Canada $1700+$650 CRA Double Payment: If you’ve been hearing talk about a $1700 + $650 CRA double payment hitting Canadian bank accounts in November 2025, you’re not alone. Canadians rely heavily on benefit payments from the Canada Revenue Agency (CRA) to help manage household expenses, especially in times when prices for groceries, fuel, and rent keep climbing. But is this double payment truly a special bonus or just a misunderstanding of regular government payouts? Let’s break it down clearly, from the payment schedule and eligibility criteria to smart tips on maximizing your benefits.

Table of Contents

Canada $1700+$650 CRA Double Payment

The rumored $1700 + $650 CRA double payment in November 2025 is best understood as the total of several regular benefits arriving in a single month. Knowing exactly when payments hit and who qualifies helps you stay ahead financially. Filing taxes on time, signing up for direct deposit, and keeping your CRA profile current are your best strategies to get benefits without hassle. These supports, from the Child Benefit to Old Age Security, help families, seniors, and workers across Canada keep their budgets balanced when it counts.

| Aspect | Details |

|---|---|

| $1700 + $650 Payment | Combined total from multiple benefits; no distinct double payment announced |

| November Payment Dates | CCB: Nov 20; CPP, OAS, GIS: Nov 26; ACFB & some provincial benefits: Nov 27 |

| Eligibility | Based on income, family size, age, disability status, and tax filing status |

| Payments Tax Status | Most benefits like CCB, OAS, GIS are tax-free; CPP is taxable |

| How to Maximize Benefits | File taxes early, use direct deposit, update CRA My Account info |

| Official Reference | CRA Benefit Payment Dates |

What Is the Canada $1700+$650 CRA Double Payment?

Simply put: there’s no official double payment of exactly $1700 plus $650 from the CRA. What is happening is that many Canadians receive multiple payments from different benefits around the same time, which can add up to that ballpark figure.

These payments include:

- Canada Child Benefit (CCB)

- Canada Pension Plan (CPP)

- Old Age Security (OAS) and Guaranteed Income Supplement (GIS)

- Provincial benefits like the Alberta Child and Family Benefit (ACFB)

When combined, these benefits can sum to amounts in the $1,600-$2,400 range for eligible recipients in one month, particularly November which is a heavy payout month.

Detailed November 2025 CRA Payment Schedule

Here’s an overview of key CRA benefit payments expected in November 2025:

| CRA Benefit | Payment Date | Who Qualifies | Typical Payment Amounts |

|---|---|---|---|

| Canada Child Benefit (CCB) | November 20, 2025 | Families with children under 18 | Up to $619/month per child |

| Canada Pension Plan (CPP) | November 26, 2025 | Retired, disabled, or survivor contributors | Around $1,308/month |

| Old Age Security (OAS) & GIS | November 26, 2025 | Seniors 65+, low-income seniors | OAS: ~$713; GIS up to $1,065 |

| Alberta Child & Family Benefit (ACFB) | November 27, 2025 | Low-to-moderate income families in Alberta | About $936 quarterly |

Other benefits such as GST/HST credits, Canada Disability Benefits, and provincial programs have distinct payout dates, some quarterly or annually.

Who Is Eligible for These Benefits?

CRA payments depend heavily on eligibility criteria such as:

- Family and Children: To get the CCB, you must live with and care for children under 18. Filing your taxes is essential to maintaining eligibility for monthly payments.

- Age: OAS and GIS programs support seniors aged 65 and above. Residency requirements typically include living in Canada for at least 10 years after age 18.

- Income: Most benefits are income-tested, with lower-income families and seniors qualifying for higher payments; higher incomes see reduced amounts via sliding scales.

- Disability: The Canada Disability Benefit (CDB), launched in 2025, helps low-income working-age Canadians with approved Disability Tax Credits.

- Residency: You must be a Canadian resident for tax purposes; permanent residents and citizens typically qualify. Recent moves aim to automatically file taxes for ~1 million low-income Canadians by 2027, expanding to 5.5 million by 2028, to ensure benefits reach those eligible.

Eligibility nuances can vary by benefit type and province, so filing taxes every year and promptly updating your info with CRA is crucial.

Why Canada $1700+$650 CRA Double Payment Matter?

These payments are lifelines for millions of Canadians facing financial stress due to inflation and rising living costs. They help cover essential expenses like:

- Groceries, heating, and rent

- Childcare, educational supplies, and clothing

- Medical costs and disability support

- Senior living expenses

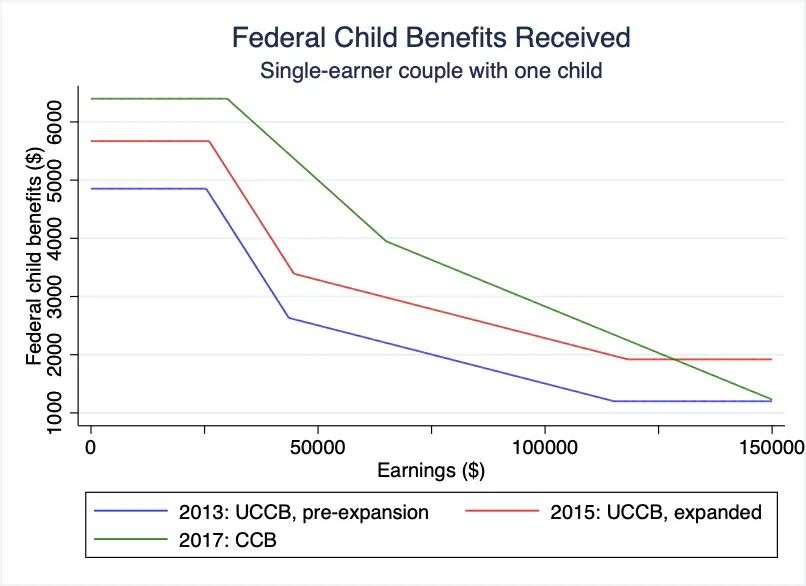

For families, benefits like the Canada Child Benefit helped lift over 435,000 children out of poverty between 2015-2019. The new Canada Family Benefit adds up to $445 monthly in 2025 to further aid households.

Tips to Maximize Your CRA Benefits

- File Taxes Early and Accurately

Filing by April 30 ensures benefits are not delayed or paused. Even if you earned little or no income, file a return. - Choose Direct Deposit

It’s the fastest way to get paid. Avoid waiting on mailed checks, especially with postal delays. - Keep CRA Information Updated

Life changes like marriage, a new baby, or moving require prompt updates to ensure correct benefit payments. - Monitor Your CRA My Account

Set up online access to review payments, update details, and receive notifications directly. - Apply or Renew Disability Tax Credits

For disabled Canadians, having an approved DTC is essential to qualify for disability-related benefits. - Stay Informed on New Programs

The CRA regularly updates and launches benefit programs like the Canada Disability Benefit and expanded family supports.

Understanding Tax Implications

- Most benefits like the CCB, OAS, GIS, and family supplements are tax-free and do not affect your taxable income.

- CPP payments are taxable income, but withholding is often automatic.

- Earnings from employment, investments, or other sources may impact benefit amounts under income thresholds.

- Accurate reporting on tax returns avoids overpayments or future repayment demands.

Common Myths About CRA Benefit Payments: Debunked

Misinformation about CRA payments tends to spread quickly, especially on social media. One of the biggest myths is the idea of “special double payments” or surprise one-time bonuses like the rumored $1700 + $650 payment. The truth? Most of these claims are misunderstandings or combinations of several regular benefits paid close together.

Another common myth involves the $3,500 Old Age Security payment, which often makes rounds online; however, no such one-time payment has been confirmed by CRA for 2025. The last significant one-time payment was $500 for seniors in 2021 during the pandemic.

The CRA regularly reviews benefits to ensure correct eligibility and avoid overpayments, which sometimes results in clawbacks. While these reviews aim to protect taxpayers, some eligible recipients have faced delayed or reduced payments due to strict documentation requirements.

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

Additional CRA Benefits To Know

- GST/HST Credit: Paid quarterly to help low-income Canadians offset sales tax costs; next payment is in January 2026.

- Canada Workers Benefit: Supports low-income workers with advance payments in select months.

- Veteran Disability Pension: Lifelong financial support for veterans suffering service-related disabilities.

- Automatic Tax Filing Coming Soon: The government plans to automatically file taxes for many low-income earners by 2027 to ensure benefit access.

Staying abreast of these programs can help you maximize your financial support from the government.