Canada $2616 Caregiver Credit: Taking care of family isn’t just love — it’s work, time, and money. Whether you’re raising a child with a disability, supporting your spouse who’s dealing with a chronic condition, or helping an aging parent, caregiving is a full-time commitment. The Canadian government recognizes this responsibility and offers financial relief through the Canada $2616 Caregiver Credit (CCC) in 2025.

Now, here’s the catch: the CCC isn’t a paycheck you’ll find in your mailbox. It’s a non-refundable tax credit, which means it helps reduce the taxes you owe but doesn’t give you a monthly deposit like the Canada Child Benefit (CCB). For many caregivers, though, it’s still a game-changer when filing taxes. This guide will walk you through what the CCC is, who qualifies, how much you can claim, and the exact steps to file it. Plus, we’ll cover real-world examples, common mistakes, and pro tips so you don’t leave money on the table.

Canada $2616 Caregiver Credit

| Topic | Details |

|---|---|

| Credit Name | Canada Caregiver Credit (CCC) |

| Base Amount (2025) | $2,616 for eligible dependants |

| Who Qualifies? | Spouse, common-law partner, children, parents, grandparents, siblings, nieces, nephews with physical/mental impairment |

| Type of Benefit | Non-refundable tax credit (reduces taxes owed, not direct cash) |

| How to Claim | On tax return using Schedule 5 (lines 30300, 30400, 30425, 30450, 30500 depending on relationship) |

| Payment Date | Applied when CRA processes your 2025 tax return (spring 2026) |

| Introduced | 2017, replacing older caregiver credits |

| Official Resource | Government of Canada – Caregiver Credit |

What is the Canada Caregiver Credit (CCC)?

The Canada Caregiver Credit is a tax break designed for people who support a spouse, partner, or dependant with a prolonged physical or mental impairment. Unlike direct benefit programs, CCC reduces your taxable income, leaving you with lower taxes or a higher refund.

Think of it like a “discount” on your taxes. You don’t see the money as a monthly deposit, but when tax season rolls around, you pay less. For families balancing caregiving with work, this can make a huge difference.

History and Purpose of CCC

The CCC came into effect in 2017, when the government decided to simplify three separate programs — the caregiver amount, infirm dependant credit, and family caregiver credit. By merging them, the goal was to:

- Reduce paperwork for taxpayers

- Provide broader eligibility for families supporting dependants

- Keep tax relief consistent across different caregiving situations

The $2,616 base amount in 2025 reflects inflation adjustments. It ensures caregivers get a fair shake even as the cost of living rises.

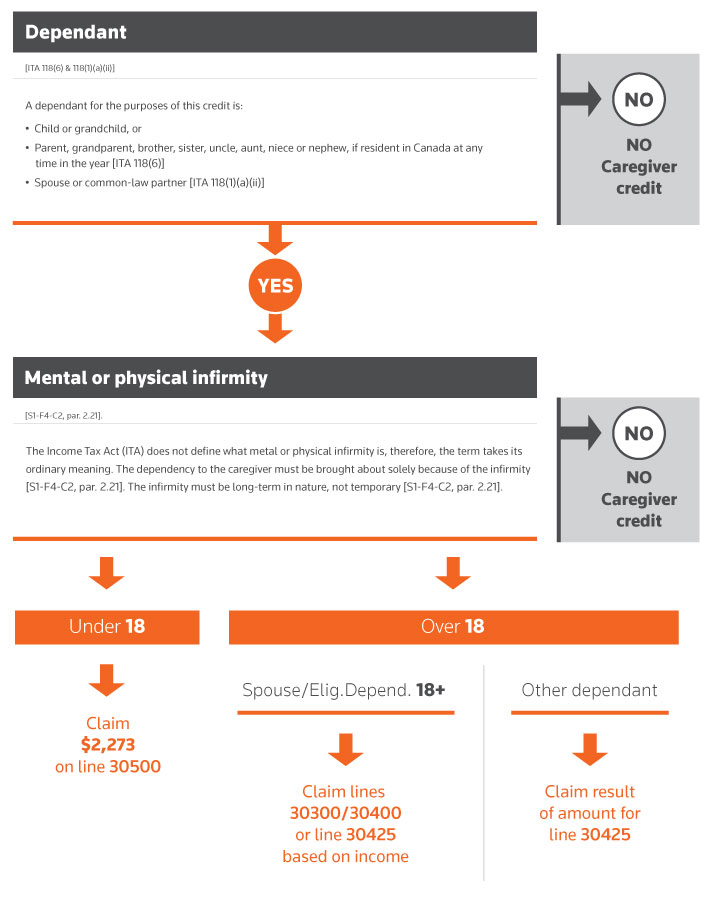

Who is Eligible for the Canada $2616 Caregiver Credit?

Eligibility depends on both your relationship to the dependant and their situation. Here’s the breakdown:

Eligible Relationships

- Spouse or common-law partner

- Children under 18 with a disability or impairment

- Adult children, parents, grandparents, siblings, nieces, nephews, aunts, or uncles if they live in Canada and depend on you

Conditions You Must Meet

- The dependant must have a physical or mental impairment documented by a medical professional.

- They must depend on you for basic needs like food, clothing, and shelter.

- They generally must reside in Canada.

- Only one person can claim CCC per dependant per year (though couples may split).

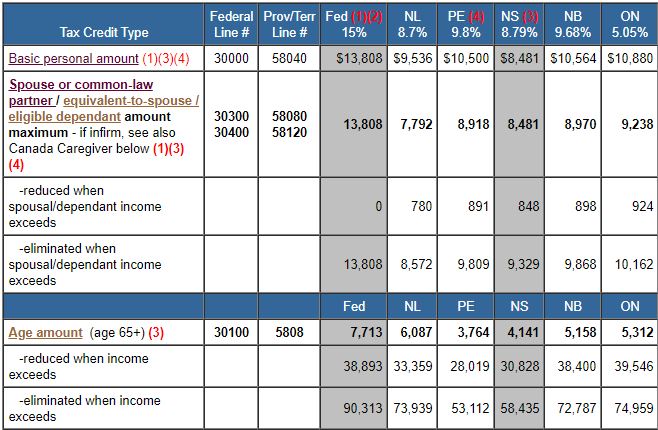

How Much is the Canada Caregiver Credit Worth?

For the 2025 tax year, the CCC provides a base amount of $2,616. But depending on the dependant, you might qualify for additional credits:

- Spouse or common-law partner: Claim $2,616 on line 30300; additional caregiver amounts on 30425.

- Eligible dependant (over 18): $2,616 on line 30400; more possible on 30425.

- Child under 18 with impairment: $2,616 on line 30500.

- Other infirm dependants (18+): Claim on line 30450.

Important note: The CCC is a non-refundable tax credit. That means if your taxes owed are already zero, you won’t receive extra money. It lowers your bill but doesn’t generate cash payments.

CCC vs. Other Programs

Let’s compare CCC with two other well-known Canadian supports:

| Program | What It Does | Type |

|---|---|---|

| CCC | Reduces taxes if you support someone with impairment | Non-refundable tax credit |

| DTC (Disability Tax Credit) | Reduces tax payable; required for many disability-related programs | Non-refundable tax credit |

| CCB (Canada Child Benefit) | Monthly cash payments to parents of children under 18 | Tax-free benefit |

In short, CCC works best when combined with other credits like the DTC, especially if your dependant has long-term disabilities.

How to Claim the Canada $2616 Caregiver Credit?

Filing the CCC isn’t complicated, but you’ve got to get it right.

Step 1: Collect Documentation

- Doctor’s statement confirming impairment

- Disability Tax Credit certificate (if applicable)

- Proof that you provide support (receipts, rent payments, etc.)

Step 2: Use Schedule 5

This is where you declare your dependant’s details. Make sure to fill in the right line:

- 30300 for spouse/partner

- 30400 for eligible dependant

- 30425 for caregiver amount (spouse/dependant 18+)

- 30450 for other infirm dependants (18+)

- 30500 for children under 18 with impairment

Step 3: File Your Return

File online using CRA-approved software like TurboTax Canada or through a tax professional.

Step 4: Keep Records

The CRA doesn’t ask you to mail in proof when filing, but they may audit you later. Keep all medical notes and receipts for at least six years.

Practical Examples

- Spouse with Chronic Illness

If your partner can’t work due to illness, you claim $2,616 on line 30300. If their income is low, you can add extra on line 30425. - Parent Caring for Elderly Relative

If you’re supporting your mom with Alzheimer’s and she lives with you, you may qualify for the CCC under line 30450. - Child with Disability

A single parent with a 13-year-old child diagnosed with autism can claim $2,616 on line 30500.

These examples show how flexible the CCC can be depending on your situation.

Common Mistakes Caregivers Make

- Assuming it’s a cash benefit. It’s not — it’s a credit.

- Not getting proper medical documentation. CRA won’t accept vague proof.

- Double claiming. Only one caregiver can claim per dependant.

- Missing deadlines. File by April 30, 2026 for 2025 returns.

Tips from Tax Experts

- Plan ahead. If your dependant’s income is near the threshold, timing matters for eligibility.

- Use CRA My Account. This portal keeps your tax slips and forms organized.

- Check other credits. The Disability Tax Credit or medical expense credits may add extra relief.

- Keep consistent records. CRA audits often target caregiver claims; missing paperwork is the top reason for denial.

Canada Wage News: $17.65/Hour Pay Raise; Is Your Province on the List?

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

Why CCC Matters in 2025?

Caregiving in Canada is on the rise. With an aging population, nearly 1 in 4 Canadians over 15 years old provides some form of care to a family member, according to Statistics Canada. For many, this unpaid role affects their jobs and income.

Programs like the CCC don’t replace wages, but they do offer recognition and financial relief. As healthcare costs and inflation rise in 2025, every dollar saved at tax time counts.