Canada $1600 CPP Bonus Payment: The rumor about a Canada $1,600 CPP bonus payment in October 2025 has spread rapidly across social media platforms and online forums. Many Canadians are eager to know if there’s any truth behind this claim and whether they’ll actually see a surprise deposit in their accounts. Let’s dig deep into what this really means, separate fact from fiction, and explain exactly how the Canada Pension Plan (CPP) works, who might qualify for any future changes, and what steps you should take to protect yourself from misinformation and scams.

Table of Contents

Canada $1600 CPP Bonus Payment

The claim about a $1,600 CPP bonus payment in October 2025 is false. The Canada Pension Plan continues to operate on a monthly, predictable schedule, with adjustments based only on inflation and long-term reforms, not sudden bonuses. Before believing viral claims or planning your budget around them, always confirm.

| Topic | Details / Stats (2025) | Official Source |

|---|---|---|

| Program Name | Canada Pension Plan (CPP) | Government of Canada |

| Rumored Bonus Payment | $1,600 in October 2025 | No official confirmation |

| Next Actual CPP Payment | October 29, 2025 | Payment Schedule 2025 |

| Average Monthly CPP (2024) | $758.32 | Service Canada |

| Funding Model | Contributions from workers and employers | CPP Investment Board |

| Scam Alert | Beware of fake bonus claims via text or email |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan (CPP) is one of the cornerstones of Canada’s social safety net. It’s a retirement income program that provides monthly payments to individuals who have made contributions during their working years.

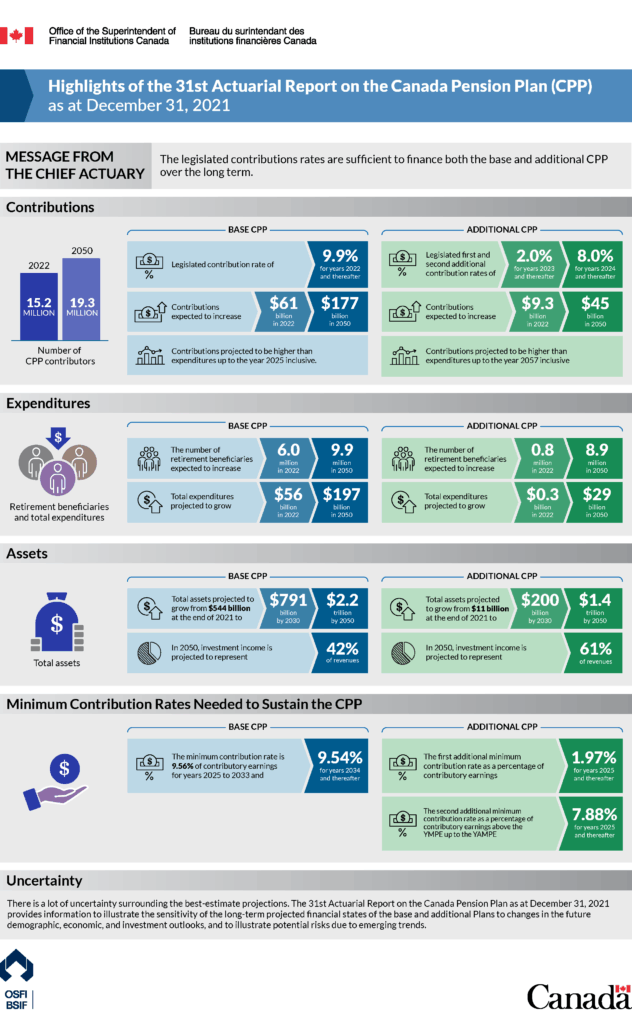

Both employees and employers contribute a percentage of earnings toward CPP, which is managed by the Canada Pension Plan Investment Board (CPPIB). When Canadians retire, become disabled, or pass away, CPP ensures that they or their survivors receive income support.

Here are a few quick facts about CPP (as of 2024):

- Managed funds: Over $630 billion CAD

- Number of beneficiaries: About 6 million Canadians

- Average monthly payment (retirement): $758.32

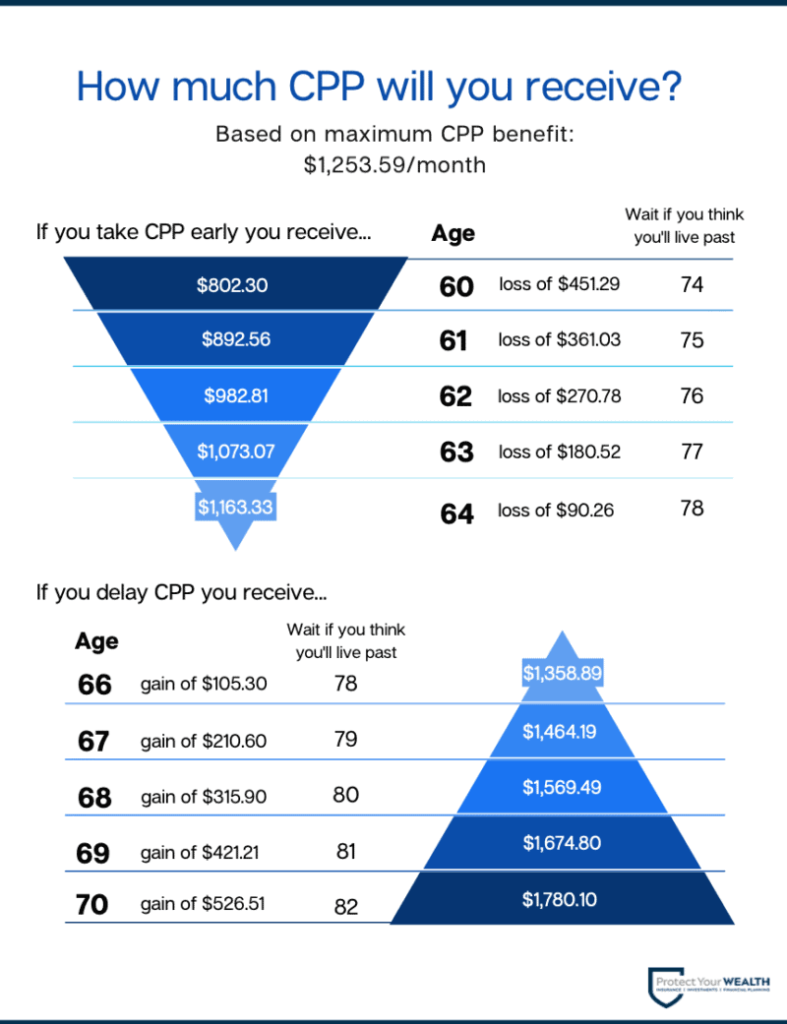

- Maximum monthly payment: $1,364.60

- Indexation: Adjusted each January for inflation

Where Did the Canada $1600 CPP Bonus Payment Claim Come From?

The idea of a $1,600 “CPP bonus payment” in October 2025 likely originated from misleading social media posts, videos, and blog articles that took a kernel of truth—such as annual payment increases or cost-of-living adjustments—and exaggerated it into a viral headline.

Some creators on platforms like YouTube or Facebook often use clickbait phrases like “Breaking News: Seniors to Get $1,600 CPP Bonus!” to attract viewers, even though there’s no official basis for the claim.

Here’s what the Government of Canada has stated:

“Be aware of misinformation online. The Government of Canada has not introduced any new one-time CPP payment or bonus.”

How the CPP System Works (and Why Bonuses Don’t Fit)?

The CPP is designed as a steady, predictable monthly benefit, not a program for issuing one-time “bonuses.” Every month, eligible recipients receive their payment, usually on the last Wednesday of the month. For example, the payment for October 2025 is scheduled for October 29.

CPP operates under strict federal legislation and is funded by mandatory contributions, not discretionary government spending. Therefore, any major change—like a new bonus or top-up—would require:

- Parliamentary approval

- Budget allocation

- Administrative implementation through Service Canada

None of these steps have occurred. There’s no bill or public proposal to add a $1,600 bonus to CPP payouts.

A Brief History of CPP and Benefit Adjustments

Understanding CPP’s history helps explain why a “bonus” doesn’t align with its structure.

The program was introduced in 1966, providing a basic income replacement for retirees. Since then, it’s evolved through several adjustments:

- 1987: Major reform to ensure long-term sustainability.

- 1997: Creation of the CPP Investment Board to manage funds professionally.

- 2019: Start of the CPP enhancement program, gradually increasing contributions and future benefits.

- Annual Indexing: Payments rise every January based on the Consumer Price Index (CPI).

These updates are systematic, data-driven, and legislatively approved—not sudden or unannounced.

Why the Canada $1600 CPP Bonus Payment Doesn’t Add Up?

Let’s analyze the financial and legislative reasons why such a “bonus” is almost impossible under the current CPP model:

- No budget mention: The 2025 federal budget draft (or fiscal update) includes no allocation for a CPP bonus.

- Enormous cost: With around 6 million beneficiaries, $1,600 each would cost nearly $9.6 billion CAD.

- Legal framework: CPP is governed jointly by federal and provincial ministers. Changes require wide consensus.

- No historical precedent: CPP has never issued one-time bonus payments in nearly 60 years.

- No administrative preparation: Service Canada has made no updates or announcements about new payment mechanisms.

If a new payment were approved, it would be publicly announced months in advance, with clear eligibility criteria and communication through official government websites, not viral posts.

How to Check If You’re Eligible for Any CPP Updates?

Even though the “bonus” itself is fictional, it’s good to know how to verify your own CPP eligibility and payment information.

- Log in to My Service Canada Account.

This secure portal shows your contribution history, estimated payments, and upcoming deposit dates. - Review your CPP Statement of Contributions.

It lists every year of contributions and helps you estimate your future benefit. - Track inflation adjustments.

CPP payments rise every January to match cost-of-living changes, ensuring purchasing power stays stable. - Check for CPP enhancement eligibility.

If you’ve contributed since 2019, you’ll qualify for higher benefits when you retire due to the enhanced CPP phase.

Comparing CPP with Other Canadian Benefits

Many people confuse CPP with other benefit programs that do sometimes have temporary or supplemental payments. Here’s how they differ:

| Program | Purpose | Payment Type | Bonus or Top-Up History |

|---|---|---|---|

| CPP | Retirement and disability income | Monthly pension | No one-time bonuses |

| OAS (Old Age Security) | Universal benefit for seniors 65+ | Monthly | Occasional top-ups during crises |

| GIS (Guaranteed Income Supplement) | Extra help for low-income seniors | Monthly | Indexed, but no “bonuses” |

| CERB / CRB (pandemic benefits) | Temporary income support | One-time or recurring short-term | Ended in 2022 |

So while Canada has offered temporary relief programs before, these were emergency measures, not part of the permanent pension system.

Real-World Example: How CPP Actually Pays Out

Take Daniel, a 67-year-old retiree from Ottawa. He contributed to CPP for 40 years and started receiving benefits at 65. His monthly deposit of $970 arrives on the last Wednesday of every month.

If Daniel heard about the $1,600 “bonus,” he could verify it easily by logging into his Service Canada account. The dashboard would show his upcoming payment as usual — but no extra “bonus” entry.

In other words, no changes occur without official notice.

How to Verify Benefit News Safely?

In today’s digital age, misinformation spreads fast. To protect yourself from fake benefit claims:

- Use official websites only.

The real ones end with “.gc.ca” (e.g., canada.ca, servicecanada.gc.ca). - Don’t trust screenshots or viral videos.

Scammers often use doctored images with fake government logos. - Never share personal information.

No legitimate government agency will text or email you asking for SIN or banking details. - Follow trusted news outlets.

Reliable sources like CBC News, CTV, and Global News verify stories before publishing. - Report scams immediately.

Contact the Canadian Anti-Fraud Centre if you receive suspicious messages.

What Professionals and Financial Advisors Should Know?

Financial planners, journalists, and policy professionals should be cautious when addressing such claims with clients or audiences. Here are key steps to maintain credibility:

- Verify sources before sharing any information publicly.

- Estimate fiscal impact before assuming feasibility — large bonuses affect federal budgets.

- Educate clients about the structure of public pensions.

- Track real policy updates through Parliamentary releases, not social media trends.

- Encourage digital literacy — misinformation about money can lead to fraud or misplanning.

Could the Government Offer Other Financial Support in 2025?

Although the $1,600 CPP bonus isn’t real, seniors may still see targeted financial support through other means. Based on historical trends:

- Old Age Security (OAS) benefits may increase in July 2025 due to inflation indexing.

- The Guaranteed Income Supplement (GIS) might see eligibility updates tied to income thresholds.

- Some provinces (like Ontario and British Columbia) could introduce energy rebates or housing credits for seniors.

It’s always smart to review annual budgets (usually released in March or April) to see if new supports are added.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

Canada Cost of Living Increase in October 2025 – Check Eligibility & Amount, Payment Date