Canada $1560 CPP Monthly Increase Payment: There’s been a lot of talk lately about the so-called “Canada $1,560 CPP monthly increase payment for seniors in October 2025.” Sounds exciting, doesn’t it? But before you celebrate or make plans for that extra cash, let’s separate fact from fiction. In this article, I’ll break down what’s really happening with the Canada Pension Plan (CPP), when any legitimate increase could be credited, who’s eligible, and what steps you can take today to make the most of your benefits.

Table of Contents

Canada $1560 CPP Monthly Increase Payment

To sum it up — the rumored $1,560 CPP monthly payment for October 2025 hasn’t been officially confirmed. The current maximum CPP benefit is $1,433/month, and any increases will follow inflation and enhancement schedules, not sudden jumps. If an official raise occurs, expect to see it credited on October 29, 2025, the regular payment date. Your best move right now is to verify your contributions, keep your Service Canada account updated, and stay alert for scams or false claims. The Canada Pension Plan remains one of the most reliable income programs in the world. While the $1,560 figure might not be real today, the program’s steady evolution means Canadians can count on continued support well into the future.

| Topic | Details / Estimates | Sources / Notes |

|---|---|---|

| Current maximum CPP (2025) | $1,433 per month | Government of Canada |

| Rumored $1,560 CPP figure | Not officially confirmed | Likely confusion with combined CPP + OAS + GIS |

| Next CPP payment date | October 29, 2025 | Canada Benefits Calendar |

| Eligibility | Must have contributed to CPP, be age 60–70, and apply | Service Canada |

| Indexing Frequency | Annual (based on CPI) | Canada Pension Plan Act |

| Payment Method | Direct deposit or mailed cheque | Government of Canada |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan is one of the country’s core social programs, designed to replace a portion of your income after you retire. It’s funded through contributions from employees, employers, and self-employed Canadians.

Every working Canadian between the ages of 18 and 70 who earns more than a minimum threshold contributes a percentage of their income into the CPP fund. When you retire, the government calculates your benefit based on how much and how long you’ve contributed, adjusted for inflation.

The CPP is not a welfare program — it’s a contributory plan, which means the more you pay in, the more you get out. In 2025, the average monthly CPP payment is about $850, while the maximum is $1,433 for those who contributed the full amount throughout their careers. So, where does this $1,560 number come from?

Is There Really a Canada $1560 CPP Monthly Increase Payment in October 2025?

As of now, there’s no official confirmation from the Government of Canada that CPP payments will increase to $1,560 per month in October 2025.

That number seems to have originated from online rumors or social media posts that combine different benefit programs — like CPP, Old Age Security (OAS), and the Guaranteed Income Supplement (GIS) — into one total.

Here’s the reality:

- The CPP does adjust payments annually based on inflation, but the increase is typically between 2–4% per year, not hundreds of dollars.

- The OAS and GIS also adjust quarterly, and those adjustments are separate from CPP.

- A jump from $1,433 to $1,560 (a 9% rise) would require a major policy announcement or legislative change, and none has been made public.

If an increase does happen, you’d hear it directly through official sources, not just social media.

When Will the CPP Increase Be Credited?

If any official increase takes effect, the timing will depend on the benefits payment schedule. CPP payments are issued once per month, usually toward the end.

According to the official 2025 benefits calendar, the October 2025 CPP payment date is October 29, 2025.

Those who receive direct deposits typically see the money in their accounts early that day, while those who receive cheques might get them a few days later, depending on postal service and holidays.

So, if the increase were approved, the first payment reflecting that boost would likely arrive on October 29, 2025.

Why the Government Adjusts CPP?

The CPP is indexed to inflation through the Consumer Price Index (CPI) — meaning it goes up when the cost of living rises. This system protects retirees from losing purchasing power as prices climb.

Between 2020 and 2024, inflation in Canada averaged around 3–4%, with spikes in groceries, rent, and energy. To offset that, the CPP payment amount increased slightly each year.

In addition, the CPP Enhancement, introduced in 2019, is gradually raising contribution rates and future benefits. By the mid-2040s, this enhancement will replace about one-third of a worker’s pre-retirement income (up from 25% under the old system).

That’s great news for younger Canadians, though it won’t drastically raise current retirees’ payments yet.

Eligibility for CPP — Who Qualifies for the Maximum Amount?

To qualify for any CPP benefit, you must:

- Have made at least one valid contribution to CPP.

- Be 60 years or older.

- Apply for your benefit (it doesn’t start automatically).

To qualify for the maximum payment, you must:

- Contribute the maximum amount every year from age 18 until you start drawing CPP.

- Have an average income equal to or above the yearly maximum pensionable earnings (YMPE).

The YMPE for 2025 is $68,500, meaning you contribute a percentage of your income up to that limit.

Those who had gaps in employment, part-time work, or lower earnings will receive less, though they can still benefit from proportional increases.

How to Maximize Your CPP Benefits?

Even if you’re years away from retiring, there are smart ways to increase your CPP payout:

1. Work longer.

Every additional year you work and contribute adds to your average earnings record.

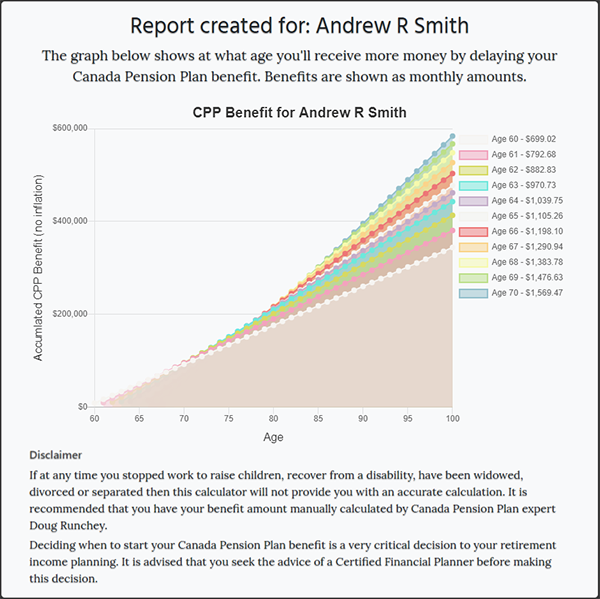

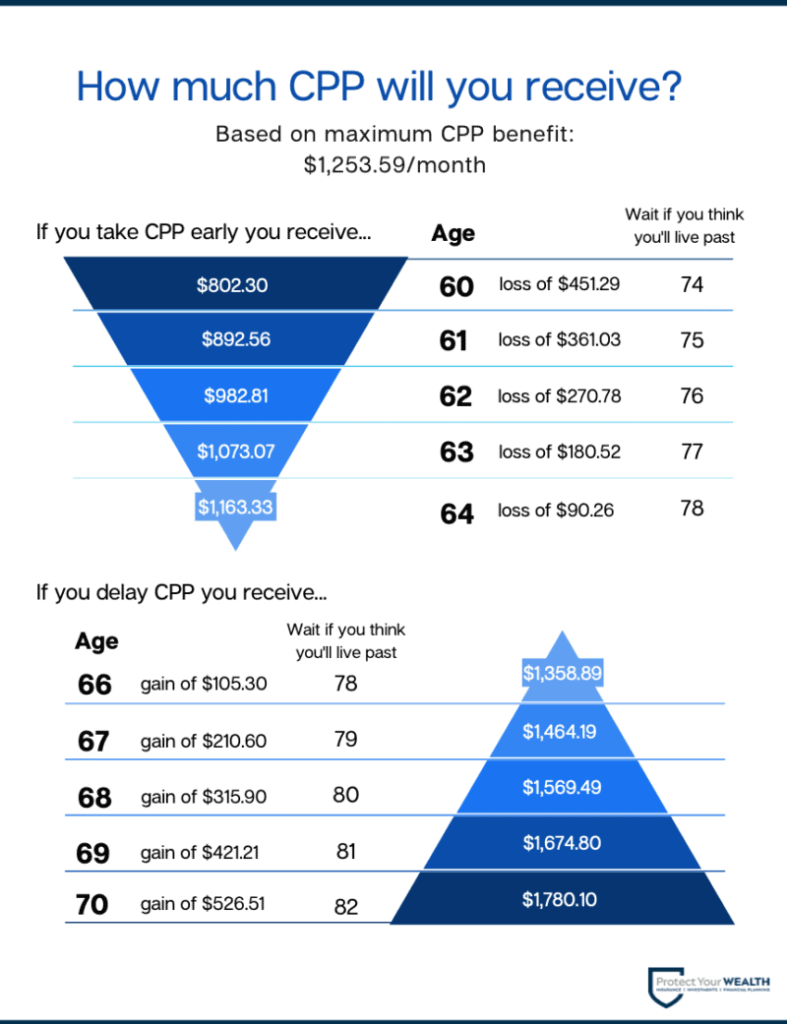

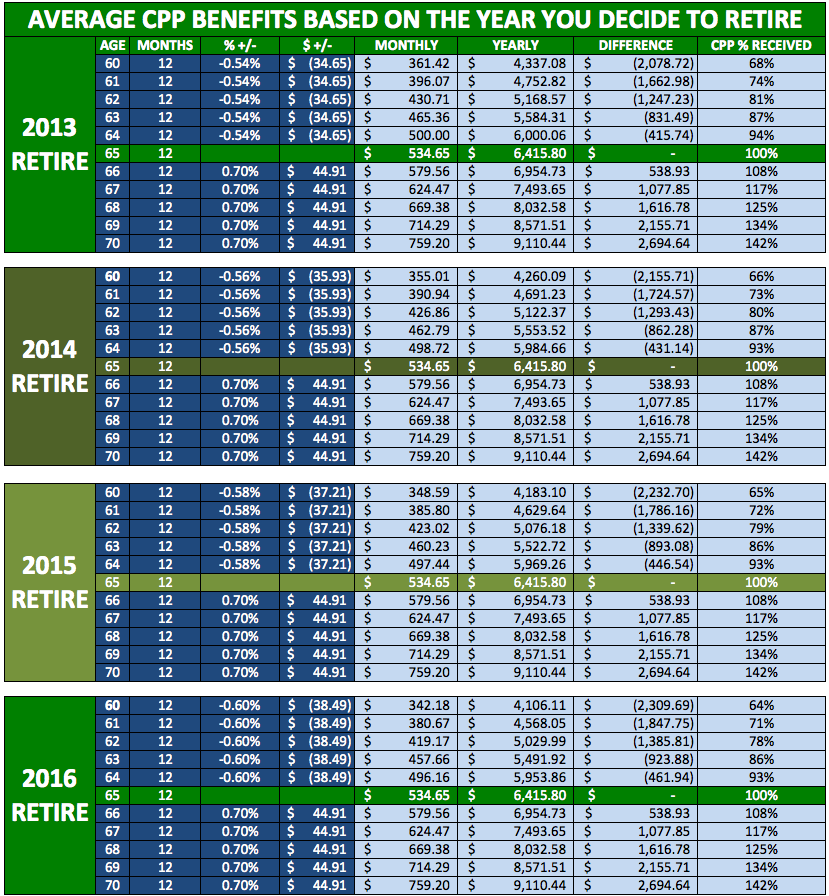

2. Delay CPP past age 65.

You can start receiving CPP as early as 60 or delay it until 70. For every month you delay past 65, your benefit increases by 0.7%, or 8.4% per year — up to a 42% boost by age 70.

3. Keep your income steady.

Avoid long periods of low or no earnings if possible.

4. Check your contributions record.

Sign in to your My Service Canada Account to review your Statement of Contributions and fix any missing years.

5. Understand taxes.

CPP income is taxable. If your CPP increases, you might owe slightly more tax — so plan accordingly with your accountant or financial advisor.

Economic Context — Why Talk of a Boost Matters

Canada’s aging population is growing quickly. By 2030, nearly one in four Canadians will be over age 65. That means more people relying on fixed incomes and public pensions.

At the same time, costs for essentials like rent, medication, and utilities are climbing. For many seniors, even a $50–$100 monthly increase can make a major difference.

While the $1,560 rumor may not be accurate, it reflects a broader reality — Canadians are worried about retirement security and want reassurance that the CPP will keep pace with real-world living costs.

CPP, OAS, and GIS — Understanding the Full Picture

Your CPP isn’t your only source of income in retirement. Many seniors also qualify for:

- Old Age Security (OAS) – A monthly payment available to Canadians aged 65+ who have lived in Canada for at least 10 years.

- Guaranteed Income Supplement (GIS) – An additional payment for low-income seniors receiving OAS.

Together, CPP + OAS + GIS can bring your total monthly income close to or above $1,560, which may explain where the rumor began.

The Long-Term Future of CPP

The Canada Pension Plan is considered one of the most stable public pension systems in the world. According to the Office of the Chief Actuary, the CPP fund is financially sustainable for at least the next 75 years.

As of 2025, the CPP Investment Board manages over $630 billion in assets, ensuring there’s enough to pay future generations of retirees.

This long-term stability means Canadians can count on CPP as a dependable foundation, even as short-term political debates come and go.

Protect Yourself — Avoid Fake “CPP Increase” Scams

Unfortunately, some scammers use fake “CPP increase” news to trick seniors into sharing personal info.

Here’s how to stay safe:

- Never respond to unsolicited emails or texts claiming to offer CPP boosts.

- Don’t share your SIN, banking info, or My Service Canada login.

- Always verify information through official government websites — the URL should end in “.gc.ca.”

If you suspect a scam, report it to the Canadian Anti-Fraud Centre at 1-888-495-8501.

Real-Life Example

Let’s imagine two retirees:

Mary, age 68, worked 35 years full-time in Ontario. She contributed near the maximum each year and receives $1,230 CPP plus $600 OAS, totaling $1,830 per month.

If the maximum rises to $1,560, Mary’s payment could climb to around $1,560 + OAS = $2,160 monthly, a welcome boost.

John, on the other hand, worked part-time for many years. His CPP is $850 and OAS adds $600, for $1,450 total. Even if CPP increases, John may only see a modest rise.

That’s how CPP enhancements work — the higher your contributions, the bigger your share of the increase.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

CPP & OAS Benefit Payment Coming In October 2025 – Check Revised Amount & Eligibility