Canada $1700 CPP Releasing: that headline has been making waves across news feeds and Facebook groups lately. Many seniors are asking, “Am I really getting $1,700 a month?” or “Who qualifies for this new CPP increase?” Before you start planning an extra vacation or upgrading your camper, let’s slow down and unpack what’s true, what’s hype, and how the Canada Pension Plan (CPP) actually works in 2025. This guide explains everything — in plain English — so you’ll walk away confident about what’s coming, when, and how to make the most of it.

Table of Contents

Canada $1700 CPP Releasing

Here’s the bottom line: Canada’s CPP system remains one of the most stable, secure retirement programs in the world. While you won’t see a $1,700 monthly CPP payment by itself, combining your CPP, OAS, and GIS can absolutely reach that mark or more — especially with inflation indexing and enhancement benefits in place. Smart planning makes all the difference. Review your CPP statement, consider delaying benefits if you can, and always apply for every eligible program. That October 29, 2025 deposit might not make you rich overnight, but it’s a steady, inflation-protected foundation you can rely on for decades.

| Topic | Key Info (2025) | Source / Link |

|---|---|---|

| Maximum CPP Monthly Payment (Age 65) | CAD $1,433.40 | Canada.ca – CPP Amounts |

| Average CPP Payment (2025) | About CAD $848/month | Canada.ca |

| CPP Payment Date in October 2025 | October 29, 2025 | |

| CPP Contribution Rate (2025) | 5.95% (employee) / 11.9% (self-employed) | |

| Maximum Pensionable Earnings (YMPE) | $71,300 | |

| Possible Combined Income (CPP + OAS + GIS) | ~$1,700/month or higher |

What’s This “Canada $1700 CPP Releasing” Really About?

Let’s start with the big question: Is CPP increasing to $1,700/month in October 2025?

The short answer is no — not exactly.

The official maximum Canada Pension Plan (CPP) payment in 2025 for someone starting at age 65 is around $1,433.40/month.

So where does the $1,700 number come from? It’s a combined figure — likely referring to CPP + Old Age Security (OAS) and sometimes the Guaranteed Income Supplement (GIS). When you stack these programs together, many retirees see total monthly payments close to $1,700 or even more.

In other words, that viral number is technically true, but not from CPP alone.

Understanding the Canada Pension Plan (CPP)

The Canada Pension Plan is the backbone of retirement income for millions of Canadians. It’s a contributory, earnings-based program — meaning your payout depends on how much and how long you contributed while working.

You contribute automatically through payroll deductions (or self-employment payments) throughout your career. Those contributions build your future pension. When you retire, CPP sends you a monthly payment to replace part of your lost income.

CPP also includes benefits for:

- Disability (if you become unable to work before retirement)

- Survivors (for a spouse or children if you pass away)

- Post-retirement contributions (if you keep working after 65)

The CPP Enhancement: Bigger Benefits Ahead

Since 2019, the Canadian government has been gradually rolling out the CPP Enhancement — a long-term reform that increases how much workers and employers contribute, in exchange for larger future benefits.

By 2025, this enhancement reaches full phase-in. What does that mean?

- The replacement rate — the percentage of your pre-retirement income CPP replaces — rises from 25% to 33%.

- There’s a new upper limit on pensionable earnings: in 2025, Canadians earning between $71,300 and $81,200 will pay into a second-tier “CPP2.”

- Those extra contributions will eventually translate into bigger pension payments for future retirees.

This is good news for younger workers, but it also ensures that today’s seniors see stronger indexing and stability in their monthly deposits.

Who Qualifies for CPP?

CPP isn’t a “free” benefit — you must have paid into it at least once during your working life. Here are the main eligibility points:

- You must be at least 60 years old.

You can start CPP anytime between age 60 and 70. - You must have made valid contributions.

Even one year of contributions counts, but the more you contribute, the higher your benefit. - You must apply.

CPP doesn’t start automatically — you need to submit an application via My Service Canada Account. - You don’t have to live in Canada.

Canadians living abroad can still receive CPP, thanks to international social security agreements.

How Much Will You Get? (Example Scenarios)

Let’s look at two examples to make it easy.

Example 1: Robert, age 65

- Worked full-time for 40 years

- Always earned at or above the maximum pensionable earnings

- Starts CPP at age 65

➡ He’ll receive around $1,433/month in 2025.

Example 2: Linda, age 62

- Worked part-time and took career breaks

- Chooses to take CPP early at 62

➡ Her amount is reduced (by 0.6% per month before 65), resulting in roughly $950/month.

If both also receive OAS (around $713/month), their total income could range between $1,600–$2,100/month, depending on income and GIS eligibility.

CPP Payment Dates for 2025

Planning your budget around fixed income? Here are the official CPP payment dates for 2025 as published on Canada.ca:

| Month | Payment Date |

|---|---|

| January 2025 | January 29 |

| February 2025 | February 26 |

| March 2025 | March 27 |

| April 2025 | April 28 |

| May 2025 | May 28 |

| June 2025 | June 26 |

| July 2025 | July 29 |

| August 2025 | August 27 |

| September 2025 | September 25 |

| October 2025 | October 29 |

| November 2025 | November 26 |

| December 2025 | December 22 |

Payments are typically direct-deposited on those dates. If you’re still using mailed checks (some folks do), expect delivery a few days later.

How to Boost Your CPP Benefits?

Everyone wants the biggest check possible. The good news? There are legit ways to maximize your CPP income without breaking any rules.

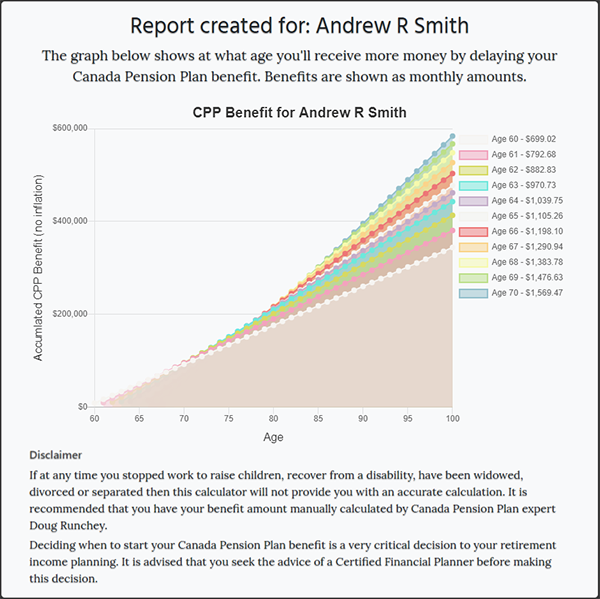

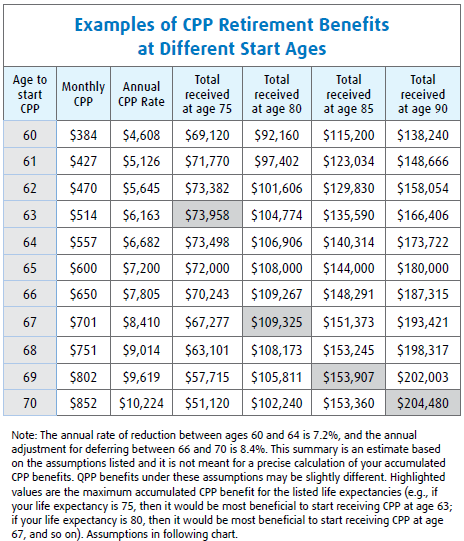

1. Work Longer or Delay Taking CPP

If you can afford to wait, delaying CPP until age 70 can increase your payment by up to 42%. Each month you delay after 65 adds 0.7% to your payout.

2. Contribute the Maximum Each Year

Your CPP grows with your contributions. If you’re employed, max out your annual pensionable earnings (YMPE).

3. Combine with OAS and GIS

The Old Age Security (OAS) and Guaranteed Income Supplement (GIS) are powerful add-ons.

- OAS provides about $713/month in 2025 for most Canadians.

- GIS offers up to $1,065/month for low-income singles or couples.

Combined, these programs can help you comfortably cross that $1,700/month threshold.

4. Keep Your Records Updated

Missing or incorrect contribution records can cost you money. Log in to your My Service Canada Account and review your CPP history regularly.

5. Consider CPP Income Splitting

Married or common-law couples can share CPP income for tax efficiency. This can lower your tax bill while maintaining your total household income.

Inflation and Cost-of-Living Adjustments

The CPP is indexed every January to reflect the Consumer Price Index (CPI) — a measure of inflation. In January 2024, CPP benefits increased 4.4% to match inflation. While 2025’s adjustment will depend on inflation trends through late 2024, experts predict another 2–3% rise.

This system keeps your purchasing power stable as prices for essentials — groceries, gas, utilities — continue to rise.

How to Apply for Canada $1700 CPP Releasing (Step-by-Step)

Applying is straightforward and takes about 10–20 minutes online. Here’s how:

- Go to the Service Canada website.

- Log in to your My Service Canada Account (MSCA) or create one.

- Select “Apply for CPP Retirement Pension.”

- Fill in your details — birth date, contribution history, and preferred start date.

- Submit online or mail your signed form.

Most applications are processed in 6–8 weeks, and payments start the month after approval.

Common Myths About the “$1,700 CPP”

Let’s clear up some misunderstandings that keep spreading online:

- Myth 1: Everyone gets $1,700 from CPP.

→ False. That’s a combined estimate (CPP + OAS + GIS). - Myth 2: The government is giving a one-time CPP bonus in October 2025.

→ No confirmed “bonus” has been announced. CPP follows regular indexation, not lump-sum increases. - Myth 3: CPP is running out of money.

→ Totally untrue. The Canada Pension Plan Investment Board (CPPIB) manages over $630 billion in assets as of 2024, ensuring sustainability for at least 75 years.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date