Canada $300 Federal Payment: If you’re living in Canada and heard whispers about a $300 federal payment coming your way this October 2025, you’re in the right spot. This article breaks down everything you need to know about this payment — from who’s gonna get it, when, and how to make sure you’re on the list. Whether you’re a busy pro trying to keep on top of benefits or just want the scoop explained plain and simple, this read will have you covered like maple syrup on pancakes. So, let’s dive right into the details!

Canada $300 Federal Payment

To wrap it up, the $300 federal payment in October 2025 is a solid way the Canadian government is stepping in to ease the financial load on many Canadians during inflationary times. It’s automatic, easy, and designed to help those who need it most without extra effort on your part. Just file your taxes, keep an eye on your CRA account, and use the funds wisely to stretch your budget a bit further this fall.

| Feature | Details |

|---|---|

| Payment Amount | $300 one-time federal payment |

| Target Group | Canadian residents with low to modest income who filed 2024 taxes |

| Distribution Start | Began late September 2025, continuing through October |

| How to Get It | Automatic through CRA, no application needed |

| Purpose | To assist with inflation and increased cost of living |

| Payment Method | Direct deposit or mailed cheque |

| Official Info Source | Canada Revenue Agency (CRA) Official Website |

What’s This Canada $300 Federal Payment All About?

The Canadian government announced a special $300 federal payment aimed at helping folks cope with rising living costs. It’s a one-time boost designed to ease the pinch from inflation and everyday expenses, especially for families, seniors, and low-to-moderate income Canadians. The payment is tied to your previous tax filings, so if you filed your 2024 income tax returns, the government will know if you qualify, no extra hassle needed on your end.

In other words: No need to apply, and the cash could show up straight into your bank account if you get direct deposits from the Canada Revenue Agency (CRA). For others, a cheque will be mailed out soon after.

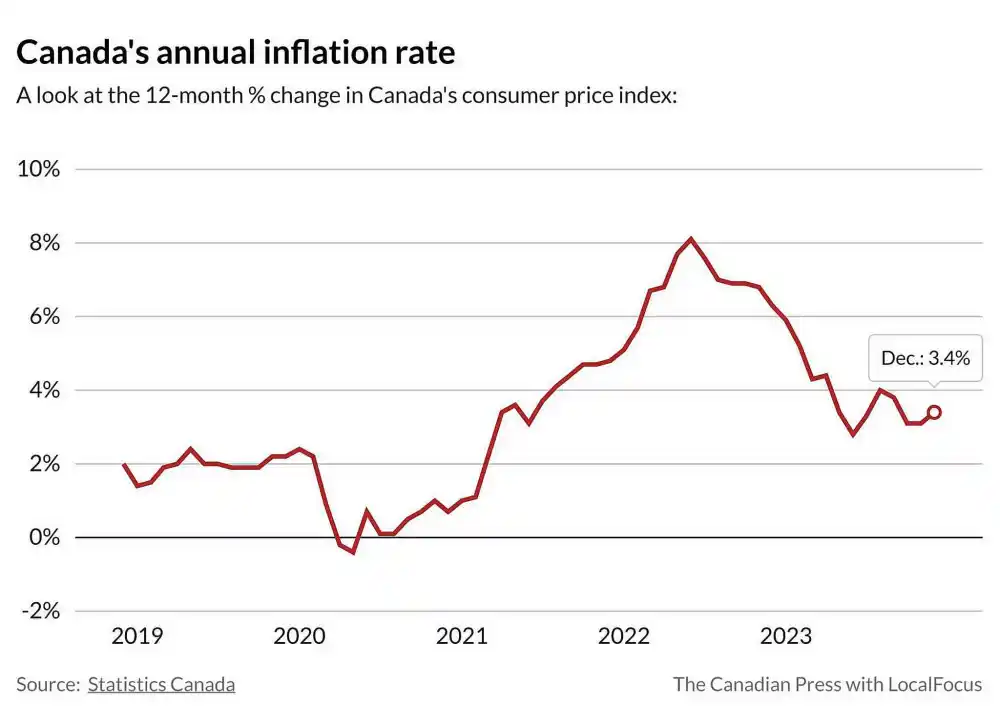

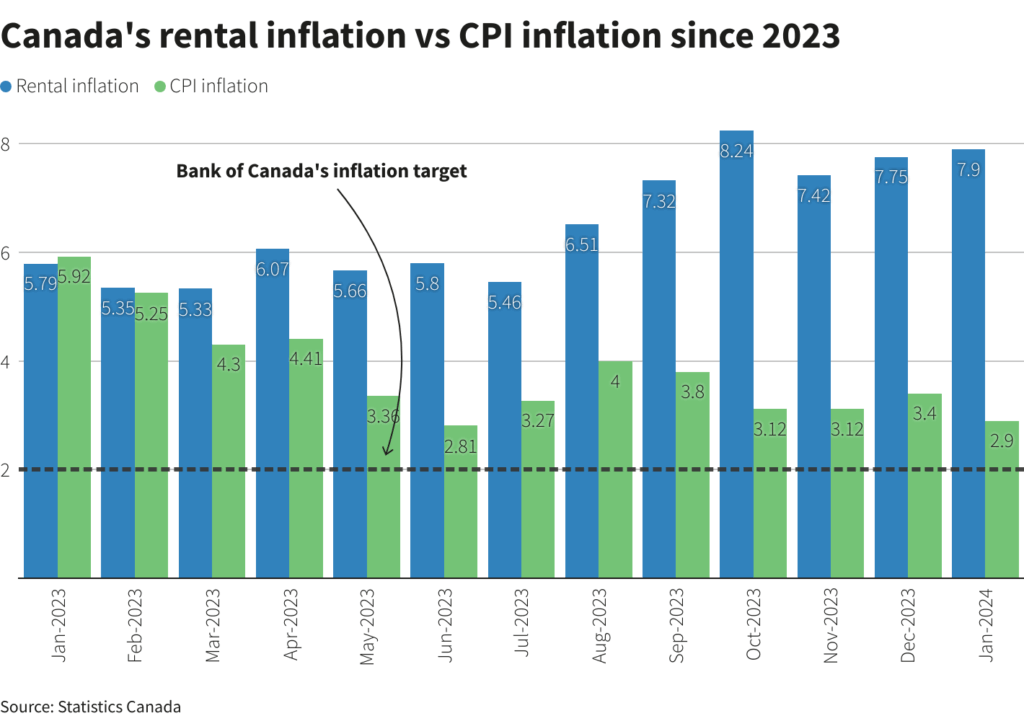

Why It Matters Right Now: Inflation’s Real Impact

Inflation in Canada has ticked up recently, with the Consumer Price Index rising by 3.5% in 2025, marking noticeable increases in grocery bills, gas prices, and utility costs. This means everyday essentials are costing Canadians more, hitting low and middle-income families the hardest. The $300 payment is part of the government’s strategy to cushion this financial squeeze and keep Canadian households stable.

Who’s Eligible for the Canada $300 Federal Payment?

Eligibility is pretty straightforward but has some key points to keep in mind:

- You must be a Canadian resident for tax purposes.

- You need to have filed your 2024 income tax return with the CRA.

- Income thresholds focus on low to moderate-income earners and families who receive credits like the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit.

- Seniors receiving Guaranteed Income Supplement (GIS) or Canada Pension Plan (CPP) retirees may also be included.

- Students and workers affected by the rising cost of living might see this payment if they meet the other criteria.

Pro tip: If you want to double-check your eligibility, use CRA’s online benefits calculator or contact their helpline to get personalized info fast.

Official Views and Expert Take

According to a recent statement from a CRA spokesperson, “This $300 payment is designed to provide targeted, quick relief to Canadians feeling the financial pinch. We want to make sure aid gets to those who need it most efficiently and transparently.”

Financial expert Lisa Morgan from the Canadian Economic Institute adds, “While $300 might not cover all added expenses, it’s a welcome boost that, when combined with other programs, can significantly ease monthly budgets, especially for vulnerable groups.”

How and When Will You Receive Canada $300 Federal Payment?

- The payment rollout officially started September 27, 2025, with many folks getting their money right in their bank accounts if they use direct deposit.

- For those on paper cheque, payments typically take longer due to mailing times—expect cheques within a few weeks after the direct deposit window.

- The CRA automatically calculates who qualifies, so no paperwork or special applications are necessary.

- Other related benefits like the Canada Child Benefit (CCB) and GST credits also continue in 2025, sometimes with additional top-ups this fall.

This system minimizes red tape—no long waits, no complicated forms, just straightforward support when you need it.

A Step-by-Step Guide to Making Sure You Get the Payment

- File Your Taxes on Time

The CRA determines who gets the payment from your 2024 tax return. If you haven’t filed yet, now’s the moment to do so. It’s fast, easy, and often free through certified tax software or community programs. - Update Your CRA My Account Info

Log in to your CRA “My Account” online portal to check your direct deposit info and other contact details. This ensures your payment lands in the right place without delays. - Watch for Official Communications

The CRA will send notifications if you qualify or if there are any issues. These may arrive by mail, email, or through My Account messages. - Plan Your Budget

Though $300 is a one-time payment, using it for essentials like groceries, utility bills, or emergency savings can make a meaningful difference.

Managing Your $300 Payment Wisely

Getting a sudden financial boost feels great! To make the most of it:

- Cover overdue bills first to avoid extra fees.

- Stock up on non-perishables or household essentials.

- Put a portion aside for emergencies or unexpected expenses.

- Consider paying down high-interest debt for long-term savings.

- Explore free financial education resources online like the Financial Consumer Agency of Canada for more tips.

History of Federal Payments in Canada: A Quick Look

Canada has a history of stepping in during economic challenges. From the 2009 Economic Action Plan during the Great Recession to COVID-19 emergency benefits, federal payments have helped millions across the country. This $300 payment fits into that tradition as a targeted measure responding specifically to 2025’s inflation pressures.

Beware of Scams: How to Protect Yourself

Unfortunately, scammers often pose as government officials during payment periods.

- CRA will never ask for personal or banking info via phone or email.

- Always verify messages through the official CRA My Account or website.

- Report suspicious calls or emails to the Canadian Anti-Fraud Centre.

Staying alert ensures your money ends up in YOUR hands, not a scammer’s.

Related Federal Supports to Know

If you qualify for the $300 payment, here are some additional benefits you might want to explore:

- GST/HST Credit: A quarterly tax-free payment to offset sales taxes paid on goods and services.

- Canada Child Benefit (CCB): Monthly payments to help with child-rearing costs.

- Guaranteed Income Supplement (GIS): Extra support for low-income seniors receiving Old Age Security.

- Canada Workers Benefit (CWB): Tax relief for low-income working individuals.

Checking your eligibility for all these supports could unlock additional funds to help balance your finances.

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it? Payment Date

Canada CRA $496 GST/HST Credit for October 2025: Check Payment Dates & Eligibility Criteria

Canada OAS Payment Increased to $1,615 in October 2025: Who will get it? Check Payment Date