Canada $2988 OAS Per Month: You may have come across headlines or social media posts boasting: “Canada $2988 OAS per month for these seniors.” At first glance, that sounds like a dream come true. Who wouldn’t want nearly $3,000 landing in their bank account every single month, simply for being retired? But here’s the catch — that claim is misleading. While the Old Age Security (OAS) program is real and extremely important for Canadian seniors, it does not provide anywhere near $2,988 a month on its own. That figure is more like a combination of several retirement income sources stacked together.

In this guide, we’ll break it all down: how OAS really works, who qualifies, the actual payment amounts in 2025, where the “$2,988” number comes from, and how you can maximize your retirement income. We’ll also dig into payment dates, the history of OAS, tax implications, and even real-life scenarios. By the end, you’ll have clarity — not confusion — about what you can expect.

Canada $2988 OAS Per Month

The idea that Canada pays $2,988/month in OAS is misleading. In reality, the maximum OAS in 2025 is about $727–$800/month. Seniors may approach $2,988 only when combining OAS with CPP, GIS, and private pensions or savings. For Canadians, the key is not to rely on OAS alone. Instead, see it as part of a broader retirement income strategy. By planning ahead, knowing your entitlements, and making smart financial choices, you can build a retirement that’s secure, comfortable, and free from unpleasant surprises.

| Topic | Details |

|---|---|

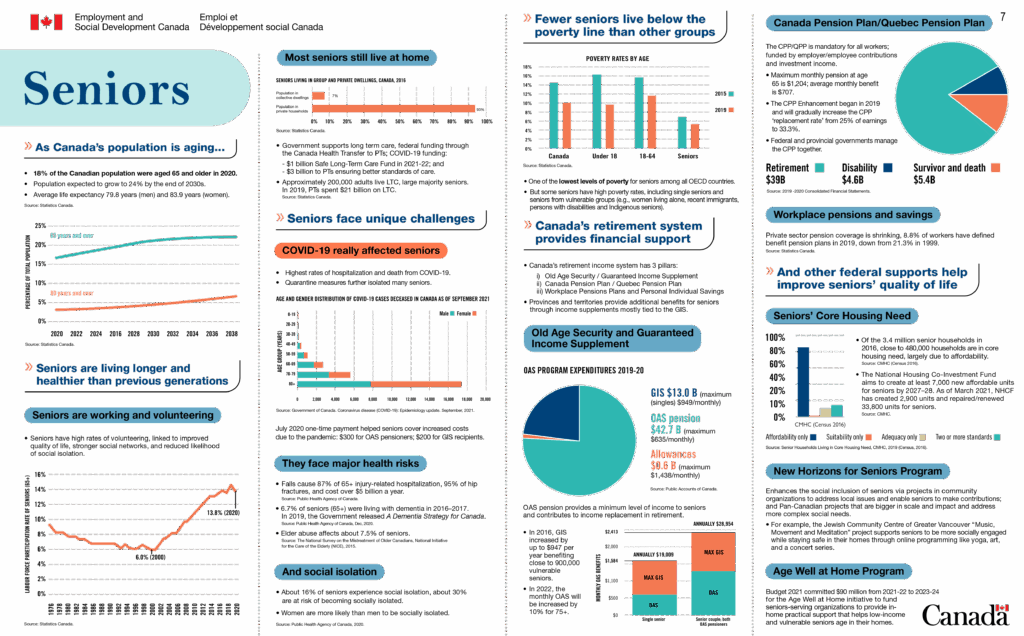

| Official OAS Amount (2025) | $727.67/month (ages 65–74), $800.44/month (75+) [Government of Canada] |

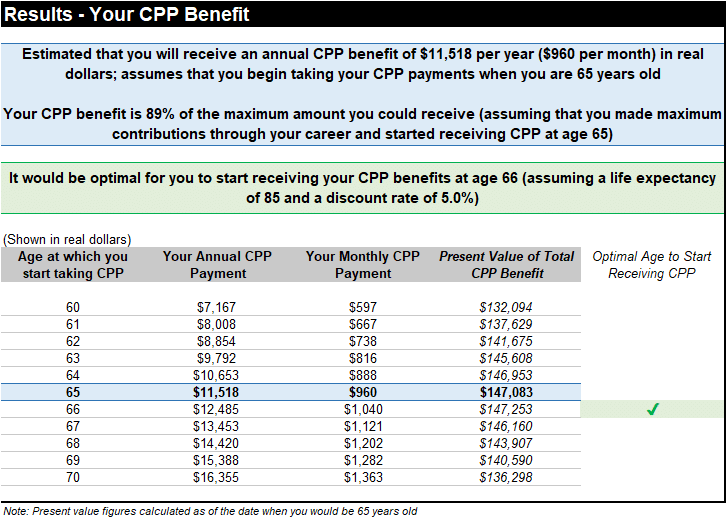

| Maximum CPP Benefit (2025) | About $1,433/month if you contributed the maximum |

| GIS (Guaranteed Income Supplement) | Income-tested; up to ~$1,065/month for singles |

| Typical Combined Income (OAS + CPP + GIS) | Around $1,200–$2,200/month, sometimes more with private pensions. The $2,988 figure is misleading. |

| Payment Dates in 2025 | Last 3 business days of each month (e.g., October 29, 2025) |

A Quick Look Back: Why Does OAS Exist?

The Old Age Security program was introduced in 1927, back when the average Canadian senior lived on very little. It started with payments of just $20 a month — tiny by today’s standards, but back then it was a lifeline.

The program has evolved over the decades to become a major part of Canada’s retirement system, along with the Canada Pension Plan (CPP) and private savings tools like RRSPs and TFSAs. Unlike CPP, you don’t “pay into” OAS during your working years. It’s funded through general tax revenues and meant to ensure that every senior has at least some baseline income in retirement.

The Real OAS Payment Amounts

So let’s set the record straight. As of 2025, the maximum OAS benefit is:

- Ages 65–74: $727.67 per month

- Ages 75+: $800.44 per month (includes a 10% boost added in 2022 for older seniors)

This is far below the $2,988 claim. Even if you delay OAS up to age 70 (which increases the monthly payment by 0.6% for every month delayed), you won’t get anywhere near $3,000.

Why the Canada $2988 OAS Per Month Is Misleading?

The $2988 oas number floating around online is not from OAS alone. It’s a combined figure that mixes multiple retirement income sources:

- OAS: ~$727–$800

- CPP: up to ~$1,433 (only if you contributed the maximum throughout your working life)

- GIS: up to ~$1,065 for low-income seniors

- Private savings or pensions: depends on individual circumstances

When you stack all those together, some seniors could reach close to $2988 OAS per month. But the truth is, very few Canadians will hit that number, and OAS by itself won’t take you there.

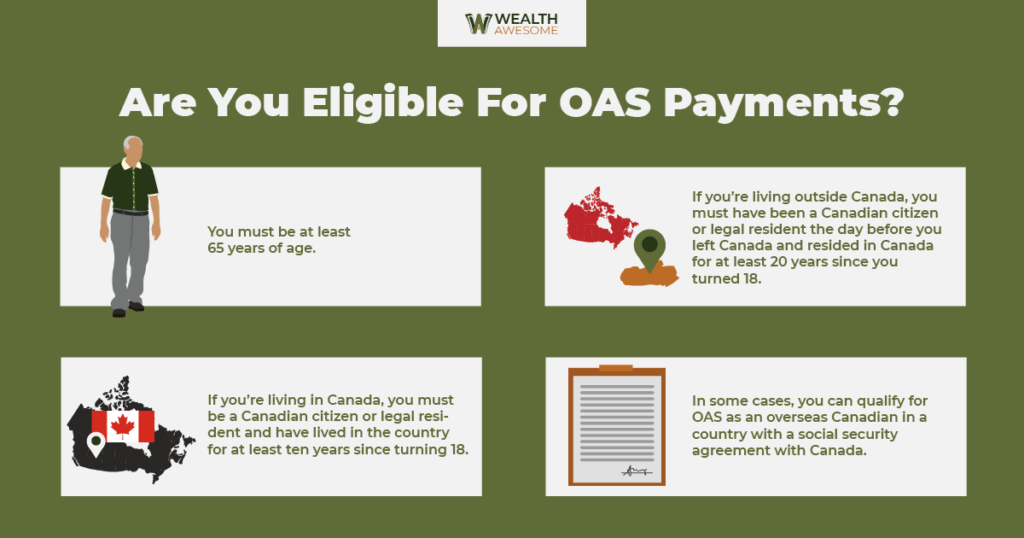

Understanding Eligibility Rules

To qualify for OAS, you must:

- Be 65 years or older

- Be a Canadian citizen or legal resident at the time your application is approved

- Have lived in Canada for at least 10 years after turning 18 (for a partial pension)

- For a full pension, you need 40 years of residence in Canada after age 18

If you’ve lived abroad, you may still qualify if you have at least 20 years in Canada after age 18, or through an international social security agreement.

OAS in Context: Cost of Living

Let’s talk about why OAS alone isn’t enough. According to Numbeo, the average monthly expenses for a single person in Canada (excluding rent) are around $1,300. Add in rent — which ranges from $1,000 in smaller towns to $2,200+ in cities like Toronto or Vancouver — and you’re easily looking at $2,500–$3,500 per month.

That’s why OAS, even with CPP or GIS, should be seen as a supplement, not a complete solution. It’s a foundation, not a full house.

Provincial and Territorial Supplements

On top of federal programs, many provinces offer additional supports for low-income seniors. For example:

- Ontario GAINS (Guaranteed Annual Income System): Provides monthly top-ups for OAS and GIS recipients with low income.

- BC Seniors Supplement: Offers small extra payments on top of GIS.

- Alberta Seniors Benefit: Helps with living costs for low- and moderate-income seniors.

These vary, but they’re worth checking out if you’re struggling to make ends meet.

The OAS Clawback (Tax Recovery)

Here’s the not-so-fun part: OAS is taxable income. And if your income is above a certain level, you may face the OAS recovery tax (often called the “clawback”).

- In 2025, the threshold is around $90,997.

- If your income is above this, your OAS is reduced.

- Once your income is very high (around $148,000), your OAS can be fully clawed back.

This means wealthier seniors may receive little to no OAS at all.

How to Apply for Canada $2988 OAS Per Month: Step-by-Step

- Check your mail – Service Canada may automatically enroll you. If so, you’ll receive a letter.

- Apply online – If you’re not auto-enrolled, use your My Service Canada Account.

- Gather documents – Social Insurance Number, proof of residence, and banking info.

- Pick your start date – You can start at 65 or delay up to 70 for a higher amount.

- Wait for approval – Applications can take a few months, so apply early.

Real-Life Scenarios

- Mary, 67: Worked part-time most of her life. Gets partial OAS ($400), small CPP ($600), and full GIS ($900). Total: ~$1,900/month.

- John, 70: Worked full-time and maxed out CPP contributions. Delayed OAS, now gets ~$1,100 OAS plus $1,433 CPP. Total: ~$2,500/month.

- Lena, 75: Retired early with strong savings. Gets OAS ($800), CPP ($800), and $1,200 from investments. Total: ~$2,800/month.

Each case is different. That’s why planning ahead is so important.

OAS Payment Dates in 2025

Payments are made monthly, typically on the third-last business day of the month. For example:

- January 29, 2025

- February 26, 2025

- March 27, 2025

- October 29, 2025

Tips for Maximizing Your Retirement Income

- Delay if you can: Deferring OAS until 70 increases your monthly benefit by up to 36%.

- Pair with CPP: Coordinate your CPP and OAS start dates to balance your income needs.

- Check GIS eligibility: Especially if your retirement income is low.

- Use tax shelters: TFSAs, RRSPs, and RRIFs can help stretch your income while minimizing taxes.

- Budget realistically: Don’t count on OAS covering everything — plan for housing, healthcare, and inflation.

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility

$742 OAS Boost Confirmed by CRA for October 2025: Check Eligibility & Payment Schedule

OAS $808 and GIS $1,097 Payments for in October 2025: Is it true? Check Eligibility