Canada $300 Federal Payment: If you’ve been keeping an eye on the news or chatting with friends lately, chances are you’ve heard about the $300 federal payment that might be hitting Canadians’ bank accounts in November 2025. This potential benefit has generated quite a buzz, especially among families and seniors facing rising costs of living. But what exactly is this payment? Who qualifies, and how can you ensure you don’t miss out? In this comprehensive guide, we’ll break down everything you need to know — whether you’re a single parent, a senior, or just someone trying to make ends meet.

Table of Contents

Canada $300 Federal Payment

The upcoming $300 federal payment in November 2025 is more than just extra cash — it’s a sign that the government recognizes the real struggles faced by Canadians in dealing with elevated costs. Whether you’re a parent managing kids’ expenses, a senior on a fixed income, or just someone trying to bridge the gap between paychecks, this boost can make a real difference. Make sure you’re eligible by filing your taxes and updating your info. Planning ahead and budgeting wisely can turn this temporary relief into meaningful financial stability. You don’t have to navigate these benefits alone — resources are there to support you, and staying informed is the best way to ensure you receive every dollar you qualify for.

| Aspect | Details |

|---|---|

| Payment Amount | One-time payment of $300 |

| Expected Payment Window | Between November 20 and 30, 2025 |

| Eligible Recipients | Low- to middle-income families, seniors, and benefit recipients |

| Purpose | To help offset rising costs, such as food, heating, and utilities |

| Related Benefits in November 2025 | CCB, OAS, CPP, GST/HST Credit, CWB, Climate Action Incentive |

| Source | Canada Revenue Agency |

Context and Background of the Canada $300 Federal Payment

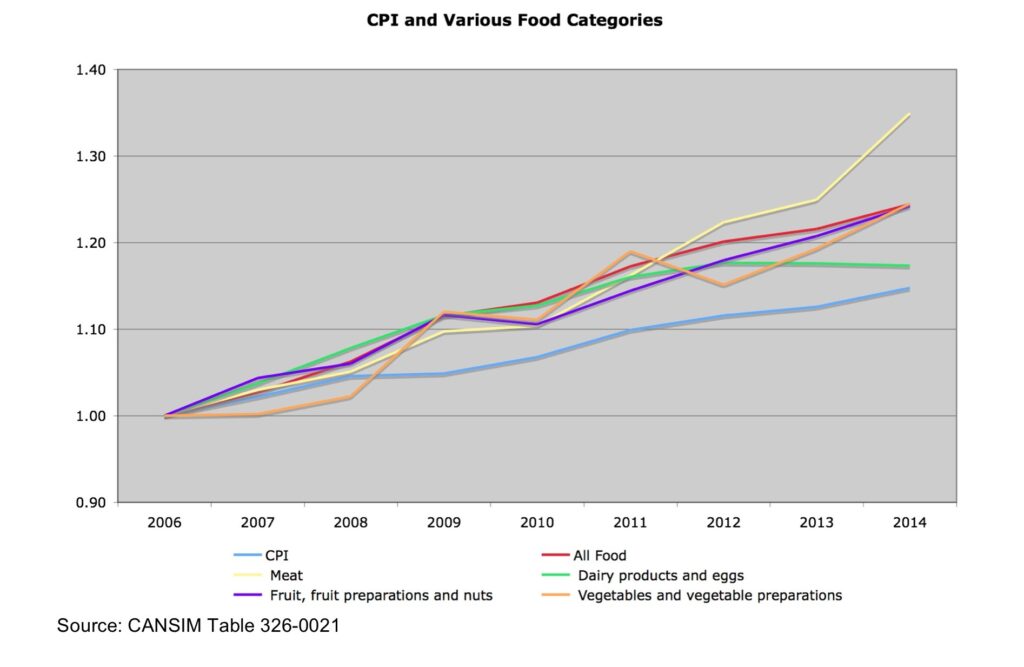

The Canadian government regularly offers various benefits to support its citizens. These include the Canada Child Benefit (CCB), Old Age Security (OAS), Canada Pension Plan (CPP), and many others designed to help low- and middle-income Canadians cope with economic pressures. The anticipated $300 one-time payment is part of an ongoing effort to provide additional relief during challenging times, especially considering inflationary pressures, high energy costs, and food prices increasing across the country.

While this payment has been extensively discussed in headlines and social media groups, the official confirmation from the government was pending, leading to many questions around eligibility, payment dates, and application processes. This guide consolidates the latest verified information to clear up the confusion.

What Is the Canada $300 Federal Payment About?

The $300 federal payment is intended as a one-time financial boost designed primarily for low- and middle-income Canadians. Think of it as a seasonal “extra” — much like a holiday bonus — that can help families pay for groceries, heating bills, or urgent expenses during winter.

This initiative is part of a broader move by the government to cushion the impact of inflation, which has hit food prices, energy bills, and housing costs hard over the past year. It aligns with previous support measures, including increased child benefits, tax credits, and pensions, aiming to make daily life a little easier.

Why Was This Payment Introduced?

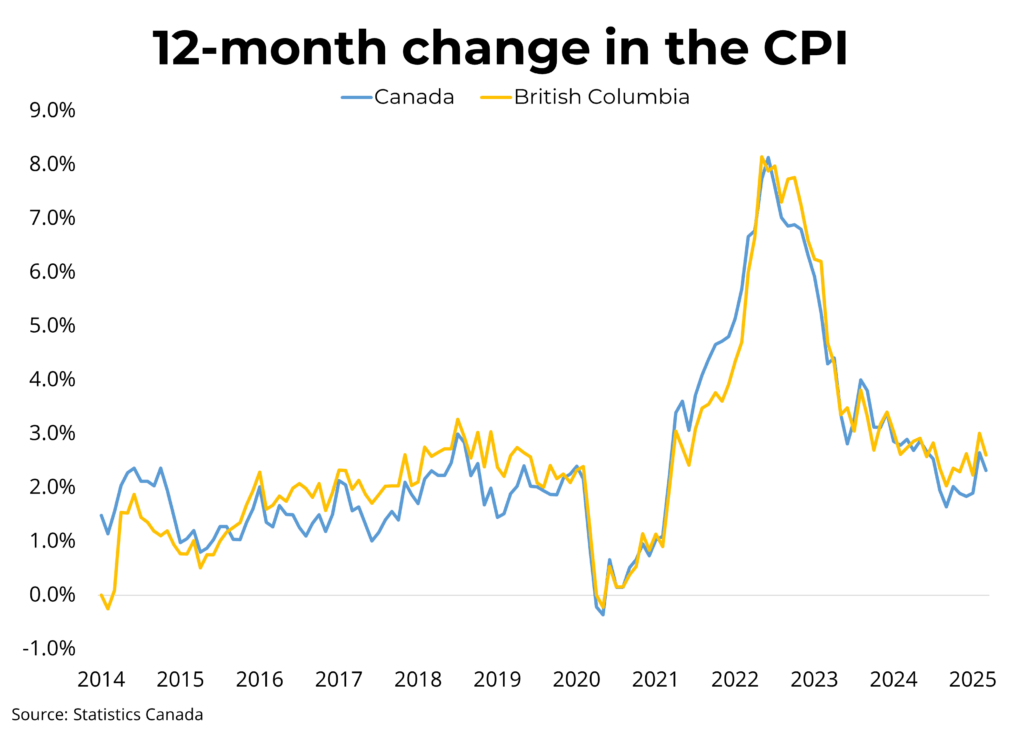

Inflationary pressures have led to an increase in the cost of essentials for many Canadian households. For example, in 2025, the average cost of utilities and groceries has risen approximately 8-10% across the country, according to Statistics Canada. Recognizing this, the government announced targeted payments to assist those most affected, especially seniors living on fixed incomes and working families struggling to cover rising expenses.

Who Qualifies for the $300 Payment?

Understanding eligibility is crucial. While the government has provided general criteria, specifics may vary based on income, household size, and province. The key factors include:

- Residency: Must be a legal resident of Canada.

- Tax Filing: Must have filed your 2024 taxes by the deadline (April 30, 2025).

- Income Level: Households below certain net income thresholds — often around CAD $60,000 — are likely targets.

- Benefit Recipients: People already receiving benefits like the Canada Child Benefit (CCB), Old Age Security (OAS), or Canada Pension Plan (CPP) may automatically qualify.

- Additional Factors: Seniors receiving international or provincial benefits, or individuals on income assistance, might be eligible too.

Special Note for Seniors and Benefit Recipients

According to the latest schedules, recipients of Old Age Security (OAS) and Canada Pension Plan (CPP) will likely see the $300 bonus automatically reflected in their November benefits if they meet the criteria.

When Will the Payment Be Made?

Based on official schedules, the payment window for the $300 bonus is expected to land between November 20 and 30, 2025. Most recipients will get their money via direct deposit, which is faster and more secure, while some might receive paper checks, which can take additional days to arrive.

How to Track Your Payment?

- Check your CRA My Account: This portal provides real-time updates on benefit payments.

- Ensure your banking details are current: For direct deposit, update your info on CRA’s official portal.

- Contact CRA: If your payment is delayed or you think you qualify but haven’t received it, call the CRA helpline.

Other Benefits and Payments in November 2025

In addition to the $300 bonus, many Canadians will receive their regular benefits, such as:

- Canada Child Benefit (CCB): Paid around the 20th of each month.

- Old Age Security (OAS): Distributed on November 27.

- Canada Pension Plan (CPP): Also paid on November 27.

- GST/HST Credits: Usually sent earlier in October but applicable in upcoming quarterly payments.

- Canada Workers Benefit (CWB): Next scheduled for payment on November 25, helping low-wage workers.

Why It’s Important?

Knowing your payment dates helps you plan your finances better. For instance, if the $300 bonus is your main winter support, aligning your bills and expenses around it can prevent surprises.

How to Maximize and Budget Your $300 Cash?

Cash doesn’t last forever, so here are tips on making this bonus work for you:

- Prioritize urgent expenses: Heating, groceries, or medication.

- Set aside savings: Even a small emergency fund is powerful.

- Pay down debt: Use the money to reduce high-interest credit card debt.

- Plan for upcoming bills: Car repairs, school supplies, or holiday shopping.

- Compare prices: Use apps or websites to find discounts on essentials.

How to Check Your Eligibility and Appeal if Necessary?

If you believe you qualify but haven’t received the payment, here’s what to do:

- Verify your tax filings: Ensure you filed your 2024 return correctly.

- Update your information: Make sure your bank details and contact info are current on CRA.

- Reach out to CRA: If no payment arrives by early December, contact CRA customer support.

- File an appeal: If you’ve been wrongly disqualified, you may appeal or request a review via CRA’s online portal.

Historical Context: Past Relief Payments

The $300 in November 2025 isn’t the first time Canadians have received targeted relief. During the pandemic in 2020, the government launched the Canada Emergency Response Benefit (CERB) and later Canada Recovery Benefit (CRB), which offered similar lump-sum support.

In 2025, the government continues the tradition of offering seasonal aid—not only for economic recovery but to support families, seniors, and workers during tough times.

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

$628 Canada Grocery Rebate in November 2025: Is it true? How to Check Status