system, alongside the CPP and private savings.

Understanding the “Canada $3500 Old Age Security Payment” Rumor

Let’s clear the air: there’s no official announcement from the Government of Canada about a $3,500 OAS payment for November 2025. The confusion likely stems from:

- The earlier $2,350 one-time top-up paid in mid-2025 to help offset inflation pressures.

- Speculative online claims or fake “benefit boost” posts circulating on social media.

OAS doesn’t work as a lump-sum program. It’s a steady monthly benefit, designed for long-term support, not occasional big deposits.

How Much Can You Get from OAS in 2025?

The amount you receive depends on your age, income, and years of residency in Canada after age 18.

- Ages 65–74: Up to $740.09/month

- Ages 75 and over: Up to $814.10/month (includes 10% increase introduced in 2022)

If you lived in Canada fewer than 40 years after turning 18, you’ll receive a partial OAS payment. It’s calculated as:

Years lived in Canada ÷ 40 = Proportionate OAS amount

Example: You lived in Canada for 28 years — you get 28/40 = 70% of full OAS.

OAS payments are reviewed every three months (January, April, July, October) and adjusted according to inflation using the Consumer Price Index (CPI).

Who Can Receive OAS?

To qualify for the full Old Age Security pension, you must:

- Be 65 years or older.

- Be a Canadian citizen or legal resident when approved.

- Have lived in Canada for at least 10 years (if residing in Canada).

- Have lived in Canada for at least 20 years (if residing abroad).

You can still qualify if you’ve worked in another country that has a social security agreement with Canada — your time abroad can count toward residency.

If you receive other income from employment, investments, or private pensions, OAS may be adjusted through the OAS Recovery Tax (Clawback) once your annual income exceeds about $90,997 (2025 threshold).

How to Apply for Canada $3500 Old Age Security Payment?

Many seniors are automatically enrolled if they’ve filed taxes consistently and their information is updated with Service Canada. If not automatically enrolled, you can:

- Apply online via My Service Canada Account (MSCA).

- Apply by mail using the OAS Application Form (ISP-3550).

- Visit Service Canada offices for in-person help.

You can apply up to 11 months before turning 65 to ensure payments start on time.

OAS Add-Ons: GIS and Allowances

Guaranteed Income Supplement (GIS) – For seniors with low annual incomes (under around $21,624 for singles, and $28,000 for couples in 2025). It’s non-taxable and paid monthly along with OAS.

Allowance for Spouses and Survivors – Available for individuals aged 60–64 whose spouses receive GIS, or for widowed persons within that age bracket. These programs ensure income stability even before full OAS eligibility starts.

Together, GIS and Allowances provide vital additional income to nearly 2.3 million Canadian seniors annually.

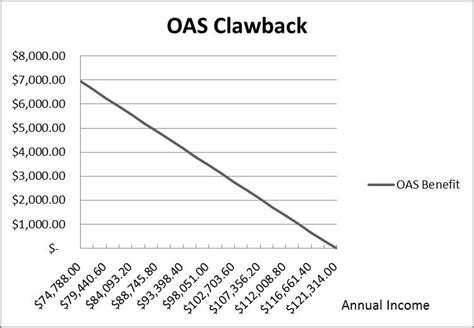

The OAS Clawback (Recovery Tax)

If your net income exceeds a set threshold — about $90,997 in 2025 — the government begins reducing your OAS benefits. At around $148,605 (65–74) or $154,196 (75+), your OAS may be entirely clawed back.

This system ensures that support focuses on those who need it most. The clawback is calculated when you file your annual tax return, so having a good accountant or retirement planner can help minimize losses.

Why Some Delay OAS Payments?

You can delay OAS up to age 70 to increase your monthly pension by 0.6% per month of delay, up to 36% more by waiting the full five years.

This strategy makes sense if:

- You plan to work after 65.

- You have other income streams like CPP or RPP.

- You want larger lifetime payments later.

Example: Someone choosing to start OAS at age 70 instead of 65 could see their monthly payment climb from $740 to about $1,005.

How OAS Fits in Canada’s Modern Pension System?

Canada’s retirement income system is built on three pillars:

- Public Pensions – OAS, GIS, and CPP provide a foundation for all seniors.

- Employer Pensions – Workplace pension plans (defined benefit or contribution).

- Private Savings – RRSPs, TFSAs, and personal investments.

For most Canadians, the first pillar — OAS — guarantees a baseline of financial stability. The other two layers determine overall comfort in retirement.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility